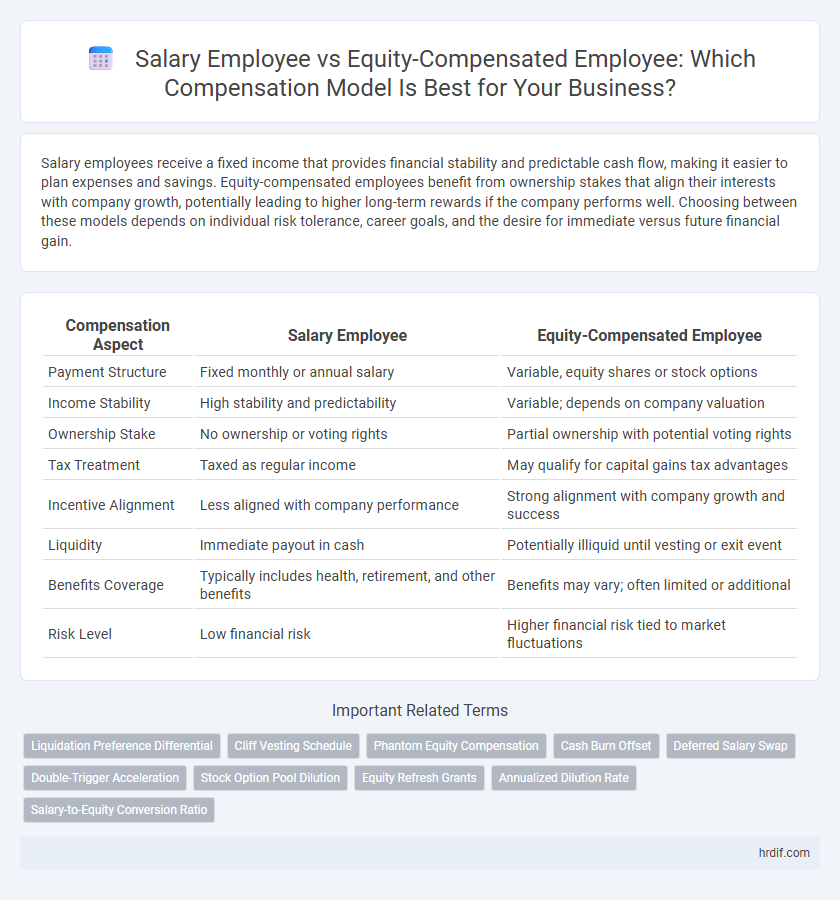

Salary employees receive a fixed income that provides financial stability and predictable cash flow, making it easier to plan expenses and savings. Equity-compensated employees benefit from ownership stakes that align their interests with company growth, potentially leading to higher long-term rewards if the company performs well. Choosing between these models depends on individual risk tolerance, career goals, and the desire for immediate versus future financial gain.

Table of Comparison

| Compensation Aspect | Salary Employee | Equity-Compensated Employee |

|---|---|---|

| Payment Structure | Fixed monthly or annual salary | Variable, equity shares or stock options |

| Income Stability | High stability and predictability | Variable; depends on company valuation |

| Ownership Stake | No ownership or voting rights | Partial ownership with potential voting rights |

| Tax Treatment | Taxed as regular income | May qualify for capital gains tax advantages |

| Incentive Alignment | Less aligned with company performance | Strong alignment with company growth and success |

| Liquidity | Immediate payout in cash | Potentially illiquid until vesting or exit event |

| Benefits Coverage | Typically includes health, retirement, and other benefits | Benefits may vary; often limited or additional |

| Risk Level | Low financial risk | Higher financial risk tied to market fluctuations |

Overview: Salary vs Equity Compensation Models

Salary compensation models provide employees with a fixed, predictable income, ensuring financial stability and straightforward tax implications. Equity compensation models grant employees ownership stakes through stock options or shares, aligning their interests with company performance and offering potential for significant long-term financial gains. Companies often balance these models to attract talent while motivating employees through both immediate rewards and future value creation.

Key Differences Between Salary and Equity Compensation

Salary compensation provides employees with fixed, predictable income paid regularly, offering financial stability and straightforward tax treatment. Equity compensation grants employees ownership stakes such as stock options or restricted shares, aligning their interests with company performance and potential long-term financial gains. The key differences involve liquidity timing, risk exposure, and incentive alignment, with salary ensuring immediate cash flow while equity ties rewards to company growth and market valuation.

Advantages of Salary Compensation for Employees

Salary compensation provides employees with a consistent and predictable income, ensuring financial stability and ease of budgeting. It often includes benefits like health insurance, retirement plans, and paid leave, which enhance overall employee well-being. Fixed salaries reduce the risk of income fluctuation compared to equity compensation, particularly in volatile markets.

Benefits and Risks of Equity Compensation

Equity-compensated employees benefit from potential long-term wealth creation through stock appreciation and alignment with company performance, fostering ownership mentality. However, risks include market volatility, lack of liquidity, and the dependency on company success, which may lead to uncertain financial outcomes compared to fixed salary employees. This compensation model suits motivated employees willing to accept higher risk for potentially greater rewards.

Financial Stability: Salary vs Equity Payouts

Salary employees receive fixed, predictable income that ensures consistent financial stability and eases budgeting for personal expenses. Equity-compensated employees face variable payouts tied to company performance, introducing potential financial fluctuation and uncertainty. This difference in compensation structure significantly impacts an employee's short-term cash flow and long-term wealth accumulation risk.

