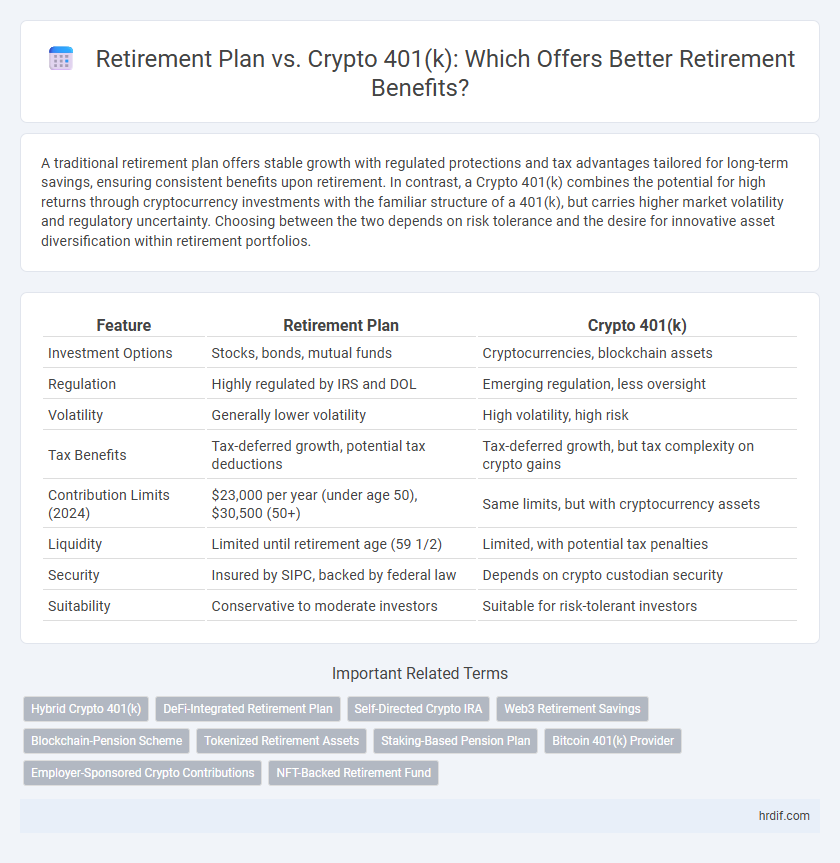

A traditional retirement plan offers stable growth with regulated protections and tax advantages tailored for long-term savings, ensuring consistent benefits upon retirement. In contrast, a Crypto 401(k) combines the potential for high returns through cryptocurrency investments with the familiar structure of a 401(k), but carries higher market volatility and regulatory uncertainty. Choosing between the two depends on risk tolerance and the desire for innovative asset diversification within retirement portfolios.

Table of Comparison

| Feature | Retirement Plan | Crypto 401(k) |

|---|---|---|

| Investment Options | Stocks, bonds, mutual funds | Cryptocurrencies, blockchain assets |

| Regulation | Highly regulated by IRS and DOL | Emerging regulation, less oversight |

| Volatility | Generally lower volatility | High volatility, high risk |

| Tax Benefits | Tax-deferred growth, potential tax deductions | Tax-deferred growth, but tax complexity on crypto gains |

| Contribution Limits (2024) | $23,000 per year (under age 50), $30,500 (50+) | Same limits, but with cryptocurrency assets |

| Liquidity | Limited until retirement age (59 1/2) | Limited, with potential tax penalties |

| Security | Insured by SIPC, backed by federal law | Depends on crypto custodian security |

| Suitability | Conservative to moderate investors | Suitable for risk-tolerant investors |

Overview: Traditional Retirement Plan vs Crypto 401(k)

A traditional retirement plan offers stable, regulated investment options with predictable tax advantages and employer contributions, ensuring long-term financial security. A Crypto 401(k) integrates digital assets like Bitcoin and Ethereum, providing high growth potential alongside increased volatility and regulatory uncertainty. Both plans aim to maximize retirement benefits, but the Crypto 401(k) appeals to investors seeking diversification and exposure to emerging blockchain technology.

