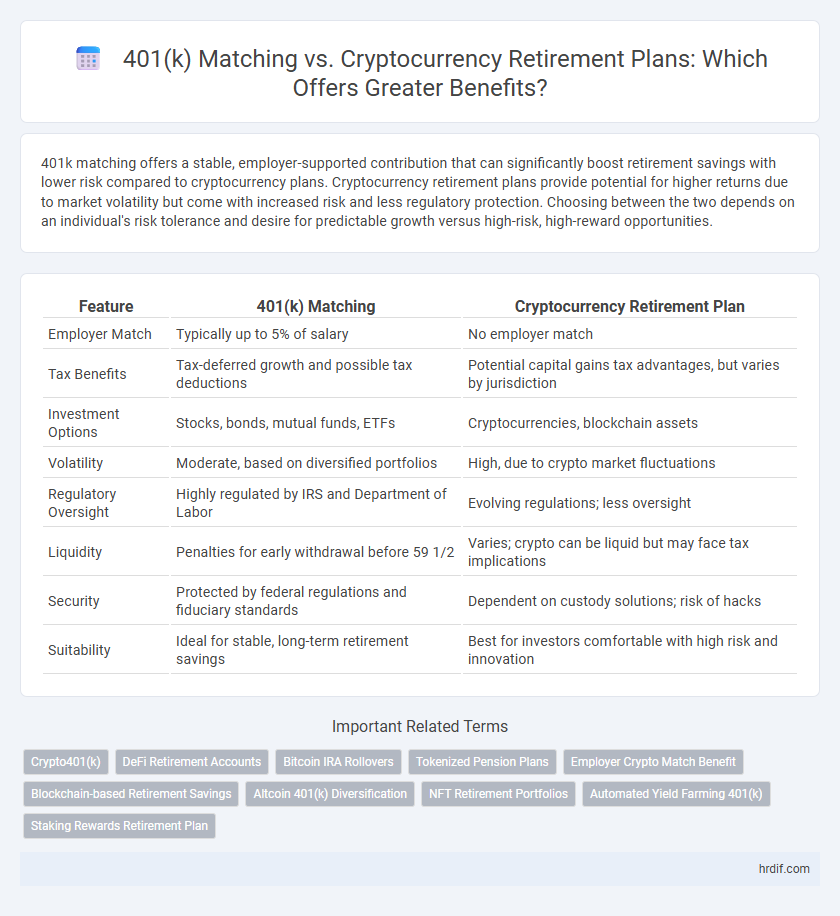

401k matching offers a stable, employer-supported contribution that can significantly boost retirement savings with lower risk compared to cryptocurrency plans. Cryptocurrency retirement plans provide potential for higher returns due to market volatility but come with increased risk and less regulatory protection. Choosing between the two depends on an individual's risk tolerance and desire for predictable growth versus high-risk, high-reward opportunities.

Table of Comparison

| Feature | 401(k) Matching | Cryptocurrency Retirement Plan |

|---|---|---|

| Employer Match | Typically up to 5% of salary | No employer match |

| Tax Benefits | Tax-deferred growth and possible tax deductions | Potential capital gains tax advantages, but varies by jurisdiction |

| Investment Options | Stocks, bonds, mutual funds, ETFs | Cryptocurrencies, blockchain assets |

| Volatility | Moderate, based on diversified portfolios | High, due to crypto market fluctuations |

| Regulatory Oversight | Highly regulated by IRS and Department of Labor | Evolving regulations; less oversight |

| Liquidity | Penalties for early withdrawal before 59 1/2 | Varies; crypto can be liquid but may face tax implications |

| Security | Protected by federal regulations and fiduciary standards | Dependent on custody solutions; risk of hacks |

| Suitability | Ideal for stable, long-term retirement savings | Best for investors comfortable with high risk and innovation |

Understanding 401k Matching: Traditional Benefits

401k matching offers employees a guaranteed return on investment by doubling contributions up to a certain percentage, providing a stable and tax-advantaged growth environment essential for long-term retirement savings. Unlike cryptocurrency retirement plans, 401k matching reduces financial risk through employer contributions and adherence to regulatory protections under ERISA. This traditional benefit ensures consistent compound growth, enhancing retirement security with predictable asset accumulation.

