Pension plans provide long-term financial security by guaranteeing a steady income after retirement, ensuring stability for employees in their later years. Financial wellness programs offer personalized strategies to manage debt, save, and invest, improving overall financial health and reducing stress before retirement. Combining both benefits creates a comprehensive approach, addressing immediate financial challenges and securing future income streams.

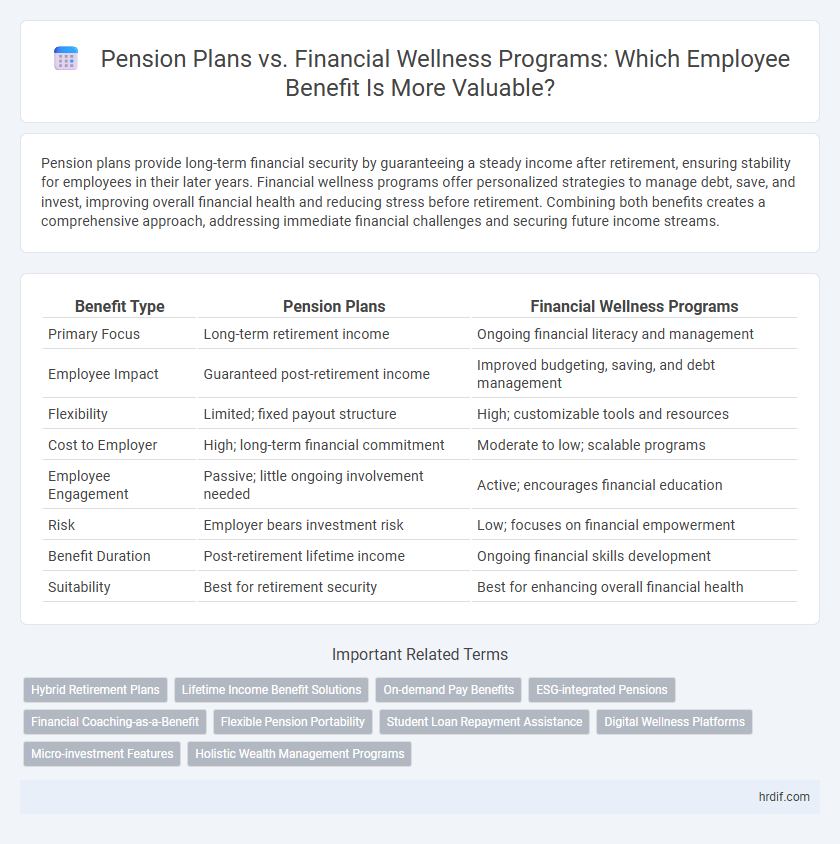

Table of Comparison

| Benefit Type | Pension Plans | Financial Wellness Programs |

|---|---|---|

| Primary Focus | Long-term retirement income | Ongoing financial literacy and management |

| Employee Impact | Guaranteed post-retirement income | Improved budgeting, saving, and debt management |

| Flexibility | Limited; fixed payout structure | High; customizable tools and resources |

| Cost to Employer | High; long-term financial commitment | Moderate to low; scalable programs |

| Employee Engagement | Passive; little ongoing involvement needed | Active; encourages financial education |

| Risk | Employer bears investment risk | Low; focuses on financial empowerment |

| Benefit Duration | Post-retirement lifetime income | Ongoing financial skills development |

| Suitability | Best for retirement security | Best for enhancing overall financial health |

Understanding Pension Plans: Traditional Benefits Overview

Pension plans provide a defined benefit that guarantees a fixed income after retirement, offering financial security through predictable monthly payments based on salary and years of service. These traditional plans contrast with financial wellness programs, which emphasize comprehensive financial education, personalized planning, and tools to manage assets, savings, and debt throughout an employee's career. Understanding the stability and long-term value of pension benefits helps employees appreciate foundational retirement security compared to the broader but less guaranteed support of financial wellness initiatives.

Financial Wellness Programs: Modern Solutions Explained

Financial wellness programs offer personalized financial education, debt management tools, and savings plans that adapt to employees' evolving needs, promoting long-term financial health beyond traditional pension benefits. These programs provide real-time budgeting support, retirement planning resources, and emergency fund guidance, enabling employees to achieve greater financial stability. Emphasizing proactive financial management, financial wellness programs enhance overall employee well-being and productivity compared to the fixed nature of conventional pension schemes.

Key Differences Between Pension and Financial Wellness Programs

Pension programs provide structured, long-term retirement income based on salary and years of service, offering financial security through guaranteed payments. Financial wellness programs focus on improving employees' overall money management skills, including budgeting, debt reduction, and retirement planning, enhancing short-term and long-term financial well-being. The key difference lies in pensions delivering fixed retirement benefits, while wellness programs promote proactive financial health and literacy.

Impact on Employee Retention and Satisfaction

Pension plans offer long-term financial security, significantly enhancing employee retention by fostering loyalty and reducing turnover rates. Financial wellness programs improve overall satisfaction by addressing immediate financial concerns, leading to higher productivity and reduced stress. Combining both benefits creates a comprehensive support system that maximizes employee engagement and loyalty.

Flexibility: Adapting to Diverse Workforce Needs

Pension plans provide long-term financial security with fixed contributions and predictable payouts, but often lack flexibility to accommodate varying career paths and changing employee needs. Financial wellness programs offer personalized solutions such as budgeting tools, debt management, and flexible saving options, enabling employees to address immediate and evolving financial challenges. Emphasizing adaptive benefits, financial wellness initiatives align better with the diverse lifestyles and financial goals of a modern workforce.

