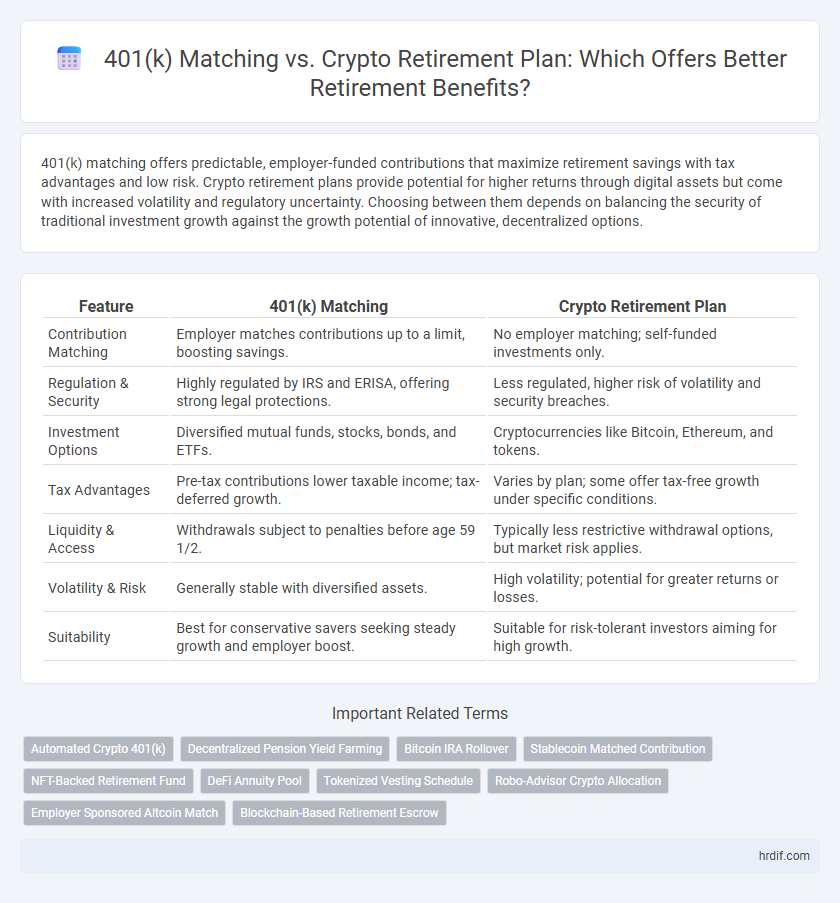

401(k) matching offers predictable, employer-funded contributions that maximize retirement savings with tax advantages and low risk. Crypto retirement plans provide potential for higher returns through digital assets but come with increased volatility and regulatory uncertainty. Choosing between them depends on balancing the security of traditional investment growth against the growth potential of innovative, decentralized options.

Table of Comparison

| Feature | 401(k) Matching | Crypto Retirement Plan |

|---|---|---|

| Contribution Matching | Employer matches contributions up to a limit, boosting savings. | No employer matching; self-funded investments only. |

| Regulation & Security | Highly regulated by IRS and ERISA, offering strong legal protections. | Less regulated, higher risk of volatility and security breaches. |

| Investment Options | Diversified mutual funds, stocks, bonds, and ETFs. | Cryptocurrencies like Bitcoin, Ethereum, and tokens. |

| Tax Advantages | Pre-tax contributions lower taxable income; tax-deferred growth. | Varies by plan; some offer tax-free growth under specific conditions. |

| Liquidity & Access | Withdrawals subject to penalties before age 59 1/2. | Typically less restrictive withdrawal options, but market risk applies. |

| Volatility & Risk | Generally stable with diversified assets. | High volatility; potential for greater returns or losses. |

| Suitability | Best for conservative savers seeking steady growth and employer boost. | Suitable for risk-tolerant investors aiming for high growth. |

Understanding 401(k) Matching: The Basics

401(k) matching is an employer benefit where companies contribute a percentage of an employee's salary to their retirement account, often up to a certain limit. This match effectively boosts retirement savings by providing free money, increasing the overall investment without additional effort from the employee. Understanding the specific matching formula and contribution limits is crucial to maximize this benefit in a traditional retirement savings plan.

