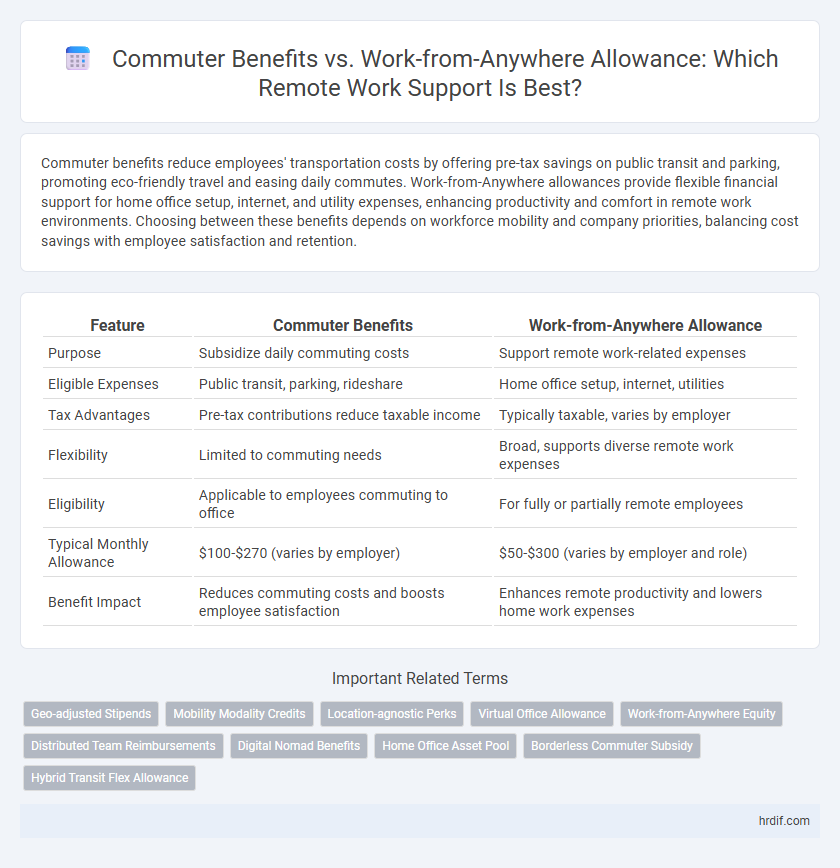

Commuter benefits reduce employees' transportation costs by offering pre-tax savings on public transit and parking, promoting eco-friendly travel and easing daily commutes. Work-from-Anywhere allowances provide flexible financial support for home office setup, internet, and utility expenses, enhancing productivity and comfort in remote work environments. Choosing between these benefits depends on workforce mobility and company priorities, balancing cost savings with employee satisfaction and retention.

Table of Comparison

| Feature | Commuter Benefits | Work-from-Anywhere Allowance |

|---|---|---|

| Purpose | Subsidize daily commuting costs | Support remote work-related expenses |

| Eligible Expenses | Public transit, parking, rideshare | Home office setup, internet, utilities |

| Tax Advantages | Pre-tax contributions reduce taxable income | Typically taxable, varies by employer |

| Flexibility | Limited to commuting needs | Broad, supports diverse remote work expenses |

| Eligibility | Applicable to employees commuting to office | For fully or partially remote employees |

| Typical Monthly Allowance | $100-$270 (varies by employer) | $50-$300 (varies by employer and role) |

| Benefit Impact | Reduces commuting costs and boosts employee satisfaction | Enhances remote productivity and lowers home work expenses |

Understanding Commuter Benefits in the Modern Workplace

Commuter benefits provide tax-advantaged options for employees to cover transportation costs such as transit passes, vanpooling, and parking fees, reducing the financial burden of daily commutes. These benefits enhance employee satisfaction and retention by promoting sustainable travel and lowering out-of-pocket expenses. In contrast, Work-from-Anywhere allowances support remote work by reimbursing home office setup and internet expenses rather than focusing on transit-related costs.

