Commuter benefits reduce daily transportation costs, encouraging sustainable travel and improving employee punctuality, while remote office setup allowances help create a productive home workspace, enhancing comfort and efficiency. Both benefits contribute to employee satisfaction and retention by addressing different work environments. Choosing between them depends on whether employees primarily work on-site or remotely, tailoring support to their specific needs.

Table of Comparison

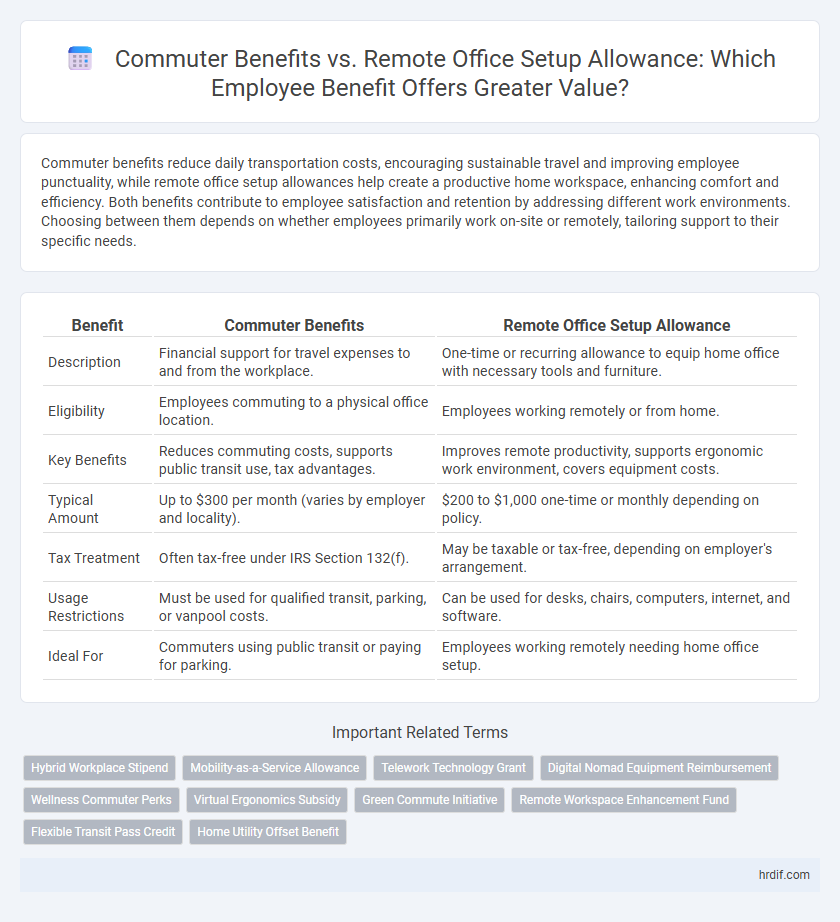

| Benefit | Commuter Benefits | Remote Office Setup Allowance |

|---|---|---|

| Description | Financial support for travel expenses to and from the workplace. | One-time or recurring allowance to equip home office with necessary tools and furniture. |

| Eligibility | Employees commuting to a physical office location. | Employees working remotely or from home. |

| Key Benefits | Reduces commuting costs, supports public transit use, tax advantages. | Improves remote productivity, supports ergonomic work environment, covers equipment costs. |

| Typical Amount | Up to $300 per month (varies by employer and locality). | $200 to $1,000 one-time or monthly depending on policy. |

| Tax Treatment | Often tax-free under IRS Section 132(f). | May be taxable or tax-free, depending on employer's arrangement. |

| Usage Restrictions | Must be used for qualified transit, parking, or vanpool costs. | Can be used for desks, chairs, computers, internet, and software. |

| Ideal For | Commuters using public transit or paying for parking. | Employees working remotely needing home office setup. |

Understanding Commuter Benefits in Today’s Workforce

Commuter benefits offer employees pre-tax savings on transportation costs such as transit passes, parking fees, and vanpooling, which reduces their taxable income and increases overall take-home pay. These benefits cater to a workforce that still relies on public transportation or carpooling, promoting environmental sustainability and reducing traffic congestion. In contrast, a remote office setup allowance addresses the needs of remote workers by reimbursing home office expenses, but commuter benefits remain vital for organizations supporting hybrid or in-office attendance.

