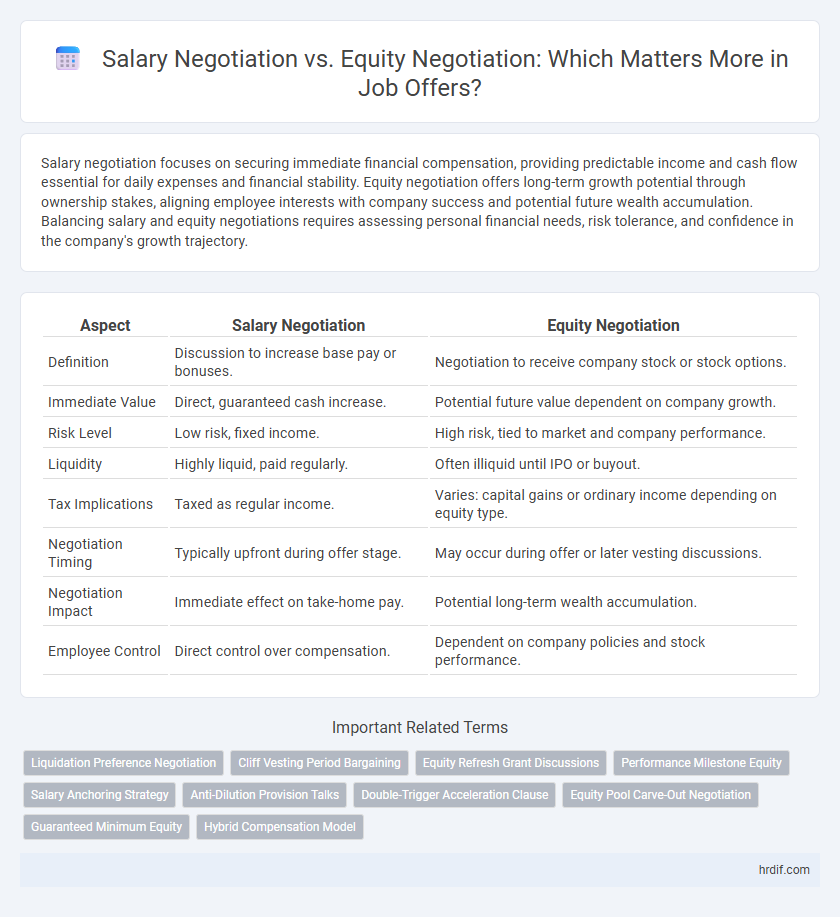

Salary negotiation focuses on securing immediate financial compensation, providing predictable income and cash flow essential for daily expenses and financial stability. Equity negotiation offers long-term growth potential through ownership stakes, aligning employee interests with company success and potential future wealth accumulation. Balancing salary and equity negotiations requires assessing personal financial needs, risk tolerance, and confidence in the company's growth trajectory.

Table of Comparison

| Aspect | Salary Negotiation | Equity Negotiation |

|---|---|---|

| Definition | Discussion to increase base pay or bonuses. | Negotiation to receive company stock or stock options. |

| Immediate Value | Direct, guaranteed cash increase. | Potential future value dependent on company growth. |

| Risk Level | Low risk, fixed income. | High risk, tied to market and company performance. |

| Liquidity | Highly liquid, paid regularly. | Often illiquid until IPO or buyout. |

| Tax Implications | Taxed as regular income. | Varies: capital gains or ordinary income depending on equity type. |

| Negotiation Timing | Typically upfront during offer stage. | May occur during offer or later vesting discussions. |

| Negotiation Impact | Immediate effect on take-home pay. | Potential long-term wealth accumulation. |

| Employee Control | Direct control over compensation. | Dependent on company policies and stock performance. |

Understanding Salary vs Equity: Key Differences

Salary negotiation involves discussing a fixed, predictable cash compensation reflected in paychecks, while equity negotiation centers on ownership stakes in the company, which can fluctuate in value and provide long-term financial upside. Salary offers immediate financial stability and impact on cash flow, whereas equity represents potential future wealth linked to company performance and growth. Understanding these differences enables candidates to align their compensation preferences with personal financial goals and risk tolerance during job offer discussions.

Assessing Your Priorities: Cash Compensation or Ownership

Evaluating whether to prioritize salary or equity hinges on your immediate financial needs versus long-term wealth potential; a higher cash salary provides stability and liquidity, essential for covering living expenses and debts. Equity, such as stock options or shares, offers ownership stakes that may appreciate, aligning your interests with company growth but carrying inherent risk and delayed returns. Assessing your personal financial situation, risk tolerance, and career timeline helps determine if immediate cash compensation or equity ownership better supports your professional and financial goals.

Market Trends: Salary and Equity Packages in 2024

Market trends in 2024 reveal a growing emphasis on equity packages as startups and tech companies leverage stock options to attract top talent while managing cash flow. Salary negotiation remains critical for candidates prioritizing immediate financial stability, especially in industries with less volatile equity potential. Data from leading salary reports indicate a 15% average increase in base salaries, while equity valuations fluctuate based on market conditions and company growth projections.

Evaluating Equity Offers: Types and Vesting Schedules

Equity offers in job negotiations typically include stock options, restricted stock units (RSUs), or employee stock purchase plans (ESPPs), each with distinct tax implications and potential for growth. Understanding vesting schedules, such as graded or cliff vesting, is crucial to evaluate when shares become owned and the impact on long-term compensation. Analyzing these elements helps balance immediate salary needs against future financial gains tied to company performance and stock liquidity.

