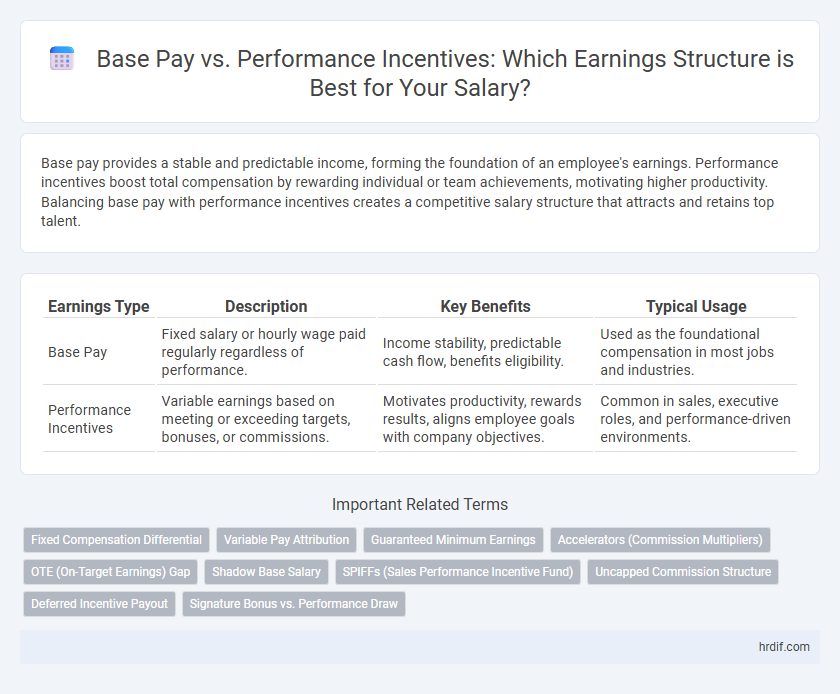

Base pay provides a stable and predictable income, forming the foundation of an employee's earnings. Performance incentives boost total compensation by rewarding individual or team achievements, motivating higher productivity. Balancing base pay with performance incentives creates a competitive salary structure that attracts and retains top talent.

Table of Comparison

| Earnings Type | Description | Key Benefits | Typical Usage |

|---|---|---|---|

| Base Pay | Fixed salary or hourly wage paid regularly regardless of performance. | Income stability, predictable cash flow, benefits eligibility. | Used as the foundational compensation in most jobs and industries. |

| Performance Incentives | Variable earnings based on meeting or exceeding targets, bonuses, or commissions. | Motivates productivity, rewards results, aligns employee goals with company objectives. | Common in sales, executive roles, and performance-driven environments. |

Understanding Base Pay: The Foundation of Earnings

Base pay represents the fixed salary agreed upon between an employee and employer, serving as the fundamental component of total earnings. It provides financial stability and reflects the market value of the job role based on experience, skills, and industry standards. Understanding base pay is crucial for evaluating overall compensation, as it forms the reliable income before including variable performance incentives.

What Are Performance Incentives?

Performance incentives are variable components of compensation designed to reward employees for achieving specific goals, exceeding targets, or contributing to company success. Unlike base pay, which is fixed, these incentives directly link earnings to individual or team performance, encouraging productivity and motivation. Common performance incentives include bonuses, commissions, profit sharing, and stock options.

Comparing Base Pay and Incentive Compensation

Base pay provides a consistent and predictable salary foundation, ensuring financial stability for employees regardless of fluctuating performance metrics. Performance incentives, including bonuses and commissions, directly link compensation to individual or company achievements, driving motivation and rewarding exceptional results. Comparing base pay and incentive compensation highlights the balance between guaranteed earnings and performance-driven rewards essential for comprehensive employee remuneration strategies.

Pros and Cons of Base Pay Structures

Base pay structures provide employees with stable and predictable earnings, which enhance financial security and simplify budgeting but may limit motivation to exceed performance expectations. Fixed salary models ensure equity and transparency, reducing disputes over compensation fairness, yet they might not adequately reward high achievers or foster a high-performance culture. Organizations balancing base pay with performance incentives can address these drawbacks by maintaining a consistent income floor while encouraging productivity and innovation.

The Impact of Performance Incentives on Motivation

Performance incentives significantly enhance employee motivation by directly linking compensation to individual or team achievements, which encourages higher productivity and goal alignment. Studies show that employees receiving performance-based rewards report increased job satisfaction and engagement, driving improved overall performance. A well-structured incentive program can reduce turnover rates by fostering a results-oriented work culture focused on continuous improvement and excellence.

Choosing the Right Balance: Base Salary vs. Bonuses

Choosing the right balance between base salary and performance incentives is crucial for maximizing earnings and motivation. A competitive base pay ensures financial stability and attracts top talent, while performance-based bonuses drive productivity and reward exceptional results. Employers who tailor compensation packages to align with employee goals and company objectives often see improved retention and overall performance.