What Is a Crypto Retirement Plan?

A crypto retirement plan allows investors to allocate retirement savings into digital assets such as Bitcoin or Ethereum, offering potential for high growth and diversification compared to traditional 401(k) matching programs. These plans leverage blockchain technology to provide transparency and security while enabling tax-advantaged growth similar to conventional retirement accounts. Investors seeking alternative options may choose crypto retirement plans to capitalize on the emerging digital economy while balancing risk and reward in their long-term savings strategy.

Security and Regulation: 401(k) vs Crypto Accounts

401(k) plans offer established security and are regulated by the Employee Retirement Income Security Act (ERISA), providing participants with legal protections and fiduciary oversight. Crypto retirement accounts, while innovative, face less regulatory clarity and higher volatility, exposing investors to potential risks from market fluctuations and cybersecurity threats. Prioritizing a 401(k) match ensures compliance with federal safeguards, whereas crypto plans demand thorough due diligence to manage security and regulatory uncertainties.

Employer Contributions: The Advantage of 401(k) Matching

Employer contributions in 401(k) matching plans significantly boost retirement savings by providing free money that directly increases an employee's investment. This advantage creates an immediate return on contribution, which is often unmatched by crypto retirement plans lacking employer participation. Leveraging 401(k) matching maximizes long-term growth through compounded gains and tax-deferred benefits.

Growth Potential: Comparing Investment Returns

401(k) matching offers steady, employer-backed contributions that amplify retirement savings with historically stable growth linked to diversified stock and bond funds. Crypto retirement plans present higher growth potential through exposure to volatile digital assets like Bitcoin and Ethereum, which can yield significant returns but carry increased risk. Balancing traditional 401(k) benefits with crypto investments may optimize overall retirement portfolio growth by combining reliability with high-return opportunities.

Volatility and Risk: Traditional vs Crypto Retirement

401(k) matching offers stable, employer-backed contributions with lower volatility, making it a safer choice for consistent retirement growth. Crypto retirement plans expose investors to high volatility and significant risk due to market fluctuations, potentially leading to substantial gains or losses. Balancing the risk profile and long-term financial goals is crucial when choosing between traditional 401(k) matching and crypto-based retirement savings.

Fees and Costs: Which Plan Is More Affordable?

401(k) matching plans typically offer lower fees due to employer contributions and established fund management, making them a cost-effective option for retirement savings. Crypto retirement plans may involve higher transaction fees, network costs, and tax complexities that can reduce net returns. Evaluating plan affordability requires analyzing expense ratios, administrative fees, and potential hidden costs associated with each option.

Tax Benefits: 401(k) Plans Compared to Crypto IRAs

401(k) plans offer significant tax advantages, including tax-deferred growth and pre-tax contributions that reduce taxable income. In contrast, Crypto IRAs provide the benefit of tax-advantaged growth, but contributions are typically made with after-tax dollars, limiting immediate tax relief. The structured tax benefits of 401(k) plans generally create a more predictable and advantageous tax environment for retirement savings compared to the nascent and complex tax framework associated with cryptocurrency retirement accounts.

Long-Term Stability: Evaluating Retirement Security

401(k) matching offers long-term stability through employer contributions and regulated investment options, ensuring predictable growth and retirement security. Crypto retirement plans provide high-growth potential but come with significant volatility and regulatory uncertainties that may affect long-term reliability. Evaluating retirement security involves balancing the dependable, steady accumulation from 401(k) matches against the speculative nature of crypto assets.

Choosing the Right Plan for Your Career Stage

Younger professionals benefit from crypto retirement plans due to potential high-growth opportunities and portfolio diversification, while those closer to retirement often prefer 401(k) matching for its stable, employer-contributed returns and tax advantages. Mid-career individuals should assess risk tolerance and long-term goals, balancing crypto's volatility with 401(k)'s consistent growth and matching incentives. Tailoring retirement savings by career stage maximizes wealth accumulation and aligns investment strategies with personal financial needs.