Long-term Security: Comparing Retirement Outcomes

Pension plans offer guaranteed income streams, providing retirees with stable, predictable financial security throughout retirement. Financial wellness programs emphasize education and personal financial management, potentially enhancing participants' ability to save and invest for retirement but lacking the guaranteed safety net pensions provide. Long-term retirement outcomes tend to be more secure under pension schemes, while financial wellness depends on individual discipline and market performance.

Cost Implications for Employers and Employees

Pension plans often require higher upfront and ongoing employer contributions, increasing long-term financial obligations compared to financial wellness programs, which generally involve lower immediate costs and focus on education and behavioral changes. Employees benefit from predictable retirement income through pensions, yet may face limited flexibility, whereas financial wellness programs promote broader financial literacy and personal management, potentially reducing stress and increasing productivity. Employers balancing these options must consider not only direct expenses but also the impact on employee engagement, retention, and overall organizational financial health.

Financial Literacy: The Role in Wellness Programs

Financial literacy plays a pivotal role in enhancing the effectiveness of wellness programs by empowering employees to make informed decisions about their pensions and overall financial health. While traditional pension plans provide long-term retirement security, integrating financial wellness programs offers comprehensive education on budgeting, debt management, and investment strategies, leading to improved financial stability and reduced stress. Companies investing in financial literacy initiatives report higher employee engagement and better preparation for retirement, making these programs a valuable complement to pension benefits.

Future-Proofing Employee Benefits

Pension plans provide long-term financial security through guaranteed retirement income, directly addressing employees' future financial needs and reducing reliance on external savings. Financial wellness programs complement pensions by offering personalized education, budgeting tools, and debt management, empowering employees to enhance their overall financial health and make informed decisions. Combining both benefits creates a future-proof employee compensation strategy that balances stable retirement income with proactive financial literacy.

Deciding the Best Fit: Pension vs. Financial Wellness Programs

Pension plans provide long-term financial security through guaranteed retirement income based on salary and years of service, making them ideal for employees valuing stability and predictability. Financial wellness programs offer flexible, personalized resources like budgeting tools and retirement planning education, helping employees improve overall money management and prepare for various financial goals. Employers should evaluate workforce demographics, employee financial literacy, and desired benefit outcomes to determine whether the structured reliability of pensions or the adaptive support of financial wellness programs best meets organizational and employee needs.

Related Important Terms

Hybrid Retirement Plans

Hybrid retirement plans combine the security of traditional pensions with the flexibility of financial wellness programs, enhancing long-term financial stability for employees. These plans integrate guaranteed income streams from pensions with personalized financial education and savings options, promoting comprehensive retirement readiness and improved benefit engagement.

Lifetime Income Benefit Solutions

Lifetime Income Benefit Solutions provide guaranteed income streams that complement traditional pension plans by addressing retirement longevity risks. Financial wellness programs enhance overall benefit strategies by promoting employee financial literacy and proactive retirement planning, but may lack the assured, lifelong payouts that pension-like solutions offer.

On-demand Pay Benefits

On-demand pay benefits provide immediate access to earned wages, enhancing financial wellness by reducing reliance on traditional pensions that offer delayed retirement income. Integrating on-demand pay within financial wellness programs improves employee satisfaction and reduces financial stress, outperforming conventional pension plans in addressing day-to-day cash flow needs.

ESG-integrated Pensions

ESG-integrated pensions align retirement savings with environmental, social, and governance criteria, enhancing long-term value and promoting sustainable investment practices that support corporate responsibility. Financial wellness programs complement these pensions by educating employees on budgeting and financial planning, fostering overall financial security and engagement in benefit offerings.

Financial Coaching-as-a-Benefit

Financial coaching-as-a-benefit provides personalized guidance that enhances employees' ability to manage budgets, reduce debt, and plan for both short-term expenses and long-term savings, leading to improved financial wellness and reduced stress. Unlike traditional pensions, which offer fixed retirement income, financial coaching empowers employees with adaptable strategies to achieve greater financial security throughout their careers and retirement.

Flexible Pension Portability

Flexible pension portability enhances employee financial wellness by allowing seamless transfer of retirement savings across jobs, reducing barriers to maintaining consistent pension contributions. Unlike traditional pension plans, financial wellness programs often lack this portability, limiting long-term retirement security optimization for mobile workforces.

Student Loan Repayment Assistance

Student Loan Repayment Assistance programs offer employees targeted debt relief, reducing financial stress more immediately than traditional pension plans, which provide long-term retirement security but lack direct support for educational debt. Incorporating loan repayment benefits into financial wellness initiatives enhances overall employee satisfaction and retention by addressing urgent financial challenges faced by younger workforces.

Digital Wellness Platforms

Digital wellness platforms enhance financial wellness programs by providing personalized tools for budget management, retirement planning, and stress reduction, leading to improved employee engagement and long-term financial security. Compared to traditional pension plans, these platforms offer dynamic, real-time financial insights that empower employees to make informed decisions and optimize their overall financial well-being.

Micro-investment Features

Micro-investment features in pension plans enable employees to incrementally grow retirement savings through regular, small contributions, promoting long-term financial security. Financial wellness programs with micro-investment options offer real-time portfolio tracking and educational tools, enhancing employee engagement and immediate control over personal finances.

Holistic Wealth Management Programs

Holistic wealth management programs integrate pension plans with comprehensive financial wellness strategies, offering employees personalized investment advice, retirement planning, and debt management to enhance long-term financial security. These programs improve overall benefit effectiveness by addressing multiple aspects of financial health beyond traditional pension schemes, fostering greater employee engagement and well-being.

Pension vs Financial wellness programs for benefit. Infographic

hrdif.com

hrdif.com