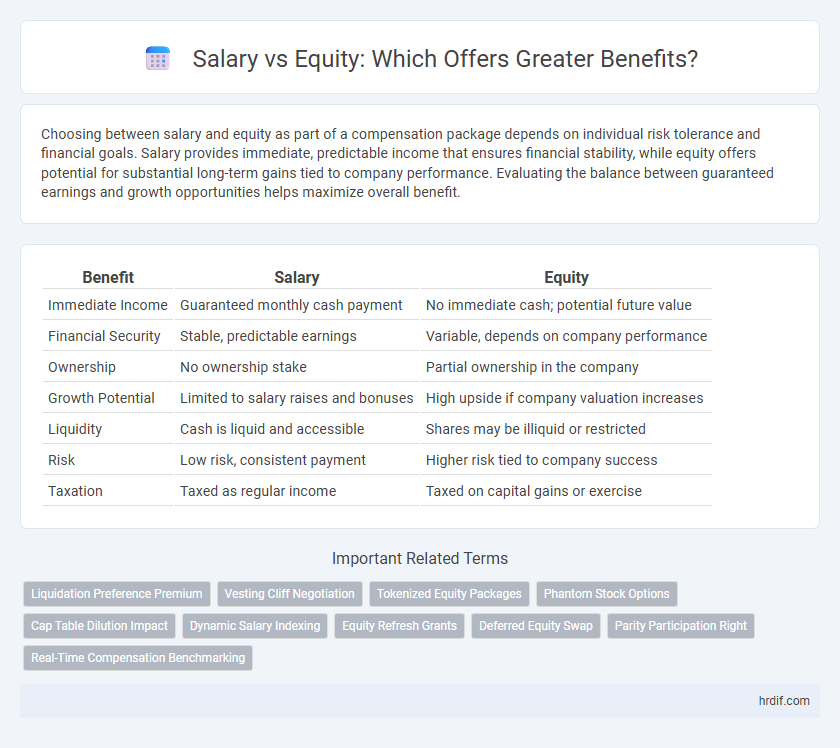

Choosing between salary and equity as part of a compensation package depends on individual risk tolerance and financial goals. Salary provides immediate, predictable income that ensures financial stability, while equity offers potential for substantial long-term gains tied to company performance. Evaluating the balance between guaranteed earnings and growth opportunities helps maximize overall benefit.

Table of Comparison

| Benefit | Salary | Equity |

|---|---|---|

| Immediate Income | Guaranteed monthly cash payment | No immediate cash; potential future value |

| Financial Security | Stable, predictable earnings | Variable, depends on company performance |

| Ownership | No ownership stake | Partial ownership in the company |

| Growth Potential | Limited to salary raises and bonuses | High upside if company valuation increases |

| Liquidity | Cash is liquid and accessible | Shares may be illiquid or restricted |

| Risk | Low risk, consistent payment | Higher risk tied to company success |

| Taxation | Taxed as regular income | Taxed on capital gains or exercise |

Financial Security: Weighing Salary Against Equity

Evaluating financial security involves comparing the guaranteed income of a salary with the potential long-term gains of equity. A stable salary offers consistent cash flow for daily expenses and risk management, while equity provides opportunities for substantial wealth accumulation through company growth and stock value appreciation. Balancing salary and equity decisions depends on one's risk tolerance, financial obligations, and long-term investment goals.

Long-Term Value: Equity’s Potential Versus Instant Pay

Equity offers long-term financial growth potential, often surpassing the immediate value of a higher salary by aligning employee incentives with company success. While salary provides instant, predictable income for daily expenses, equity can substantially increase net worth if the company's valuation rises over time. Balancing salary and equity ensures both short-term stability and the possibility of significant future rewards.

Risk Tolerance: Choosing Certainty or Upside

Salary offers guaranteed income with minimal risk, providing financial stability and predictable cash flow for employees seeking certainty. Equity compensation carries higher risk due to market fluctuations but offers potential for significant upside if the company's value increases substantially. Risk tolerance plays a crucial role in choosing between immediate salary security and the long-term growth opportunities that equity may provide.

Tax Implications: Salary Income vs. Equity Gains

Salary income is typically subject to regular income tax rates, including payroll taxes such as Social Security and Medicare, which can significantly reduce take-home pay. Equity gains, especially long-term capital gains, are often taxed at lower rates, creating potential for substantial tax savings if shares are held over time. Understanding the timing and type of equity compensation is crucial for optimizing tax efficiency and maximizing overall employee benefits.

Career Stage Considerations: Early vs. Late Benefit

Early career professionals often benefit more from equity compensation, as the potential for company growth can significantly increase their long-term wealth. Late-career individuals tend to prioritize salary for immediate financial stability and liquidity, reflecting a lower risk tolerance. Balancing salary and equity according to career stage aligns compensation strategies with personal financial goals and risk profiles.

