Choosing between 401k and cryptocurrency matching for a retirement plan depends on risk tolerance and long-term growth potential. 401k plans offer tax advantages, employer matching, and a stable investment framework ideal for steady retirement savings. Cryptocurrency matching introduces higher volatility but may provide significant gains, making it suitable for investors seeking aggressive growth in their retirement portfolio.

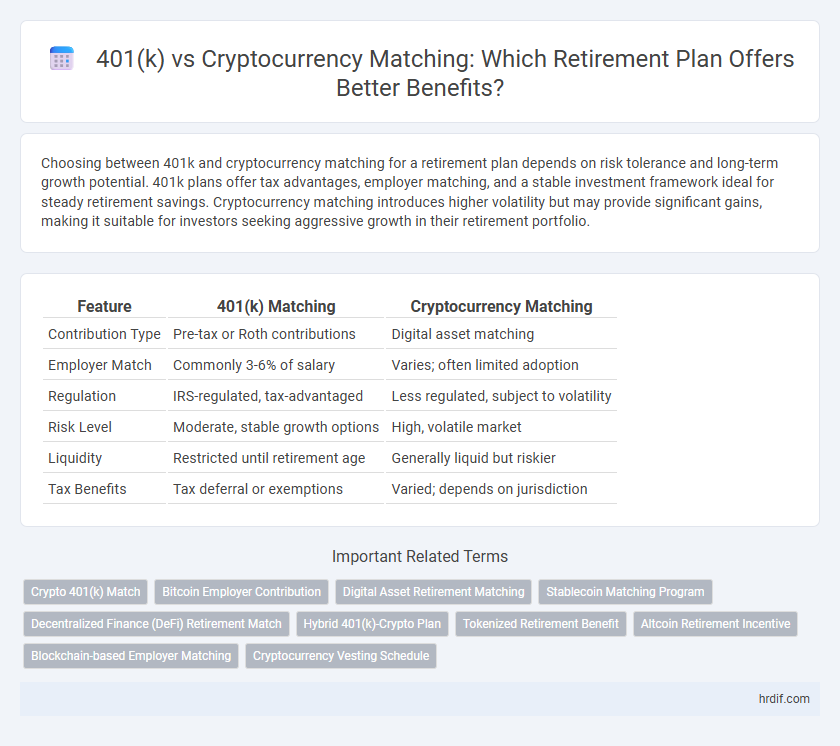

Table of Comparison

| Feature | 401(k) Matching | Cryptocurrency Matching |

|---|---|---|

| Contribution Type | Pre-tax or Roth contributions | Digital asset matching |

| Employer Match | Commonly 3-6% of salary | Varies; often limited adoption |

| Regulation | IRS-regulated, tax-advantaged | Less regulated, subject to volatility |

| Risk Level | Moderate, stable growth options | High, volatile market |

| Liquidity | Restricted until retirement age | Generally liquid but riskier |

| Tax Benefits | Tax deferral or exemptions | Varied; depends on jurisdiction |

Comparing 401k and Cryptocurrency Matching: Which Offers Better Retirement Benefits?

401k plans provide structured retirement benefits with employer matching contributions and tax advantages, ensuring predictable long-term growth and risk mitigation. Cryptocurrency matching offers potential for higher returns due to market volatility but carries significant risk and regulatory uncertainty, which may affect retirement security. Choosing between 401k and cryptocurrency matching depends on individual risk tolerance and investment goals for optimized retirement planning.

Tax Advantages: 401k vs Cryptocurrency Matching Explained

401(k) plans offer significant tax advantages by allowing contributions to be made pre-tax, reducing taxable income and enabling tax-deferred growth until withdrawal. Cryptocurrency matching, while innovative, currently lacks clear tax regulations and may subject earnings to capital gains taxes upon sale, potentially increasing tax liabilities. Understanding these tax implications is crucial when comparing 401(k) benefits to cryptocurrency matching options for long-term retirement planning.

Risk and Volatility: Assessing Your Retirement Options

401k plans offer stable, regulated growth with employer matching contributions, minimizing risk and providing predictable retirement savings. Cryptocurrency matching introduces high volatility and unpredictable returns, increasing risk but potentially yielding significant gains. Evaluating your risk tolerance and retirement timeline is crucial when choosing between the security of a 401k and the speculative nature of cryptocurrency for your retirement plan.

Employer Contributions: Traditional 401k vs Crypto Matching

Employer contributions to traditional 401k plans typically follow a structured matching formula, such as 50% match on the first 6% of employee deferrals, providing predictable growth and tax advantages. Cryptocurrency matching offers potential for higher returns through asset appreciation but carries increased volatility and regulatory uncertainty, impacting retirement security. Evaluating employer contribution strategies between traditional 401k and crypto matching requires balancing stable, tax-deferred growth against speculative gains with fluctuating market risks.

Security and Regulation: Protecting Your Retirement Savings

401(k) plans offer robust security and regulatory protections backed by the Employee Retirement Income Security Act (ERISA), ensuring fiduciary oversight and government safeguards for your retirement savings. Cryptocurrency matching lacks comprehensive regulation, exposing investments to higher volatility, cybersecurity risks, and potential fraud. Prioritizing 401(k) matching contributes to a more secure and stable retirement portfolio, minimizing threats to your financial future.

Growth Potential: Long-Term Prospects for 401k and Crypto Matching

401k plans offer consistent, tax-advantaged growth with employer matching contributions that gradually build retirement savings through diversified investments like stocks and bonds. Cryptocurrency matching introduces higher volatility but also the potential for exponential returns driven by blockchain innovation and market adoption trends. Balancing 401k stability with the speculative growth potential of crypto matching can enhance long-term retirement portfolio diversification.