Cryptocurrency Retirement Plans: The New Frontier

Cryptocurrency retirement plans offer a modern alternative to traditional 401k matching programs by leveraging blockchain technology for enhanced transparency and potentially higher returns through digital asset appreciation. These plans enable tax-advantaged investments in cryptocurrencies like Bitcoin and Ethereum, helping diversify retirement portfolios beyond conventional stocks and bonds. Employers embracing crypto retirement options provide employees with innovative benefits that tap into the growing digital economy while maintaining compliance with IRS regulations.

Comparing Growth Potential: 401k vs Crypto Investments

401k matching contributions offer steady, tax-advantaged growth with employer-funded incentives, ensuring a reliable retirement savings boost. Cryptocurrency retirement plans present higher growth potential due to market volatility and rapid appreciation but come with increased risk and regulatory uncertainty. Investors seeking long-term benefit optimization must weigh the stable, compounded returns of 401k matching against the speculative, high-reward nature of crypto investments.

Security and Regulation: Which Option is Safer?

401k matching benefits offer greater security and regulatory oversight, backed by the Employee Retirement Income Security Act (ERISA) and the Department of Labor, ensuring participant protections and fiduciary responsibility. Cryptocurrency retirement plans lack standardized regulation and are subject to market volatility and potential cybersecurity risks, making them less secure in comparison. Employer-sponsored 401k plans provide a safer, more stable retirement savings option due to established legal frameworks and federal insurance protections.

Employer Contributions: Maximizing Your 401k Benefits

Employer contributions to a 401k plan significantly boost retirement savings through matching programs, often providing up to 5% of an employee's salary as free money. This guaranteed contribution increases the overall investment growth and reduces the risk compared to cryptocurrency retirement plans, which lack consistent employer funding. Maximizing 401k matching benefits ensures a reliable foundation for long-term financial security, leveraging tax advantages and compounding growth unavailable in most crypto options.

Tax Advantages: 401k Matching Versus Crypto Retirement

401k matching offers significant tax advantages including pre-tax contributions and employer matches that grow tax-deferred until withdrawal, effectively lowering taxable income during working years. Cryptocurrency retirement plans provide potential tax benefits through tax-advantaged accounts like self-directed IRAs, but gains may be subject to capital gains tax upon distribution, depending on plan structure. While 401ks deliver predictable tax savings and employer benefits, crypto retirement accounts offer higher growth potential yet come with increased tax uncertainty and regulatory risks.

Volatility and Risk: How 401k and Crypto Plans Differ

401(k) matching plans offer stable, employer-backed contributions that reduce investment risk, making them a reliable retirement benefit with lower volatility. Cryptocurrency retirement plans expose investors to high market volatility and regulatory uncertainties, increasing the potential for significant gains but also substantial losses. The risk profile of 401(k) plans is generally more conservative, aligning with long-term retirement security, whereas crypto plans demand tolerance for fluctuating asset values and speculative investment strategies.

Liquidity and Withdrawal Flexibility: 401k vs Cryptocurrency

401k plans offer limited liquidity and strict withdrawal rules, typically penalizing early distributions before age 59 1/2, which can restrict access to funds during emergencies. Cryptocurrency retirement plans provide greater withdrawal flexibility and higher liquidity, allowing investors to move or convert digital assets quickly without traditional penalties. However, the volatility of cryptocurrencies introduces risks that can impact the stability of retirement savings compared to the more regulated 401k matching benefits.

Long-Term Retirement Outcomes: What History Tells Us

401k matching programs have consistently demonstrated strong long-term retirement outcomes due to employer contributions and historically stable growth in traditional equities and bonds. Cryptocurrency retirement plans offer high growth potential but come with significant volatility and lack the extensive historical data supporting consistent returns. Long-term retirement benefits tend to favor 401k matching for risk-adjusted growth and predictable wealth accumulation.

