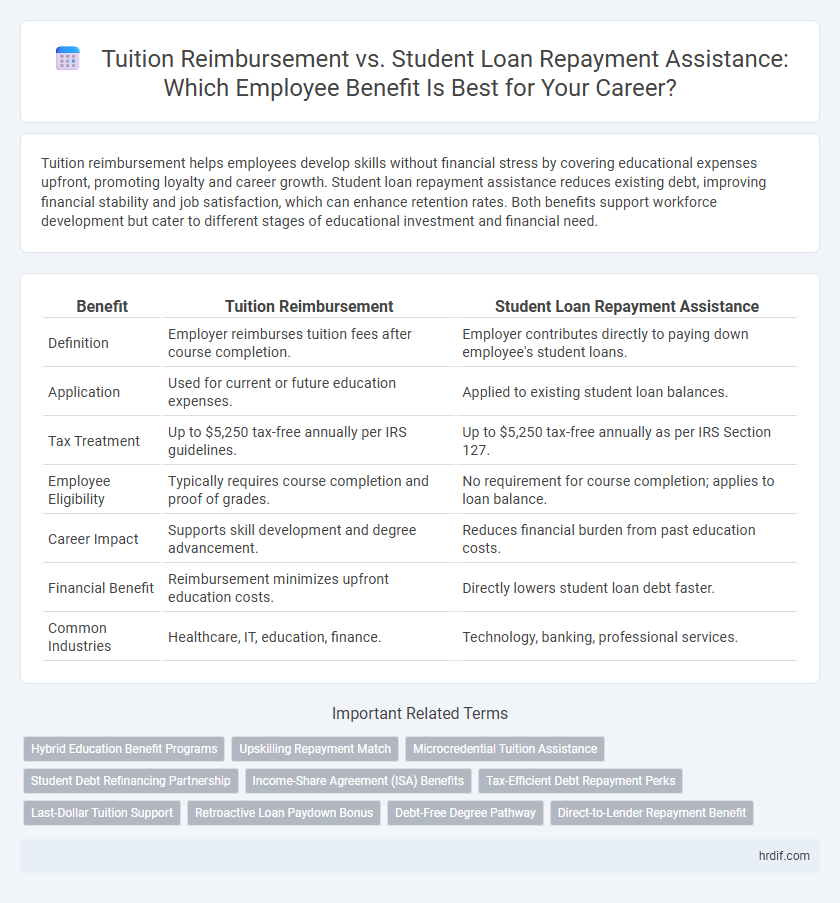

Tuition reimbursement helps employees develop skills without financial stress by covering educational expenses upfront, promoting loyalty and career growth. Student loan repayment assistance reduces existing debt, improving financial stability and job satisfaction, which can enhance retention rates. Both benefits support workforce development but cater to different stages of educational investment and financial need.

Table of Comparison

| Benefit | Tuition Reimbursement | Student Loan Repayment Assistance |

|---|---|---|

| Definition | Employer reimburses tuition fees after course completion. | Employer contributes directly to paying down employee's student loans. |

| Application | Used for current or future education expenses. | Applied to existing student loan balances. |

| Tax Treatment | Up to $5,250 tax-free annually per IRS guidelines. | Up to $5,250 tax-free annually as per IRS Section 127. |

| Employee Eligibility | Typically requires course completion and proof of grades. | No requirement for course completion; applies to loan balance. |

| Career Impact | Supports skill development and degree advancement. | Reduces financial burden from past education costs. |

| Financial Benefit | Reimbursement minimizes upfront education costs. | Directly lowers student loan debt faster. |

| Common Industries | Healthcare, IT, education, finance. | Technology, banking, professional services. |

Introduction to Employee Education Benefits

Tuition reimbursement programs directly cover employees' course fees, promoting skill development without upfront costs, while student loan repayment assistance helps reduce existing debt, enhancing financial wellness and long-term retention. Employers offering these benefits typically see increased employee engagement and career advancement, fostering a more educated and motivated workforce. Choosing between these options depends on organizational goals and employee needs, balancing immediate educational support with debt relief strategies.

What is Tuition Reimbursement?

Tuition reimbursement is an employer-sponsored benefit that covers or reimburses employees for the cost of tuition and related educational expenses when pursuing courses or degrees relevant to their job. This program encourages skill development and professional growth by reducing the financial burden of continuing education. Unlike student loan repayment assistance, tuition reimbursement directly supports ongoing learning while employees remain with the company.

What is Student Loan Repayment Assistance?

Student Loan Repayment Assistance is an employer-sponsored benefit that helps employees pay down their student loan debt by making direct contributions to their loan accounts. This program often includes matching payments or fixed monthly amounts, reducing the financial burden of student loans and accelerating debt repayment. By alleviating loan obligations, Student Loan Repayment Assistance enhances employee financial wellness and supports long-term career retention.

Key Differences Between Tuition Reimbursement and Loan Repayment

Tuition reimbursement typically covers the direct cost of eligible courses upfront or after course completion, reducing the immediate financial burden for employees seeking further education. Student loan repayment assistance programs provide employees with funds specifically to help pay down existing educational debt, easing long-term financial obligations. The primary distinction lies in timing and purpose: tuition reimbursement supports new educational expenses, while loan repayment assistance targets past student loans.

Eligibility Criteria for Each Program

Tuition reimbursement programs typically require employees to maintain a minimum tenure, often six months to one year, and pursue degrees related to their current job or career path. Student loan repayment assistance programs usually have eligibility criteria centered on employment status, with some requiring full-time positions and a minimum period of service, but they may not restrict the field of study. Both programs often mandate the submission of official documentation, such as transcripts or loan statements, to verify enrollment and payment status.

