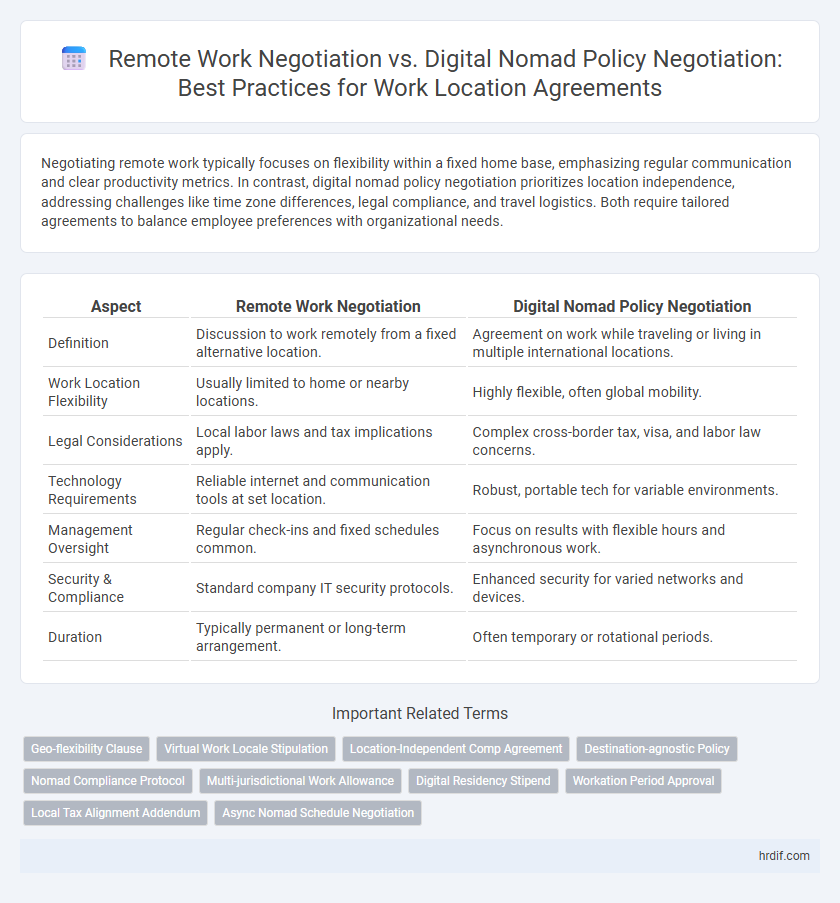

Negotiating remote work typically focuses on flexibility within a fixed home base, emphasizing regular communication and clear productivity metrics. In contrast, digital nomad policy negotiation prioritizes location independence, addressing challenges like time zone differences, legal compliance, and travel logistics. Both require tailored agreements to balance employee preferences with organizational needs.

Table of Comparison

| Aspect | Remote Work Negotiation | Digital Nomad Policy Negotiation |

|---|---|---|

| Definition | Discussion to work remotely from a fixed alternative location. | Agreement on work while traveling or living in multiple international locations. |

| Work Location Flexibility | Usually limited to home or nearby locations. | Highly flexible, often global mobility. |

| Legal Considerations | Local labor laws and tax implications apply. | Complex cross-border tax, visa, and labor law concerns. |

| Technology Requirements | Reliable internet and communication tools at set location. | Robust, portable tech for variable environments. |

| Management Oversight | Regular check-ins and fixed schedules common. | Focus on results with flexible hours and asynchronous work. |

| Security & Compliance | Standard company IT security protocols. | Enhanced security for varied networks and devices. |

| Duration | Typically permanent or long-term arrangement. | Often temporary or rotational periods. |

Defining Remote Work and Digital Nomad Policies

Remote work policies establish guidelines allowing employees to perform job duties outside traditional office settings, emphasizing stable home office environments and regular work hours. Digital nomad policies specifically address location-independent work, permitting employees to travel and work globally while managing compliance with international tax, labor laws, and company security protocols. Defining clear parameters for each policy ensures alignment with organizational goals, employee needs, and legal considerations in work location negotiation.

