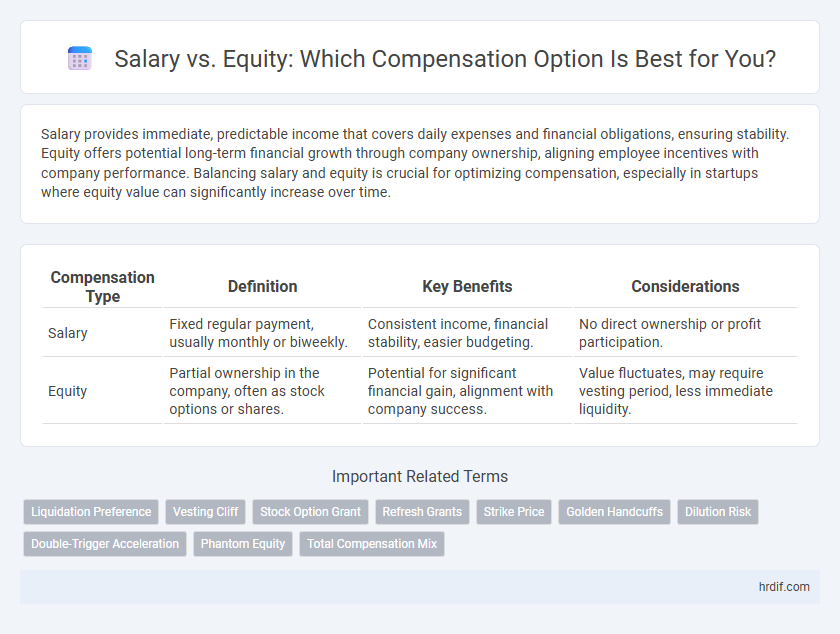

Salary provides immediate, predictable income that covers daily expenses and financial obligations, ensuring stability. Equity offers potential long-term financial growth through company ownership, aligning employee incentives with company performance. Balancing salary and equity is crucial for optimizing compensation, especially in startups where equity value can significantly increase over time.

Table of Comparison

| Compensation Type | Definition | Key Benefits | Considerations |

|---|---|---|---|

| Salary | Fixed regular payment, usually monthly or biweekly. | Consistent income, financial stability, easier budgeting. | No direct ownership or profit participation. |

| Equity | Partial ownership in the company, often as stock options or shares. | Potential for significant financial gain, alignment with company success. | Value fluctuates, may require vesting period, less immediate liquidity. |

Understanding Salary and Equity: Key Differences

Salary provides a fixed, predictable income paid regularly, usually monthly, offering financial stability and liquidity. Equity compensation represents ownership stakes in a company, aligning employee incentives with long-term business growth but carrying potential risk due to fluctuating stock values. Understanding these differences helps professionals balance immediate financial needs with future wealth-building opportunities when negotiating total compensation packages.

Pros and Cons of Salary Compensation

Salary compensation offers predictable income and financial stability, ensuring consistent cash flow for daily expenses. Employers often provide additional benefits such as health insurance and retirement plans tied to salary. However, fixed salary lacks the upside potential of equity, limiting long-term wealth creation and exposure to company growth.

The Upside and Risks of Equity Compensation

Equity compensation offers the upside of potential substantial financial gains if the company's valuation increases significantly, aligning employee interests with long-term growth and success. However, the risks include market volatility, illiquidity, and the possibility of losing value if the company underperforms or fails. Unlike fixed salary, equity's compensation value is uncertain and often depends on external events such as IPOs or acquisitions.

Salary vs Equity: Which Offers More Financial Security?

Salary provides consistent, predictable income that covers regular expenses and reduces financial uncertainty, making it a more reliable form of compensation for immediate financial security. Equity, often in the form of stock options or shares, carries potential for significant long-term wealth but fluctuates based on company performance and market conditions, thus presenting higher risk. Employees prioritizing stability typically prefer salary, while those willing to assume risk for future gains may find equity more advantageous.

Long-term Wealth Potential: Salary vs Equity

Equity offers significant long-term wealth potential by aligning employee interests with company growth, often resulting in exponential financial gains if the company succeeds. Salaries provide stable and predictable income but lack the upside potential tied to market valuations and company performance. Balancing salary and equity ensures both immediate financial security and the opportunity for substantial wealth accumulation over time.

Tax Implications of Salary and Equity Compensation

Salary income is subject to standard income tax rates and payroll taxes, resulting in immediate tax liabilities upon receipt. Equity compensation, such as stock options or restricted stock units, often benefits from favorable tax treatment, including deferral of tax until exercise or sale, and potential capital gains tax rates. Understanding the timing and type of equity awards is crucial for optimizing tax outcomes and aligning compensation with financial goals.

