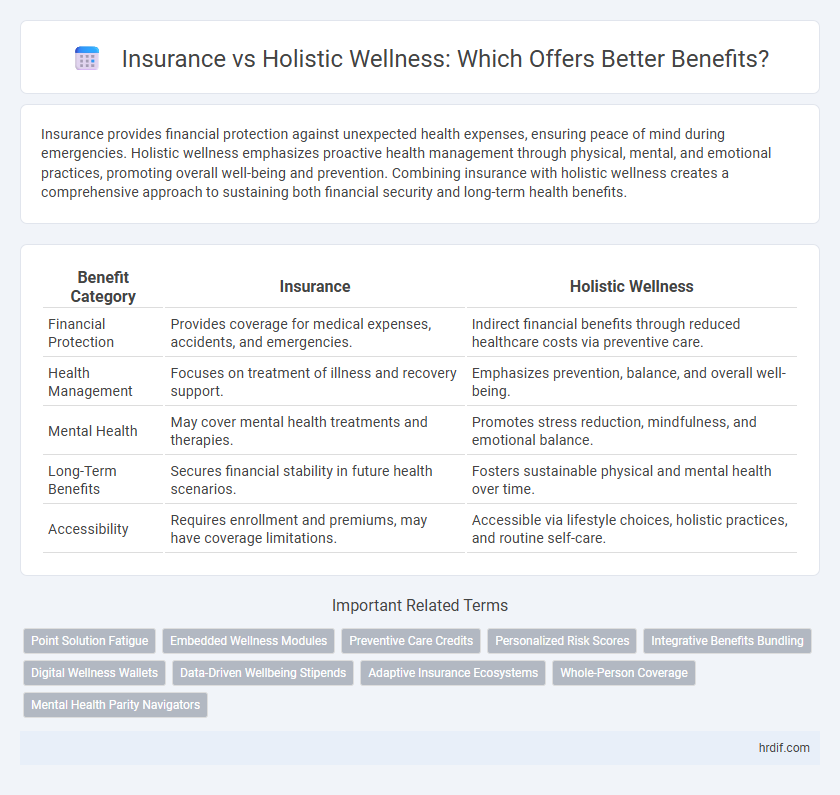

Insurance provides financial protection against unexpected health expenses, ensuring peace of mind during emergencies. Holistic wellness emphasizes proactive health management through physical, mental, and emotional practices, promoting overall well-being and prevention. Combining insurance with holistic wellness creates a comprehensive approach to sustaining both financial security and long-term health benefits.

Table of Comparison

| Benefit Category | Insurance | Holistic Wellness |

|---|---|---|

| Financial Protection | Provides coverage for medical expenses, accidents, and emergencies. | Indirect financial benefits through reduced healthcare costs via preventive care. |

| Health Management | Focuses on treatment of illness and recovery support. | Emphasizes prevention, balance, and overall well-being. |

| Mental Health | May cover mental health treatments and therapies. | Promotes stress reduction, mindfulness, and emotional balance. |

| Long-Term Benefits | Secures financial stability in future health scenarios. | Fosters sustainable physical and mental health over time. |

| Accessibility | Requires enrollment and premiums, may have coverage limitations. | Accessible via lifestyle choices, holistic practices, and routine self-care. |

Understanding Insurance Benefits for Employees

Understanding insurance benefits for employees involves recognizing coverage details, claim procedures, and network restrictions to maximize value. Holistic wellness programs complement insurance by addressing mental, physical, and emotional health needs, enhancing overall employee well-being. Integrating both approaches fosters a supportive workplace that reduces absenteeism and boosts productivity.

Exploring Holistic Wellness Programs

Holistic wellness programs offer comprehensive benefits by addressing physical, mental, and emotional health, which traditional insurance often overlooks. These programs integrate nutrition, exercise, mindfulness, and stress management to enhance overall well-being and prevent chronic diseases. Investing in holistic wellness can reduce healthcare costs by promoting proactive health maintenance rather than reactive treatments covered by insurance.

Comparing Coverage: Insurance vs Holistic Wellness

Insurance coverage typically focuses on specific health risks and medical treatments, providing financial protection against illness, injury, or emergencies. Holistic wellness benefits emphasize preventative care, mental health, nutrition, and lifestyle improvements, promoting overall well-being rather than addressing isolated health events. Comparing coverage, insurance offers tangible economic security during health crises, whereas holistic wellness programs invest in long-term health maintenance and quality of life enhancement.

Long-Term Impact of Insurance Benefits

Insurance benefits provide financial security by covering unexpected medical expenses, ensuring long-term stability for individuals and families. Holistic wellness programs emphasize preventive care and lifestyle improvements, potentially reducing healthcare costs over time through better overall health. Combining insurance with holistic wellness strategies maximizes long-term benefits by addressing both immediate medical needs and sustained well-being.

Holistic Wellness: Enhancing Employee Satisfaction

Holistic wellness programs significantly enhance employee satisfaction by addressing physical, mental, and emotional health, leading to increased productivity and reduced absenteeism. Unlike traditional insurance benefits that primarily cover medical expenses, holistic wellness initiatives promote preventive care and overall well-being. Companies investing in comprehensive wellness strategies experience higher employee engagement and retention rates.

