Commuter benefits reduce the financial burden of daily travel by covering expenses such as transit passes, parking, or fuel, which directly supports employees who commute to the office. In contrast, a remote work allowance provides funds to equip and maintain a productive home office, addressing expenses like internet, utilities, and office supplies for employees working from home. Both benefits enhance employee satisfaction and productivity by targeting the specific needs of in-office and remote work environments.

Table of Comparison

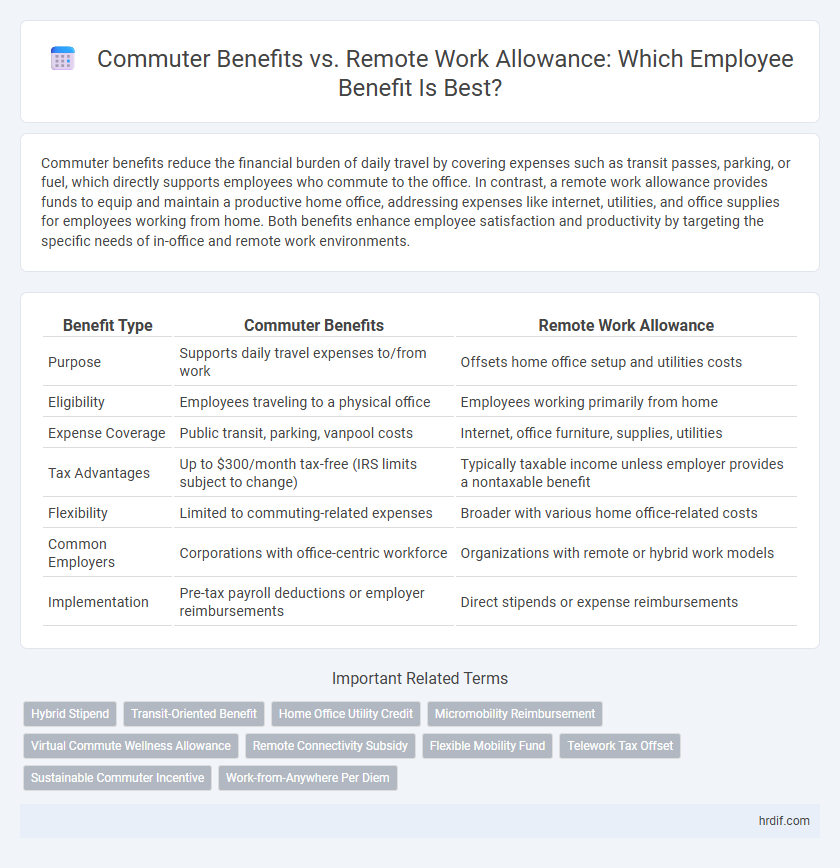

| Benefit Type | Commuter Benefits | Remote Work Allowance |

|---|---|---|

| Purpose | Supports daily travel expenses to/from work | Offsets home office setup and utilities costs |

| Eligibility | Employees traveling to a physical office | Employees working primarily from home |

| Expense Coverage | Public transit, parking, vanpool costs | Internet, office furniture, supplies, utilities |

| Tax Advantages | Up to $300/month tax-free (IRS limits subject to change) | Typically taxable income unless employer provides a nontaxable benefit |

| Flexibility | Limited to commuting-related expenses | Broader with various home office-related costs |

| Common Employers | Corporations with office-centric workforce | Organizations with remote or hybrid work models |

| Implementation | Pre-tax payroll deductions or employer reimbursements | Direct stipends or expense reimbursements |

Understanding Commuter Benefits and Remote Work Allowances

Commuter benefits provide employees with tax-advantaged reimbursements for transportation expenses such as transit passes, vanpooling, and parking, reducing their overall commuting costs. Remote work allowances cover costs associated with setting up and maintaining a home office, including internet, utilities, and office supplies, supporting productivity outside the traditional workplace. Understanding the distinction ensures employers optimize employee satisfaction and compliance with tax regulations while addressing diverse work arrangements.

Key Differences Between Commuter Benefits and Remote Work Allowances

Commuter benefits primarily cover expenses related to transportation such as public transit passes, parking fees, and vanpooling costs, offering tax advantages to employees who travel to a physical workplace. Remote work allowances focus on reimbursing home office expenses including internet, utilities, and office supplies, helping employees maintain productivity while working from home. The key difference lies in the nature of expenses covered: commuter benefits target travel costs tied to commuting, whereas remote work allowances address costs associated with a home-based work environment.

Financial Impact on Employees: Commuter vs Remote Benefits

Commuter benefits such as transit passes and parking subsidies directly reduce daily travel expenses, providing consistent financial savings for employees who commute regularly. Remote work allowances typically cover home office setup and internet costs, offering a one-time or periodic reimbursement that alleviates expenses but may not offset daily commuting costs. Evaluating commuter benefits against remote work allowances reveals distinct impacts on employees' financial well-being, with commuter benefits offering ongoing reductions in transportation costs and remote allowances addressing workspace-related expenditures.

Tax Implications for Both Commuter and Remote Work Allowances

Commuter benefits offer tax advantages by allowing employees to exclude transit and parking expenses from taxable income, reducing overall tax liability. Remote work allowances, often treated as taxable income unless specifically excluded under IRS guidelines, may increase an employee's taxable wages and affect withholding. Employers must carefully design these benefits to optimize tax savings and remain compliant with IRS regulations.

Employee Preference Trends: Commuter Benefits or Remote Work?

Employee preference trends reveal a growing inclination towards remote work allowances over traditional commuter benefits, reflecting increased demand for flexibility and cost savings associated with home-based work. Data from recent surveys indicate that approximately 65% of employees favor remote work allowances due to reduced commuting time and expenses. Companies adopting remote work benefits report higher employee satisfaction and retention rates compared to those offering standard commuter benefits alone.