Related Important Terms

Automated Crypto 401(k)

Automated Crypto 401(k) plans offer the advantage of integrating blockchain technology to streamline contributions and investments, potentially providing higher growth through diversified digital assets compared to traditional 401(k) matching programs tied to employer contributions. These plans leverage smart contracts to automatically manage portfolio rebalancing and tax-efficient transactions, enhancing retirement savings performance and security.

Decentralized Pension Yield Farming

Decentralized pension yield farming offers higher potential returns and liquidity compared to traditional 401(k) matching by leveraging blockchain protocols that enable users to earn passive income through staking and liquidity pools. This innovative approach to retirement savings diversifies risk and enhances growth opportunities beyond conventional employer-sponsored plans.

Bitcoin IRA Rollover

Bitcoin IRA rollover offers potential for higher returns and portfolio diversification, leveraging cryptocurrency's growth within a tax-advantaged retirement account. Unlike traditional 401(k) matching programs, Bitcoin IRAs enable investors to transfer existing retirement funds into digital assets, maximizing long-term savings through blockchain technology.

Stablecoin Matched Contribution

Stablecoin matched contributions in a crypto retirement plan offer a unique advantage by combining the stability of USD-pegged assets with employer matching benefits, reducing volatility risks compared to traditional 401(k) matching. This approach enhances diversification and potential growth in retirement savings while maintaining predictable value retention through stablecoins like USDC or DAI.

NFT-Backed Retirement Fund

NFT-backed retirement funds offer a unique advantage by combining traditional 401(k) matching benefits with the growth potential of digital assets, providing diversified retirement savings with built-in liquidity and transparency. These funds allow investors to leverage blockchain technology for secure ownership and real-time valuation, enhancing retirement portfolio flexibility compared to conventional 401(k) plans.

DeFi Annuity Pool

401(k) matching offers traditional, employer-funded contributions that grow tax-deferred, providing a reliable foundation for retirement savings, while DeFi Annuity Pools in crypto retirement plans utilize decentralized finance protocols to generate yield through smart contract-based interest and automated asset management. DeFi Annuity Pools enable continuous liquidity and composable finance benefits, potentially delivering higher returns and reduced reliance on centralized financial institutions compared to conventional 401(k) matching programs.

Tokenized Vesting Schedule

A tokenized vesting schedule in crypto retirement plans offers transparent, automated release of funds aligned with predefined timelines, enhancing control over retirement savings compared to traditional 401(k) matching which relies on employer contributions and fixed schedules. This innovative approach ensures real-time tracking and flexible management of vested assets, potentially increasing investment efficiency and retirement readiness.

Robo-Advisor Crypto Allocation

Robo-advisor crypto allocation in retirement plans offers automated, algorithm-driven portfolio management that diversifies assets beyond traditional 401(k) matching contributions, potentially increasing returns through cryptocurrency exposure. Integrating crypto into retirement savings via robo-advisors provides personalized investment strategies and continuous portfolio rebalancing, enhancing growth opportunities while managing risk compared to conventional retirement account options.

Employer Sponsored Altcoin Match

Employer-sponsored altcoin match programs offer an innovative alternative to traditional 401(k) matching by allowing employees to receive contributions in cryptocurrency, potentially enhancing portfolio diversification and growth prospects. These crypto retirement plans provide access to digital assets with high volatility and growth potential, catering to investors seeking higher returns compared to conventional fiat-based 401(k) matches.

Blockchain-Based Retirement Escrow

Blockchain-based retirement escrow enhances 401(k) matching benefits by providing transparent, secure, and tamper-proof management of retirement savings, reducing the risk of fraud and administrative errors. This innovative technology enables real-time tracking and automated smart contracts, ensuring precise fund allocation and greater control over crypto retirement plan assets.

401(k) Matching vs Crypto Retirement Plan for Retirement Savings. Infographic

hrdif.com

hrdif.com