Salary Negotiation Strategies: Maximizing Your Base Pay

Effective salary negotiation strategies prioritize researching industry benchmarks and understanding the company's compensation structure to maximize base pay. Clearly articulating your value through quantifiable achievements and leveraging competing offers strengthens your position for higher salary offers. Focusing on salary components such as sign-on bonuses, performance bonuses, and guaranteed raises ensures a comprehensive approach to maximizing immediate and long-term earnings.

Equity Negotiation Tactics: What to Ask For

When negotiating equity as part of a job offer, prioritize understanding the total value of stock options, including the number of shares, vesting schedule, and potential dilution. Ask for details about the company's valuation, exit strategy, and any upcoming funding rounds that may impact equity worth. Clarify terms such as exercise price, acceleration clauses, and post-termination exercise period to ensure maximum benefit from your equity stake.

Risk vs Reward: Balancing Salary and Equity

Salary negotiation offers immediate financial certainty with guaranteed income and benefits, minimizing risk for employees. Equity negotiation introduces potential for significant long-term rewards aligned with company growth but carries inherent risk due to market volatility and company performance. Balancing salary and equity requires evaluating personal risk tolerance, financial stability, and confidence in the company's future success.

Impact on Long-Term Career Growth

Salary negotiation provides immediate financial security and can enhance short-term career stability, but equity negotiation offers potential for substantial long-term wealth creation tied to company performance. Equity stakes align employee interests with business growth, fostering motivation and deeper commitment that can accelerate career advancement. Balancing salary and equity considerations strategically influences overall compensation value and career trajectory in high-growth industries.

Legal Considerations in Salary and Equity Agreements

Legal considerations in salary negotiation primarily involve compliance with labor laws, minimum wage regulations, and tax withholding requirements to ensure fair and lawful compensation. Equity negotiation requires careful examination of stock option agreements, vesting schedules, and securities regulations to protect the employee's rights and investment. Clear documentation and understanding of both salary and equity terms are essential to avoid disputes and ensure enforceability under contract law.

Making the Final Decision: Salary, Equity, or Both?

Evaluating the final job offer requires balancing immediate salary with long-term equity potential, considering personal financial needs and risk tolerance. Salary offers guaranteed income, while equity provides ownership stakes that may appreciate but carry uncertainty. Combining both compensation elements can optimize financial security and future growth, depending on company valuation, vesting schedules, and personal career goals.

Related Important Terms

Liquidation Preference Negotiation

Negotiating liquidation preferences in equity discussions directly impacts the potential payout investors and founders receive during a liquidity event, making it a critical factor beyond just the offered salary. Understanding the implications of multiple liquidation preference layers helps candidates balance immediate cash compensation with long-term equity value, ensuring a fair and strategic job offer.

Cliff Vesting Period Bargaining

Negotiating a cliff vesting period during salary or equity discussions directly impacts the timing of ownership rights and potential financial gains, making it crucial to clarify the duration and terms to optimize long-term benefits. Shortening or modifying the cliff vesting period can increase immediate equity access and strengthen your position in overall compensation negotiations.

Equity Refresh Grant Discussions

Equity refresh grant discussions in salary negotiation offer long-term wealth potential by providing additional stock options that align employee incentives with company growth, often surpassing immediate salary increases in overall value. Prioritizing equity refresh grants requires analyzing company valuation, vesting schedules, and market comparables to maximize total compensation beyond base salary adjustments.

Performance Milestone Equity

Performance milestone equity ties stock options or shares to specific, measurable achievements within a company, aligning employee incentives with long-term corporate growth, whereas salary negotiation primarily impacts immediate cash compensation without directly linking pay to company performance. Negotiating equity based on clear performance milestones offers potential for significant financial upside while mitigating risk by ensuring rewards correspond to tangible contributions.

Salary Anchoring Strategy

Salary anchoring strategy leverages a strong initial salary figure to set a favorable negotiation baseline, influencing subsequent offers and expectations in job offer discussions. Equity negotiation often requires a different approach, as it involves long-term value estimation and risk assessment that salary anchoring alone cannot fully address.

Anti-Dilution Provision Talks

Salary negotiation secures immediate, guaranteed compensation, while equity negotiation involves long-term value tied to company performance and dilution risks. Emphasizing anti-dilution provision talks safeguards the equity's worth by protecting ownership percentage against future funding rounds and stock issuance.

Double-Trigger Acceleration Clause

Salary negotiation centers on immediate cash compensation, while equity negotiation emphasizes long-term financial gains through stock options or shares. The double-trigger acceleration clause in equity agreements accelerates vesting upon a change of control coupled with termination, providing critical protection and increased value during mergers or acquisitions.

Equity Pool Carve-Out Negotiation

Equity pool carve-out negotiation involves securing a portion of the company's stock options outside the standard equity allocation, often crucial for early employees or executives aiming to maximize long-term ownership and influence. This strategy contrasts with salary negotiation by focusing on potential future value and alignment with company growth rather than immediate cash compensation.

Guaranteed Minimum Equity

Guaranteed minimum equity provides a safety net in salary negotiations by ensuring employees receive a baseline share of company ownership regardless of performance fluctuations. This contrasts with traditional salary offers, offering long-term financial upside while mitigating the risk of undervaluation in volatile markets.

Hybrid Compensation Model

Salary negotiation secures immediate, predictable income essential for daily expenses, while equity negotiation offers potential long-term financial gain linked to company performance, appealing in startups or high-growth firms; a hybrid compensation model combines fixed salary with equity components to balance financial security and future upside, optimizing total compensation. Employers use hybrid models to attract talent by aligning employee incentives with company success, fostering retention and motivation through both guaranteed pay and ownership stakes.

Salary Negotiation vs Equity Negotiation for job offer. Infographic

hrdif.com

hrdif.com