Boosting Employee Retention with the Right Benefit Choice

Commuter benefits reduce employees' transportation costs, directly enhancing job satisfaction and decreasing turnover rates. Remote work allowances provide flexibility and support home-office expenses, appealing to a broad workforce and reinforcing loyalty. Choosing the right benefit aligned with employee preferences significantly boosts retention by addressing their daily challenges and financial needs.

Productivity Outcomes: Commuter Benefits vs Remote Work Allowance

Commuter benefits encourage regular in-office attendance, improving team collaboration and spontaneous interactions that boost productivity. Remote work allowances support home office setups, enhancing individual focus and reducing commuting stress, which can lead to higher work quality. Both benefits impact productivity differently, with commuter perks fostering face-to-face engagement and remote allowances promoting flexibility and concentration.

Employer Cost Analysis: Which Benefit Offers Better ROI?

Employers investing in commuter benefits often see a tangible reduction in transportation subsidies and tax liabilities, making it a cost-effective option with predictable expenses. Remote work allowances, while potentially higher in upfront costs due to equipment and technology investments, can lead to increased employee productivity and lower office maintenance costs, enhancing long-term ROI. Analyzing total employer costs--including tax incentives, operational savings, and employee satisfaction--reveals that remote work allowances may offer superior ROI in flexible work environments.

Environmental Considerations: Commuting vs Remote Work

Commuter benefits often incentivize the use of public transportation, reducing individual car usage and lowering greenhouse gas emissions, which positively impacts urban air quality. In contrast, remote work allowances enable employees to eliminate daily commutes altogether, significantly decreasing carbon footprints associated with transportation. Both benefit models contribute to environmental sustainability, with remote work offering greater potential for reducing energy consumption linked to commuting patterns.

Best Practices for Implementing Flexible Work Benefits

Implementing flexible work benefits requires clear communication of eligibility criteria and consistent policy application to ensure fairness between commuter benefits and remote work allowances. Leveraging digital platforms to track usage and reimbursements enhances transparency and simplifies administration, while gathering employee feedback helps tailor benefits to diverse work arrangements. Prioritizing tax-advantaged options for commuter benefits and setting caps on remote work allowances can optimize fiscal efficiency and compliance with regulatory standards.

Related Important Terms

Hybrid Stipend

Hybrid stipends offer a flexible financial benefit that combines commuter benefits and remote work allowances, enabling employees to cover expenses related to both office commuting and home office setups. This approach enhances employee satisfaction by addressing diverse work environments and promoting productivity in hybrid work models.

Transit-Oriented Benefit

Transit-oriented commuter benefits reduce employee transportation costs and promote sustainable travel by subsidizing public transit passes or vanpooling expenses. Remote work allowances, while flexible, do not directly support transit-oriented infrastructure or encourage eco-friendly commuting habits.

Home Office Utility Credit

Home Office Utility Credit offers a targeted financial benefit for remote employees by offsetting increased household expenses such as electricity and internet usage, unlike commuter benefits which primarily address transportation costs. This allowance directly supports productivity and cost savings in a remote work environment, enhancing overall employee satisfaction and retention.

Micromobility Reimbursement

Micromobility reimbursement offers a flexible commuter benefit that supports eco-friendly transportation options such as e-scooters and bike-sharing services, providing cost savings and convenience for employees. Unlike remote work allowances, which cover home office expenses, micromobility benefits directly reduce commuting costs while promoting sustainability and reducing carbon footprints.

Virtual Commute Wellness Allowance

Virtual Commute Wellness Allowance offers employees a health-focused benefit that complements or replaces traditional commuter benefits by addressing the physical and mental well-being challenges of remote work. This allowance supports purchases like ergonomic equipment, fitness apps, or wellness coaching, aligning with companies' goals to promote productivity and reduce remote work burnout.

Remote Connectivity Subsidy

Remote connectivity subsidy enhances employee productivity by covering expenses for high-speed internet and essential home office equipment, ensuring seamless communication and workflow outside traditional office environments. Unlike commuter benefits focused on transportation costs, this allowance directly supports efficient remote work infrastructure, aligning with modern flexible work arrangements.

Flexible Mobility Fund

The Flexible Mobility Fund offers a versatile approach to employee benefits by allowing workers to allocate a set budget toward either commuter benefits or remote work allowances, adapting to individual lifestyle needs. This fund enhances financial flexibility by covering diverse mobility options, including public transit passes, ridesharing, or home office expenses, optimizing workplace satisfaction and productivity.

Telework Tax Offset

The Telework Tax Offset provides employees who work remotely with tax relief to offset home office expenses, making it a financially advantageous benefit compared to traditional commuter benefits that focus on transportation costs. This allowance supports productivity from home while reducing taxable income, aligning with modern remote work trends and offering more personalized financial support than standard commuter subsidies.

Sustainable Commuter Incentive

Sustainable Commuter Incentive programs offer tax-advantaged benefits such as transit passes and vanpool subsidies that encourage eco-friendly commuting, reducing carbon emissions and lowering transportation costs for employees. Remote work allowances provide financial support for home office expenses but lack the direct environmental impact that commuter benefits promote through sustainable travel options.

Work-from-Anywhere Per Diem

Work-from-Anywhere Per Diem offers flexible financial support for employees to offset costs associated with remote work, contrasting with Commuter Benefits that specifically reduce expenses related to daily travel. This per diem approach enhances productivity and employee satisfaction by accommodating diverse work locations without the geographical constraints inherent in traditional commuter subsidies.

Commuter benefits vs Remote work allowance for benefit. Infographic

hrdif.com

hrdif.com