Commuter benefits reduce daily travel expenses through pre-tax deductions for public transit or parking, lowering overall commute costs. Remote work stipends for transportation reimburse occasional travel-related expenses, offering flexibility for hybrid workers. Choosing commuter benefits typically suits employees with regular office visits, while remote work stipends accommodate those with varied travel needs.

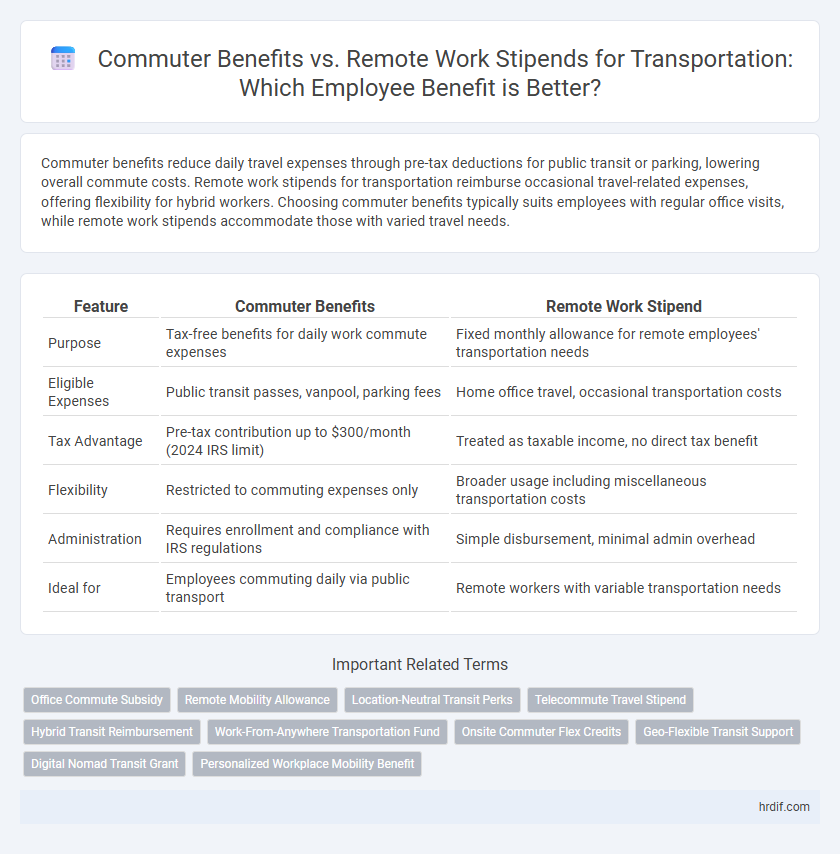

Table of Comparison

| Feature | Commuter Benefits | Remote Work Stipend |

|---|---|---|

| Purpose | Tax-free benefits for daily work commute expenses | Fixed monthly allowance for remote employees' transportation needs |

| Eligible Expenses | Public transit passes, vanpool, parking fees | Home office travel, occasional transportation costs |

| Tax Advantage | Pre-tax contribution up to $300/month (2024 IRS limit) | Treated as taxable income, no direct tax benefit |

| Flexibility | Restricted to commuting expenses only | Broader usage including miscellaneous transportation costs |

| Administration | Requires enrollment and compliance with IRS regulations | Simple disbursement, minimal admin overhead |

| Ideal for | Employees commuting daily via public transport | Remote workers with variable transportation needs |

Understanding Commuter Benefits: Key Features

Commuter benefits provide employees with tax-advantaged options specifically designed for transportation expenses such as public transit passes, vanpooling, and parking fees, often funded through pre-tax payroll deductions. These benefits reduce taxable income and maximize savings on daily commuting costs, supporting sustainable and cost-effective travel. Employers offering commuter benefits comply with IRS guidelines while enhancing employee satisfaction by directly addressing transportation expenses.

What Is a Remote Work Stipend for Transportation?

A remote work stipend for transportation is a fixed monthly allowance provided by employers to cover commuting-related expenses for employees working remotely. This stipend helps offset costs such as public transit passes, rideshares, or fuel expenses that remote workers may incur when traveling occasionally to the office or client sites. Unlike traditional commuter benefits, which often require pre-tax payroll deductions, remote work stipends offer flexible, taxable reimbursements tailored to hybrid or fully remote work arrangements.

Comparing Cost Savings: Commuting vs Remote Work

Commuter benefits often provide tax advantages and subsidized transit passes, reducing daily travel expenses for employees using public transportation. Remote work stipends typically cover home office or occasional travel costs but may not fully offset commuting expenses saved by avoiding daily commutes. Comparing cost savings reveals that while commuter benefits lower direct transit costs, remote work stipends contribute to flexibility and overall reduction in transportation expenses by minimizing or eliminating daily travel.

Flexibility and Employee Satisfaction: Two Approaches

Commuter benefits provide employees with flexible options such as transit passes or pre-tax deductions, directly reducing transportation costs and encouraging environmentally friendly commuting. Remote work stipends offer greater autonomy by reimbursing travel expenses or home office setup, enhancing work-life balance and catering to varied employee needs. Both approaches significantly boost satisfaction by addressing different aspects of flexibility and personal preference in managing transportation-related expenses.

Tax Implications of Commuter Benefits and Stipends

Commuter benefits allow employees to use pre-tax dollars for public transit and parking expenses, reducing taxable income and offering significant tax savings under IRS Section 132(f). Remote work stipends for transportation, typically treated as taxable income, do not provide the same tax advantages and must be reported as wages. Employers and employees optimize tax outcomes by choosing commuter benefits over stipends when applicable to daily transit costs.

