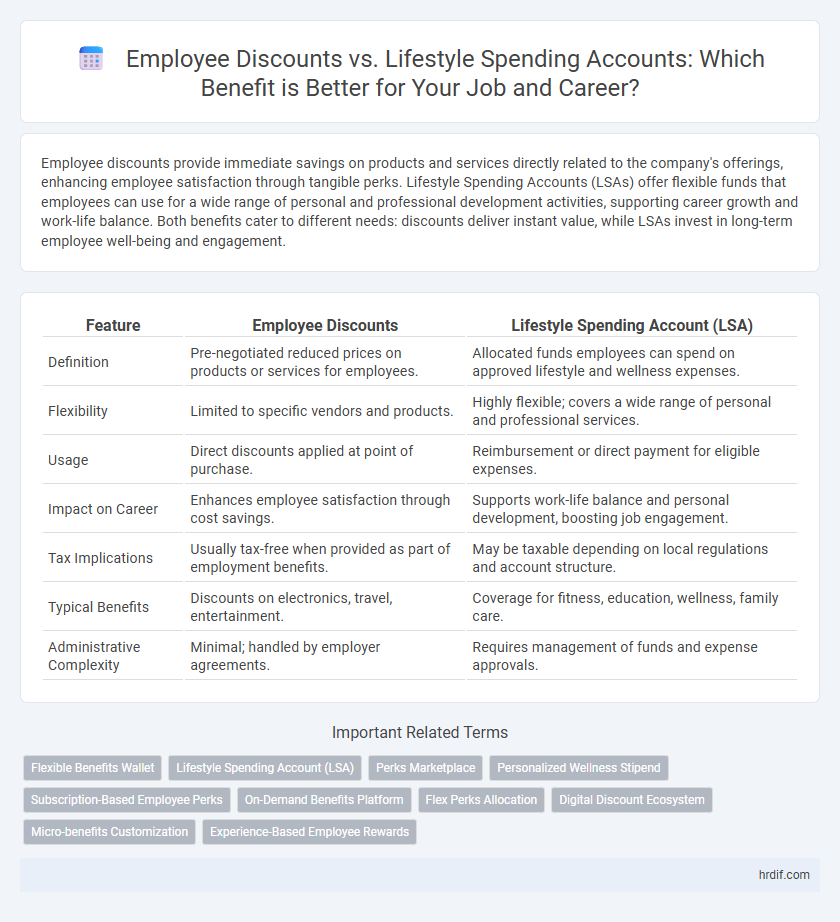

Employee discounts provide immediate savings on products and services directly related to the company's offerings, enhancing employee satisfaction through tangible perks. Lifestyle Spending Accounts (LSAs) offer flexible funds that employees can use for a wide range of personal and professional development activities, supporting career growth and work-life balance. Both benefits cater to different needs: discounts deliver instant value, while LSAs invest in long-term employee well-being and engagement.

Table of Comparison

| Feature | Employee Discounts | Lifestyle Spending Account (LSA) |

|---|---|---|

| Definition | Pre-negotiated reduced prices on products or services for employees. | Allocated funds employees can spend on approved lifestyle and wellness expenses. |

| Flexibility | Limited to specific vendors and products. | Highly flexible; covers a wide range of personal and professional services. |

| Usage | Direct discounts applied at point of purchase. | Reimbursement or direct payment for eligible expenses. |

| Impact on Career | Enhances employee satisfaction through cost savings. | Supports work-life balance and personal development, boosting job engagement. |

| Tax Implications | Usually tax-free when provided as part of employment benefits. | May be taxable depending on local regulations and account structure. |

| Typical Benefits | Discounts on electronics, travel, entertainment. | Coverage for fitness, education, wellness, family care. |

| Administrative Complexity | Minimal; handled by employer agreements. | Requires management of funds and expense approvals. |

Understanding Employee Discounts: Perks and Limitations

Employee discounts provide immediate savings on products and services, enhancing overall job satisfaction and fostering loyalty by reducing personal expenses. These perks are often limited to specific retailers or brand partners, restricting flexibility compared to broader benefit options. Understanding these constraints helps employees evaluate whether discounts align with their lifestyle needs or if alternative benefits like Lifestyle Spending Accounts offer more versatile support.

