Commuter allowance helps offset transportation costs, making daily travel to the office more affordable and reducing financial stress for employees. Remote work stipends provide funds for home office setup, internet, and utility expenses, enhancing productivity and comfort for remote employees. Both benefits improve job satisfaction by addressing distinct work environment needs and supporting employee well-being.

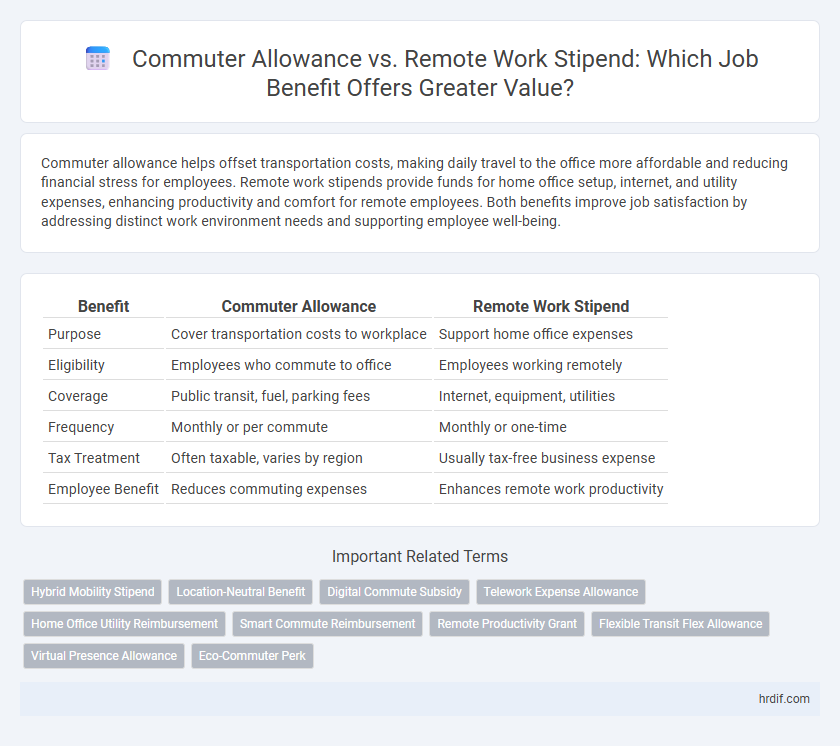

Table of Comparison

| Benefit | Commuter Allowance | Remote Work Stipend |

|---|---|---|

| Purpose | Cover transportation costs to workplace | Support home office expenses |

| Eligibility | Employees who commute to office | Employees working remotely |

| Coverage | Public transit, fuel, parking fees | Internet, equipment, utilities |

| Frequency | Monthly or per commute | Monthly or one-time |

| Tax Treatment | Often taxable, varies by region | Usually tax-free business expense |

| Employee Benefit | Reduces commuting expenses | Enhances remote work productivity |

Overview of Commuter Allowances and Remote Work Stipends

Commuter allowances provide financial support to employees covering transportation costs like public transit fares, fuel, or parking fees, directly reducing commuting expenses. Remote work stipends offer fixed amounts to help cover home office setup, internet bills, or utility costs associated with working from home. Both benefits aim to enhance employee satisfaction by addressing distinct work-related expenses, catering to on-site commuting or remote work needs respectively.

Understanding the Financial Impact of Each Benefit

Commuter allowance directly offsets daily transportation expenses such as transit passes, fuel, and parking fees, providing predictable monthly savings for employees who travel to a physical office. Remote work stipend covers home office costs including internet service, ergonomic equipment, and utility increases, which can vary widely but help reduce personal expenditures related to remote productivity. Evaluating the financial impact requires comparing consistent commute costs against fluctuating home office expenses to determine which benefit offers greater overall economic value based on individual work arrangements.

Employee Preferences: Flexibility Versus Transportation Support

Employee preferences highlight a growing demand for flexibility through remote work stipends rather than traditional commuter allowances that focus solely on transportation support. Remote work stipends provide employees with the autonomy to customize their work environment and manage expenses like home office setup, internet, and utilities. In contrast, commuter allowances limit benefits to transit costs and often fail to address the evolving needs of a hybrid or fully remote workforce.

Tax Implications for Commuter Allowance and Remote Work Stipend

Commuter allowances are often subject to specific tax exemptions depending on national laws, with some countries allowing tax-free treatment up to a certain limit, thereby reducing taxable income for employees. Remote work stipends typically fall under miscellaneous income and may be fully taxable unless explicitly exempted, potentially increasing an employee's tax liability. Understanding the distinct tax regulations for each benefit is crucial for employers and employees to maximize net compensation and ensure compliance.

Productivity Differences: Office vs. Remote Work Support

Commuter allowance supports productivity by reducing financial stress and commute fatigue, enabling employees to arrive at the office more focused and energized. Remote work stipends enhance efficiency by providing essential tools and ergonomic equipment, creating a comfortable workspace that minimizes distractions and promotes sustained concentration. Data shows that tailored benefits aligned with work settings directly influence employee output and job satisfaction.