What is a Work-from-Anywhere Allowance?

A Work-from-Anywhere Allowance is a flexible stipend designed to support remote employees by covering home office expenses, internet costs, and other work-related needs regardless of location. Unlike traditional commuter benefits, which are tied to transportation and physical office presence, this allowance empowers employees to maintain productivity and comfort while working from diverse environments. Employers use this benefit to enhance job satisfaction and accommodate the growing remote workforce.

Core Differences Between Commuter Benefits and Remote Work Allowances

Commuter benefits typically cover expenses related to transportation such as transit passes, parking fees, and rideshares, aiming to reduce the cost of commuting to a physical workplace. Remote work allowances provide financial support for home office setup, internet bills, and other work-from-anywhere expenses, enabling employees to maintain productivity outside traditional office settings. The core difference lies in commuter benefits facilitating travel to a fixed location whereas remote work allowances support flexible, location-independent work environments.

Financial Impact: Which Benefit Offers More Savings?

Commuter benefits provide tax-free reimbursements for transportation expenses, potentially saving employees up to $300 monthly, which reduces taxable income significantly. Work-from-anywhere allowances offer flexible expense coverage but are often taxable, limiting overall financial savings. Employees seeking maximum tax advantages typically benefit more from commuter benefits due to their direct impact on reducing taxable earnings.

Employee Flexibility: Commuting vs. Working Anywhere

Commuter benefits primarily support employees who travel regularly to a physical workplace by offsetting transportation costs through subsidies for public transit or parking. Work-from-anywhere allowances offer greater flexibility by providing financial support for remote work expenses, enabling employees to set up productive home offices or work from various locations. This shift enhances employee flexibility, accommodating diverse work styles and reducing dependency on daily commuting.

Tax Advantages of Commuter Benefits and Remote Allowances

Commuter benefits offer significant tax advantages by allowing employees to use pre-tax dollars for transit expenses, reducing taxable income and increasing take-home pay. Work-from-Anywhere allowances can also provide tax-free reimbursements for remote work-related costs, though their tax treatment varies by jurisdiction and employer policy. Companies leveraging these benefits can support remote work while maximizing employee financial savings through strategic tax optimization.

How These Benefits Affect Talent Attraction and Retention

Commuter benefits reduce employees' daily expenses and simplify commuting, which appeals to urban talent seeking cost-effective work options, enhancing retention rates. Work-from-anywhere allowances provide financial support for home office setup and connectivity, attracting a broader talent pool valuing flexibility and location independence. Companies offering both benefits demonstrate a commitment to employee well-being, increasing overall job satisfaction and decreasing turnover.

Employer Perspectives: Cost and Ease of Administration

Commuter benefits often provide employers with predictable costs and streamlined administration through established tax advantages and payroll integrations. Work-from-anywhere allowances, while flexible, may introduce variable expenses and require more complex tracking and compliance measures. Employers evaluating remote work support should balance the fiscal predictability of commuter benefits against the adaptability of work-from-anywhere allowances to optimize budget management and operational efficiency.

Aligning Benefits with Hybrid and Remote Work Trends

Commuter benefits traditionally support daily travel expenses, while work-from-anywhere allowances provide flexible financial support tailored to remote employees' diverse locations. Aligning benefits with hybrid and remote work trends enhances employee satisfaction by offering customizable solutions that address specific commuting needs or home office setups. Companies adopting these targeted benefits improve retention and productivity by recognizing the varied nature of modern work environments.

Choosing the Best Benefit for Your Workforce’s Needs

Commuter benefits provide tax advantages and support for employees who travel to a physical workplace, making them ideal for hybrid teams with regular office visits. Work-from-Anywhere allowances offer flexible financial support for remote employees to cover home office expenses, catering to a fully remote or distributed workforce. Selecting the best benefit depends on analyzing workforce location patterns, commuting frequency, and individual employee preferences to maximize engagement and cost-effectiveness.