What Is a Lifestyle Spending Account (LSA)?

A Lifestyle Spending Account (LSA) is a flexible employee benefit that allocates a predetermined budget for personal well-being and lifestyle expenses, enhancing overall job satisfaction and work-life balance. Unlike traditional employee discounts, LSAs empower employees to choose how they spend their benefits, covering categories such as fitness, travel, wellness, and hobbies, which directly supports career productivity and mental health. Companies offering LSAs see improved employee engagement and retention by addressing individual preferences and promoting a holistic approach to compensation beyond standard job-related perks.

Key Differences Between Employee Discounts and LSAs

Employee discounts provide immediate cost savings on company products or partner services, directly reducing out-of-pocket expenses for employees. Lifestyle Spending Accounts (LSAs) offer flexible, tax-advantaged funds that employees can allocate toward various lifestyle and wellness expenses, promoting personalized financial wellness. Key differences include the scope of benefits--employee discounts are limited to specific products or services, whereas LSAs provide broader spending options aligned with individual preferences and career well-being.

Impact on Employee Satisfaction and Retention

Employee discounts directly enhance financial well-being by providing immediate savings on products and services, fostering a sense of loyalty and increasing retention rates. Lifestyle Spending Accounts (LSAs) offer personalized benefit options that align with diverse employee interests, boosting overall satisfaction and engagement. Companies implementing LSAs report higher retention due to the flexibility and perceived value, compared to traditional employee discount programs.

Customization and Flexibility: LSAs vs. Traditional Discounts

Lifestyle Spending Accounts (LSAs) offer greater customization and flexibility compared to traditional employee discounts by allowing employees to allocate funds toward a wide range of personal and professional expenses tailored to their individual needs. Unlike fixed discounts that target specific products or services, LSAs empower employees to choose how and when to spend benefits, enhancing job satisfaction and career development. This adaptable approach supports diverse lifestyles and priorities, making LSAs a more valuable benefit in attracting and retaining talent.

Tax Implications for Employees and Employers

Employee discounts provide immediate tax benefits as they are often considered a nontaxable fringe benefit if the discount does not exceed the employer's gross profit percentage on the product or service. Lifestyle Spending Accounts (LSAs) offer greater flexibility by allowing tax-free reimbursement of various wellness and lifestyle expenses, thereby optimizing tax efficiency for both employees and employers when structured correctly under IRS guidelines. Employers benefit from deductions on these benefits, but must ensure compliance with nondiscrimination rules to maintain favorable tax treatment.

Inclusion and Diversity: Catering to Varied Employee Needs

Employee discounts offer a straightforward way to support diverse employee preferences by providing access to products and services across different cultures and lifestyles. Lifestyle Spending Accounts (LSAs) enhance inclusion by allowing employees to allocate funds according to their unique interests, such as wellness, childcare, or education, promoting personalized benefits. Both options contribute to a more inclusive workplace by acknowledging varied needs and fostering employee engagement and satisfaction.

Cost-Effectiveness for Organizations

Employee discounts provide organizations with a straightforward and low-cost benefit that drives employee satisfaction and loyalty through direct savings on products or services. Lifestyle Spending Accounts (LSAs) offer customizable benefits that align with diverse employee preferences, which can enhance retention but may involve higher administrative costs. Understanding the balance between the fixed, predictable expenses of employee discounts and the flexible, potentially variable costs of LSAs is crucial for maximizing cost-effectiveness in talent management strategies.

Employee Participation and Utilization Rates

Employee discounts consistently show higher participation rates, with approximately 75% of eligible employees actively using these benefits due to immediate cost savings on products and services. Lifestyle Spending Accounts (LSAs) demonstrate increasing utilization, particularly among younger professionals, reaching engagement levels around 60%, driven by their flexibility in covering diverse wellness and recreational expenses. Companies report that combining both options can boost overall employee satisfaction and participation rates by up to 85%, enhancing recruitment and retention outcomes.