Industry Trends in Compensation Strategies

Industry trends in compensation strategies reveal a growing emphasis on balancing base pay with performance incentives to enhance employee motivation and retention. Companies increasingly adopt variable pay models, where base salaries provide financial stability while performance incentives, such as bonuses and stock options, drive productivity and align individual goals with organizational success. Data from recent surveys indicate that sectors like technology and finance lead in integrating performance-based rewards, reflecting a shift towards meritocratic pay structures in competitive markets.

How Base Pay and Incentives Affect Retention

Base pay establishes a stable financial foundation that enhances employee loyalty by providing consistent income security. Performance incentives, such as bonuses or commissions, motivate higher productivity and encourage employees to meet or exceed organizational goals. A balanced compensation strategy combining competitive base pay with meaningful incentives significantly improves retention by addressing both financial stability and performance recognition.

Negotiating Your Compensation Package

Negotiating your compensation package requires a clear understanding of the balance between base pay and performance incentives, as employers often allocate a fixed salary combined with variable bonuses tied to meeting targets. Emphasizing your value through past achievements and industry benchmarks strengthens your position to secure higher base pay while ensuring performance incentives are meaningful and attainable. Tailoring your negotiation to include transparent metrics for bonuses maximizes earning potential and aligns incentives with company goals.

Future Outlook: The Evolving Role of Base Pay and Incentives

Base pay remains a critical foundation for earnings stability, ensuring predictable income amid fluctuating market conditions. Performance incentives are increasingly tailored to drive productivity and align employee goals with company growth, reflecting a shift towards merit-based compensation models. Future compensation strategies emphasize a dynamic balance, leveraging data analytics to optimize the ratio between base pay and variable incentives for enhanced motivation and retention.

Related Important Terms

Fixed Compensation Differential

Base pay provides a fixed compensation differential that ensures stable earnings regardless of performance fluctuations, serving as the foundational salary component. Performance incentives supplement this base by offering variable rewards tied directly to individual or company achievements, creating potential for increased total compensation.

Variable Pay Attribution

Variable pay attribution is a key component in earnings, distinguishing base pay from performance incentives by linking compensation directly to individual or company performance metrics. This approach motivates employees through bonuses, commissions, and profit-sharing plans, enhancing overall productivity while keeping fixed salary costs predictable.

Guaranteed Minimum Earnings

Base pay guarantees a fixed minimum income regardless of performance, ensuring financial stability for employees. Performance incentives provide variable earnings that reward exceptional work but do not affect the guaranteed minimum base salary.

Accelerators (Commission Multipliers)

Base pay provides a stable income foundation, while performance incentives such as accelerators act as commission multipliers that exponentially increase earnings when sales targets are exceeded. These accelerators motivate employees to surpass quotas by offering progressive commissions, thereby driving higher revenue and rewarding top performers more generously.

OTE (On-Target Earnings) Gap

Base pay represents the fixed salary guaranteed to an employee, while performance incentives vary based on achieving specific targets, collectively forming the On-Target Earnings (OTE). The OTE gap highlights the difference between the guaranteed base pay and the total potential earnings including bonuses, essential for understanding compensation competitiveness and motivation structures.

Shadow Base Salary

Shadow base salary represents the foundational fixed income used to calculate performance incentives, ensuring consistent earnings regardless of bonus fluctuations. It provides financial stability by separating guaranteed pay from variable rewards tied to individual or company performance.

SPIFFs (Sales Performance Incentive Fund)

Base pay provides a consistent salary foundation, while performance incentives such as Sales Performance Incentive Fund (SPIFFs) offer targeted bonuses that drive short-term sales goals and motivate employee performance. SPIFFs are typically time-bound financial rewards directly linked to achieving specific sales targets, creating an effective mechanism for boosting revenue and aligning employee efforts with company objectives.

Uncapped Commission Structure

Base pay offers stable earnings while an uncapped commission structure maximizes income potential through performance incentives, enabling sales professionals to significantly increase total compensation based on results. This pay model motivates higher productivity by directly linking effort to earnings without limits on commission, fostering aggressive target achievement and business growth.

Deferred Incentive Payout

Deferred incentive payout structures allow employees to receive a portion of their performance-based earnings at a later date, aligning long-term company growth with individual motivation. This approach balances the stability of base pay with the potential upside of performance incentives, encouraging sustained achievement and retention.

Signature Bonus vs. Performance Draw

Base pay establishes a fixed salary providing financial stability, while performance incentives like signature bonuses and performance draws motivate employees by directly linking earnings to achievements. Signature bonuses offer immediate, substantial rewards for signing contracts or meeting key milestones, whereas performance draws function as advance payments against future commissions, balancing upfront cash flow with performance-based compensation.

Base Pay vs Performance Incentives for earnings. Infographic

hrdif.com

hrdif.com