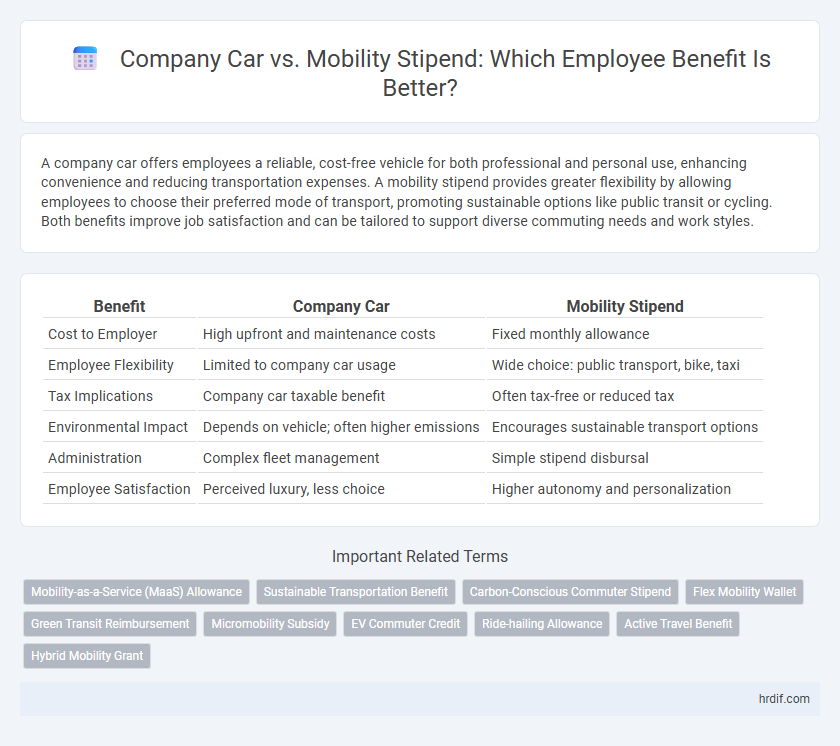

A company car offers employees a reliable, cost-free vehicle for both professional and personal use, enhancing convenience and reducing transportation expenses. A mobility stipend provides greater flexibility by allowing employees to choose their preferred mode of transport, promoting sustainable options like public transit or cycling. Both benefits improve job satisfaction and can be tailored to support diverse commuting needs and work styles.

Table of Comparison

| Benefit | Company Car | Mobility Stipend |

|---|---|---|

| Cost to Employer | High upfront and maintenance costs | Fixed monthly allowance |

| Employee Flexibility | Limited to company car usage | Wide choice: public transport, bike, taxi |

| Tax Implications | Company car taxable benefit | Often tax-free or reduced tax |

| Environmental Impact | Depends on vehicle; often higher emissions | Encourages sustainable transport options |

| Administration | Complex fleet management | Simple stipend disbursal |

| Employee Satisfaction | Perceived luxury, less choice | Higher autonomy and personalization |

Understanding Company Cars and Mobility Stipends

Company cars provide employees with a dedicated vehicle, covering fuel, maintenance, and insurance, which simplifies commuting and often enhances job satisfaction. Mobility stipends offer financial flexibility, allowing recipients to choose preferred transportation methods such as public transit, ride-sharing, or personal vehicle use. Understanding the cost-efficiency and tax implications of each option helps organizations tailor benefits to employee needs and optimize overall mobility budgets.

Key Differences Between Company Cars and Mobility Stipends

Company cars provide employees with a dedicated vehicle for both work and personal use, often including maintenance, insurance, and fuel costs covered by the employer. Mobility stipends offer flexible financial support that employees can use for various transportation options such as public transit, ridesharing, or car rentals, promoting cost-efficiency and sustainability. The key difference lies in ownership and flexibility, where company cars offer convenience and control, while stipends support personalized, multimodal travel choices.

Cost Comparison: Company Car vs Mobility Stipend

A company car often entails higher upfront costs, including purchase, maintenance, insurance, and depreciation, resulting in significant long-term expenses for the employer. Conversely, a mobility stipend provides a flexible, fixed monthly amount, allowing employees to choose their preferred transportation while enabling employers to control budget predictability and reduce administrative overhead. Evaluating factors such as total cost of ownership, tax implications, and employee utilization patterns reveals that mobility stipends can offer a more cost-effective and adaptable solution compared to traditional company cars.

Tax Implications for Each Benefit

Company cars are typically considered a taxable fringe benefit, with the taxable amount calculated based on the vehicle's value and personal usage, often resulting in higher taxable income for the employee. Mobility stipends offer greater tax flexibility, as they can sometimes be structured to cover various transportation expenses with potentially lower or deferred tax liabilities depending on the jurisdiction. Employers should evaluate local tax regulations to optimize the financial efficiency of either benefit type for both the company and employees.

Employee Flexibility and Lifestyle Impact

Company cars provide employees with a fixed vehicle option, ensuring consistent access but limited personal choice in mobility. Mobility stipends offer greater flexibility, allowing employees to select transportation methods that best fit their lifestyle, such as public transit, ridesharing, or bike rentals. This adaptability enhances work-life balance and supports diverse commuting preferences, aligning benefits with individual needs.

Environmental Considerations in Mobility Benefits

Company cars typically contribute to higher carbon emissions and increased environmental impact compared to mobility stipends, which encourage the use of eco-friendly transportation options like public transit, cycling, and carpooling. Mobility stipends promote sustainability by incentivizing employees to choose greener, more flexible commuting methods, reducing overall company carbon footprints. Emphasizing mobility stipends aligns corporate benefits with environmental responsibility goals, enhancing brand reputation and supporting global emissions reduction targets.