Impact on Work-Life Balance: Office vs Remote

Commuter benefits reduce daily travel stress and expenses, enhancing employee focus and punctuality for office work. Remote work stipends for transportation, while less frequent, offer flexibility and autonomy, supporting a better integration of personal and professional life. Balancing these options influences overall work-life harmony by addressing the unique needs of commuting and remote workers.

Administrative Considerations for Employers

Employers managing commuter benefits must navigate complex regulatory compliance, including tax code adherence and record-keeping for pre-tax transit and parking deductions. Remote work stipends for transportation offer simplified administration but require clear policies to prevent misuse and ensure equitable distribution among employees. Balancing these options demands thorough evaluation of administrative costs, employee eligibility, and integration with existing payroll systems.

Environmental Effects: Transportation Choices

Commuter benefits encourage the use of public transit, carpooling, and biking by reducing employees' out-of-pocket costs, leading to lower carbon emissions and decreased traffic congestion. Remote work stipends for transportation often support occasional travel needs but may not consistently reduce commuting frequency, resulting in varied environmental impacts. Prioritizing commuter benefits aligns stronger with sustainable transportation choices and significantly reduces an organization's overall carbon footprint.

Equity and Accessibility: Meeting Diverse Needs

Commuter benefits provide equitable access to public transit and sustainable transportation options, supporting employees who rely on buses, trains, or carpools. Remote work stipends offer flexible funds for transportation-related expenses at home, but may not address the needs of workers without reliable transit access. Prioritizing commuter benefits ensures greater inclusivity by directly reducing commuting costs for diverse workforce segments, promoting accessibility and fairness.

Choosing the Right Benefit for Your Workforce

Commuter benefits often provide tax-free reimbursements for public transit and vanpooling, helping reduce employees' out-of-pocket transportation costs and encouraging sustainable commuting. Remote work stipends for transportation offer flexible support for occasional travel needs, such as rideshares or fuel expenses when employees commute less frequently. Selecting the right benefit depends on your workforce's commuting patterns, budget constraints, and company sustainability goals to maximize employee satisfaction and retention.

Related Important Terms

Office Commute Subsidy

Office commute subsidies under commuter benefits reduce employee transportation costs through pre-tax deductions and employer contributions, enhancing financial savings compared to remote work stipends that typically cover non-commute expenses. Commuter benefits programs often include options for transit passes, vanpool services, and parking subsidies, making them more targeted and cost-effective for daily office travel needs.

Remote Mobility Allowance

Remote mobility allowance offers employees flexible financial support for diverse transportation needs beyond traditional commuting, contrasting with commuter benefits that typically cover fixed transit options. This allowance enhances remote work convenience by reimbursing expenses such as ride-sharing, car rentals, or bike shares, promoting adaptable and personalized mobility solutions.

Location-Neutral Transit Perks

Commuter benefits provide tax-advantaged transit subsidies specifically tied to an employee's commuting expenses, offering significant savings for public transportation costs in urban centers. Location-neutral remote work stipends, while flexible and covering broader transportation needs, lack the targeted tax benefits of commuter programs, making them less efficient for employees relying on mass transit regardless of their work location.

Telecommute Travel Stipend

Telecommute travel stipends provide flexible financial support for remote employees' occasional transportation needs, reducing out-of-pocket expenses related to commuting or business travel. Compared to traditional commuter benefits, these stipends empower telecommuters with personalized funds to cover rideshare, public transit, or mileage reimbursement, enhancing employee satisfaction and work-life balance.

Hybrid Transit Reimbursement

Hybrid transit reimbursement offers a flexible commuter benefit by covering costs for both public transportation and occasional remote work travel expenses, optimizing savings for employees who split time between home and office. This approach maximizes tax advantages and supports sustainable commuting options, enhancing overall employee satisfaction and productivity.

Work-From-Anywhere Transportation Fund

Work-from-anywhere transportation funds offer flexible financial support for employees regardless of location, unlike traditional commuter benefits which are limited to specific transit expenses. This approach enhances mobility by covering varied transportation costs, from rideshares to parking, optimizing employee satisfaction and productivity.

Onsite Commuter Flex Credits

Onsite Commuter Flex Credits provide employees with pre-tax savings specifically for public transit, parking, and vanpooling expenses, making them a cost-effective alternative to a remote work stipend that covers broader transportation costs. These credits optimize tax benefits while encouraging environmentally friendly commuting options, enhancing employee retention and reducing overall transportation expenses for onsite workers.

Geo-Flexible Transit Support

Commuter benefits typically offer pre-tax savings on public transit and parking expenses directly linked to daily commutes, enhancing affordability for employees traveling to a fixed office location. Geo-flexible transit support through remote work stipends provides broader flexibility by reimbursing transportation costs regardless of location, accommodating hybrid and fully remote employees who may use varied transit options beyond traditional commutes.

Digital Nomad Transit Grant

The Digital Nomad Transit Grant offers a flexible alternative to traditional Commuter Benefits by providing remote workers with a stipend specifically designed to cover diverse transportation expenses, including ride-sharing, public transit, and micro-mobility options. Unlike fixed commuter benefits, this grant supports the varied and dynamic travel needs of digital nomads, enhancing their mobility and reducing out-of-pocket transportation costs while working remotely.

Personalized Workplace Mobility Benefit

Personalized workplace mobility benefits enhance employee satisfaction by offering tailored options such as commuter benefits for public transit or remote work stipends that cover diverse transportation needs. These customized solutions optimize cost-efficiency and promote sustainable commuting practices aligned with individual work arrangements.

Commuter Benefits vs Remote Work Stipend for transportation. Infographic

hrdif.com

hrdif.com