Job Security and Career Growth Implications

Salary employees experience greater job security due to fixed regular income and established benefits, fostering stable career growth through predictable compensation pathways. Equity-compensated employees face variable income tied to company performance, which can enhance long-term wealth but introduces higher financial risk and uncertainty impacting career stability. The trade-off between fixed salary security and equity's growth potential influences both employee retention and motivation within organizational compensation models.

Tax Implications of Salary and Equity Compensation

Salary employees face straightforward tax withholding on wages, subject to federal, state, and local income taxes plus payroll taxes such as Social Security and Medicare. Equity-compensated employees encounter complex tax implications depending on the type of equity--such as stock options or restricted stock units--with potential tax events triggered at grant, vesting, or exercise, often resulting in capital gains or ordinary income taxation. Understanding the timing and nature of taxable events is crucial for optimizing tax liability and compliance under salary versus equity compensation models.

Long-Term Wealth Potential: Which Model Wins?

Equity-compensated employees typically have greater long-term wealth potential due to the ability to benefit from stock appreciation and company growth, aligning their financial success with the firm's performance. In contrast, salaried employees receive consistent, predictable income but lack exposure to the exponential upside that equity can provide. Employees in startups or high-growth companies often find equity compensation more rewarding over time, especially if the company's valuation increases significantly.

Suitable Employee Profiles for Each Compensation Model

Salary employees typically suit stable roles requiring consistent performance and clear benchmarks, such as administrative staff, customer service representatives, or technical positions with defined responsibilities. Equity-compensated employees are often found in startup environments or senior-level roles like executives, product developers, and key contributors whose impact directly influences company growth and long-term value creation. Companies match compensation models to employee profiles by aligning salary structures with predictability and equity with motivation for entrepreneurial risk and reward.

Making the Right Choice: Salary or Equity Compensation

Choosing between salary and equity compensation hinges on financial stability versus long-term growth potential. Salary provides predictable income crucial for immediate expenses and financial planning, while equity offers ownership stakes that can yield substantial returns aligned with company success. Evaluating personal risk tolerance and career goals ensures the optimal compensation model aligns with both immediate needs and future wealth-building opportunities.

Related Important Terms

Liquidation Preference Differential

Salary employees receive fixed, predictable income without exposure to company financial outcomes, while equity-compensated employees hold shares or options that may gain value based on company performance and liquidation preferences. The liquidation preference differential significantly affects equity holders by granting priority payouts during exit events, often reducing residual proceeds for common shareholders and impacting the total compensation realized by equity-compensated employees.

Cliff Vesting Schedule

Salary employees receive regular fixed income without equity stakes, while equity-compensated employees benefit from stock options or shares subject to a cliff vesting schedule, typically requiring a continuous employment period (e.g., one year) before any equity ownership vests. This cliff vesting model incentivizes employee retention by delaying equity benefits until after the initial service period is completed.

Phantom Equity Compensation

Phantom equity compensation provides salary employees with financial benefits that mimic stock ownership without actual equity dilution, aligning employee incentives with company performance while preserving cash flow. This model offers a tax-efficient alternative to traditional equity plans by granting cash bonuses tied to company valuation, enhancing retention and motivation among key employees without transferring ownership.

Cash Burn Offset

Salary employees provide predictable cash burn due to fixed monthly payments, offering financial stability but increasing immediate cash outflow. Equity-compensated employees reduce upfront cash burn by substituting part of compensation with stock options or shares, aligning long-term incentives with company performance while preserving cash reserves.

Deferred Salary Swap

Deferred Salary Swap allows salary employees to convert a portion of their fixed income into equity compensation, aligning long-term incentives with company performance. This model enhances employee retention by balancing immediate cash flow needs with potential equity growth benefits.

Double-Trigger Acceleration

Double-trigger acceleration in equity-compensated employee contracts ensures that stock options or equity vest immediately upon both a company acquisition and subsequent involuntary termination, providing a critical safeguard for employee wealth. Salary employees typically lack this equity-based protection, relying solely on fixed wages that do not benefit directly from corporate liquidity events.

Stock Option Pool Dilution

Salary employees receive fixed monetary compensation, providing predictable income without affecting company ownership, whereas equity-compensated employees gain ownership stakes through stock options, which can lead to dilution of the stock option pool and reduce the percentage ownership of all equity holders as new shares are allocated. Managing stock option pool dilution is crucial for balancing employee incentives with maintaining shareholder value in startup and growth-stage companies.

Equity Refresh Grants

Equity-compensated employees benefit from Equity Refresh Grants, which provide ongoing stock options or shares to align their incentives with company performance and encourage long-term retention. Salary employees receive fixed cash compensation, lacking the potential upside and ownership stake that Equity Refresh Grants offer in equity-based compensation models.

Annualized Dilution Rate

Salary employees experience predictable annual compensation without affecting company equity, while equity-compensated employees face dilution of ownership reflected in the Annualized Dilution Rate, which measures the yearly percentage decrease in an employee's equity stake due to new shares issued. Understanding the Annualized Dilution Rate is crucial for balancing growth incentives against ownership retention in equity-based compensation models.

Salary-to-Equity Conversion Ratio

Salary-to-equity conversion ratio quantifies the equivalence between fixed salary and equity compensation, crucial for balancing immediate cash flow with long-term incentive alignment in employee remuneration. Equilibrium in this ratio enhances employee retention and motivation by transparently linking valuation of base salary against potential future equity appreciation.

Salary employee vs Equity-compensated employee for compensation model. Infographic

hrdif.com

hrdif.com