Maintenance, Insurance, and Hidden Costs

Choosing a company car often entails the employer covering maintenance, insurance, and unexpected hidden costs such as repairs and depreciation, reducing the employee's financial burden. Mobility stipends provide flexibility but may require employees to manage and pay for upkeep, insurance premiums, and incidental expenses out-of-pocket. Careful evaluation of these factors reveals that company cars offer predictable costs and comprehensive coverage, while mobility stipends shift cost responsibility and variability to the individual.

Recruitment and Retention: Which Attracts Top Talent?

Offering a company car provides tangible value and convenience that appeals to candidates seeking stability and long-term perks, enhancing recruitment efforts. Mobility stipends offer flexibility and personalization, appealing to a diverse workforce and supporting retention by accommodating evolving commuting preferences. Companies balancing both options often see improved attraction and retention rates, as they cater to a broader spectrum of top talent priorities.

Company Culture and Brand Image Alignment

Offering a company car as a benefit reinforces a traditional, status-oriented company culture and projects a strong brand image of stability and prestige. In contrast, providing a mobility stipend aligns with modern, flexible work environments, promoting a culture of employee autonomy and sustainability while enhancing the brand's reputation for innovation and adaptability. Both options impact employee perception and external brand identity, making the choice crucial for aligning benefits with organizational values.

Future Trends in Employee Mobility Benefits

Emerging trends in employee mobility benefits focus on flexible options such as mobility stipends, which offer personalized transportation choices over traditional company cars. Data indicates a growing preference for sustainable and cost-effective benefits aligning with corporate social responsibility goals and evolving workforce values. Mobility stipends also promote work-life balance by enabling employees to integrate various transport modes, reflecting a shift towards adaptable and employee-centric benefit programs.

Related Important Terms

Mobility-as-a-Service (MaaS) Allowance

A Mobility-as-a-Service (MaaS) allowance offers employees flexible, cost-efficient alternatives to traditional company cars by integrating multiple transport modes such as public transit, bike-sharing, and ride-hailing services into a single streamlined benefit. This approach enhances employee autonomy, reduces commuting costs, and supports sustainable urban mobility while simplifying administrative overhead for employers.

Sustainable Transportation Benefit

Company cars often contribute to higher carbon emissions and increased environmental impact, whereas mobility stipends encourage employees to choose sustainable transportation options like public transit, cycling, or car-sharing programs, significantly reducing the company's overall carbon footprint. Transitioning to mobility stipends aligns with corporate sustainability goals by promoting eco-friendly travel and supporting urban air quality improvements.

Carbon-Conscious Commuter Stipend

A Carbon-Conscious Commuter Stipend offers employees flexible, eco-friendly transportation options while reducing the company's carbon footprint compared to traditional company cars, which typically involve higher emissions and maintenance costs. This benefit incentivizes sustainable commuting choices such as public transit, biking, and carpooling, aligning corporate sustainability goals with employee convenience and environmental responsibility.

Flex Mobility Wallet

The Flex Mobility Wallet offers a versatile alternative to a traditional company car by consolidating various transportation benefits into one digital platform, allowing employees to seamlessly choose between public transit, ride-sharing, or bike rentals. This mobility stipend enhances flexibility and cost-efficiency, empowering businesses to optimize their benefits strategy while promoting sustainable and personalized commuting options.

Green Transit Reimbursement

Green transit reimbursement through a mobility stipend incentivizes employees to choose eco-friendly transportation options such as public transit, biking, or electric scooters, reducing carbon emissions and fostering sustainability. Unlike a traditional company car, mobility stipends offer flexible, cost-effective green commuting alternatives that align with environmental goals and promote employee well-being.

Micromobility Subsidy

A micromobility subsidy as part of a mobility stipend offers employees flexible, eco-friendly transportation options while reducing company expenses compared to traditional company cars. This benefit promotes sustainable commuting with options like e-scooters and bike-sharing, enhancing employee satisfaction and supporting corporate social responsibility goals.

EV Commuter Credit

Providing an EV commuter credit as part of a mobility stipend offers employees flexible, eco-friendly transportation options without the long-term commitment and tax implications of a company car. This approach encourages electric vehicle use, reduces carbon emissions, and aligns with corporate sustainability goals while optimizing cost efficiency.

Ride-hailing Allowance

A ride-hailing allowance as part of a mobility stipend offers employees flexible, cost-effective transportation without the long-term commitments and tax liabilities associated with a company car. This benefit maximizes convenience and supports sustainable commuting by covering expenses for services like Uber or Lyft, enhancing employee satisfaction and productivity.

Active Travel Benefit

A mobility stipend offers greater flexibility for active travel benefits by encouraging sustainable transportation options such as cycling and public transit, which reduce carbon emissions and promote employee health. Company cars often limit active travel choices, while stipends support personalized, eco-friendly commuting solutions tailored to individual lifestyles.

Hybrid Mobility Grant

Hybrid Mobility Grant offers more flexibility and cost-efficiency compared to a traditional company car, allowing employees to combine public transportation, car-sharing, and personal vehicle use under a unified benefit. This approach promotes sustainable commuting habits while optimizing employer expenses by tailoring mobility solutions to individual needs.

Company car vs Mobility stipend for benefit. Infographic

hrdif.com

hrdif.com