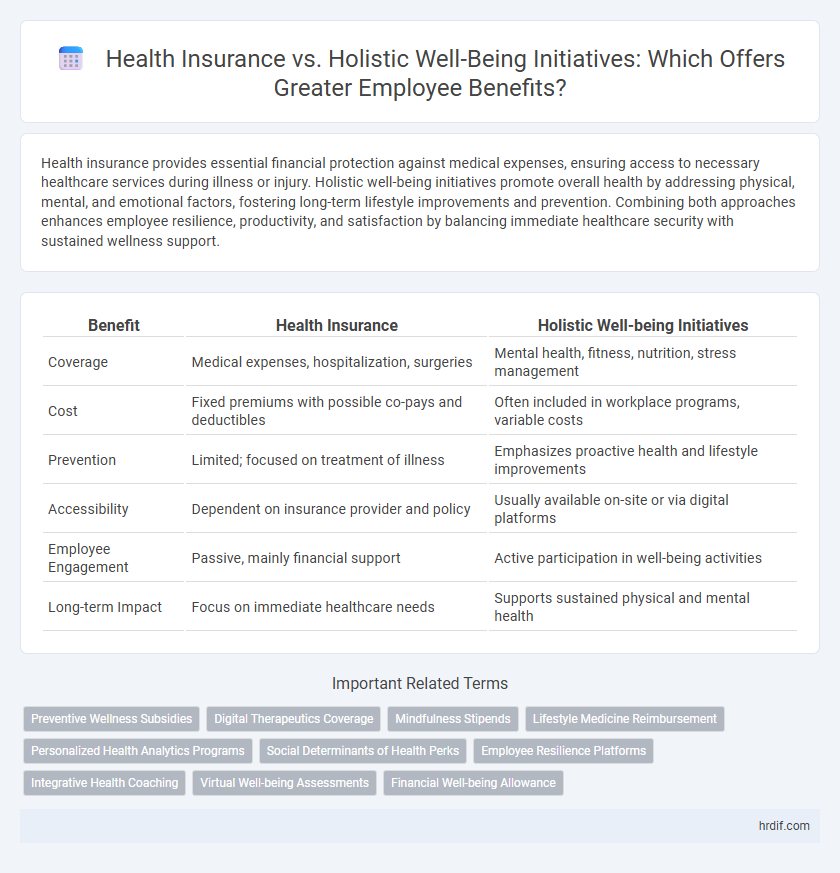

Health insurance provides essential financial protection against medical expenses, ensuring access to necessary healthcare services during illness or injury. Holistic well-being initiatives promote overall health by addressing physical, mental, and emotional factors, fostering long-term lifestyle improvements and prevention. Combining both approaches enhances employee resilience, productivity, and satisfaction by balancing immediate healthcare security with sustained wellness support.

Table of Comparison

| Benefit | Health Insurance | Holistic Well-being Initiatives |

|---|---|---|

| Coverage | Medical expenses, hospitalization, surgeries | Mental health, fitness, nutrition, stress management |

| Cost | Fixed premiums with possible co-pays and deductibles | Often included in workplace programs, variable costs |

| Prevention | Limited; focused on treatment of illness | Emphasizes proactive health and lifestyle improvements |

| Accessibility | Dependent on insurance provider and policy | Usually available on-site or via digital platforms |

| Employee Engagement | Passive, mainly financial support | Active participation in well-being activities |

| Long-term Impact | Focus on immediate healthcare needs | Supports sustained physical and mental health |

Understanding Employee Benefit Preferences

Health insurance remains a crucial benefit that addresses immediate medical needs and financial protection for employees. Holistic well-being initiatives, including mental health support, fitness programs, and stress management, align with growing employee demands for comprehensive health solutions. Understanding employee preferences requires analyzing demographic data and engagement metrics to tailor benefits that foster both physical health and overall well-being.

Comparing Traditional Health Insurance and Holistic Well-being

Traditional health insurance primarily covers medical expenses such as hospital stays, doctor visits, and prescription medications, providing financial protection against unexpected health costs. Holistic well-being initiatives focus on preventative care, mental health, nutrition, exercise, and stress management, aiming to improve overall quality of life and reduce long-term healthcare needs. Combining traditional health insurance with holistic well-being programs offers a comprehensive approach to employee health, balancing cost control with enhanced physical and mental wellness.

The Financial Impact of Health Insurance vs. Well-being Programs

Health insurance primarily reduces out-of-pocket medical expenses by covering hospitalization, treatments, and medications, directly mitigating financial risk associated with illness. Holistic well-being initiatives, such as mental health support and fitness programs, contribute to long-term cost savings by promoting healthier lifestyles and reducing chronic disease prevalence. Companies investing in well-being programs often experience decreased absenteeism and lower healthcare claims, creating a measurable financial benefit alongside traditional health insurance coverage.

Employee Retention: Health Insurance or Holistic Initiatives?

Health insurance offers employees essential financial protection against medical expenses, directly impacting job satisfaction and retention by reducing stress related to healthcare costs. Holistic well-being initiatives, including mental health support, fitness programs, and flexible work arrangements, enhance overall employee engagement and productivity, fostering a supportive work environment. Combining comprehensive health insurance with holistic well-being strategies creates a robust retention framework that addresses both physical health and emotional resilience.

Mental Health Support: Insurance Versus Holistic Strategies

Health insurance plans often provide access to licensed mental health professionals and cover therapy sessions, medication, and psychiatric care, ensuring financial protection against mental health treatment costs. Holistic well-being initiatives emphasize a comprehensive approach, integrating mindfulness practices, stress management workshops, physical fitness, and social support systems to promote sustained mental resilience and emotional balance. Combining both structured insurance benefits and proactive wellness programs creates a more robust support system for long-term mental health improvement.