Impact on Employee Professional Development

Tuition reimbursement enhances employee professional development by directly supporting continued education and skill acquisition relevant to their current job roles, fostering immediate application and growth within the company. Student loan repayment assistance improves financial wellness and reduces employee stress, enabling a clearer focus on career advancement and long-term professional growth. Both benefits contribute to higher retention rates and employee engagement by aligning financial support with personal and professional development goals.

Tax Implications for Employees and Employers

Tuition Reimbursement is generally considered a tax-free employee benefit up to $5,250 annually, allowing employers to deduct these expenses as a business cost while employees avoid additional taxable income. Student Loan Repayment Assistance, however, was historically taxable as income but became tax-free for employers and employees through legislation extended through 2025, offering mutual tax advantages. Employers benefit from enhanced recruitment and retention incentives, while employees gain financial relief without the burden of increased tax liability.

Effect on Recruiting and Retention

Employer tuition reimbursement programs significantly enhance recruiting and retention by offering employees a clear path for career advancement without immediate financial burden. Student loan repayment assistance attracts candidates burdened by debt, reducing financial stress and increasing loyalty by addressing post-graduation liabilities. Both benefits improve workforce stability and job satisfaction, but tuition reimbursement tends to foster long-term skill development, while loan repayment assistance offers immediate financial relief.

Aligning Education Benefits with Career Advancement

Tuition reimbursement programs directly invest in employees' skill development by covering course expenses tied to their current or future roles, fostering immediate career growth. Student loan repayment assistance alleviates financial burdens from past education, enhancing long-term financial stability but with less impact on real-time skill acquisition. Aligning education benefits with career advancement requires employers to evaluate whether boosting current qualifications through tuition reimbursement or easing debt through loan repayment better supports their talent development strategies.

Choosing the Right Benefit Program for Your Career Goals

Tuition reimbursement offers direct financial support for courses related to an employee's current job, fostering immediate skill development and career advancement within the company. Student loan repayment assistance helps reduce outstanding education debt, improving long-term financial wellness and flexibility in career choices. Evaluate your career goals and financial needs to select a benefit program that maximizes both expert knowledge growth and debt reduction.

Related Important Terms

Hybrid Education Benefit Programs

Hybrid education benefit programs combine tuition reimbursement and student loan repayment assistance, offering employees flexible financial support for both ongoing education and existing debt reduction. These integrated benefits enhance career development opportunities by reducing the financial burden of higher education while promoting workforce retention and skill advancement.

Upskilling Repayment Match

Tuition reimbursement programs provide employees with direct financial support for completing courses, enabling skill development without upfront costs, while student loan repayment assistance offers employers a way to contribute towards existing debt, enhancing retention by easing financial burdens. Upskilling repayment match combines these benefits by aligning employer contributions with employee education expenses, maximizing career growth incentives and financial relief simultaneously.

Microcredential Tuition Assistance

Microcredential tuition assistance enhances career advancement by covering specialized, industry-relevant courses that boost skillsets without the long-term debt associated with traditional student loans. Unlike student loan repayment assistance, tuition reimbursement for microcredentials directly supports continuous professional development and immediate applicability in evolving job markets.

Student Debt Refinancing Partnership

Student Debt Refinancing Partnerships offer employees lower interest rates and streamlined repayment options compared to traditional Tuition Reimbursement or Student Loan Repayment Assistance programs, significantly reducing overall debt burden and accelerating financial stability. Leveraging these partnerships, companies enhance employee retention and job satisfaction by providing tailored support that directly addresses high-interest student debt refinancing.

Income-Share Agreement (ISA) Benefits

Income-Share Agreements (ISAs) offer employees the advantage of flexible repayment terms tied to their actual income, reducing financial stress compared to traditional loan obligations or fixed tuition reimbursements. ISAs align employer incentives with career success, promoting workforce retention through support that adapts to earnings rather than fixed repayment schedules.

Tax-Efficient Debt Repayment Perks

Tuition reimbursement programs offer tax-free benefits by directly covering education costs, reducing taxable income, whereas student loan repayment assistance may count as taxable income, impacting overall tax efficiency. Employers seeking to provide tax-efficient debt repayment perks often prefer tuition reimbursement to maximize financial advantages for employees pursuing career development.

Last-Dollar Tuition Support

Last-dollar tuition support in tuition reimbursement programs covers remaining education costs after scholarships and grants, reducing out-of-pocket expenses more effectively than student loan repayment assistance that focuses on paying down existing debt. Employers offering last-dollar tuition benefits enhance employee career advancement by minimizing upfront financial barriers to further education.

Retroactive Loan Paydown Bonus

Tuition reimbursement programs cover current educational expenses, whereas student loan repayment assistance, especially with a retroactive loan paydown bonus, directly reduces existing loan balances, providing immediate financial relief and incentivizing employee retention. Retroactive loan paydown bonuses uniquely enhance career benefits by rewarding tenure and past educational investments, making them a strategic advantage in talent acquisition and retention.

Debt-Free Degree Pathway

Tuition reimbursement programs reduce employee financial burden by directly covering course costs, promoting a debt-free degree pathway and enhancing job retention. Student loan repayment assistance helps employees manage existing debt, but tuition reimbursement more effectively supports long-term financial stability and career growth without accumulating loans.

Direct-to-Lender Repayment Benefit

Direct-to-Lender repayment benefits streamline student loan assistance by sending employer payments directly to loan servicers, reducing administrative burden and ensuring timely credit toward the debt. This approach enhances job-related financial wellness by lowering employee loan balances efficiently compared to traditional tuition reimbursement programs.

Tuition Reimbursement vs Student Loan Repayment Assistance for job and career. Infographic

hrdif.com

hrdif.com