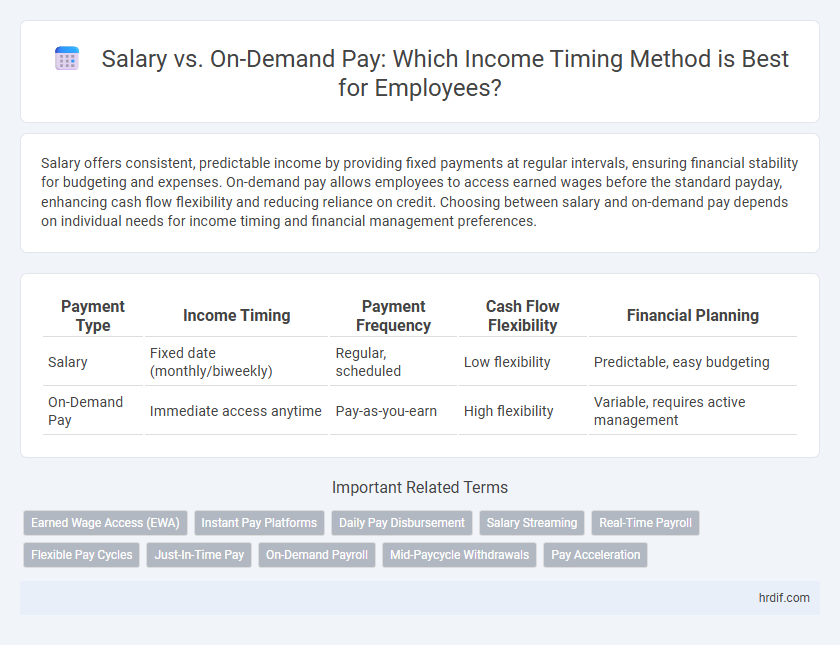

Salary offers consistent, predictable income by providing fixed payments at regular intervals, ensuring financial stability for budgeting and expenses. On-demand pay allows employees to access earned wages before the standard payday, enhancing cash flow flexibility and reducing reliance on credit. Choosing between salary and on-demand pay depends on individual needs for income timing and financial management preferences.

Table of Comparison

| Payment Type | Income Timing | Payment Frequency | Cash Flow Flexibility | Financial Planning |

|---|---|---|---|---|

| Salary | Fixed date (monthly/biweekly) | Regular, scheduled | Low flexibility | Predictable, easy budgeting |

| On-Demand Pay | Immediate access anytime | Pay-as-you-earn | High flexibility | Variable, requires active management |

Understanding Salary: Traditional Income Timing

Traditional salary provides a fixed, predictable income paid on a set schedule, typically biweekly or monthly, enabling consistent financial planning and budgeting. This stable payment structure contrasts with on-demand pay, which allows employees immediate access to earned wages but may lead to irregular cash flow. Understanding salary timing helps employees manage expenses efficiently and supports long-term financial commitments.

What Is On-Demand Pay? A Modern Payroll Alternative

On-demand pay allows employees to access a portion of their earned wages before the traditional payday, providing immediate financial flexibility compared to fixed salary schedules. This modern payroll alternative reduces the waiting period for income, enhancing cash flow management and supporting urgent financial needs. Employers benefit from increased employee satisfaction and retention by offering on-demand pay as a complement to standard salary payments.

Comparing Salary and On-Demand Pay: Key Differences

Salary provides a fixed, predictable income paid at regular intervals, typically biweekly or monthly, allowing for easier financial planning and stability. On-demand pay offers immediate access to earned wages before the standard payday, enhancing cash flow flexibility but potentially leading to inconsistent income timing. Key differences include payment frequency, financial predictability, and the ability to manage unexpected expenses efficiently.

Financial Flexibility: Salary vs On-Demand Pay

On-demand pay offers greater financial flexibility by allowing employees to access earned wages immediately, reducing reliance on traditional pay cycles and enhancing cash flow management. Salary payments, typically disbursed monthly or biweekly, provide predictable income but limit the ability to respond quickly to unexpected expenses. This immediate access to earnings with on-demand pay can improve budgeting and reduce the need for costly short-term borrowing.

Impact on Budgeting: Scheduled vs Immediate Access to Earnings

Scheduled salary payments offer predictable income, enabling structured monthly budgeting and long-term financial planning. On-demand pay provides immediate access to earned wages, which can improve cash flow management and help address unexpected expenses promptly. Choosing between these options influences financial stability, with scheduled salaries promoting consistency and on-demand pay enhancing flexibility.

Employee Financial Wellness: Which Model Wins?

On-demand pay offers employees immediate access to earned wages, reducing financial stress and enhancing overall financial wellness by preventing reliance on costly credit options. Traditional salary models provide predictable income, helping with long-term budgeting but may delay access to funds during emergencies. Employers adopting on-demand pay report higher employee satisfaction and reduced financial anxiety, positioning it as a superior model for improving employee financial wellness.