Introducing Remote Office Setup Allowances

Remote office setup allowances provide employees with a dedicated budget to create a productive home workspace, covering expenses such as ergonomic furniture, technology upgrades, and office supplies. Unlike commuter benefits, which primarily offset transportation costs, remote office allowances directly enhance work-from-home efficiency and comfort. Offering this allowance supports employee well-being and aligns with the growing trend of flexible work arrangements.

Cost Comparison: Commuter Benefits vs Remote Work Stipends

Commuter benefits typically provide tax-advantaged funds for transportation expenses, often reducing monthly commuting costs by up to 30%, while remote work stipends offer fixed monthly amounts to cover home office expenses, usually ranging between $50 to $150. Employers save on facility costs and utilities with remote work stipends, whereas commuter benefits incur ongoing expenses linked to employee transit use. Evaluating these costs reveals remote office stipends tend to be more predictable budget items, contrasted with commuter benefits that fluctuate based on employee usage and transit price variations.

Impact on Employee Productivity and Well-being

Commuter benefits reduce stress and financial burden associated with daily travel, enhancing employee focus and punctuality, which directly boosts productivity. Remote office setup allowances empower employees to create ergonomic and personalized work environments, leading to increased comfort and sustained well-being. Both benefits improve job satisfaction but remote allowances often result in longer-term health advantages, while commuter benefits offer immediate relief from travel-related exhaustion.

Flexibility and Accessibility: Which Benefit Wins?

Commuter benefits provide flexible transportation options often tailored to urban transit systems, enhancing daily travel accessibility for employees working onsite. Remote office setup allowances empower workers to create personalized home workspaces, increasing flexibility by eliminating commute constraints altogether. For maximizing flexibility and accessibility, remote office setup allowances typically deliver greater overall convenience, especially as remote work models continue to grow.

Tax Implications for Employers and Employees

Commuter Benefits offer tax advantages by allowing employees to use pre-tax dollars for transit and parking expenses, reducing taxable income for both employers and employees. Remote Office Setup Allowance typically constitutes taxable income, increasing tax liabilities for employees while employers may deduct the allowance as a business expense. Employers must carefully evaluate these tax implications to optimize cost savings and compliance when choosing between commuter benefits and remote office allowances.

Environmental Considerations: Commuting vs Home Offices

Commuter benefits reduce carbon emissions by encouraging public transit, carpooling, and biking, effectively lowering the environmental impact of daily travel. Remote office setup allowances promote energy efficiency at home, but increased residential energy use may offset some gains from reduced commuting. Evaluating environmental benefits requires analyzing transportation emissions against home energy consumption to optimize overall sustainability strategies.

Customizing Benefits for a Diverse Workforce

Commuter Benefits and Remote Office Setup Allowances cater to different employee needs, enabling companies to customize perks that reflect varied work styles and locations. Offering Commuter Benefits supports urban employees relying on public transport, while Remote Office Setup Allowance empowers home-based workers with essential equipment. Tailoring these benefits enhances employee satisfaction and retention by addressing diverse workforce preferences.

Employee Preference: Survey Insights and Trends

Employee preference trends reveal a growing inclination toward remote office setup allowances, with 68% of respondents favoring direct support to create productive home workspaces over traditional commuter benefits. Surveys indicate that flexible benefit options addressing home office needs enhance job satisfaction and retention rates, particularly among remote and hybrid workers. Data-driven insights emphasize that providing remote setup allowances aligns more closely with current workforce demands, fostering increased productivity and employee well-being.