Key Differences in Work Location Flexibility

Remote work negotiation centers on employees working from a fixed location, such as home, with set availability and consistent communication channels to maintain productivity. Digital nomad policy negotiation emphasizes unrestricted geographic mobility, allowing employees to work from multiple international locations while addressing challenges like time zone differences, compliance with local labor laws, and variable internet access. Key differences in work location flexibility stem from the stability of a remote setup versus the dynamic, location-agnostic lifestyle enabled by digital nomad policies.

Legal and Compliance Considerations

Remote work negotiation requires careful review of employment laws, tax regulations, and data privacy policies tailored to the employee's home jurisdiction, ensuring compliance with local labor standards and cybersecurity requirements. Digital nomad policy negotiation involves complex legal considerations including cross-border tax obligations, visa and work permit constraints, and multinational data protection laws to mitigate risks associated with working from multiple international locations. Companies must align both remote work and digital nomad policies with global regulatory frameworks to avoid legal liabilities and maintain compliance.

Salary and Benefits Negotiation Points

Negotiating salary and benefits for remote work typically emphasizes stable compensation structures, performance-based bonuses, and comprehensive health coverage tailored to home-office setups. Digital nomad policy negotiations prioritize flexible stipend allocations for travel expenses, coworking space allowances, and international health insurance to accommodate location changes. Both frameworks require clear agreements on tax implications and currency fluctuations to ensure financial security across different jurisdictions.

Tax Implications and Employer Responsibilities

Remote work negotiation often involves clear tax implications tied to an employee's fixed residence, requiring employers to manage payroll taxes and comply with local labor laws in a single jurisdiction. Digital nomad policy negotiation complicates tax obligations as employees may work across multiple countries, triggering multi-jurisdictional tax reporting, potential permanent establishment risks, and heightened employer compliance responsibilities. Employers must evaluate cross-border tax treaties, social security agreements, and legal frameworks to mitigate risks and ensure accurate withholding and reporting.

Managing Performance and Accountability Remotely

Remote work negotiation emphasizes setting clear performance metrics and regular check-ins to ensure accountability across distributed teams. Digital nomad policy negotiation requires additional considerations such as time zone differences, legal compliance, and secure access to company systems to maintain productivity. Effective management relies on transparent communication tools, outcome-based evaluations, and robust tracking mechanisms tailored to diverse work environments.

Technology and Security Requirements

Negotiating remote work policies emphasizes establishing secure VPN access, multi-factor authentication, and endpoint protection to safeguard company data across diverse home environments. Digital nomad policy negotiations require advanced cybersecurity protocols, including geo-fencing, encrypted communication tools, and compliance with international data protection regulations due to frequent cross-border connectivity. Both approaches demand robust technology infrastructure and continuous monitoring to prevent unauthorized access and ensure secure, seamless remote operations.

Work-Life Balance and Time Zone Challenges

Remote work negotiation emphasizes flexible schedules to maintain work-life balance, allowing employees to adapt their hours according to personal needs within consistent time zones. Digital nomad policy negotiation requires addressing time zone challenges more rigorously, as employees work from various global locations, necessitating clear guidelines to ensure overlap with team availability. Both negotiations must prioritize effective communication strategies to prevent burnout and support productivity despite geographical dispersion.

Cultural and Team Integration Concerns

Remote work negotiation prioritizes consistent cultural alignment and team cohesion through stable, location-based interactions, fostering reliable communication within a shared time zone. Digital nomad policy negotiation emphasizes flexibility but raises concerns about cultural disconnection and asynchronous collaboration challenges due to varying global locations. Balancing these approaches requires addressing integration strategies that support both dynamic work environments and team unity across diverse cultural contexts.

Steps to Successfully Negotiate Work Location Terms

Clearly define your priorities by distinguishing between remote work flexibility and digital nomad policies, emphasizing work location expectations and time zone considerations. Gather relevant data on industry standards, employee productivity metrics, and legal requirements to support your proposal. Establish transparent communication channels with decision-makers, outline mutual benefits, and prepare contingency plans to address potential concerns during negotiations.

