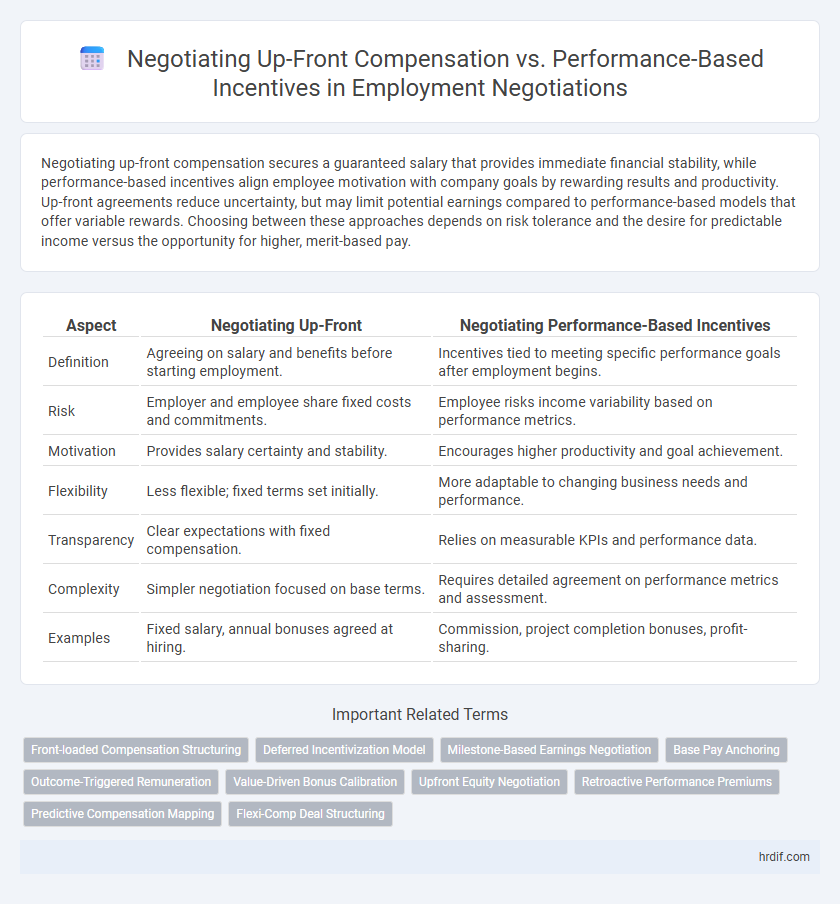

Negotiating up-front compensation secures a guaranteed salary that provides immediate financial stability, while performance-based incentives align employee motivation with company goals by rewarding results and productivity. Up-front agreements reduce uncertainty, but may limit potential earnings compared to performance-based models that offer variable rewards. Choosing between these approaches depends on risk tolerance and the desire for predictable income versus the opportunity for higher, merit-based pay.

Table of Comparison

| Aspect | Negotiating Up-Front | Negotiating Performance-Based Incentives |

|---|---|---|

| Definition | Agreeing on salary and benefits before starting employment. | Incentives tied to meeting specific performance goals after employment begins. |

| Risk | Employer and employee share fixed costs and commitments. | Employee risks income variability based on performance metrics. |

| Motivation | Provides salary certainty and stability. | Encourages higher productivity and goal achievement. |

| Flexibility | Less flexible; fixed terms set initially. | More adaptable to changing business needs and performance. |

| Transparency | Clear expectations with fixed compensation. | Relies on measurable KPIs and performance data. |

| Complexity | Simpler negotiation focused on base terms. | Requires detailed agreement on performance metrics and assessment. |

| Examples | Fixed salary, annual bonuses agreed at hiring. | Commission, project completion bonuses, profit-sharing. |

Understanding Up-Front vs Performance-Based Negotiation

Up-front negotiation establishes fixed terms such as salary, benefits, and responsibilities before employment begins, providing clarity and stability for both parties. Performance-based negotiation ties compensation or incentives to specific goals or achievements, motivating employees to exceed targets and aligning rewards with measurable outcomes. Understanding the balance between these approaches helps employers manage risk while encouraging high performance and employee engagement.

Weighing Immediate Compensation Against Long-Term Rewards

Negotiating up-front compensation provides immediate financial security, establishing a clear baseline salary that addresses short-term needs and reflects market value. In contrast, negotiating performance-based incentives aligns employee motivation with company goals, offering potential long-term rewards through bonuses, stock options, or profit sharing tied to specific achievements. Carefully weighing immediate compensation against long-term incentives ensures a balanced employment package that supports both financial stability and future growth opportunities.

Pros and Cons of Up-Front Salary Negotiation

Up-front salary negotiation provides clear expectations and immediate financial security, benefiting candidates who prioritize guaranteed compensation. However, it may limit flexibility for employers to reward future performance and can result in missed opportunities for higher earnings tied to specific achievements. This approach often leads to fixed costs for employers, reducing incentives for ongoing employee motivation and growth-based rewards.

Advantages and Risks of Performance-Based Incentives

Performance-based incentives align employee goals with company performance, driving higher motivation and productivity by rewarding measurable achievements. Risks include potential short-term focus, uncertainty in earnings, and the challenge of fairly defining performance metrics. Clear, transparent criteria and regular performance reviews mitigate these risks, ensuring incentives support long-term organizational success.