Choosing the Right Benefit for Your Workforce

Employee discounts provide immediate savings on products and services, enhancing job satisfaction and loyalty by offering tangible perks. Lifestyle Spending Accounts (LSAs) allow personalized benefit choices, promoting work-life balance and boosting overall employee well-being. Selecting the right benefit depends on workforce demographics and preferences, balancing cost-effectiveness with meaningful impact on engagement and retention.

Related Important Terms

Flexible Benefits Wallet

Employee Discounts and Lifestyle Spending Accounts both enhance workplace satisfaction by offering flexible benefits tailored to individual needs; however, the Flexible Benefits Wallet consolidates these options into a single platform, empowering employees to allocate resources efficiently across various perks and services, thus optimizing overall job value and career development opportunities. This integrated approach increases utilization rates and personalizes the benefits experience, making it a strategic tool for talent retention and engagement.

Lifestyle Spending Account (LSA)

Lifestyle Spending Accounts (LSAs) offer employees flexible, tax-efficient funds to cover wellness, fitness, and personal development expenses, enhancing overall job satisfaction and career growth. Unlike traditional employee discounts that are limited to specific products or services, LSAs empower individuals to customize their benefits according to their unique lifestyle needs and professional aspirations.

Perks Marketplace

Employee discounts provide immediate savings on products and services directly through a company's Perks Marketplace, enhancing job satisfaction and financial well-being. Lifestyle Spending Accounts offer flexible, tax-advantaged funds that employees can use for personalized perks beyond traditional discounts, supporting diverse career and personal lifestyle needs.

Personalized Wellness Stipend

Employee discounts provide tailored savings on products and services that directly support individual wellness preferences, enhancing job satisfaction and retention. Lifestyle spending accounts offer flexible, personalized wellness stipends that empower employees to invest in health and wellbeing activities aligned with their career goals and personal lifestyle.

Subscription-Based Employee Perks

Subscription-based employee perks, including employee discounts and lifestyle spending accounts, enhance job satisfaction by providing tailored savings on essentials and leisure activities. These benefits increase employee retention and motivation by offering flexible, value-driven options that align with diverse career needs and personal interests.

On-Demand Benefits Platform

Employee discounts provide instant savings on products and services directly tied to the job, enhancing immediate financial relief and workplace satisfaction. A Lifestyle Spending Account within an On-Demand Benefits Platform offers flexible, tax-advantaged funds employees can use for personal growth and wellness, fostering long-term career development and improved work-life balance.

Flex Perks Allocation

Flex Perks Allocation enhances job satisfaction by allowing employees to choose between targeted Employee Discounts or a versatile Lifestyle Spending Account, aligning benefits with personal preferences and career goals. This customizable approach increases engagement and retention by providing meaningful financial perks tailored to individual lifestyle and professional development needs.

Digital Discount Ecosystem

Employee discounts provide immediate cost savings through access to exclusive deals within a digital discount ecosystem, enhancing job satisfaction by lowering everyday expenses. Lifestyle Spending Accounts complement this by offering flexible, tax-advantaged funds that employees can allocate toward personalized wellness, professional development, and digital subscription services, supporting career growth and work-life balance.

Micro-benefits Customization

Employee discounts provide targeted savings on specific products and services, enhancing job satisfaction through immediate financial perks; Lifestyle Spending Accounts (LSAs) offer flexible micro-benefits that employees can customize to their personal needs, promoting engagement and retention by supporting diverse lifestyle choices. Customization in LSAs enables employers to tailor benefits to individual preferences, optimizing the overall employee experience and fostering long-term career commitment.

Experience-Based Employee Rewards

Experience-based employee rewards, such as lifestyle spending accounts (LSAs), offer personalized benefits that enhance job satisfaction by allowing employees to choose experiences that align with their interests, unlike traditional employee discounts which provide fixed, product-based savings. LSAs promote career engagement and retention by supporting work-life balance and encouraging employees to invest in wellness, travel, and learning activities directly linked to their personal growth and professional development.

Employee Discounts vs Lifestyle Spending Account for job and career. Infographic

hrdif.com

hrdif.com