Negotiating base pay provides immediate financial security and reflects your market value, while negotiating equity compensation offers potential long-term wealth tied to the company's success. Prioritizing base salary ensures stability for everyday expenses, whereas equity can align your incentives with the company's growth and future profitability. Balancing these components depends on your risk tolerance, financial needs, and belief in the company's prospects.

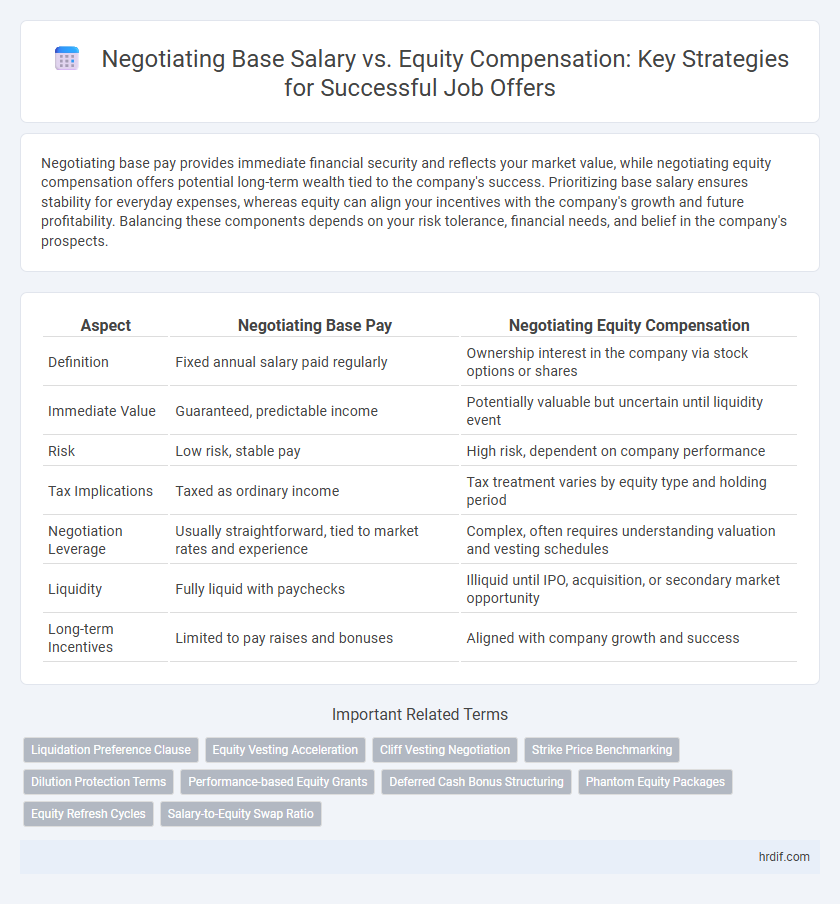

Table of Comparison

| Aspect | Negotiating Base Pay | Negotiating Equity Compensation |

|---|---|---|

| Definition | Fixed annual salary paid regularly | Ownership interest in the company via stock options or shares |

| Immediate Value | Guaranteed, predictable income | Potentially valuable but uncertain until liquidity event |

| Risk | Low risk, stable pay | High risk, dependent on company performance |

| Tax Implications | Taxed as ordinary income | Tax treatment varies by equity type and holding period |

| Negotiation Leverage | Usually straightforward, tied to market rates and experience | Complex, often requires understanding valuation and vesting schedules |

| Liquidity | Fully liquid with paychecks | Illiquid until IPO, acquisition, or secondary market opportunity |

| Long-term Incentives | Limited to pay raises and bonuses | Aligned with company growth and success |

Understanding the Difference: Base Pay vs. Equity Compensation

Base pay offers guaranteed, fixed income that directly impacts immediate financial stability, while equity compensation provides potential long-term value through stock options or shares tied to company performance. Negotiating base pay centers on securing a competitive salary reflective of market standards and personal experience. Equity compensation involves assessing the company's growth prospects and vesting schedules, balancing risk with future financial gain.

Evaluating Your Priorities: Salary Security or Long-term Gains?

When negotiating base pay versus equity compensation, assess your immediate financial needs against potential long-term wealth creation. Base salary offers guaranteed income and financial stability, while equity compensation can provide significant returns if the company grows and succeeds. Prioritizing salary security suits risk-averse candidates, whereas those confident in the company's prospects may benefit more from negotiating higher equity stakes.

Key Factors Influencing Negotiation Strategy

Negotiating base pay requires a clear understanding of market salary benchmarks, cost of living adjustments, and immediate financial needs, while equity compensation negotiation hinges on company valuation, growth potential, vesting schedules, and liquidity events. Evaluating risk tolerance and long-term financial goals influences the prioritization between fixed salary and variable equity components. Industry trends, company stage, and personal career trajectory are critical factors shaping the negotiation approach for both compensation types.

Negotiating Base Pay: Proven Techniques for Success

Negotiating base pay effectively requires thorough market research to benchmark salaries and preparation to articulate your unique value proposition confidently. Emphasizing quantifiable achievements and aligning compensation requests with industry standards increases the likelihood of a favorable outcome. Utilizing techniques such as setting a clear target salary range and practicing persuasive communication ensures a strategic edge during negotiations.

Essential Steps for Equity Compensation Negotiation

When negotiating equity compensation, clearly understand the company's valuation, equity type, and vesting schedule to assess potential value accurately. Prioritize discussing equity grants' strike price, cliff period, and acceleration triggers to align incentives and protect your interests. Secure detailed documentation of equity terms alongside base pay agreements to ensure transparency and enforceability throughout your employment.