Cost Analysis: Insurance Plans vs Wellness Initiatives

Insurance plans typically involve premium payments and out-of-pocket costs that can fluctuate based on coverage levels and claims history, often leading to predictable financial protection against major health expenses. Wellness initiatives, including preventive programs and holistic health services, generally require lower ongoing investment and may reduce long-term healthcare costs by minimizing chronic disease risks and improving overall well-being. A cost analysis reveals that integrating wellness programs with insurance can optimize financial benefits by balancing immediate expenses with preventive health savings.

Retention Rates: Insurance versus Holistic Wellness

Holistic wellness programs significantly boost employee retention rates by addressing overall health, stress management, and work-life balance, unlike traditional insurance plans that primarily cover medical expenses. Companies offering comprehensive wellness initiatives report up to 25% higher retention, as employees feel more valued and supported. Insurance benefits alone often fall short in fostering long-term engagement and satisfaction necessary for maintaining a stable workforce.

Productivity Outcomes from Wellness Benefits

Holistic wellness programs enhance employee productivity by addressing physical, mental, and emotional health, reducing absenteeism and presenteeism more effectively than traditional insurance benefits alone. Integrating wellness initiatives such as stress management, fitness incentives, and mental health support leads to sustained performance improvements that standard insurance coverage fails to achieve. Companies investing in comprehensive wellness benefit designs report higher engagement levels and measurable gains in overall workforce productivity.

Personalization: Tailoring Benefits to Employee Needs

Personalization in employee benefits enhances engagement by aligning insurance options and holistic wellness programs with individual health profiles and lifestyle preferences. Custom-tailored benefits improve employee satisfaction and retention through targeted coverage, preventive care, and wellness initiatives. Data-driven customization leverages employee feedback and health analytics to optimize both insurance plans and holistic wellness offerings.

Future Trends in Employee Benefit Programs

Future trends in employee benefit programs emphasize a shift from traditional insurance plans to holistic wellness solutions that address mental, physical, and financial health. Integrating technology-driven platforms and personalized wellness initiatives enhances employee engagement and productivity, reducing overall healthcare costs. Companies adopting comprehensive wellness strategies see improved retention rates and a more resilient workforce prepared for evolving workplace challenges.

Related Important Terms

Point Solution Fatigue

Insurance often addresses specific medical expenses but can contribute to point solution fatigue by requiring multiple policies and claims for different health issues. Holistic wellness integrates physical, mental, and emotional health, reducing the need for fragmented coverage and promoting sustained overall well-being.

Embedded Wellness Modules

Embedded wellness modules in insurance plans enhance benefit value by integrating preventive care, chronic disease management, and mental health resources directly into coverage. These modules improve overall health outcomes and reduce long-term costs, offering a comprehensive approach beyond traditional insurance benefits.

Preventive Care Credits

Insurance often covers specific medical treatments after illness onset, while Holistic Wellness programs emphasize preventive care credits to incentivize regular health maintenance and early intervention. Preventive Care Credits reward activities such as routine check-ups, vaccinations, and lifestyle coaching, reducing long-term healthcare costs and promoting overall well-being.

Personalized Risk Scores

Insurance leverages personalized risk scores to tailor coverage and premiums based on individual health data, enhancing financial protection by addressing specific risks. Holistic wellness integrates these risk scores with lifestyle and behavioral insights to promote preventive care, improving overall well-being and reducing long-term insurance costs.

Integrative Benefits Bundling

Integrative benefits bundling combines insurance coverage with holistic wellness programs to optimize overall health outcomes and reduce long-term costs. This approach enhances employee well-being by addressing physical, mental, and preventive care under a single, cohesive benefits package.

Digital Wellness Wallets

Digital wellness wallets enhance insurance benefits by consolidating health data, enabling personalized care and proactive management of medical expenses. Integrating holistic wellness features like fitness tracking and mental health resources within these wallets maximizes overall well-being and reduces long-term healthcare costs.

Data-Driven Wellbeing Stipends

Data-driven wellbeing stipends empower employees by allocating funds based on personalized health metrics, optimizing both insurance coverage and holistic wellness initiatives. Integrating these stipends enhances benefit programs by promoting preventative care, reducing claim costs, and improving overall productivity through tailored wellness support.

Adaptive Insurance Ecosystems

Adaptive Insurance Ecosystems enhance benefit offerings by integrating personalized risk assessment and real-time health data analytics, promoting proactive coverage adjustments. This approach outperforms traditional insurance by aligning with holistic wellness strategies that support preventive care and comprehensive health management.

Whole-Person Coverage

Whole-person coverage integrates insurance benefits with holistic wellness approaches, addressing physical, mental, and emotional health to enhance overall well-being. This comprehensive strategy reduces healthcare costs by preventing illness through proactive wellness programs alongside traditional insurance protection.

Mental Health Parity Navigators

Mental Health Parity Navigators bridge gaps between insurance coverage and holistic wellness by ensuring equitable access to mental health services, promoting comprehensive care that integrates therapy, medication, and wellness practices. Their role enhances benefit programs by navigating complex policies to support mental health parity and improve patient outcomes.

Insurance vs Holistic Wellness for benefit. Infographic

hrdif.com

hrdif.com