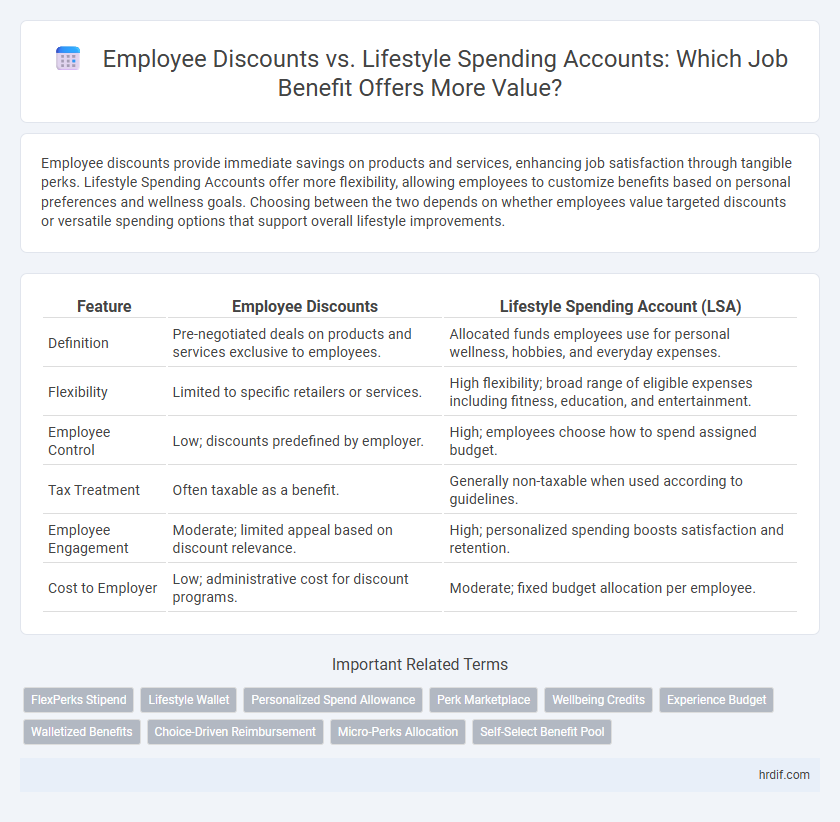

Employee discounts provide immediate savings on products and services, enhancing job satisfaction through tangible perks. Lifestyle Spending Accounts offer more flexibility, allowing employees to customize benefits based on personal preferences and wellness goals. Choosing between the two depends on whether employees value targeted discounts or versatile spending options that support overall lifestyle improvements.

Table of Comparison

| Feature | Employee Discounts | Lifestyle Spending Account (LSA) |

|---|---|---|

| Definition | Pre-negotiated deals on products and services exclusive to employees. | Allocated funds employees use for personal wellness, hobbies, and everyday expenses. |

| Flexibility | Limited to specific retailers or services. | High flexibility; broad range of eligible expenses including fitness, education, and entertainment. |

| Employee Control | Low; discounts predefined by employer. | High; employees choose how to spend assigned budget. |

| Tax Treatment | Often taxable as a benefit. | Generally non-taxable when used according to guidelines. |

| Employee Engagement | Moderate; limited appeal based on discount relevance. | High; personalized spending boosts satisfaction and retention. |

| Cost to Employer | Low; administrative cost for discount programs. | Moderate; fixed budget allocation per employee. |

Understanding Employee Discounts: Traditional Perks Explained

Employee discounts offer immediate savings on products and services directly related to the employer's industry, fostering brand loyalty and enhancing employee satisfaction through tangible cost reductions. These traditional perks often include exclusive price reductions on company merchandise, travel, dining, and entertainment, providing consistent financial benefits aligned with the organization's offerings. Understanding the scope and limitations of employee discounts helps employees maximize value while allowing employers to maintain a cost-effective, attractive benefits program.