Assessing Company Valuation and Potential Equity Growth

Assessing company valuation is crucial when negotiating equity compensation to determine the potential upside compared to a higher base pay. Equity's worth depends on the startup's market position, funding stage, and growth trajectory, which can offer exponential returns if the company scales successfully. Evaluating dilution risks and exit strategies helps balance immediate salary needs with long-term wealth creation opportunities through equity.

Risks and Rewards: Comparing Immediate Cash vs. Equity Upside

Negotiating base pay offers immediate financial security and predictable income, reducing the risk of cash flow issues, while equity compensation presents potential for significant long-term rewards if the company's value increases but carries the risk of worthlessness if the business underperforms. Evaluating the balance between immediate cash and equity upside requires assessing one's financial stability, risk tolerance, and the startup's growth prospects. Equity often aligns employee incentives with company success, but a higher base salary ensures steady earnings regardless of market or company performance.

Common Mistakes When Negotiating Salary and Equity

Common mistakes when negotiating base pay versus equity compensation include failing to understand the long-term value and potential dilution of equity, leading to undervaluation of ownership stakes. Candidates often focus solely on immediate salary figures without assessing the total compensation package and market benchmarks for both salary and equity. Ignoring tax implications and vesting schedules during negotiations can result in unexpected financial disadvantages and reduced overall benefits.

Tailoring Negotiation Approaches to Role and Industry

Negotiation strategies for base pay versus equity compensation must align with the specific role and industry to maximize value and satisfaction. Tech startups demand a stronger emphasis on negotiating equity stakes due to high growth potential, while established corporations prioritize competitive base salaries reflecting market standards. Understanding industry benchmarks and role-specific compensation structures enables candidates to tailor their approach effectively and secure optimal total rewards.

Combining Base Pay and Equity: Striking the Right Balance

Combining base pay and equity compensation requires understanding their distinct financial impacts and aligning them with personal risk tolerance and long-term goals. Base pay offers immediate, guaranteed income crucial for day-to-day expenses, while equity compensation provides potential for significant wealth growth tied to company performance. Striking the right balance involves negotiating a competitive salary to ensure financial stability while securing enough equity to benefit from future upside, maximizing overall compensation value.

Related Important Terms

Liquidation Preference Clause

Negotiating base pay often provides immediate and guaranteed income, while equity compensation with a Liquidation Preference Clause can offer substantial returns if the company exits favorably, but carries the risk of delayed or diminished payouts. Understanding the seniority level and multiple types of Liquidation Preferences--such as participating or non-participating--is critical to accurately valuing equity versus guaranteed salary during negotiations.

Equity Vesting Acceleration

Negotiating equity compensation often includes discussions around equity vesting acceleration, which can provide employees with faster access to shares in the event of termination or acquisition, offering a valuable safeguard beyond base pay increases. Equity vesting acceleration clauses enhance financial security and align long-term incentives, making them a critical component of total compensation negotiations for startup and tech roles.

Cliff Vesting Negotiation

Cliff vesting negotiation plays a critical role when balancing base pay versus equity compensation, as employees often seek clarity on the time frame before accessing full stock benefits. Understanding the company's cliff vesting schedule is essential for negotiating equitable terms that align with long-term retention incentives and immediate financial needs.

Strike Price Benchmarking

Negotiating base pay typically involves benchmarking against industry salary data and company compensation structures to ensure competitive fixed income, while negotiating equity compensation requires careful analysis of strike price benchmarking to assess potential future value and dilution risks. Comparing strike prices to current market valuations helps candidates understand the realistic upside of stock options relative to guaranteed base salary offers.

Dilution Protection Terms

Negotiating equity compensation requires close attention to dilution protection terms such as anti-dilution clauses and weighted average adjustments, which safeguard an employee's ownership percentage during future funding rounds. Base pay negotiations focus on fixed salary figures, while equity discussions must prioritize these protections to maintain long-term value and prevent dilution of shares.

Performance-based Equity Grants

Performance-based equity grants align employee incentives with company success by awarding shares contingent on achieving specific milestones or financial targets, promoting long-term value creation. Negotiating base pay often secures immediate financial stability, whereas emphasizing performance-based equity can significantly enhance total compensation through future growth and performance achievements.

Deferred Cash Bonus Structuring

Negotiating deferred cash bonus structuring involves balancing immediate financial incentives with long-term equity growth potential, where base pay offers guaranteed income while equity compensation aligns employee interests with company performance. Structuring deferred bonuses requires clear terms on vesting schedules, payout triggers, and valuation methods to maximize compensation value and risk mitigation in negotiation discussions.

Phantom Equity Packages

Negotiating base pay provides immediate financial stability and predictable income, whereas phantom equity packages offer long-term value tied to company performance without diluting ownership. Phantom equity compensation aligns employee incentives with business growth by granting cash bonuses equivalent to stock appreciation, making it a strategic choice in roles where cash flow and ownership preservation are priorities.

Equity Refresh Cycles

Equity refresh cycles provide ongoing opportunities to negotiate additional stock options or shares, often aligning incentives with company performance and long-term growth potential. Unlike base pay, which is typically fixed annually, equity refresh negotiations allow employees to build wealth over time by securing ownership stakes during key company valuation milestones.

Salary-to-Equity Swap Ratio

Evaluating the salary-to-equity swap ratio is crucial when negotiating base pay versus equity compensation, as it determines the fair value exchange between immediate cash salary and long-term ownership stakes. Understanding industry benchmarks and company valuation trends helps candidates optimize their total compensation package by balancing guaranteed income with potential equity growth.

Negotiating base pay vs Negotiating equity compensation for roles. Infographic

hrdif.com

hrdif.com