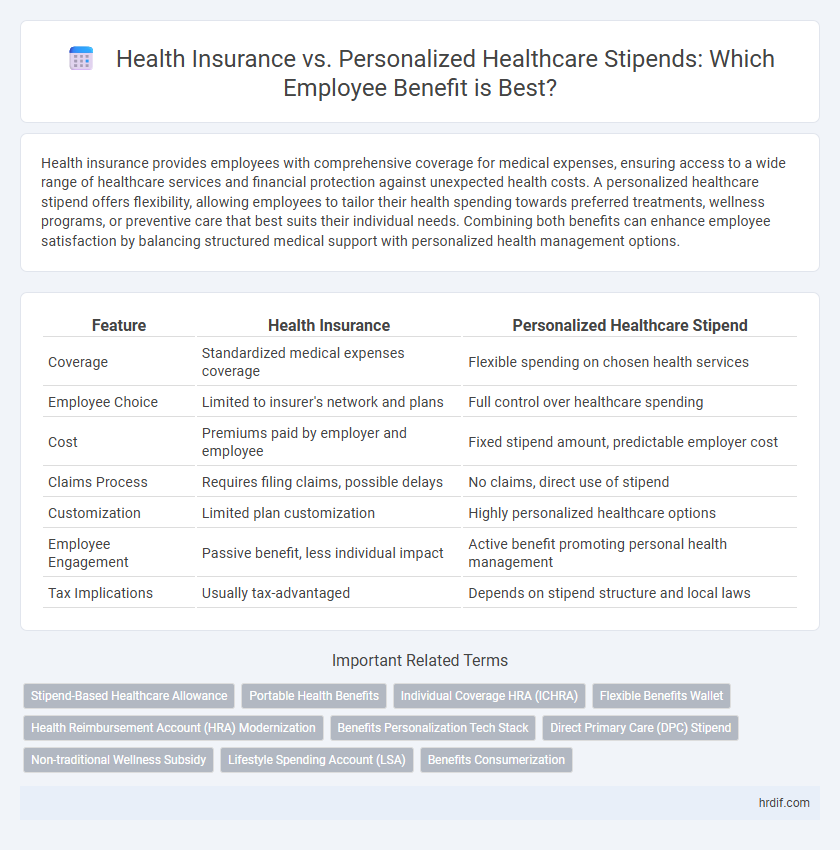

Health insurance provides employees with comprehensive coverage for medical expenses, ensuring access to a wide range of healthcare services and financial protection against unexpected health costs. A personalized healthcare stipend offers flexibility, allowing employees to tailor their health spending towards preferred treatments, wellness programs, or preventive care that best suits their individual needs. Combining both benefits can enhance employee satisfaction by balancing structured medical support with personalized health management options.

Table of Comparison

| Feature | Health Insurance | Personalized Healthcare Stipend |

|---|---|---|

| Coverage | Standardized medical expenses coverage | Flexible spending on chosen health services |

| Employee Choice | Limited to insurer's network and plans | Full control over healthcare spending |

| Cost | Premiums paid by employer and employee | Fixed stipend amount, predictable employer cost |

| Claims Process | Requires filing claims, possible delays | No claims, direct use of stipend |

| Customization | Limited plan customization | Highly personalized healthcare options |

| Employee Engagement | Passive benefit, less individual impact | Active benefit promoting personal health management |

| Tax Implications | Usually tax-advantaged | Depends on stipend structure and local laws |

Understanding Health Insurance and Personalized Healthcare Stipends

Health insurance provides comprehensive coverage for medical expenses, including hospital visits, prescriptions, and preventive care, offering financial protection against unexpected health costs. Personalized healthcare stipends allocate a fixed amount of money to employees, empowering them to choose health-related services or wellness products that best meet their individual needs. Understanding these options helps employers design flexible benefits that cater to diverse employee health preferences while managing costs effectively.

Key Differences Between Traditional Health Insurance and Stipends

Traditional health insurance offers comprehensive coverage for medical expenses, including hospitalization, prescription drugs, and specialist visits, often with fixed premiums and out-of-pocket costs. Personalized healthcare stipends provide employees with a flexible budget to choose their preferred health services or wellness options, fostering tailored healthcare experiences and potential cost savings. Key differences include cost predictability, coverage scope, and employee autonomy in utilizing benefits.

Cost Comparison: Which Option Saves Employers More?

Health insurance plans typically involve fixed monthly premiums combined with variable out-of-pocket costs, often resulting in higher expenses for employers compared to personalized healthcare stipends. Personalized healthcare stipends provide a set allowance, enabling employees to allocate funds for preventive care, wellness programs, or telemedicine services, which can reduce administrative costs and encourage cost-conscious health decisions. Employers save more with stipends by minimizing unpredictable claims and fostering healthier workforces, ultimately lowering total healthcare expenditures.

Flexibility and Choice: Stipends vs Insurance Plans

Personalized healthcare stipends offer employees the flexibility to select medical services and providers that best suit their individual needs, unlike traditional health insurance plans with fixed networks and coverage limits. Stipends empower employees to allocate funds toward alternative treatments, wellness programs, or out-of-network care, enhancing personalized health management. This choice-centric approach contrasts with standardized insurance plans, promoting greater employee satisfaction and tailored healthcare engagement.

Employee Satisfaction with Healthcare Benefits

Employee satisfaction is significantly higher when health insurance is paired with a personalized healthcare stipend, as this combination offers both comprehensive coverage and flexibility to address individual medical needs. Personalized stipends empower employees to access preferred providers, wellness programs, and alternative treatments, leading to greater perceived value and engagement. Companies adopting this hybrid approach report improved retention rates and overall well-being among their workforce.