Understanding Retirement Plan Structures

Retirement plan structures provide tax advantages and employer matching contributions, ensuring stable long-term growth through diversified investment options like bonds and mutual funds. Crypto 401(k) plans incorporate digital assets such as Bitcoin and Ethereum, offering higher volatility and potential for significant returns while carrying increased risk and regulatory uncertainty. Understanding these differences helps investors align their retirement goals with suitable risk tolerance and financial strategies.

Key Benefits of Traditional 401(k) Accounts

Traditional 401(k) accounts offer tax-deferred growth, allowing contributions to lower taxable income while investments grow without immediate tax liability. Employers often provide matching contributions, significantly boosting the retirement savings potential. Additionally, these plans typically offer a wide range of regulated investment options, ensuring stability and compliance with IRS rules for retirement benefits.

Crypto 401(k): Emerging Benefits and Opportunities

Crypto 401(k) plans offer emerging benefits such as tax-advantaged growth and diversification through digital assets like Bitcoin and Ethereum, potentially enhancing long-term retirement returns. These plans provide access to a new asset class with high growth potential, addressing the volatility challenges of traditional retirement plans. The integration of blockchain technology ensures transparency, security, and faster transaction processing, positioning Crypto 401(k)s as innovative retirement solutions.

Risk Factors: Traditional vs Crypto Retirement Investments

Retirement plans like traditional 401(k)s typically offer lower risk due to regulated investment options and federal protections, providing stable, long-term growth. Crypto 401(k)s expose investors to higher volatility and cybersecurity risks, which can lead to significant gains but also substantial losses. Evaluating risk tolerance and diversification strategies is crucial when choosing between conventional retirement plans and crypto-based investment vehicles.

Tax Implications for Each Retirement Benefit

Retirement plans such as traditional 401(k)s offer tax-deferred growth, allowing contributions to reduce taxable income until withdrawals begin at retirement, typically taxed as ordinary income. In contrast, a Crypto 401(k) can provide tax advantages similar to traditional 401(k)s but includes the added potential for tax-free growth if structured as a Roth Crypto 401(k), where qualified withdrawals are exempt from income tax. Understanding the tax implications, such as required minimum distributions for traditional plans versus the volatile nature of cryptocurrency assets, is crucial for optimizing long-term retirement benefits.

Employer Contributions: Standard vs Crypto-Linked Plans

Employer contributions in standard retirement plans typically follow fixed matching formulas based on employee contributions, providing predictable growth and tax advantages. Crypto 401(k) plans introduce employer contributions linked to cryptocurrency assets, offering potential for higher returns but with increased market volatility and regulatory considerations. Choosing between these options involves balancing the stability of traditional contributions against the innovative, yet riskier, prospects of crypto-linked employer matches.

Portfolio Diversification in Retirement Accounts

Retirement plans offer traditional portfolio diversification with a mix of stocks, bonds, and mutual funds, reducing risk across various asset classes. Crypto 401(k) accounts introduce digital assets like Bitcoin and Ethereum, providing exposure to high-growth opportunities but with increased volatility. Combining conventional retirement plans with crypto 401(k) options maximizes diversification, balancing stable returns and innovative investment growth.

Security and Regulation: Safeguarding Retirement Assets

Retirement Plans offer robust security through established federal regulations like ERISA, ensuring asset protection and fiduciary oversight. Crypto 401(k) plans introduce innovative investment opportunities but currently face evolving regulatory frameworks that may expose assets to higher risks. Prioritizing security, traditional Retirement Plans provide greater regulatory safeguards for preserving retirement benefits over crypto alternatives.

Choosing the Optimal Retirement Benefit for Your Career

Selecting the optimal retirement benefit involves comparing traditional retirement plans with crypto 401(k) options based on factors like tax advantages, investment growth potential, and risk tolerance. Traditional retirement plans offer stable, regulated growth with employer matching and predictable returns, whereas crypto 401(k)s introduce high volatility but potential for significant gains via blockchain assets. Evaluating your career timeline, income stability, and risk appetite ensures a personalized strategy that maximizes long-term retirement benefits and financial security.