Assessing Your Leverage in Negotiation

Assessing your leverage in negotiation requires a clear understanding of your unique skills, market demand, and the employer's urgency to fill the role. When negotiating up-front salary, leverage comes from proven experience and competitive offers, while performance-based incentives depend on measurable achievements and clear benchmarks. Effective negotiation balances immediate compensation desires with long-term value tied to your performance metrics and the company's growth objectives.

When to Prioritize Up-Front Compensation

Prioritize up-front compensation when the role demands immediate financial security or involves high risk and uncertainty, such as startups or volatile industries. Candidates with unique, high-demand skills may also benefit from negotiating guaranteed base salaries rather than performance-based incentives that depend on factors beyond their control. Early career professionals or those seeking stability often prefer up-front pay to mitigate financial unpredictability during the initial employment period.

Situations Favoring Performance-Based Incentives

Performance-based incentives excel in roles with clear, measurable outcomes, such as sales or project completion targets, where employee contributions directly impact company success. These incentives align employee motivation with organizational goals, fostering accountability and driving high performance over time. They are particularly effective in dynamic industries requiring adaptability and continuous achievement rather than fixed upfront rewards.

Industry Trends: Which Model Leads?

Industry trends reveal a growing preference for performance-based incentives over up-front negotiation in employment contracts, driven by employers' desire to align compensation with measurable outcomes. Data from recent labor market analyses indicate that companies adopting performance-based models report higher employee motivation and retention rates, particularly in tech and sales sectors. This shift suggests a strategic move towards incentivizing productivity rather than fixed initial salaries, reflecting evolving priorities in talent management.

Key Strategies for Blending Both Approaches

Blending upfront negotiation with performance-based incentives involves setting clear baseline compensation while aligning rewards to measurable outcomes like sales targets or project milestones. Key strategies include defining transparent performance metrics, establishing regular review intervals for adjusting incentives, and ensuring mutual agreement on accountability standards. This approach balances security with motivation, encouraging sustained employee productivity and commitment.

Common Pitfalls in Employment Incentive Negotiations

Common pitfalls in employment incentive negotiations include failing to clearly define performance metrics and timelines, which can lead to disputes and unmet expectations. Employers often underestimate the importance of aligning incentives with measurable outcomes, resulting in incentives that do not effectively motivate employees or drive performance. Neglecting to consider long-term implications and employee retention when negotiating performance-based incentives can reduce the overall effectiveness of compensation packages.

Related Important Terms

Front-loaded Compensation Structuring

Front-loaded compensation structuring emphasizes negotiating higher up-front salaries or bonuses to secure immediate financial benefits, reducing dependency on future performance metrics. This approach contrasts with performance-based incentives by prioritizing guaranteed earnings, minimizing risks associated with fluctuating individual or company outcomes during the employment term.

Deferred Incentivization Model

Negotiating performance-based incentives through a Deferred Incentivization Model aligns employee rewards with long-term organizational goals, increasing motivation and retention by linking compensation directly to measurable outcomes. This contrasts with up-front negotiations, which fix salaries regardless of future performance and may limit flexibility in adapting to evolving business objectives.

Milestone-Based Earnings Negotiation

Milestone-based earnings negotiation structures compensation around specific, predefined achievements, ensuring alignment between employer expectations and employee performance. This approach incentivizes goal completion and offers measurable progress benchmarks, reducing ambiguity in employment agreements.

Base Pay Anchoring

Base pay anchoring establishes a clear financial benchmark that simplifies initial negotiations by setting concrete expectations, reducing ambiguity and potential conflicts. Performance-based incentives shift focus from fixed salaries to measurable outcomes, encouraging alignment of employee efforts with company goals while maintaining motivation through variable rewards.

Outcome-Triggered Remuneration

Outcome-triggered remuneration aligns employee compensation directly with measurable performance targets, maximizing motivation and driving productivity. Negotiating performance-based incentives instead of upfront fixed salaries reduces financial risk for employers while fostering accountability and goal-oriented behavior.

Value-Driven Bonus Calibration

Value-driven bonus calibration aligns employee incentives with measurable performance metrics, fostering motivation and ensuring compensation reflects actual contributions. Negotiating performance-based incentives upfront enhances transparency and encourages accountability, while fixed upfront negotiations may limit flexibility in rewarding exceptional achievements.

Upfront Equity Negotiation

Upfront equity negotiation secures a fixed ownership stake at the start of employment, providing immediate alignment of interests and clear valuation. This approach contrasts with performance-based incentives, where equity is earned over time contingent on meeting predefined milestones, potentially delaying ownership benefits and complicating valuation.

Retroactive Performance Premiums

Retroactive performance premiums offer a strategic advantage by aligning employee motivation with measurable outcomes, ensuring compensation reflects actual achievement rather than projected potential. Negotiating these incentives retroactively emphasizes accountability and can improve long-term productivity by rewarding proven success rather than anticipated performance.

Predictive Compensation Mapping

Predictive Compensation Mapping leverages data analytics to forecast employee performance and align compensation structures, enabling employers to choose between negotiating up-front salaries or performance-based incentives that maximize motivation and retention. Integrating predictive models ensures tailored incentive plans that balance upfront commitments with measurable outcomes, optimizing total compensation in talent acquisition strategies.

Flexi-Comp Deal Structuring

Flexi-comp deal structuring balances upfront salary negotiations with performance-based incentives to align employee motivation and company goals effectively. This hybrid approach enhances flexibility and risk-sharing, optimizing compensation packages to drive measurable results while maintaining competitive base pay.

Negotiating up-front vs Negotiating performance-based incentives for employment. Infographic

hrdif.com

hrdif.com