Negotiating Your Compensation Package: Salary and Equity

Negotiating your compensation package requires a clear understanding of salary versus equity components, balancing immediate cash flow with long-term wealth potential. Salary provides predictable income essential for financial stability, while equity offers ownership stakes that may appreciate significantly if the company succeeds. Prioritize transparent discussions on valuation, vesting schedules, and potential dilution to maximize the overall value of your compensation package.

Industry Trends: Who Offers Salary, Who Offers Equity?

Tech startups and high-growth companies predominantly offer equity as part of compensation packages to attract talent willing to take risks for potential long-term gains, while established corporations and government organizations typically provide higher base salaries with limited or no equity options. Industries such as technology, biotechnology, and fintech show a strong preference for equity to align employee incentives with company performance, whereas sectors like finance, healthcare, and manufacturing prioritize fixed salary structures. Compensation trends indicate that startups use equity to conserve cash flow and motivate employees, while mature firms emphasize predictable income and benefits to retain experienced professionals.

Startup Equity vs Corporate Salary: What Should You Choose?

Startup equity offers potential for significant long-term financial gains through company growth and stock value appreciation, appealing to risk-tolerant employees seeking wealth creation. Corporate salary provides stable, predictable income with benefits like health insurance and retirement plans, ideal for those prioritizing financial security and immediate cash flow. Choosing between startup equity and corporate salary depends on individual risk tolerance, financial goals, and career stage, balancing immediate compensation with future upside potential.

Making the Right Choice: Factors to Consider in Salary vs Equity

Evaluating salary versus equity compensation requires analyzing personal financial stability, risk tolerance, and long-term wealth goals. Consider immediate cash flow needs, as salary provides guaranteed income, while equity offers potential for substantial future gains tied to company performance. Understanding the startup's valuation, growth prospects, and vesting schedules is critical to making an informed decision that balances security and upside potential.

Related Important Terms

Liquidation Preference

Salary offers immediate, guaranteed income, while equity compensation depends on company performance and liquidity events, with liquidation preference clauses prioritizing equity holders' payouts during exit events. Understanding liquidation preferences is crucial for evaluating equity value, as these terms dictate the order and amount shareholders receive before common stockholders get paid.

Vesting Cliff

A vesting cliff in equity compensation typically requires employees to work for a set period, often one year, before any shares vest, creating a risk that equity has no immediate monetary value compared to a guaranteed salary. This fundamental difference impacts the liquidity and financial security of compensation packages, making salary a more stable form of income especially during the initial stages of employment.

Stock Option Grant

Stock option grants provide employees with the potential for significant future financial rewards based on company performance, often complementing a lower base salary. Equity compensation aligns employee interests with shareholder value, incentivizing long-term commitment and growth beyond immediate salary benefits.

Refresh Grants

Refresh grants provide ongoing equity compensation that complements a base salary by aligning employee incentives with long-term company performance and potential stock appreciation. These grants help maintain employee motivation and retention by periodically increasing an individual's ownership stake, balancing immediate salary benefits with future financial upside.

Strike Price

Strike price plays a critical role in equity compensation, determining the fixed price at which employees can purchase stock options, directly impacting potential financial gain. Compared to salary, equity with a favorable strike price offers long-term wealth accumulation but carries market risk, while salary provides immediate, guaranteed income.

Golden Handcuffs

Golden handcuffs in compensation refer to equity-based incentives designed to retain key employees by making the potential financial loss of leaving the company significant. These equity grants often include stock options or restricted stock units that vest over time, aligning employee interest with company performance while limiting immediate liquidity compared to a higher cash salary.

Dilution Risk

Salary provides guaranteed income without exposure to dilution risk, while equity compensation can lose value as additional shares are issued, reducing each shareholder's ownership percentage. Understanding dilution risk is crucial when evaluating equity packages, as it directly impacts long-term financial outcomes compared to fixed salary earnings.

Double-Trigger Acceleration

Double-Trigger Acceleration in equity compensation ensures that employees receive immediate vesting of stock options or shares upon both a change in company control and subsequent termination without cause, providing financial security beyond base salary. This mechanism aligns employee incentives with company success while mitigating risks of sudden job loss, offering a balanced compensation strategy compared to fixed salary packages.

Phantom Equity

Phantom equity offers employees benefits similar to stock ownership without actual shares, providing long-term incentives without diluting company equity or requiring immediate cash payouts. Unlike traditional salaries, phantom equity aligns employee compensation with company performance, enhancing motivation through potential future payouts tied to valuation growth.

Total Compensation Mix

Total compensation mix balances salary and equity to align employee incentives with company performance, offering immediate financial stability through salary and potential long-term gains via equity. Equity components such as stock options or restricted stock units (RSUs) complement base salary, enhancing overall earnings and fostering ownership mentality among employees.

Salary vs Equity for compensation. Infographic

hrdif.com

hrdif.com