Life insurance provides financial security for your family in the event of your death, ensuring that your career investments and future earnings are protected. Pet insurance covers veterinary expenses, allowing you to focus on your professional growth without worrying about unexpected pet health costs. Both types of coverage contribute to maintaining stability and peace of mind in your personal and professional life.

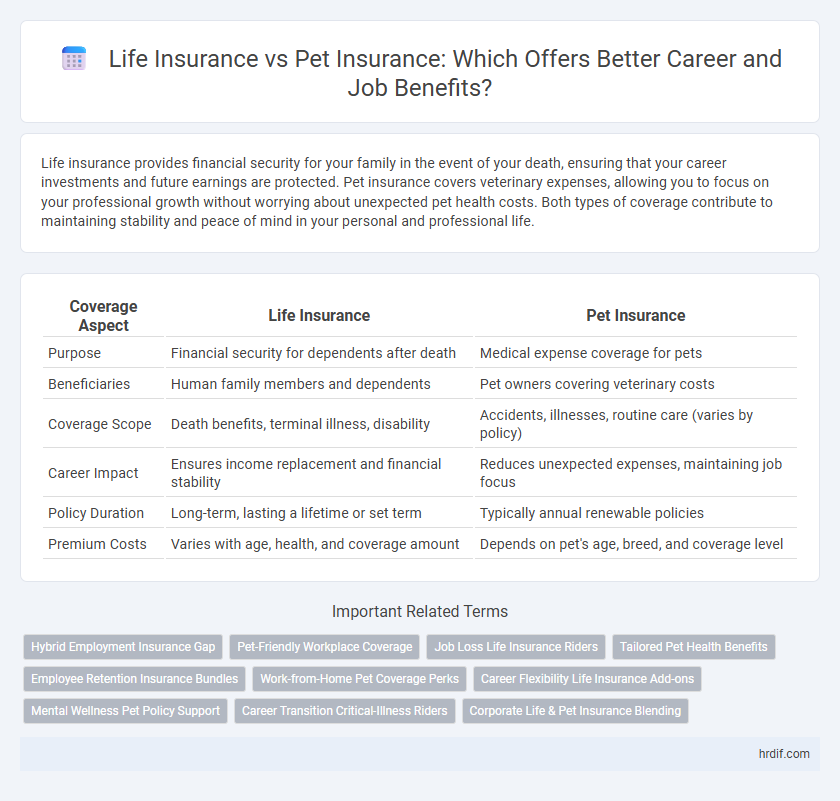

Table of Comparison

| Coverage Aspect | Life Insurance | Pet Insurance |

|---|---|---|

| Purpose | Financial security for dependents after death | Medical expense coverage for pets |

| Beneficiaries | Human family members and dependents | Pet owners covering veterinary costs |

| Coverage Scope | Death benefits, terminal illness, disability | Accidents, illnesses, routine care (varies by policy) |

| Career Impact | Ensures income replacement and financial stability | Reduces unexpected expenses, maintaining job focus |

| Policy Duration | Long-term, lasting a lifetime or set term | Typically annual renewable policies |

| Premium Costs | Varies with age, health, and coverage amount | Depends on pet's age, breed, and coverage level |

Understanding Life Insurance Benefits for Professionals

Life insurance benefits for professionals provide critical financial security by offering income replacement and debt coverage in the event of disability or death, ensuring career stability for dependents. Employers often include life insurance as part of comprehensive benefits packages, enhancing employee retention and attracting talent in competitive job markets. Pet insurance coverage, while valuable for managing veterinary expenses, generally does not impact career benefits or financial planning in the same capacity as life insurance for professionals.

Pet Insurance: An Overlooked Benefit in the Workplace

Pet insurance coverage in the workplace offers significant benefits by reducing employee stress related to unexpected veterinary expenses and improving overall job satisfaction. Employers providing pet insurance demonstrate a commitment to employee well-being and work-life balance, fostering loyalty and reducing turnover rates. This overlooked benefit supports a healthier, more focused workforce while enhancing recruitment appeal in competitive job markets.

Comparing Life and Pet Insurance for Career Stability

Life insurance provides financial security for dependents in case of untimely death, ensuring career stability by protecting family income and future financial obligations. Pet insurance covers veterinary expenses, reducing unexpected out-of-pocket costs and preventing financial stress that might impact job performance. Comparing both, life insurance offers broader protection linked to long-term financial planning, whereas pet insurance supports immediate healthcare needs that indirectly contribute to career focus.

Financial Security: Life Insurance Coverage for Employees

Life insurance coverage provides employees with crucial financial security by offering income replacement and debt coverage in the event of unexpected death, ensuring their family's financial stability. Unlike pet insurance, which covers veterinary expenses, life insurance safeguards an employee's dependents from financial hardship, preserving long-term economic well-being. Employers offering comprehensive life insurance benefits enhance job satisfaction and career retention by providing peace of mind and supporting employees' financial planning.

Employee Wellness: The Role of Pet Insurance

Pet insurance plays a crucial role in employee wellness by reducing stress and financial burdens associated with unexpected veterinary expenses, leading to improved focus and productivity at work. Unlike life insurance, which secures long-term financial stability for employees' families, pet insurance addresses immediate health needs of pets, contributing to overall mental health and job satisfaction. Employers offering pet insurance as part of their benefits package demonstrate a commitment to holistic employee well-being, potentially enhancing retention and morale.

