Commuter allowances reduce the financial burden of daily travel, making in-office work more affordable and encouraging consistent attendance. Remote work stipends support home office setup and internet costs, enhancing productivity and comfort for employees working from home. Both benefits improve employee satisfaction by addressing different needs tied to work location preferences.

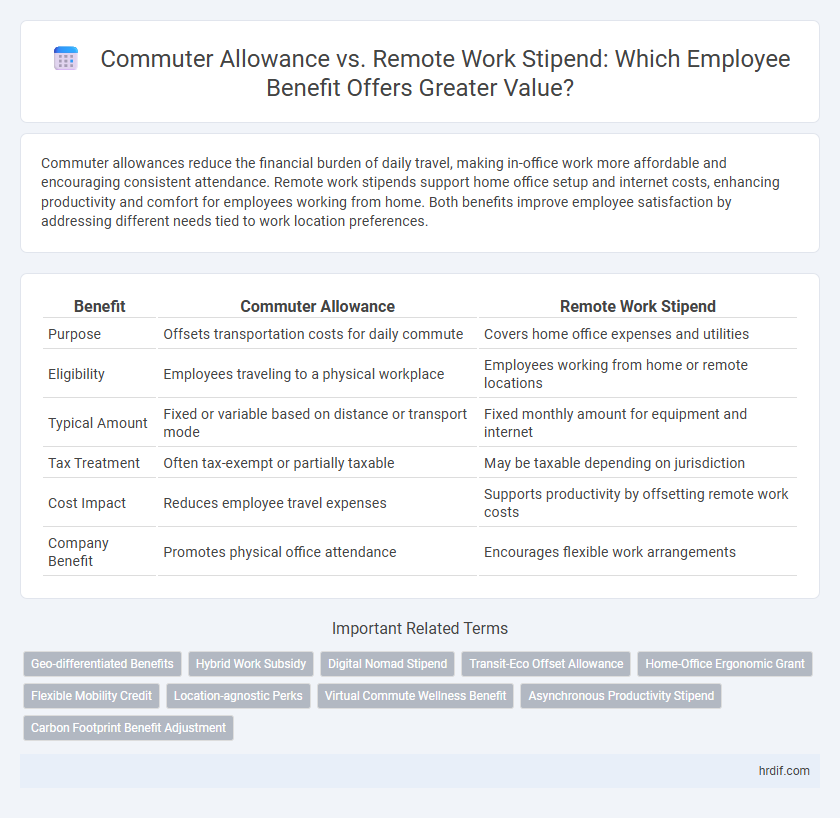

Table of Comparison

| Benefit | Commuter Allowance | Remote Work Stipend |

|---|---|---|

| Purpose | Offsets transportation costs for daily commute | Covers home office expenses and utilities |

| Eligibility | Employees traveling to a physical workplace | Employees working from home or remote locations |

| Typical Amount | Fixed or variable based on distance or transport mode | Fixed monthly amount for equipment and internet |

| Tax Treatment | Often tax-exempt or partially taxable | May be taxable depending on jurisdiction |

| Cost Impact | Reduces employee travel expenses | Supports productivity by offsetting remote work costs |

| Company Benefit | Promotes physical office attendance | Encourages flexible work arrangements |

Understanding Commuter Allowances: Key Features and Advantages

Commuter allowances provide employees with financial support to cover transportation costs such as public transit fares, parking fees, or fuel expenses, promoting cost-effective and reliable travel to the workplace. These allowances often lead to increased punctuality, reduced stress during commutes, and improved job satisfaction by easing the burden of daily travel expenses. Companies benefit from enhanced employee retention and productivity by addressing commuting challenges through structured financial assistance.

What is a Remote Work Stipend? An Overview

A remote work stipend is a financial benefit provided by employers to cover expenses related to setting up and maintaining a productive home office, including internet costs, office supplies, and ergonomic furniture. Unlike a commuter allowance, which reimburses transportation expenses for traveling to a physical workplace, a remote work stipend supports employees working from home, promoting flexibility and reducing out-of-pocket costs. This stipend enhances employee satisfaction by offsetting the unique costs of remote work environments while supporting productivity and comfort.

Cost Savings: Commuter Allowance vs Remote Work Stipend

Commuter allowances often incur higher costs due to ongoing expenses like fuel, public transportation fares, and parking fees, whereas remote work stipends typically cover one-time or limited recurring expenses such as home office setup and internet services, resulting in significant cost savings for employers. Remote work stipends reduce overhead associated with physical office maintenance and commuting subsidies, offering a more scalable and budget-friendly benefit. Companies leveraging remote work stipends experience decreased transportation costs and increased employee retention, enhancing overall financial efficiency.

Employee Productivity and Wellbeing: Which Benefit Wins?

Commuter allowances reduce employee stress and fatigue associated with daily travel, directly enhancing productivity by ensuring timely arrivals and focused work hours. Remote work stipends improve wellbeing by enabling employees to create personalized, comfortable home office environments that foster concentration and work-life balance. Considering sustained productivity and holistic wellbeing, remote work stipends often provide more significant and lasting benefits compared to commuter allowances.

Tax Implications: Navigating Commuter and Remote Work Benefits

Commuter allowances often provide tax-exempt benefits when used for qualified transportation expenses, reducing taxable income for employees. Remote work stipends, however, may be considered taxable income unless specifically excluded under IRS guidelines, affecting overall tax liabilities. Employers must carefully structure these benefits to optimize tax outcomes and ensure compliance with local tax regulations.