Flexibility and Personalization in Benefits Packages

Health insurance provides essential financial protection against medical expenses, yet holistic well-being initiatives offer greater flexibility and personalization by addressing physical, mental, and emotional health through tailored programs. Employers incorporating wellness activities, mental health support, and lifestyle coaching enable employees to customize benefits that best fit their unique needs and preferences. This integrated approach enhances overall satisfaction and engagement, surpassing the limitations of traditional health insurance alone.

Measurable Outcomes of Health Insurance and Well-being Initiatives

Health insurance primarily delivers measurable outcomes through direct financial protection against medical expenses, reducing out-of-pocket costs and improving access to healthcare services. Holistic well-being initiatives demonstrate measurable benefits by enhancing employee productivity, reducing absenteeism, and improving mental and physical health metrics through preventative care and lifestyle support. Combining health insurance with well-being programs leads to synergistic effects, maximizing overall health outcomes and cost efficiency for organizations.

Enhancing Workplace Culture Through Holistic Benefits

Integrating health insurance with holistic well-being initiatives creates a comprehensive benefits package that supports physical, mental, and emotional health, fostering a positive and productive workplace culture. Holistic benefits such as mindfulness programs, fitness memberships, and mental health resources promote employee engagement and reduce absenteeism more effectively than health insurance alone. Companies that prioritize holistic well-being see improved job satisfaction, higher retention rates, and a collaborative environment that drives organizational success.

Cost-Effectiveness of Health Insurance and Well-being Programs

Health insurance offers cost-effective risk protection by covering medical expenses, reducing out-of-pocket costs for employees and employers alike. Holistic well-being initiatives enhance productivity and reduce absenteeism by addressing mental, physical, and emotional health, ultimately lowering indirect costs. Combining both approaches maximizes overall benefit value, balancing immediate healthcare coverage with long-term wellness investment.

Future Trends: Integrating Insurance with Holistic Well-being

Future trends in employee benefits emphasize the integration of health insurance with holistic well-being initiatives, creating comprehensive support systems that address physical, mental, and emotional health. Companies increasingly adopt technology-driven platforms combining traditional insurance coverage with personalized wellness programs, preventive care, and mental health resources. This fusion enhances employee engagement, reduces healthcare costs, and promotes sustainable well-being outcomes.

Related Important Terms

Preventive Wellness Subsidies

Preventive wellness subsidies within health insurance plans reduce long-term healthcare costs by encouraging regular screenings and vaccinations, fostering early detection and management of chronic conditions. Holistic well-being initiatives complement this by promoting mental health, fitness programs, and nutrition education, leading to improved overall employee productivity and reduced absenteeism.

Digital Therapeutics Coverage

Digital Therapeutics Coverage within health insurance plans offers targeted, evidence-based interventions for chronic conditions, enhancing treatment outcomes and reducing long-term healthcare costs. Holistic well-being initiatives complement this by promoting preventive care and mental health support, fostering overall employee wellness and productivity.

Mindfulness Stipends

Mindfulness stipends offered through holistic well-being initiatives enhance employee mental health by reducing stress and improving focus, complementing traditional health insurance coverage that primarily addresses physical ailments. Incorporating mindfulness stipends can lead to increased productivity and lower healthcare costs by promoting preventive mental wellness practices alongside conventional medical benefits.

Lifestyle Medicine Reimbursement

Health insurance often covers acute medical treatments but may limit reimbursement for holistic well-being initiatives like lifestyle medicine, which emphasizes preventive care and chronic disease management through nutrition, exercise, and stress reduction. Expanding lifestyle medicine reimbursement can reduce healthcare costs and improve long-term outcomes by incentivizing personalized, sustainable lifestyle changes.

Personalized Health Analytics Programs

Personalized Health Analytics Programs within health insurance plans leverage data-driven insights to tailor coverage and preventive care, enhancing individual health outcomes and reducing long-term costs. Holistic well-being initiatives complement this by promoting lifestyle changes and mental health support, creating a comprehensive approach to employee wellness that extends beyond traditional insurance benefits.

Social Determinants of Health Perks

Health insurance primarily covers medical expenses, while holistic well-being initiatives address Social Determinants of Health (SDOH) such as housing, nutrition, and stress management to improve overall employee health. Investing in programs targeting SDOH leads to reduced absenteeism, increased productivity, and long-term healthcare cost savings.

Employee Resilience Platforms

Employee resilience platforms offer a comprehensive approach by integrating health insurance benefits with holistic well-being initiatives, enhancing mental, physical, and emotional support. These platforms improve overall workforce productivity and reduce absenteeism through personalized health management and proactive stress reduction strategies.

Integrative Health Coaching

Integrative Health Coaching enhances employee well-being by combining personalized health insurance benefits with holistic well-being initiatives, addressing physical, mental, and emotional health comprehensively. This approach improves engagement, reduces healthcare costs, and promotes sustainable lifestyle changes that traditional health insurance alone cannot achieve.

Virtual Well-being Assessments

Virtual Well-being Assessments through health insurance programs provide personalized health risk evaluations that enable targeted preventive care, reducing medical expenses and improving patient outcomes. Holistic well-being initiatives leverage these assessments to address physical, mental, and emotional health simultaneously, enhancing overall employee productivity and satisfaction.

Financial Well-being Allowance

Health insurance provides essential financial protection against medical expenses, while holistic well-being initiatives, supported by a Financial Well-being Allowance, empower employees with resources for stress management, wellness programs, and preventive care. Integrating a Financial Well-being Allowance enhances overall employee satisfaction by addressing both healthcare costs and lifestyle factors that impact long-term health and productivity.

Health insurance vs Holistic well-being initiatives for benefit. Infographic

hrdif.com

hrdif.com