Employer Considerations: Costs and Benefits

Employers evaluating Salary vs On-Demand Pay must balance cost predictability with employee satisfaction; salaried wages provide fixed payroll expenses, facilitating budgeting and financial planning. On-demand pay systems potentially reduce turnover and improve morale but may incur higher administrative costs and require advanced payroll technology integration. Weighing long-term savings from reduced absenteeism against upfront expenses is critical for strategic compensation planning.

Legal and Compliance Issues in Payout Methods

Salary payment methods are governed by strict legal frameworks to ensure timely and accurate wage distribution, with clear regulations on minimum wage, overtime, and withholding taxes. On-demand pay solutions must comply with these labor laws while maintaining transparent records to avoid violations such as wage theft or misclassification. Employers adopting on-demand payout systems face compliance challenges including data security, consent for deductions, and adherence to specific state and federal wage payment statutes.

Industry Adoption: Trends in Salary and On-Demand Pay

Industry adoption of salary versus on-demand pay reveals a growing preference for flexible income timing among employees, with 45% of companies integrating on-demand pay solutions in 2024. Traditional salaried models still dominate 65% of large enterprises, offering consistent monthly income, while startups and gig economy firms prioritize on-demand pay to boost worker satisfaction and retention. Emerging trends indicate hybrid compensation models combining fixed salaries with instant wage access to enhance financial wellness and adapt to dynamic workforce needs.

Choosing the Right Income Timing Solution for Your Career

Choosing the right income timing solution depends on your financial needs and career goals. Salaries provide predictable, regular income that supports budgeting and long-term planning, while on-demand pay offers flexibility to access earnings as needed for unexpected expenses. Evaluating job stability and cash flow preferences helps determine whether a fixed salary or on-demand pay aligns better with your financial management strategy.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) enables workers to access a portion of their earned salary before the regular payday, improving cash flow and reducing reliance on high-interest loans. Unlike traditional salary payments, EWA offers flexible income timing tailored to immediate financial needs without affecting the overall monthly income.

Instant Pay Platforms

Instant pay platforms enable employees to access earned wages immediately, improving cash flow and financial flexibility compared to traditional salary schedules that distribute pay on fixed dates. This real-time income timing reduces reliance on payday loans and enhances employee satisfaction by aligning compensation with daily work efforts.

Daily Pay Disbursement

Daily pay disbursement in on-demand pay systems allows employees to access earned wages immediately after work, contrasting with traditional salary models where income is received on a fixed schedule, typically biweekly or monthly. This immediate access to funds improves cash flow management and reduces financial stress by eliminating long waiting periods between paychecks.

Salary Streaming

Salary streaming offers employees continuous access to earned wages throughout the pay period, contrasting with traditional salary payouts that occur on fixed dates. This on-demand pay model enhances financial flexibility, reducing reliance on high-interest loans and improving cash flow management.

Real-Time Payroll

Real-time payroll enables employees to access earned wages instantly instead of waiting for the traditional salary disbursement schedule, improving cash flow and financial flexibility. On-demand pay allows workers to withdraw pay as they earn it, reducing reliance on payday loans and enhancing overall income timing control compared to fixed salary payments.

Flexible Pay Cycles

Flexible pay cycles in on-demand pay systems allow employees to access earned wages before the traditional biweekly or monthly salary schedule, enhancing financial agility and reducing dependence on credit. Unlike fixed salary payments, on-demand pay provides immediate income timing that adapts to individual cash flow needs, promoting better budgeting and financial stability.

Just-In-Time Pay

Just-In-Time Pay offers employees immediate access to earned wages, optimizing cash flow and reducing reliance on traditional pay cycles that delay income by weeks. This on-demand pay model enhances financial flexibility, minimizes short-term borrowing, and aligns income timing directly with work performed.

On-Demand Payroll

On-demand payroll offers immediate access to earned wages, eliminating the traditional wait for a fixed salary schedule and enhancing cash flow flexibility for employees. This system reduces financial stress by allowing workers to access income as they earn it, contrasting with conventional salary structures that provide pay only on set dates.

Mid-Paycycle Withdrawals

Mid-paycycle withdrawals in on-demand pay systems provide employees immediate access to earned wages, enhancing financial flexibility compared to traditional salary models that disburse income only at fixed intervals. This real-time earning access reduces reliance on high-interest loans and improves cash flow management for workers facing unexpected expenses.

Pay Acceleration

Pay acceleration through on-demand pay provides employees immediate access to earned wages, reducing financial stress compared to traditional fixed salary payment cycles. This flexible income timing enhances cash flow management, enabling workers to better meet urgent expenses without waiting for the standard payroll date.

Salary vs On-Demand Pay for income timing. Infographic

hrdif.com

hrdif.com