Salary typically refers to a fixed, regular payment agreed upon between employer and employee, often disbursed through traditional banking systems. Digital wage payment methods leverage technology to deliver funds directly to mobile wallets or digital accounts, enabling faster, more flexible access to earnings. This shift enhances convenience, reduces transaction costs, and improves financial inclusion for workers.

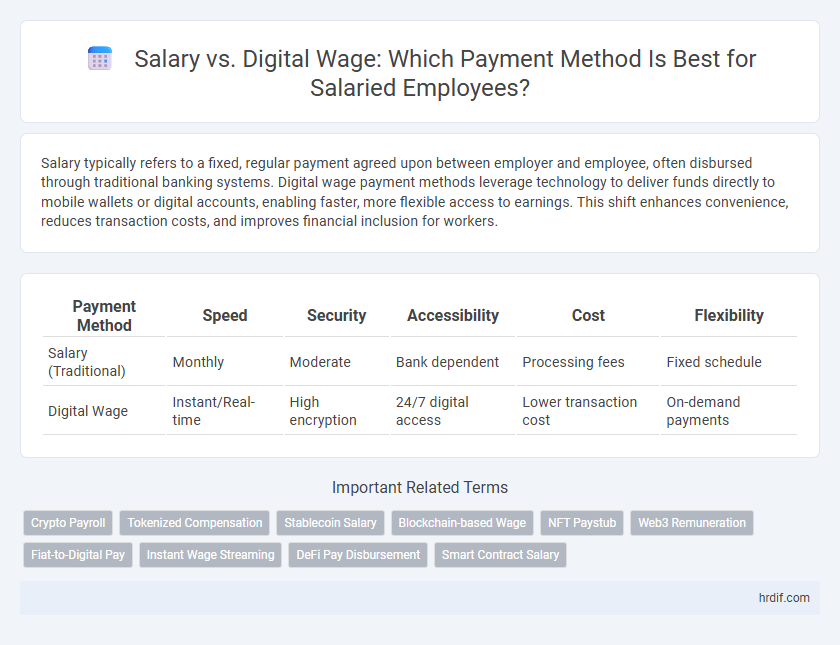

Table of Comparison

| Payment Method | Speed | Security | Accessibility | Cost | Flexibility |

|---|---|---|---|---|---|

| Salary (Traditional) | Monthly | Moderate | Bank dependent | Processing fees | Fixed schedule |

| Digital Wage | Instant/Real-time | High encryption | 24/7 digital access | Lower transaction cost | On-demand payments |

Understanding Salary and Digital Wage: Key Differences

Salary refers to a fixed, regular payment typically expressed as an annual amount and paid monthly or biweekly, covering an employee's overall compensation for their work. Digital wage, on the other hand, emphasizes the method of payment through electronic systems, enabling faster, more secure, and often real-time transactions directly to the employee's digital wallet or bank account. The primary difference lies in salary as the amount agreed upon for labor, while digital wage focuses on the modern, technology-driven delivery of that compensation.

Traditional Salary Payment: Pros and Cons

Traditional salary payment offers the advantage of predictable, fixed income with established legal protections, ensuring employees receive consistent monthly wages. However, it often lacks flexibility, can lead to delayed payments due to bureaucratic processes, and may not accommodate gig economy workers or freelancers efficiently. Employers benefit from structured payroll systems but face challenges in adapting to evolving digital payment preferences and reducing transaction costs.

Digital Wage Explained: Modern Payment Solutions

Digital wage platforms offer real-time salary payments, enhancing cash flow and financial flexibility for employees compared to traditional salary disbursements. These modern payment solutions leverage mobile wallets, prepaid cards, and instant bank transfers to ensure faster access to earned wages, reducing reliance on monthly pay cycles. By integrating digital wage systems, companies improve transparency, reduce administrative costs, and foster financial inclusion for a mobile and remote workforce.

Security Aspects: Salary vs Digital Wage

Traditional salary payments through banks offer established security protocols such as encryption, two-factor authentication, and regulatory oversight, reducing risks of fraud and unauthorized access. Digital wage systems leverage blockchain technology and biometric verification to enhance transaction transparency and prevent identity theft. While both methods provide robust security measures, digital wages introduce innovation in real-time tracking and immutable records, minimizing payment manipulation and error.

Payment Flexibility: Comparing Salary and Digital Wage

Payment flexibility significantly differs between traditional salary and digital wage systems, with digital wages offering real-time access to earnings, enabling employees to receive payments instantly or on-demand. Salaries typically follow fixed schedules such as monthly or biweekly disbursements, limiting financial agility for workers needing immediate funds. Digital wage platforms enhance cash flow management and budgeting by allowing more frequent, customizable payment options tailored to individual financial needs.