Choosing the Right Retirement Plan: Key Factors to Consider

401k matching offers a reliable employer-funded contribution, maximizing retirement savings with tax advantages and predictable growth, while cryptocurrency retirement plans provide high growth potential but come with significant volatility and regulatory uncertainty. Key factors to consider include risk tolerance, investment timeline, liquidity needs, and employer offerings. Evaluating stability, tax implications, and diversification opportunities helps in selecting the optimal retirement plan for long-term financial security.

Related Important Terms

Crypto401(k)

Crypto401(k) plans offer the benefit of diversifying retirement portfolios with cryptocurrency assets, providing potential for higher returns compared to traditional 401(k) matching contributions that typically invest in stocks and bonds. These plans enable tax-advantaged growth while allowing participants to capitalize on the rising adoption of digital currencies within a regulated retirement framework.

DeFi Retirement Accounts

401k matching offers a guaranteed employer contribution that enhances retirement savings through traditional investment vehicles, while Cryptocurrency retirement plans, particularly DeFi Retirement Accounts, provide decentralized financial benefits such as higher yield opportunities, transparency, and increased control over assets. DeFi-based plans leverage blockchain technology to reduce fees and enable programmable smart contracts, contrasting with the relatively fixed structure of 401k matching benefits.

Bitcoin IRA Rollovers

401k matching offers guaranteed employer contributions that boost retirement savings with tax advantages, while Bitcoin IRA Rollovers provide exposure to cryptocurrency like Bitcoin, potentially enhancing portfolio diversification and growth through digital asset appreciation. Choosing between traditional 401k matching and Bitcoin IRA Rollovers depends on risk tolerance, investment goals, and the desire for innovative retirement benefits in a tax-advantaged account.

Tokenized Pension Plans

Tokenized pension plans leverage blockchain technology to offer transparent, secure, and customizable retirement benefits, potentially providing higher returns compared to traditional 401(k) matching schemes. These plans enable fractional ownership of diversified digital assets, increasing liquidity and flexibility in long-term retirement savings strategies.

Employer Crypto Match Benefit

Employer crypto match benefits offer a unique advantage by allowing employees to accumulate digital assets directly in their retirement accounts, potentially yielding higher long-term growth compared to traditional 401k matching. These programs align with emerging financial trends, providing diversification and liquidity options that conventional 401k plans may lack.

Blockchain-based Retirement Savings

Blockchain-based retirement savings offer enhanced transparency, security, and decentralized control compared to traditional 401k matching programs, reducing administrative costs and fraud risks. The integration of smart contracts in cryptocurrency retirement plans automates contributions and distributions, providing greater flexibility and real-time portfolio management benefits for long-term wealth accumulation.

Altcoin 401(k) Diversification

401(k) matching provides a guaranteed employer contribution that enhances retirement savings, whereas an Altcoin 401(k) enables diversification by incorporating alternative cryptocurrencies into the portfolio, potentially increasing growth opportunities and risk management. This hybrid approach balances traditional financial security with exposure to emerging digital assets, optimizing long-term benefits.

NFT Retirement Portfolios

401k matching offers a stable, employer-backed retirement benefit with tax advantages and predictable growth, while NFT retirement portfolios in cryptocurrency plans provide innovative diversification and potential high returns through digital asset investments. Leveraging NFTs for retirement combines blockchain transparency and uniqueness, appealing to investors seeking cutting-edge benefits beyond traditional 401k matching structures.

Automated Yield Farming 401(k)

Automated yield farming 401(k) plans combine traditional employer matching benefits with decentralized finance strategies, optimizing retirement growth through blockchain-based yield generation. These plans provide a unique synergy by leveraging automated smart contract protocols for passive income, outperforming conventional 401(k) returns while maintaining tax advantages and regulatory compliance.

Staking Rewards Retirement Plan

401k matching programs offer guaranteed employer contributions that grow tax-deferred, providing a stable and predictable retirement benefit. In contrast, Staking Rewards Cryptocurrency retirement plans can yield potentially higher returns through passive income on digital assets but carry increased volatility and regulatory risks.

401k matching vs Cryptocurrency retirement plan for benefit. Infographic

hrdif.com

hrdif.com