Enhancing Job Satisfaction with Insurance Benefits

Life insurance provides financial security that reduces stress, allowing employees to focus on career growth and job performance. Pet insurance coverage alleviates concerns about unexpected veterinary expenses, promoting peace of mind and increased workplace productivity. Both benefits contribute to enhanced job satisfaction by supporting overall well-being and reducing financial worries.

Making the Right Choice: Life vs Pet Insurance for Your Career

Choosing between life insurance and pet insurance depends on your career priorities and financial responsibilities. Life insurance provides critical income protection and financial security for your family in case of untimely death, ensuring peace of mind for career-focused individuals. Pet insurance offers valuable coverage for unexpected veterinary expenses, supporting pet owners who want to maintain career productivity without the stress of high pet care costs.

Insurance Perks that Attract and Retain Top Talent

Life insurance offers financial security for employees' families, enhancing job loyalty and reducing turnover, while pet insurance addresses rising demand for comprehensive benefits that cater to personal well-being and work-life balance. Employers providing robust pet insurance plans demonstrate commitment to employee satisfaction, which can be a decisive factor in talent acquisition and retention strategies. Combining life and pet insurance coverage creates a competitive benefits package that attracts high-caliber professionals seeking holistic protection and care.

How Insurance Coverage Impacts Career Growth

Life insurance provides financial security that ensures career stability by covering family obligations in the event of untimely death, reducing stress and enabling risk-taking for career advancement. Pet insurance minimizes unexpected veterinary expenses, preventing financial setbacks that could distract from work performance and limit professional growth. Both types of coverage contribute to peace of mind, allowing employees to focus on skill development and job responsibilities without the burden of unforeseen financial crises.

Choosing the Best Insurance Benefits for Professional Success

Life insurance provides financial security for your family's future, ensuring peace of mind that supports career focus without distraction. Pet insurance, on the other hand, covers unexpected veterinary costs, reducing stress that can impact work performance. Selecting the best insurance benefits aligns with your professional goals by minimizing personal financial risks and enhancing overall job productivity.

Related Important Terms

Hybrid Employment Insurance Gap

Life insurance provides financial security for families in case of untimely death, while pet insurance covers veterinary expenses, typically excluding income replacement benefits essential for hybrid employment scenarios. Hybrid employment insurance gaps arise because traditional policies often overlook freelancers' or remote workers' needs, making tailored coverage crucial for comprehensive career risk management.

Pet-Friendly Workplace Coverage

Pet insurance coverage in a pet-friendly workplace enhances employee satisfaction by reducing financial stress related to veterinary care, leading to increased productivity and lower absenteeism. Life insurance primarily supports long-term financial security for employees' families, while pet insurance directly benefits immediate well-being, aligning with companies that prioritize holistic employee care.

Job Loss Life Insurance Riders

Job Loss Life Insurance Riders provide financial protection by covering premium payments during periods of unemployment, ensuring life insurance policies remain active without burdening the policyholder. Unlike pet insurance, which focuses on veterinary expenses, job loss riders directly support career stability and income security during unexpected job transitions.

Tailored Pet Health Benefits

Life insurance primarily safeguards an individual's financial dependents in case of unexpected death, while pet insurance offers tailored pet health benefits that ensure veterinary care coverage, which supports overall well-being and reduces stress for pet-owning professionals. Employers incorporating pet insurance into benefits packages demonstrate commitment to employee wellness, potentially boosting job satisfaction and career longevity by addressing personalized pet health needs.

Employee Retention Insurance Bundles

Life insurance and pet insurance coverage integrated into employee retention insurance bundles enhance job satisfaction by addressing diverse personal needs, increasing workforce loyalty and reducing turnover rates. Customized bundles combining life and pet insurance provide comprehensive financial security, making employees more likely to remain with their employer long-term.

Work-from-Home Pet Coverage Perks

Life insurance secures financial stability for dependents in case of untimely death, while pet insurance provides coverage for veterinary expenses, essential for remote workers managing both career and pet care from home. Work-from-home employees benefit from pet insurance perks such as reduced stress, enhanced productivity, and peace of mind knowing pet health costs are covered without disrupting their job performance.

Career Flexibility Life Insurance Add-ons

Life insurance with career flexibility add-ons offers tailored coverage that adapts to job changes, providing financial security during career transitions or unemployment periods. Pet insurance typically lacks such flexibility features, making life insurance a more comprehensive option for protecting income and family well-being throughout varying career stages.

Mental Wellness Pet Policy Support

Life insurance provides financial security and peace of mind that reduces workplace stress, while pet insurance offers mental wellness support by covering veterinary care and promoting emotional stability through pet health assurance. Investing in both policies enhances overall job performance and career resilience by safeguarding personal and emotional well-being.

Career Transition Critical-Illness Riders

Career transition critical-illness riders in life insurance provide financial security during health challenges that may impact job stability, covering medical expenses and income loss to support continued career growth. Pet insurance coverage, while beneficial for animal health, lacks provisions for human critical illness protection, making life insurance essential for managing career-related risks during serious health events.

Corporate Life & Pet Insurance Blending

Corporate life and pet insurance blending offers comprehensive protection that enhances employee benefits packages by addressing both personal and professional well-being, boosting job satisfaction and retention. Integrating life insurance with pet insurance coverage supports employees' financial security and peace of mind, fostering a balanced work-life environment and improving overall productivity.

Life Insurance vs Pet Insurance Coverage for job and career. Infographic

hrdif.com

hrdif.com