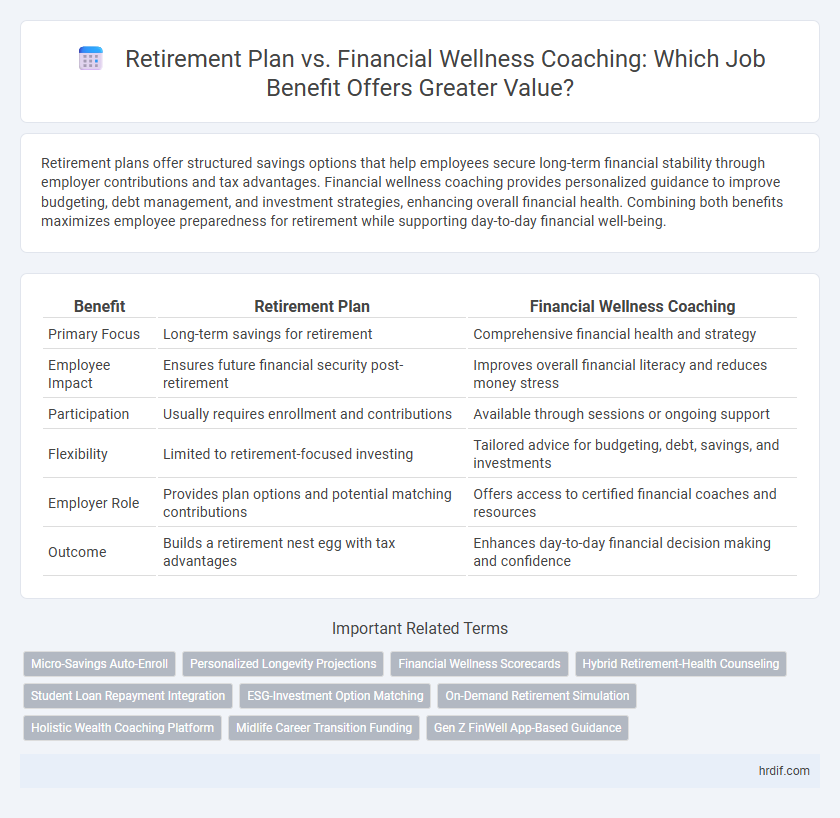

Retirement plans offer structured savings options that help employees secure long-term financial stability through employer contributions and tax advantages. Financial wellness coaching provides personalized guidance to improve budgeting, debt management, and investment strategies, enhancing overall financial health. Combining both benefits maximizes employee preparedness for retirement while supporting day-to-day financial well-being.

Table of Comparison

| Benefit | Retirement Plan | Financial Wellness Coaching |

|---|---|---|

| Primary Focus | Long-term savings for retirement | Comprehensive financial health and strategy |

| Employee Impact | Ensures future financial security post-retirement | Improves overall financial literacy and reduces money stress |

| Participation | Usually requires enrollment and contributions | Available through sessions or ongoing support |

| Flexibility | Limited to retirement-focused investing | Tailored advice for budgeting, debt, savings, and investments |

| Employer Role | Provides plan options and potential matching contributions | Offers access to certified financial coaches and resources |

| Outcome | Builds a retirement nest egg with tax advantages | Enhances day-to-day financial decision making and confidence |

Understanding Retirement Plans as an Employee Benefit

Retirement plans offer employees a structured way to save for their future through employer-sponsored options like 401(k) or pension plans, often including company matching contributions that enhance long-term financial security. Financial wellness coaching complements these plans by providing personalized guidance to help employees maximize their retirement savings, manage debt, and create comprehensive financial strategies. Understanding the specifics of retirement plan features and leveraging financial coaching can improve employee engagement, increase participation rates, and promote overall financial well-being.

What is Financial Wellness Coaching?

Financial Wellness Coaching is a personalized service designed to help employees improve their overall financial health by providing tailored guidance on budgeting, debt management, and long-term financial goals. Unlike traditional retirement plans, which primarily focus on saving for retirement, financial wellness coaching addresses immediate and future financial challenges to reduce stress and increase productivity. Employers offering financial wellness coaching often see increased employee engagement and reduced financial-related absenteeism.

Key Differences: Retirement Plans vs Financial Wellness Coaching

Retirement plans primarily provide structured savings options with tax advantages and employer contributions to secure long-term financial stability after leaving the workforce. Financial wellness coaching offers personalized guidance on budgeting, debt management, and investment strategies to improve employees' overall financial health and reduce stress in the present. Unlike retirement plans focused on future benefits, financial wellness coaching addresses immediate financial challenges and promotes ongoing financial literacy.

Advantages of Offering Retirement Plans to Employees

Offering retirement plans as a job benefit significantly enhances employee financial security by providing structured savings, tax advantages, and employer contributions that compound over time. These plans can improve employee retention and satisfaction by demonstrating long-term investment in workforce well-being. Compared to financial wellness coaching, retirement plans deliver tangible, measurable outcomes that directly contribute to employees' future economic stability.

The Impact of Financial Wellness Coaching on Employee Productivity

Financial wellness coaching significantly enhances employee productivity by reducing financial stress, which directly lowers absenteeism and boosts focus during work hours. Employees who engage in personalized financial coaching show improved decision-making skills and greater job satisfaction, leading to higher retention rates. Compared to traditional retirement plans, financial wellness coaching offers ongoing support that cultivates long-term financial stability and workplace engagement.