Company Growth Impact: Equity Appreciation Potential

Equity compensation aligns employee incentives with company growth, offering significant upside potential as the company scales and valuations increase. Unlike fixed salaries, equity value can multiply substantially during successful funding rounds or public offerings, enhancing long-term wealth accumulation. This potential for equity appreciation motivates employees to directly contribute to the company's sustained growth and innovation.

Liquidity: Access to Cash with Salary and Equity

Salary provides immediate liquidity by delivering consistent cash flow for daily expenses and financial obligations, ensuring predictable access to money. Equity, while potentially lucrative, often lacks immediate liquidity as shares may require vesting periods and depend on market conditions or company events for cash conversion. Balancing salary with equity helps optimize cash access while retaining long-term wealth-building potential.

Negotiation Strategies: Maximizing Total Benefit

Negotiation strategies for maximizing total benefit involve balancing salary and equity by assessing immediate financial needs against long-term growth potential. Prioritize clear valuation of equity options, including vesting schedules and exit scenarios, to align with personal risk tolerance and market trends. Leveraging comprehensive market data and transparent communication enhances the ability to secure a compensation package that optimizes both immediate income and future wealth accumulation.

Employee Motivation: Engagement with Salary or Equity

Employee motivation is significantly influenced by the structure of compensation, where salary offers immediate financial security, enhancing daily engagement and satisfaction. Equity, on the other hand, aligns employee interests with company growth, fostering long-term commitment and a stronger sense of ownership. Balancing salary and equity can maximize motivation by addressing both short-term needs and long-term aspirations.

Market Trends: Evolving Benefit Preferences

Market trends indicate a growing preference for equity-based compensation as employees seek long-term financial gains and ownership stakes in companies. Salary packages remain crucial for immediate financial stability, but equity benefits increasingly attract talent in competitive industries such as technology and startups. Data shows that 45% of professionals now prioritize equity over salary increments, reflecting a shift towards value-driven and performance-linked benefits.

Related Important Terms

Liquidation Preference Premium

Salary provides immediate, guaranteed compensation while equity offers potential long-term value, with liquidation preference premiums protecting investors by ensuring they receive a multiple of their investment before common shareholders in a liquidity event. Understanding liquidation preference terms is crucial for employees weighing immediate salary benefits against the risk and reward of equity stakes.

Vesting Cliff Negotiation

Negotiating a vesting cliff in equity compensation can maximize long-term financial benefits by securing a minimum period before shares begin to vest, aligning incentives with company performance and retention goals. Comparing salary versus equity benefits requires evaluating upfront cash flow needs against potential future gains, with a well-negotiated vesting cliff serving as a critical factor in mitigating risk and enhancing shareholder value.

Tokenized Equity Packages

Tokenized equity packages offer employees a flexible and transparent benefit by converting traditional stock options into easily tradable digital tokens, enhancing liquidity and potential value growth. Unlike fixed salaries, these tokenized equity benefits align employee incentives with company performance, potentially maximizing long-term financial gains.

Phantom Stock Options

Phantom Stock Options offer employees the financial upside of equity without actual stock ownership, aligning incentives while preserving company control and avoiding dilution. This benefit provides a valuable alternative to higher salary demands by delivering potential future cash rewards tied to company performance.

Cap Table Dilution Impact

Equity compensation can significantly impact the cap table dilution, reducing the ownership percentage of existing shareholders but potentially increasing long-term financial gain if the company's valuation grows. Salary provides immediate financial stability without affecting the cap table, yet it lacks the upside potential tied to equity's influence on company value and shareholder dilution.

Dynamic Salary Indexing

Dynamic Salary Indexing enhances employee benefits by aligning salary adjustments with real-time market trends and cost-of-living fluctuations, ensuring competitive compensation without the fixed delays of traditional raises. Equity components complement this by offering long-term growth potential, balancing immediate financial security with ownership incentives for sustained wealth accumulation.

Equity Refresh Grants

Equity refresh grants provide ongoing ownership in the company, aligning employee incentives with long-term growth and offering potential for significant financial upside beyond fixed salary compensation. These grants serve as a key benefit in retention strategies, enhancing total rewards by supplementing base salary through vested shares that appreciate as the company scales.

Deferred Equity Swap

Deferred equity swap offers a strategic benefit by allowing employees to convert future equity stakes into immediate salary, balancing cash flow needs with long-term financial growth. This approach optimizes compensation packages by aligning employee incentives with company performance while providing flexibility in tax planning and liquidity.

Parity Participation Right

Parity Participation Right ensures shareholders receive returns proportionate to their equity, balancing salary and equity benefits by allowing employees to share equally in company profits alongside fixed compensation. This rights structure aligns employee incentives with corporate growth, enhancing long-term financial gains compared to salary-only benefits.

Real-Time Compensation Benchmarking

Real-time compensation benchmarking empowers companies to balance salary and equity offerings by providing up-to-date market data, ensuring competitive total rewards packages that attract and retain top talent. Leveraging dynamic salary and equity insights helps optimize employee benefits, align with industry standards, and enhance overall compensation strategy effectiveness.

Salary vs Equity for benefit. Infographic

hrdif.com

hrdif.com