Legal and Compliance Considerations for Employers

Employers must navigate complex legal frameworks when offering health insurance versus personalized healthcare stipends, ensuring compliance with the Affordable Care Act (ACA) and Internal Revenue Service (IRS) regulations. Health insurance plans are subject to stringent coverage and reporting requirements, while healthcare stipends must be carefully structured to avoid classification as taxable income or violations of nondiscrimination rules under ERISA. Staying informed about state-specific mandates and regularly consulting legal counsel helps employers mitigate risks and maintain compliance.

Tax Implications of Health Insurance Versus Stipends

Health insurance premiums paid by employers are generally tax-exempt for employees, providing substantial tax benefits and reducing taxable income. Personalized healthcare stipends, treated as taxable income, increase employees' taxable earnings and may lead to higher tax liabilities. Employers should evaluate these tax implications to optimize employee benefits and compliance with tax regulations.

Impact on Talent Attraction and Retention

Health insurance offers comprehensive coverage that appeals to employees seeking security against medical expenses, enhancing talent attraction and retention by addressing critical healthcare needs. Personalized healthcare stipends provide flexible support tailored to individual wellness priorities, increasing employee satisfaction and fostering loyalty through empowerment and choice. Companies leveraging either option effectively demonstrate a commitment to employee well-being, which strongly influences candidate preference and long-term retention rates.

Administrative Ease: Managing Insurance vs Stipends

Health insurance requires complex administrative processes including claims processing, provider network management, and regulatory compliance, which can increase employer overhead. Personalized healthcare stipends simplify administration by providing fixed monthly amounts to employees, reducing paperwork and streamlining benefit management. This approach allows HR teams to allocate resources more efficiently compared to traditional insurance plan administration.

Future Trends in Employee Healthcare Benefits

Health insurance remains a fundamental employee benefit, providing comprehensive coverage for medical expenses, but personalized healthcare stipends are emerging as a flexible alternative that empowers employees to tailor their healthcare spending. Future trends indicate a shift towards hybrid models combining traditional insurance with stipends to enhance employee autonomy and satisfaction. Data shows that companies adopting personalized stipends experience higher engagement and improved wellness outcomes, reflecting a growing emphasis on individualized healthcare solutions.

Related Important Terms

Stipend-Based Healthcare Allowance

Stipend-based healthcare allowances provide employees with flexible funds to choose personalized medical services, enhancing satisfaction and control over their health benefits. This approach reduces administrative costs for employers while empowering employees to tailor healthcare spending according to their individual needs and preferences.

Portable Health Benefits

Portable health benefits offer employees the flexibility to maintain continuous coverage regardless of job changes, whereas traditional health insurance is often tied to a specific employer, limiting portability. Personalized healthcare stipends empower employees to allocate funds toward tailored health services, enhancing satisfaction and promoting preventative care beyond standard insurance plans.

Individual Coverage HRA (ICHRA)

Individual Coverage Health Reimbursement Arrangements (ICHRA) offer employers a flexible alternative to traditional health insurance by providing tax-free reimbursements for employee health expenses tailored to individual needs. This personalized healthcare stipend empowers employees to choose plans that best fit their medical requirements, enhancing satisfaction and cost-efficiency in employee benefits management.

Flexible Benefits Wallet

Flexible Benefits Wallet empowers employees to allocate funds between health insurance and personalized healthcare stipends, maximizing individual health needs and financial efficiency. This adaptable approach enhances employee satisfaction by offering tailored coverage options and direct control over healthcare spending.

Health Reimbursement Account (HRA) Modernization

Health Reimbursement Account (HRA) modernization allows employers to offer more flexible health benefits by enabling employees to use funds for personalized healthcare expenses beyond traditional insurance premiums. This shift from standard health insurance to customized healthcare stipends through HRAs enhances employee satisfaction by covering a broader range of medical costs tailored to individual needs.

Benefits Personalization Tech Stack

Health insurance provides comprehensive risk coverage, while a personalized healthcare stipend empowers employees to tailor their benefits, enhancing satisfaction and engagement. Integrating benefits personalization tech stack enables seamless customization, data-driven insights, and real-time adjustments to optimize employee health outcomes and cost management.

Direct Primary Care (DPC) Stipend

Direct Primary Care (DPC) Stipends offer employees personalized healthcare access by funding membership-based primary care services that eliminate insurance middlemen, reducing out-of-pocket costs and improving preventive care. This approach enhances employee wellness and productivity by delivering timely, comprehensive medical attention without the traditional barriers of health insurance networks.

Non-traditional Wellness Subsidy

Non-traditional wellness subsidies such as personalized healthcare stipends empower employees to allocate funds toward tailored health services, promoting proactive self-care and addressing individual wellness needs beyond conventional health insurance coverage. These stipends enhance flexibility and choice, often resulting in increased employee satisfaction and improved overall well-being by supporting diverse health modalities like mental health apps, fitness programs, and alternative therapies.

Lifestyle Spending Account (LSA)

Health Insurance provides essential medical coverage, while a Personalized Healthcare Stipend, such as a Lifestyle Spending Account (LSA), offers employees flexible funds to spend on wellness activities, fitness programs, and preventive care tailored to their lifestyle needs. LSAs empower employees to take proactive control of their health by reimbursing expenses for gym memberships, mental health services, and holistic treatments not covered by traditional insurance.

Benefits Consumerization

Personalized healthcare stipends empower employees with flexible funds tailored to their unique health needs, enhancing satisfaction and engagement compared to traditional health insurance plans. This consumer-driven approach promotes proactive wellness management, driving better health outcomes and cost efficiency for both employers and employees.

Health Insurance vs Personalized Healthcare Stipend for employee benefits. Infographic

hrdif.com

hrdif.com