Matching Benefits to Employee Lifestyles

Commuter allowances provide financial support for employees who travel regularly to a physical workplace, covering expenses such as transit passes, fuel, and parking fees. Remote work stipends address the needs of telecommuting employees by reimbursing costs related to home office setup, internet connectivity, and ergonomic equipment. Tailoring benefits to match employee lifestyles enhances satisfaction and productivity by aligning support with individual commuting and work environment preferences.

Impact on Talent Attraction and Retention

Commuter allowance enhances talent attraction by addressing daily transportation costs, appealing to employees who prefer or need to work onsite, while remote work stipends boost retention by supporting home office setup and flexibility, catering to remote workers' comfort and productivity. Companies offering both benefits demonstrate adaptability and a commitment to employee well-being, which strengthens overall engagement and loyalty. Data shows employers with tailored commute and remote incentives experience up to 30% higher retention rates and attract a broader talent pool.

Environmental Considerations: Commuter Allowance vs Remote Work Stipend

Commuter allowances typically encourage transportation use that increases carbon emissions, whereas remote work stipends support home office setups, significantly reducing daily travel and lowering overall environmental impact. Offering remote work stipends aligns with corporate sustainability goals by minimizing commuters' carbon footprints and decreasing urban traffic congestion. Companies optimizing benefits for environmental considerations often prioritize remote work stipends over commuter allowances to promote greener business practices.

Administrative Ease and Policy Implementation

Commuter allowances simplify administrative processes by using standardized expense reports and predictable reimbursement amounts, enabling clear policy implementation for onsite employees. Remote work stipends require adaptable policies to accommodate varied home office setups and technology needs, often demanding more detailed tracking and flexible approval workflows. Businesses benefit from streamlined commuter allowance policies, but remote work stipends offer tailored support that can improve employee productivity and satisfaction when managed effectively.

Future Workplace Trends: The Shift in Employee Benefits

Commuter allowances have traditionally supported employees' daily travel, but remote work stipends are gaining prominence as flexible work models reshape benefit priorities. Remote work stipends cover home office equipment and internet costs, aligning with the increasing demand for hybrid and fully remote setups. Future workplace trends emphasize benefits that enhance productivity and employee well-being regardless of location, signaling a shift from location-based perks to versatile support systems.

Related Important Terms

Geo-differentiated Benefits

Geo-differentiated benefits tailor commuter allowances and remote work stipends based on regional cost of living and commuting expenses, optimizing employee satisfaction and cost efficiency. Companies offering location-specific compensation packages can better address local financial needs, enhancing workforce retention and productivity.

Hybrid Work Subsidy

A hybrid work subsidy combines commuter allowance and remote work stipend, optimizing employee benefits by covering transportation costs on office days and home office expenses on remote days. This flexible approach enhances productivity and reduces financial strain, supporting a balanced hybrid work model.

Digital Nomad Stipend

Digital Nomad Stipends offer flexible financial support tailored for remote employees working from various locations, covering expenses such as coworking spaces, internet, and travel, enhancing productivity and work-life balance. Unlike traditional commuter allowances fixed to daily travel costs, Digital Nomad Stipends provide broader compensation reflecting the dynamic needs of remote work lifestyles.

Transit-Eco Offset Allowance

Transit-Eco Offset Allowance offers employees a sustainable benefit by subsidizing eco-friendly transportation costs, reducing carbon footprint while supporting commuting expenses. Compared to Remote Work Stipends, which cover home office setups and utility costs, this allowance specifically incentivizes public transit use and eco-friendly travel choices, aligning with corporate sustainability goals.

Home-Office Ergonomic Grant

Commuter allowances primarily reduce daily travel expenses, while remote work stipends, such as the Home-Office Ergonomic Grant, directly enhance employee productivity and well-being by funding ergonomic office equipment. Investing in ergonomic grants supports long-term health benefits and reduces the risk of musculoskeletal disorders compared to traditional commuting benefits.

Flexible Mobility Credit

Flexible Mobility Credit offers greater adaptability compared to traditional commuter allowances by supporting a wide range of transportation options and remote work expenses. This benefit enhances employee satisfaction by covering costs for public transit, ride-sharing, bike rentals, and remote office setups, aligning with modern hybrid work models.

Location-agnostic Perks

Commuter allowance offers financial support tied to physical travel expenses, while a remote work stipend provides flexible funds to enhance productivity regardless of location, emphasizing location-agnostic perks. This shift towards remote stipends underscores employer commitment to adaptable benefits that cater to diverse work environments beyond traditional office commutes.

Virtual Commute Wellness Benefit

Commuter allowance provides financial support for daily travel expenses, promoting ease and saving time for employees using public transport or driving. The Virtual Commute Wellness Benefit addresses remote workers' mental health by encouraging structured breaks and mindfulness during virtual transitions, improving productivity and reducing burnout.

Asynchronous Productivity Stipend

Commuter allowances traditionally offset travel expenses, enhancing punctuality and reducing stress, while asynchronous productivity stipends provide flexible financial support for remote workers to optimize home office setups and work independently across time zones. The asynchronous productivity stipend emphasizes increased efficiency by funding ergonomic equipment, high-speed internet, and software tools tailored to remote, flexible schedules.

Carbon Footprint Benefit Adjustment

Commuter allowance reduces carbon emissions by incentivizing green transportation methods, directly lowering the company's overall environmental impact. Remote work stipends further decrease carbon footprints by minimizing daily travel, supporting sustainable work habits that contribute to long-term ecological benefits.

Commuter allowance vs Remote work stipend for benefit. Infographic

hrdif.com

hrdif.com