Cost-Benefit Analysis for Employers: Retirement Plans vs Coaching

Retirement plans offer long-term financial security for employees, often featuring tax advantages and predictable employer contributions that boost retention and reduce turnover costs. Financial wellness coaching provides personalized guidance to improve employees' financial habits, potentially decreasing stress-related productivity losses and healthcare expenses. Employers should weigh the upfront administrative and contribution costs of retirement plans against the measurable productivity gains and reduced absenteeism from effective financial coaching programs.

Employee Preferences: Retirement Plan or Financial Wellness Coaching?

Employees increasingly favor comprehensive retirement plans offering long-term financial security, but many also value financial wellness coaching for personalized guidance and improving money management skills. Data shows that 65% of workers appreciate retirement plans, while 48% seek financial wellness programs to reduce stress and boost confidence in financial decisions. Employers who integrate both benefits can meet diverse employee preferences, enhancing satisfaction and retention.

Integrating Retirement Planning with Financial Wellness Coaching

Integrating retirement planning with financial wellness coaching enhances employees' long-term financial security by providing personalized strategies that address both immediate financial habits and future retirement goals. This combined approach improves financial literacy, encourages proactive savings, and reduces stress related to retirement readiness. Employers offering this integrated benefit see higher employee engagement, retention, and overall workplace productivity.

Trends in Job Benefits: The Rise of Financial Wellness Programs

Financial wellness coaching is rapidly becoming a preferred job benefit over traditional retirement plans as employers seek to address employees' immediate financial stress and long-term security. Trends indicate a shift toward personalized financial guidance, with 80% of companies integrating wellness programs that include budgeting, debt management, and investment education. This proactive approach enhances overall employee satisfaction and retention by fostering financial literacy and resilience beyond mere retirement savings.

Choosing the Best Benefit: Factors Employers Should Consider

Employers should evaluate employee demographics, financial literacy levels, and long-term savings goals when choosing between retirement plans and financial wellness coaching as job benefits. Retirement plans offer structured savings with tax advantages, while financial wellness coaching promotes personalized financial health and decision-making skills. The optimal benefit aligns with organizational culture, employee needs, and retention objectives, maximizing overall workforce financial security.

Related Important Terms

Micro-Savings Auto-Enroll

Micro-Savings Auto-Enroll programs within financial wellness coaching offer employees seamless, automated contributions that gradually build savings, enhancing retirement readiness without requiring complex decision-making. Compared to traditional retirement plans, this approach promotes consistent savings behavior and financial confidence, leading to improved long-term financial security and reduced stress.

Personalized Longevity Projections

Retirement plans often provide structured savings options but lack personalized longevity projections that tailor future financial needs based on individual health and lifestyle data. Financial wellness coaching integrates personalized longevity projections, enabling employees to optimize retirement strategies by considering lifespan estimates and potential healthcare costs for a more secure financial future.

Financial Wellness Scorecards

Retirement plans offer structured long-term savings with tax advantages that improve employees' financial readiness for retirement, directly impacting their Financial Wellness Scorecards by increasing retirement readiness metrics. Financial wellness coaching enhances overall financial literacy and behavior, positively influencing scorecards through improved budgeting, debt management, and stress reduction, which complement the security provided by retirement plans.

Hybrid Retirement-Health Counseling

Hybrid retirement-health counseling combines personalized retirement planning with financial wellness coaching, enhancing overall employee well-being by addressing both long-term savings and immediate health-related financial concerns. Integrating these services supports smarter investment decisions and healthier lifestyle choices, resulting in improved job satisfaction and reduced financial stress.

Student Loan Repayment Integration

Retirement plans integrated with student loan repayment options enhance employee financial security by allowing simultaneous contributions toward long-term savings and debt reduction. Financial wellness coaching supports this integration by providing personalized strategies to balance loan repayment with retirement goals, improving overall benefit utilization and employee satisfaction.

ESG-Investment Option Matching

Retirement plans with ESG-investment option matching enable employees to align their savings with sustainable practices while securing long-term financial growth. Financial wellness coaching enhances this benefit by providing personalized guidance to understand and optimize ESG-aligned retirement portfolios, promoting both economic and ethical outcomes.

On-Demand Retirement Simulation

On-demand retirement simulation within financial wellness coaching offers personalized, real-time projections that help employees visualize their retirement readiness and adjust savings strategies effectively. Compared to traditional retirement plans, this interactive tool enhances engagement and empowers informed decision-making, driving better long-term financial outcomes.

Holistic Wealth Coaching Platform

Retirement plans provide employees with long-term financial security through structured savings and investment options, while financial wellness coaching enhances overall financial literacy and personalized wealth strategies, addressing immediate money management and long-term goals. A holistic wealth coaching platform integrates both approaches, offering comprehensive support that improves retirement readiness alongside day-to-day financial well-being.

Midlife Career Transition Funding

Retirement plans provide structured savings and tax advantages essential for securing long-term financial stability during midlife career transitions. Financial wellness coaching complements these benefits by offering personalized strategies to manage funding challenges, optimize resources, and enhance decision-making for career and retirement planning.

Gen Z FinWell App-Based Guidance

Retirement plans offer Gen Z employees long-term financial security by systematically building savings through employer contributions and tax advantages, while financial wellness coaching via FinWell app-based guidance provides personalized strategies to improve day-to-day money management, debt reduction, and investment education. Combining both benefits maximizes financial literacy and retirement readiness, empowering Gen Z to make informed decisions and achieve holistic financial well-being early in their careers.

Retirement Plan vs Financial Wellness Coaching for job benefit Infographic

hrdif.com

hrdif.com