Accessibility and Liquidity: Cashing Out When You Retire

401k plans offer predictable accessibility with penalties typically waived after age 59 1/2, allowing retirees to cash out funds steadily while avoiding tax complications. Cryptocurrency matching provides higher liquidity, enabling immediate transactions and potentially faster access to funds but carries market volatility and regulatory risks. Evaluating retirement strategies involves balancing the stable withdrawal features of 401k accounts against the fluctuating liquidity and accessibility challenges present in cryptocurrency assets.

Fees and Expenses: Hidden Costs of 401k vs Crypto Plans

401(k) plans often include administrative fees, fund management expenses, and potential penalties for early withdrawals, which can significantly reduce retirement savings over time. Cryptocurrency retirement plans may have lower management fees but can incur hidden costs such as high transaction fees, network congestion charges, and tax complexities. Understanding these fee structures is crucial for maximizing long-term retirement wealth and minimizing unexpected expenses.

Diversification Strategies: Balancing 401k and Crypto Investments

Diversification strategies for retirement planning emphasize balancing traditional 401k accounts with cryptocurrency investments to mitigate risk and enhance potential growth. A 401k offers tax advantages and long-term stability, while cryptocurrencies provide high growth potential and portfolio innovation. Integrating both allows investors to leverage the steady returns of a 401k alongside the dynamic market opportunities present in crypto assets.

Making the Right Choice: Who Should Consider Crypto Matching Over 401k?

Investors seeking high growth potential and comfortable with market volatility may consider cryptocurrency matching over traditional 401k plans for retirement savings. Crypto matching offers the advantage of decentralization and the opportunity to capitalize on emerging blockchain technologies, appealing to tech-savvy individuals and younger demographics. However, those prioritizing stability and regulatory protections might prefer the established benefits and employer contributions of a 401k.

Related Important Terms

Crypto 401(k) Match

Crypto 401(k) match programs offer a unique opportunity for employees to grow their retirement savings with the high-growth potential of cryptocurrencies, combining traditional tax advantages with innovative digital asset exposure. These plans often provide employer matching contributions in crypto, enhancing long-term portfolio diversification and potentially increasing retirement wealth beyond the limits of conventional 401(k) plans.

Bitcoin Employer Contribution

Employers offering Bitcoin contributions alongside traditional 401(k) plans provide a unique retirement benefit that combines the stability of conventional investments with the high growth potential of cryptocurrency. This Bitcoin employer matching incentivizes employees to diversify their retirement portfolios, potentially maximizing long-term wealth accumulation through digital asset exposure.

Digital Asset Retirement Matching

Digital asset retirement matching in 401(k) plans offers employees the opportunity to diversify their retirement savings by integrating cryptocurrency options alongside traditional investments. This innovative approach enhances long-term growth potential and caters to tech-savvy employees seeking exposure to blockchain technology within a tax-advantaged retirement vehicle.

Stablecoin Matching Program

Stablecoin matching programs for retirement plans offer enhanced liquidity and reduced volatility compared to traditional 401(k) matching, providing a more secure and flexible way to accumulate retirement savings. By leveraging blockchain technology, stablecoin contributions enable instant settlements and lower transaction costs, increasing the efficiency and accessibility of retirement benefits.

Decentralized Finance (DeFi) Retirement Match

Decentralized Finance (DeFi) retirement match programs offer a dynamic alternative to traditional 401(k) matching by leveraging blockchain technology to provide transparent, low-cost, and accessible investment options. Unlike conventional plans tied to centralized financial institutions, DeFi retirement matches can enhance portfolio diversification and potentially higher returns through smart contract automation and decentralized asset exposure.

Hybrid 401(k)-Crypto Plan

A Hybrid 401(k)-Crypto Plan combines traditional retirement account security with the high-growth potential of cryptocurrency investments, offering diversified portfolio benefits and tax advantages. This approach allows employees to maximize their retirement savings by leveraging employer matching contributions in both stable 401(k) funds and dynamic crypto assets.

Tokenized Retirement Benefit

Tokenized retirement benefits offer enhanced liquidity and transparency compared to traditional 401(k) matching programs by leveraging blockchain technology for secure, real-time asset management. These digital assets provide diversified investment options and potential for higher returns, aligning with modern retirement planning trends focused on flexibility and growth.

Altcoin Retirement Incentive

Altcoin retirement incentives offer a unique advantage by enabling employees to diversify their 401k with high-growth potential cryptocurrencies, potentially enhancing long-term returns beyond traditional stock and bond allocations. This approach combines tax-advantaged retirement savings with exposure to emerging digital assets, appealing to investors seeking innovative strategies for wealth accumulation.

Blockchain-based Employer Matching

Blockchain-based employer matching in retirement plans offers transparent and instantaneous 401k contributions, enhancing trust and efficiency compared to traditional systems. This technology leverages smart contracts to automate matching funds, reducing administrative costs and ensuring accurate, real-time vesting for employee cryptocurrency investments.

Cryptocurrency Vesting Schedule

Cryptocurrency matching in retirement plans often includes a vesting schedule that dictates employee ownership over time, typically aligning with company retention goals and ensuring long-term commitment. Unlike traditional 401(k) matching, which usually vests incrementally over several years, cryptocurrency vesting can offer more flexible or accelerated timelines, leveraging blockchain transparency to secure asset distribution and enhance participant engagement.

401k vs Cryptocurrency matching for retirement plan. Infographic

hrdif.com

hrdif.com