What Is a Lifestyle Spending Account? An Overview

A Lifestyle Spending Account (LSA) is a flexible employee benefit that provides a predetermined budget for personal expenses related to wellness, hobbies, travel, and family care. Unlike traditional employee discounts that offer specific product or service savings, LSAs empower employees to choose how they allocate funds, enhancing job satisfaction and work-life balance. Companies implementing LSAs often see improved employee retention and engagement due to the personalized nature of this benefit.

Key Differences Between Employee Discounts and Lifestyle Spending Accounts

Employee discounts offer immediate savings on specific products or services from partnered brands, directly reducing purchase costs for employees. Lifestyle Spending Accounts (LSAs) provide flexible, pre-allocated funds that employees can use on a broader range of wellness and lifestyle expenses, including fitness, travel, and personal development. Unlike employee discounts, LSAs empower personalized spending while employee discounts typically deliver targeted, transactional benefits.

Flexibility in Benefits: LSA vs Employee Discount Programs

Lifestyle Spending Accounts (LSAs) offer greater flexibility compared to traditional Employee Discount Programs by allowing employees to allocate funds toward a wide range of personal benefits beyond predefined discounts. Unlike fixed discount options, LSAs enable customization based on individual preferences, such as wellness services, travel, and professional development. This adaptability enhances employee satisfaction and supports diverse lifestyle needs, making LSAs a more versatile benefit solution.

Tax Implications of Employee Discounts and Lifestyle Spending Accounts

Employee discounts typically offer immediate cost savings on products or services but may be considered a taxable benefit depending on the jurisdiction and the value of the discount provided. Lifestyle Spending Accounts (LSAs) offer greater flexibility by allowing employees to allocate a set amount towards wellness, fitness, or personal development expenses, often with favorable tax treatment or exemptions. Understanding the specific tax regulations governing employee discounts and LSAs is crucial for employers to maximize benefit efficiency and compliance.

Employee Engagement: Impact of Personalized Benefits

Employee discounts boost employee engagement by offering tailored savings on products and services employees value, enhancing job satisfaction and loyalty. Lifestyle Spending Accounts (LSAs) further personalize benefits by allowing employees to allocate funds toward wellness, hobbies, and personal development. Personalized benefits, such as employee discounts combined with LSAs, create a flexible and meaningful engagement strategy that aligns with diverse employee preferences and drives retention.

Budgeting for Benefits: Cost Considerations for Employers

Employee discounts provide a predictable budgeting advantage for employers by offering fixed price reductions on products or services, reducing overall benefit costs. Lifestyle Spending Accounts (LSAs) require flexible budgeting to accommodate diverse employee preferences and often involve variable claim amounts, increasing cost management complexity. Employers must evaluate the financial predictability of employee discounts against the customizable but potentially fluctuating expenses of LSAs to optimize benefit spending.

Attracting and Retaining Talent: Which Benefit Wins?

Employee discounts provide immediate, tangible savings on popular products and services, appealing directly to cost-conscious candidates and demonstrating a clear financial advantage. Lifestyle Spending Accounts (LSAs) offer flexible, personalized benefits that cater to diverse employee interests, promoting long-term satisfaction and boosting retention through tailored wellness and enrichment opportunities. Companies prioritizing talent attraction and retention often find LSAs more effective due to their adaptability, fostering a culture of care and engagement beyond traditional discounts.

Customization and Choice: Meeting Employee Needs

Employee Discounts provide specific savings on selected products and services, offering straightforward value with limited customization. Lifestyle Spending Accounts allow employees to allocate funds toward a diverse range of wellness, education, and leisure expenses, enabling highly personalized benefit choices. This flexibility in Lifestyle Spending Accounts meets varied employee needs more effectively, enhancing satisfaction and engagement.

Future Trends in Employee Benefits: Moving Beyond Discounts

Future trends in employee benefits emphasize personalized Lifestyle Spending Accounts (LSAs) over traditional employee discounts, reflecting a shift towards flexible, employee-centric reward systems. LSAs enable workers to allocate funds toward wellness, education, or recreation, enhancing overall satisfaction and retention. Corporations adopting this model report increased engagement and adaptability to diverse workforce needs, signaling a paradigm shift beyond standard discount offerings.