Speed and Accessibility: Digital Wage vs Traditional Salary

Digital wage systems provide faster payment processing, enabling employees to receive funds instantly or within the same day, unlike traditional salary methods that often require several days for payroll cycles and bank transfers. Accessibility is significantly enhanced with digital wages, as recipients can access their earnings directly via mobile apps or prepaid cards without needing a bank account. Traditional salary payments rely heavily on banking infrastructure, which can delay disbursement and limit access for unbanked or underbanked workers.

Employee Preferences: Shifting from Salary to Digital Wage

Employee preferences are increasingly shifting from traditional salary payments to digital wage methods due to faster access to funds and increased transparency. Digital wage systems offer real-time payment tracking and reduced reliance on physical banking infrastructure, enhancing convenience for workers. This trend supports improved financial inclusion and boosts satisfaction by aligning with the digital economy's demand for instant, flexible compensation.

Cost Implications for Employers: Salary and Digital Payments

Employers face varying cost implications when choosing between traditional salary payments and digital wage methods, with digital payments often reducing administrative expenses and transaction fees. Digital wage systems facilitate faster disbursements, minimizing payroll processing time and associated labor costs, while also enhancing financial transparency and record-keeping. However, initial setup costs for digital payroll platforms and potential cybersecurity investments may offset some savings, requiring a thorough cost-benefit analysis.

Regulatory Considerations: Compliance in Payment Methods

Regulatory frameworks increasingly mandate digital wage payments to enhance transparency and reduce fraud, compelling employers to align salary disbursements with electronic payment standards. Compliance requires adherence to data privacy laws, anti-money laundering regulations, and labor codes governing wage protection and timely salary transfers. Ensuring digital wage payments meet these regulatory criteria mitigates legal risks and fosters secure, accountable payroll management.

The Future of Employee Compensation: Trends in Digital Wages

Digital wages are revolutionizing employee compensation by enabling faster, more secure, and transparent payment methods compared to traditional salary systems. Blockchain technology and mobile payment platforms are driving this shift, allowing instant access to earnings and reducing transaction costs. Companies adopting digital wages report increased employee satisfaction and financial inclusivity, highlighting a significant trend toward the future of payroll management.

Related Important Terms

Crypto Payroll

Crypto payroll leverages blockchain technology to facilitate faster, borderless salary payments, reducing transaction fees compared to traditional digital wage methods like bank transfers or mobile payments. Companies adopting crypto payroll benefit from enhanced transparency, security, and real-time salary disbursement, making it an increasingly attractive alternative for global workforce compensation.

Tokenized Compensation

Tokenized compensation enhances digital wage systems by enabling secure, transparent, and instantaneous salary payments through blockchain technology. This method transforms traditional salary structures into programmable digital assets, improving payroll efficiency and financial inclusion.

Stablecoin Salary

Stablecoin salary offers real-time, borderless payment solutions that reduce transaction fees and currency volatility compared to traditional salary payments. This digital wage method ensures faster access to funds and enhances financial transparency for employees in global industries.

Blockchain-based Wage

Blockchain-based wages offer enhanced transparency, security, and faster transaction speeds compared to traditional salary payment methods, reducing the need for intermediaries and minimizing transaction fees. Digital wage systems on blockchain ensure immutable records and real-time verification, empowering employees with greater control and trust over their salary disbursements.

NFT Paystub

Salary payments processed through NFT paystubs offer enhanced security and transparency compared to traditional digital wage methods by leveraging blockchain technology for immutable records. This innovative payment method streamlines verification and reduces fraud, making it a superior option for both employers and employees in digital salary management.

Web3 Remuneration

Web3 remuneration leverages blockchain technology to enable transparent, immutable digital wage payments, contrasting traditional salary systems reliant on centralized banking infrastructure. Digital wages facilitate instant, borderless transactions with enhanced security, reducing fees and empowering employees with greater control over their earnings in decentralized finance ecosystems.

Fiat-to-Digital Pay

Fiat-to-digital pay enables seamless salary disbursement by converting traditional fiat currency into digital wages, enhancing transaction speed and reducing processing fees. This method supports real-time payments and improved transparency, making it an efficient alternative to conventional salary payments.

Instant Wage Streaming

Instant Wage Streaming revolutionizes traditional salary payments by enabling employees to access earned wages in real-time rather than waiting for monthly payroll cycles. This digital wage method enhances financial flexibility and reduces reliance on credit, promoting improved employee satisfaction and retention.

DeFi Pay Disbursement

DeFi pay disbursement revolutionizes salary distribution by enabling direct, transparent digital wage payments on blockchain platforms, reducing intermediaries and transaction fees. This method ensures instant access to funds with enhanced security and global reach, outperforming traditional salary payment systems in efficiency and cost-effectiveness.

Smart Contract Salary

Smart contract salary systems leverage blockchain technology to automate wage payments, ensuring transparency, security, and real-time transactions compared to traditional digital wage methods. By integrating programmable contracts, employers can reduce payroll errors, minimize processing fees, and facilitate instant disbursements directly to employees' digital wallets.

Salary vs Digital Wage for payment method. Infographic

hrdif.com

hrdif.com