Related Important Terms

Hybrid Crypto 401(k)

Hybrid Crypto 401(k) plans combine traditional retirement benefits with the growth potential of cryptocurrencies, offering tax advantages and portfolio diversification that neither a standard Retirement Plan nor a pure Crypto 401(k) alone can provide. These hybrid accounts enable investors to leverage the stability of conventional assets alongside blockchain-based investments, maximizing long-term retirement gains while managing risk.

DeFi-Integrated Retirement Plan

DeFi-integrated retirement plans offer enhanced liquidity and higher yield potential compared to traditional retirement plans and crypto 401(k)s, leveraging decentralized finance protocols to optimize asset growth and accessibility. These plans provide self-custody and automated smart contract features, reducing reliance on intermediaries and increasing transparency for long-term retirement benefits.

Self-Directed Crypto IRA

A Self-Directed Crypto IRA offers enhanced retirement benefits by allowing investors to diversify their retirement savings with digital assets, potentially achieving higher growth compared to traditional Retirement Plans. This approach provides greater control over investment choices, tax advantages, and protection against market volatility, making it a compelling alternative for long-term wealth accumulation.

Web3 Retirement Savings

Web3 retirement savings offer enhanced transparency and decentralized management compared to traditional retirement plans, enabling users to invest in crypto 401(k) accounts with potential for higher returns and reduced fees. Crypto 401(k) plans integrate blockchain technology for secure, real-time tracking of assets, providing innovative benefits such as tokenized investment options and automatic smart contract-based contributions.

Blockchain-Pension Scheme

A blockchain-pension scheme enhances retirement plans by providing transparent, tamper-proof records and real-time tracking of contributions and earnings, unlike traditional 401(k) plans which rely on centralized management. Integrating crypto 401(k) options with blockchain technology can increase security, reduce administrative costs, and enable faster, more efficient access to retirement benefits.

Tokenized Retirement Assets

Tokenized Retirement Assets within crypto 401(k) plans offer enhanced liquidity and fractional ownership, allowing investors to diversify beyond traditional retirement plans like IRAs or standard 401(k)s. This innovation enables seamless trading and real-time valuation, potentially increasing retirement benefits through greater market accessibility and reduced friction in asset management.

Staking-Based Pension Plan

Staking-based pension plans within crypto 401(k) options offer higher potential returns through passive income generated by staking digital assets, contrasting with traditional retirement plans that provide fixed interest or dividends. This approach leverages blockchain technology to enhance retirement benefits by compounding rewards and increasing portfolio diversification.

Bitcoin 401(k) Provider

A Bitcoin 401(k) provider offers retirement plans that integrate cryptocurrency investments, delivering diversification beyond traditional stock and bond options typically found in standard retirement plans. Leveraging Bitcoin's potential for long-term growth, these providers enable participants to optimize retirement benefits through digital asset exposure within a tax-advantaged account structure.

Employer-Sponsored Crypto Contributions

Employer-sponsored crypto 401(k) plans provide a unique advantage by allowing employers to contribute digital assets directly to employees' retirement accounts, potentially enhancing portfolio diversification and long-term growth. Unlike traditional retirement plans, these contributions can leverage the high volatility and appreciation potential of cryptocurrencies, offering innovative benefits for future financial security.

NFT-Backed Retirement Fund

NFT-backed retirement funds offer a unique advantage by integrating digital asset ownership into traditional retirement plans, potentially providing higher returns and diversification compared to conventional crypto 401(k) options. These funds leverage blockchain technology to secure NFTs as collateral, creating a transparent, inflation-resistant retirement benefit that adapts to evolving market dynamics.

Retirement Plan vs Crypto 401(k) for retirement benefits. Infographic

hrdif.com

hrdif.com