Related Important Terms

FlexPerks Stipend

FlexPerks Stipend offers employees a versatile benefit by combining the savings of employee discounts with the flexibility of a lifestyle spending account, allowing personalized spending on wellness, entertainment, and retail. This hybrid approach maximizes employee satisfaction by tailoring perks to individual preferences while maintaining budget control for employers.

Lifestyle Wallet

Lifestyle Spending Accounts offer employees flexible, tax-free funds to spend on wellness, fitness, and personal development, enhancing overall job satisfaction beyond traditional employee discounts. Unlike limited employee discounts, Lifestyle Wallets provide a customizable benefit that adapts to individual preferences, promoting a healthier and more engaged workforce.

Personalized Spend Allowance

Employee discounts provide targeted savings on specific products or services, while Lifestyle Spending Accounts (LSAs) offer a personalized spend allowance, enabling employees to allocate funds toward a wide range of lifestyle choices such as wellness, travel, and entertainment. LSAs enhance flexibility and employee satisfaction by accommodating individual preferences, making them a superior benefit for personalized financial empowerment.

Perk Marketplace

Employee discounts provide direct savings on products and services, enhancing immediate financial benefits for employees through established vendor partnerships. Lifestyle Spending Accounts (LSAs) offer flexible, customizable perks via a Perk Marketplace, empowering employees to choose from a variety of wellness, entertainment, and lifestyle options tailored to their preferences.

Wellbeing Credits

Employee discounts provide immediate savings on products and services, enhancing employee purchasing power, while Lifestyle Spending Accounts (LSAs) offer flexible Wellbeing Credits that employees can allocate toward health, fitness, and wellness expenses, promoting long-term wellbeing. Wellbeing Credits within LSAs empower employees to customize their benefits, supporting mental, physical, and financial health beyond traditional discounts.

Experience Budget

Employee discounts offer immediate savings on products and services, enhancing financial well-being, while Lifestyle Spending Accounts provide a flexible experience budget that empowers employees to invest in personalized wellness activities, travel, and skill development, fostering overall job satisfaction and retention. Prioritizing an experience budget within a Lifestyle Spending Account aligns benefits with individual lifestyle preferences, driving higher engagement and long-term employee happiness.

Walletized Benefits

Employee discounts offer immediate savings on products and services, directly reducing out-of-pocket expenses for employees, while Lifestyle Spending Accounts (LSAs) provide flexible, walletized benefits that empower employees to allocate funds toward personalized wellness, hobbies, and lifestyle choices. Walletized benefits in LSAs enhance employee satisfaction and retention by delivering customizable, tax-advantaged spending options beyond traditional discount programs.

Choice-Driven Reimbursement

Employee Discounts provide immediate savings on specific products or services, enhancing direct financial benefits. Lifestyle Spending Accounts offer flexible, choice-driven reimbursements that empower employees to allocate funds toward personalized wellness, hobbies, or family needs, increasing overall job satisfaction and engagement.

Micro-Perks Allocation

Employee discounts provide immediate cost savings on specific products or services, maximizing tangible value for employees, while Lifestyle Spending Accounts offer flexible micro-perks allocation that empowers personalized spending across diverse wellness, fitness, and leisure options, enhancing overall employee satisfaction and engagement. Leveraging micro-perks allocation in Lifestyle Spending Accounts supports a broader range of benefits tailored to individual preferences, driving higher utilization rates compared to traditional employee discount programs.

Self-Select Benefit Pool

Employee discounts offer immediate savings on products and services, enhancing day-to-day financial relief, while a Self-Select Benefit Pool within a Lifestyle Spending Account provides employees flexibility to allocate funds toward personalized wellness, travel, or family support expenses, promoting tailored well-being and work-life balance. Organizations leveraging Self-Select Benefit Pools report increased employee satisfaction and engagement due to customized benefit utilization aligned with individual preferences.

Employee Discounts vs Lifestyle Spending Account for job benefit Infographic

hrdif.com

hrdif.com