Related Important Terms

Geo-flexibility Clause

Geo-flexibility clauses in remote work negotiation prioritize employee autonomy in choosing work locations within specified regions, enhancing productivity while maintaining compliance with tax and labor laws. Digital nomad policy negotiation extends this flexibility globally, requiring detailed risk assessments and legal frameworks to address cross-border employment issues and data security.

Virtual Work Locale Stipulation

Remote work negotiation primarily centers on agreeing to flexible work-from-home arrangements within a fixed geographic area, emphasizing stable internet access and time zone alignment, while digital nomad policy negotiation involves establishing comprehensive virtual work locale stipulations that support continuous global mobility, including compliance with international tax laws, immigration regulations, and secure cross-border data handling. Employers and employees must address these distinct considerations to craft tailored agreements that balance operational efficiency, legal compliance, and personal flexibility in the evolving landscape of virtual work.

Location-Independent Comp Agreement

Remote work negotiation emphasizes flexibility within a fixed home location, often prioritizing stable internet and consistent office hours, while digital nomad policy negotiation centers on location-independent compensation agreements that address variable living costs, tax implications, and legal compliance across multiple jurisdictions. Advocating for clear, comprehensive location-independent compensation structures ensures equitable pay and benefits regardless of employee mobility, enhancing retention and global talent acquisition.

Destination-agnostic Policy

Negotiating a destination-agnostic policy balances employee flexibility with organizational control by allowing work from any location without limiting to traditional remote setups or digital nomad arrangements. This approach emphasizes uniform criteria for productivity, security, and compliance, enabling seamless work location choices while mitigating risks associated with geographical disparities.

Nomad Compliance Protocol

Remote work negotiation centers on flexible home or office location agreements, while digital nomad policy negotiation involves comprehensive Nomad Compliance Protocols to ensure legal adherence across multiple jurisdictions. Nomad Compliance Protocol mandates tax, labor law, and data security compliance tailored to transient workers moving internationally, providing a structured framework for digital nomads beyond typical remote work agreements.

Multi-jurisdictional Work Allowance

Negotiating remote work agreements requires clear terms on multi-jurisdictional work allowances to ensure compliance with varying tax laws, labor regulations, and social security obligations across different regions. Digital nomad policy negotiations must address complexities like visa requirements, cross-border payroll management, and data privacy standards to support flexible work locations without legal risks.

Digital Residency Stipend

Negotiating a digital nomad policy often includes securing a Digital Residency Stipend, which supports costs such as co-working spaces, local SIM cards, and community memberships, enhancing employee mobility and productivity. Remote work negotiations typically focus on home-office setups and internet reimbursements, but incorporating a Digital Residency Stipend addresses the unique financial needs of employees working internationally.

Workation Period Approval

Workation period approval typically requires clear guidelines outlining eligibility, duration limits, and compliance with local labor laws to ensure both employer control and employee flexibility. Remote work negotiations focus on fixed location agreements, while digital nomad policy negotiation demands adaptable, multi-jurisdictional compliance frameworks for employees frequently changing work locations.

Local Tax Alignment Addendum

Remote work negotiation often emphasizes stable local tax compliance aligned with employees' primary residences, whereas digital nomad policy negotiation requires flexible Local Tax Alignment Addenda to address multi-jurisdictional tax obligations and transient work locations. Incorporating precise tax residency clauses in the addendum ensures both employer and employee comply with local tax laws, minimizing legal risks and financial liabilities.

Async Nomad Schedule Negotiation

Negotiating an async nomad schedule requires aligning flexible work hours with task priorities to maintain productivity despite time zone differences, prioritizing output over synchronous presence. Clear agreements on communication windows, deliverables, and autonomous decision-making help bridge gaps between remote work stability and the dynamic nature of digital nomad policies.

Remote work negotiation vs Digital nomad policy negotiation for work location. Infographic

hrdif.com

hrdif.com