Making the Right Choice for Your Organization

Commuter benefits offer tax-advantaged options to support employees' daily transit costs, promoting eco-friendly and cost-effective travel for on-site workers. Remote office setup allowances provide financial support for home office equipment and technology, enhancing productivity and comfort for remote employees. Evaluating workforce location, company culture, and budget constraints helps organizations determine the optimal balance between commuter benefits and remote office setup allowances.

Related Important Terms

Hybrid Workplace Stipend

Hybrid workplace stipends offer employees flexible financial support that balances commuter benefits and remote office setup allowances, enhancing productivity and job satisfaction in hybrid work models. By integrating commuting cost coverage with home office enhancements, companies optimize employee well-being and operational efficiency in hybrid environments.

Mobility-as-a-Service Allowance

Mobility-as-a-Service Allowance offers greater flexibility and cost savings compared to traditional Commuter Benefits by integrating multiple transportation options into a single subsidized platform, enhancing employee mobility regardless of location. This allowance supports remote office setups by covering diverse commuting methods, reducing dependency on specific transit systems and promoting sustainable, efficient travel for a distributed workforce.

Telework Technology Grant

Telework Technology Grants enhance remote productivity by providing employees with essential equipment and software, bridging the gap between physical office infrastructure and home setups. Unlike commuter benefits that subsidize travel costs, these grants directly invest in technology, fostering a more efficient and connected remote workforce.

Digital Nomad Equipment Reimbursement

Digital Nomad Equipment Reimbursement offers targeted support by covering essential technology and office gear, enhancing productivity for remote workers beyond standard Commuter Benefits or Remote Office Setup Allowances. This focused benefit ensures that digital nomads have access to the latest tools necessary for efficient, location-independent work environments.

Wellness Commuter Perks

Wellness commuter perks in commuter benefits include subsidized transit passes, bike-sharing programs, and priority parking that promote physical activity and reduce stress. Remote office setup allowances lack these direct wellness incentives but support ergonomic home workspaces to enhance long-term comfort and productivity.

Virtual Ergonomics Subsidy

Virtual ergonomics subsidies enhance remote office setups by providing employees with financial support for ergonomic equipment tailored to home workspaces, reducing musculoskeletal issues and increasing productivity. Commuter benefits, while valuable for transportation costs, lack direct investment in personalized ergonomic improvements essential for virtual work comfort and health.

Green Commute Initiative

Commuter Benefits prioritize reducing carbon emissions by incentivizing eco-friendly transportation options such as public transit, biking, and carpooling, directly supporting the Green Commute Initiative. Remote Office Setup Allowances enable employees to create productive home workspaces but may have less direct impact on lowering commute-related environmental footprints.

Remote Workspace Enhancement Fund

The Remote Workspace Enhancement Fund offers employees a focused benefit by providing financial support to improve home office setups, directly enhancing productivity and comfort. Unlike commuter benefits, which cover travel expenses, this fund invests in ergonomic equipment and technology upgrades tailored for remote work efficiency.

Flexible Transit Pass Credit

Flexible Transit Pass Credit under commuter benefits offers a tax-efficient solution that reimburses employees for public transportation costs, directly reducing their commuting expenses. In contrast, remote office setup allowances provide one-time financial support for home office equipment but do not address ongoing commuting costs or promote sustainable transit use.

Home Utility Offset Benefit

Commuter Benefits primarily reduce transportation costs for employees traveling to a physical workplace, whereas a Remote Office Setup Allowance, including a Home Utility Offset Benefit, directly addresses increased home expenses like electricity and internet arising from remote work. Offering a Home Utility Offset Benefit enhances employee satisfaction and productivity by financially supporting home office utility costs, a key factor absent in traditional commuter-focused benefits.

Commuter Benefits vs Remote Office Setup Allowance for benefit. Infographic

hrdif.com

hrdif.com