Related Important Terms

Geo-adjusted Stipends

Geo-adjusted stipends in commuter benefits provide location-specific financial support, optimizing commuting expenses based on regional cost variations, whereas work-from-anywhere allowances offer a flexible, flat-rate stipend regardless of the employee's geographic location. Employers leveraging geo-adjusted commuter benefits can enhance cost efficiency and employee satisfaction by aligning reimbursements with local transit costs and living expenses.

Mobility Modality Credits

Mobility Modality Credits provide flexible reimbursement options tailored to diverse commuting behaviors, enhancing the value of Commuter Benefits by covering public transit, biking, and rideshare expenses. This adaptability surpasses conventional Work-from-Anywhere Allowances by directly supporting sustainable, location-specific transportation needs for remote and hybrid employees.

Location-agnostic Perks

Commuter benefits provide financial support for transportation costs tied to specific physical locations, while work-from-anywhere allowances offer flexible spending for remote employees regardless of location, enhancing overall employee satisfaction and productivity. Emphasizing location-agnostic perks like work-from-anywhere allowances fosters inclusivity and adapts to diverse workforces, driving engagement and retention in remote work environments.

Virtual Office Allowance

Virtual Office Allowance provides employees with funds to create productive remote workspaces, covering expenses such as high-speed internet, ergonomic furniture, and office supplies, which enhances efficiency and comfort. This targeted benefit supports sustained remote work more effectively than general Commuter Benefits, which primarily address transportation costs and are less relevant for remote employees.

Work-from-Anywhere Equity

Work-from-Anywhere Allowance promotes work-from-anywhere equity by providing uniform financial support regardless of employee location, unlike traditional Commuter Benefits that cater primarily to urban office commuters. This approach ensures equitable access to resources for remote workers, enhancing inclusivity and productivity across diverse geographic areas.

Distributed Team Reimbursements

Commuter benefits typically cover expenses like transit passes and parking fees for employees traveling to a physical office, while work-from-anywhere allowances provide flexible reimbursements for home office setup, coworking spaces, and internet costs supporting distributed teams. Optimizing distributed team reimbursements involves tailoring allowances to diverse remote work needs, ensuring cost-efficiency and enhanced employee productivity regardless of location.

Digital Nomad Benefits

Commuter benefits primarily reduce commuting costs for local employees, while work-from-anywhere allowances provide financial support tailored to digital nomads by covering expenses such as coworking spaces, internet services, and location-independent work tools. Offering work-from-anywhere allowances enhances employee flexibility and productivity, catering specifically to the unique needs of remote workers and digital nomads.

Home Office Asset Pool

Commuter benefits primarily offset transportation costs for employees traveling to a physical office, whereas Work-from-Anywhere Allowances frequently include Home Office Asset Pool funding to enhance remote work environments with essential equipment and technology investments. Allocating resources to Home Office Asset Pools supports employee productivity and ergonomics, driving long-term organizational efficiency and satisfaction in remote work settings.

Borderless Commuter Subsidy

The Borderless Commuter Subsidy enhances remote work support by offering flexible commuter benefits regardless of geographic location, bridging traditional commuter allowances with the evolving work-from-anywhere model. This subsidy optimizes employee satisfaction and retention by providing tax-advantaged reimbursements that accommodate diverse commuting patterns beyond conventional office commutes.

Hybrid Transit Flex Allowance

Hybrid Transit Flex Allowance offers a flexible benefit combining commuter transit subsidies with remote work support, optimizing employee mobility and cost savings. It enhances hybrid work models by reimbursing public transportation expenses while accommodating home office needs, driving productivity and sustainable commuting practices.

Commuter Benefits vs Work-from-Anywhere Allowance for remote work support. Infographic

hrdif.com

hrdif.com