Environmental Considerations and Corporate Responsibility

Commuter allowances reduce carbon emissions by encouraging public transportation and carpooling, aligning with corporate sustainability goals. Remote work stipends lessen environmental impact by minimizing daily commutes, lowering overall office energy consumption and reducing urban congestion. Companies prioritizing corporate responsibility often balance both benefits to optimize environmental performance and support eco-friendly workforce practices.

Attracting Top Talent with Innovative Benefit Packages

Commuter allowance and remote work stipend serve as strategic benefits to attract top talent by addressing diverse workforce needs and preferences. Offering flexible, innovative compensation such as remote work stipends signals a company's commitment to modern work-life balance, enhancing employer appeal. Competitive benefit packages including these options improve recruitment outcomes by demonstrating adaptability and investment in employee convenience and productivity.

Administrative Challenges and Cost Management

Commuter allowance often incurs higher administrative challenges due to tracking employee travel expenses, reimbursing varied transportation methods, and ensuring compliance with tax regulations. Remote work stipends simplify cost management by providing a fixed monthly amount for home office expenses, reducing the need for detailed expense reporting and audits. Employers benefit from predictable budgeting with remote stipends, while commuter allowances require continuous oversight to manage fluctuating costs and maintain accurate payroll records.

Policy Alignment with Hybrid and Flexible Work Models

Commuter allowance policies support traditional office attendance by covering transportation costs, ensuring alignment with hybrid work models that require regular physical presence. Remote work stipends fund home office expenses, promoting flexibility and enabling seamless work-from-anywhere arrangements. Companies adopting hybrid and flexible work policies benefit from tailoring these allowances to reflect employee work patterns and enhance overall satisfaction.

Future Trends in Employee Benefits: Commuting and Remote Work

Commuter allowances traditionally support employees with transportation costs, but remote work stipends are increasingly preferred as flexible work models rise, reflecting shifting priorities in employee benefits. Data shows a 35% annual growth in companies offering remote work stipends, addressing home office setup and internet expenses to enhance productivity. Future trends indicate a convergence of these benefits, emphasizing personalized support for diverse work arrangements and sustainable commuting options.

Related Important Terms

Hybrid Mobility Stipend

Hybrid Mobility Stipend offers a flexible financial benefit that combines elements of Commuter Allowance and Remote Work Stipend, supporting employees' hybrid work lifestyles by covering transportation costs and home office expenses. This stipend optimizes workforce mobility and productivity, making it a preferred choice over traditional commuting or remote work-specific allowances.

Location-Neutral Benefit

Commuter allowance supports employees incurring transportation costs for on-site work, while remote work stipend addresses expenses related to home office setup and utilities, promoting flexibility regardless of location. Location-neutral benefits like remote stipends enhance equity by providing financial support to all remote employees, aligning with hybrid work models and reducing geographic disparities.

Digital Commute Subsidy

Digital Commute Subsidies provide targeted financial support to remote workers by offsetting costs related to internet, software, and home office equipment, enhancing productivity without the need for physical travel. Unlike traditional Commuter Allowances that cover public transit or parking fees, these stipends recognize evolving work models by addressing digital connectivity expenses crucial for effective remote engagement.

Telework Expense Allowance

A Telework Expense Allowance specifically covers costs such as internet, office supplies, and utility bills incurred by employees working remotely, providing targeted financial support compared to a general commuter allowance which reimburses transportation expenses. This focused benefit enhances productivity and job satisfaction by directly addressing the unique needs of telecommuting employees.

Home Office Utility Reimbursement

Commuter allowance primarily covers transportation costs while remote work stipends often include home office utility reimbursement, addressing electricity, internet, and other operational expenses. Home office utility reimbursement provides a targeted financial support that directly offsets increased household costs, making remote work more viable and comfortable.

Smart Commute Reimbursement

Smart Commute Reimbursement offers employees a flexible benefit that covers expenses related to eco-friendly transportation, such as public transit, biking, or carpooling, promoting cost savings and environmental sustainability. Unlike traditional Commuter Allowance or Remote Work Stipend, this targeted reimbursement encourages smarter travel choices while supporting hybrid work models.

Remote Productivity Grant

Remote Productivity Grants offer employees financial support for home office equipment and technology upgrades, enhancing efficiency outside traditional workplaces. Unlike commuter allowances, these grants directly target remote work challenges, boosting productivity by optimizing home work environments.

Flexible Transit Flex Allowance

Flexible Transit Flex Allowance offers employees customizable options to cover commuting expenses, making it an attractive benefit compared to fixed Remote Work Stipends. This allowance supports varied transportation methods such as public transit, ridesharing, and biking, enhancing employee satisfaction through personalized commuting solutions.

Virtual Presence Allowance

Virtual Presence Allowance as a job benefit enhances employee productivity by offsetting costs associated with remote work technology and home office setups, unlike traditional commuter allowances that subsidize travel expenses. Companies offering Virtual Presence Allowance demonstrate adaptability to modern work trends, supporting seamless virtual collaboration and improving overall job satisfaction.

Eco-Commuter Perk

Eco-Commuter Perks provide employees with financial incentives to choose sustainable transportation methods, significantly reducing carbon emissions compared to traditional commuter allowances that often cover car-related expenses. Offering an Eco-Commuter Perk promotes environmental responsibility while supporting the company's green initiatives and employee well-being through reduced commuting costs.

Commuter Allowance vs Remote Work Stipend for job benefit Infographic

hrdif.com

hrdif.com