Stock options provide employees the potential for significant financial gain by granting the right to purchase company shares at a fixed price, aligning employee interests with company growth. Employee token rewards offer a flexible and immediate incentive through digital assets that can appreciate in value and provide liquidity outside traditional stock markets. Both benefits can enhance employee motivation and retention, but tokens often appeal to those seeking more diverse and accessible compensation methods.

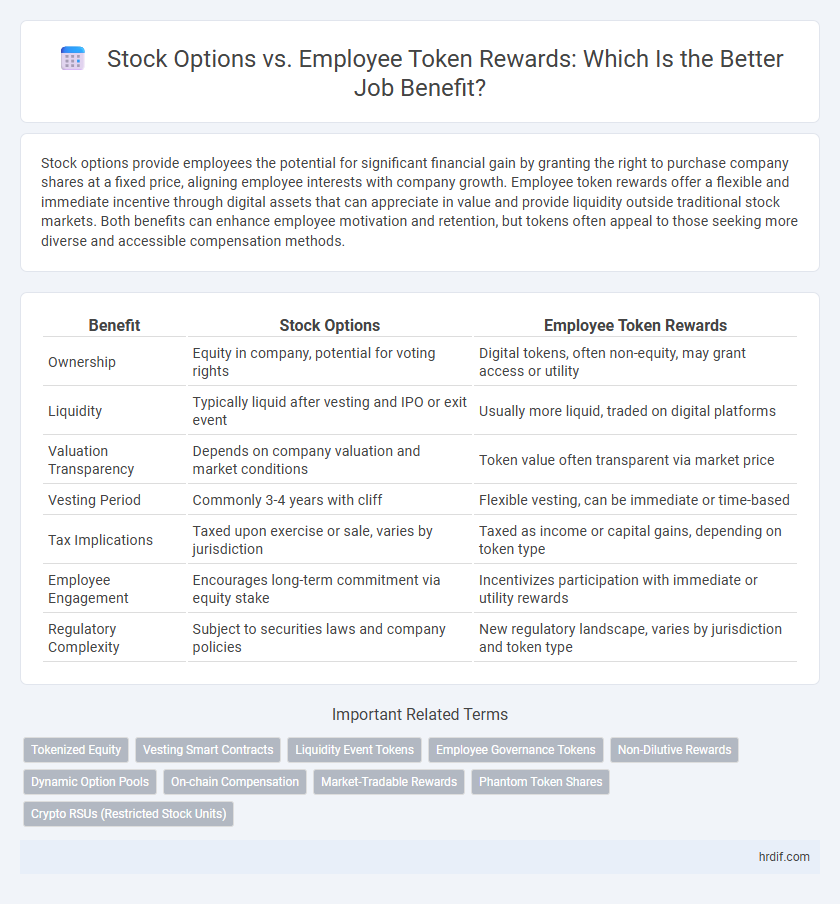

Table of Comparison

| Benefit | Stock Options | Employee Token Rewards |

|---|---|---|

| Ownership | Equity in company, potential for voting rights | Digital tokens, often non-equity, may grant access or utility |

| Liquidity | Typically liquid after vesting and IPO or exit event | Usually more liquid, traded on digital platforms |

| Valuation Transparency | Depends on company valuation and market conditions | Token value often transparent via market price |

| Vesting Period | Commonly 3-4 years with cliff | Flexible vesting, can be immediate or time-based |

| Tax Implications | Taxed upon exercise or sale, varies by jurisdiction | Taxed as income or capital gains, depending on token type |

| Employee Engagement | Encourages long-term commitment via equity stake | Incentivizes participation with immediate or utility rewards |

| Regulatory Complexity | Subject to securities laws and company policies | New regulatory landscape, varies by jurisdiction and token type |

Understanding Stock Options and Employee Token Rewards

Stock options grant employees the right to purchase company shares at a set price, offering potential financial gain if the stock value rises. Employee token rewards provide digital assets tied to company value or performance, often with unique liquidity and transferability features. Both incentives align employee interests with company success but differ in regulatory treatment, market exposure, and potential for immediate or long-term rewards.

Key Differences Between Stock Options and Token Rewards

Stock options grant employees the right to purchase company shares at a predetermined price, offering potential long-term financial gains tied to company equity growth. Employee token rewards, often issued on a blockchain, provide immediate or vesting-based digital assets that can represent ownership, utility, or access within the company ecosystem. Key differences include liquidity options, regulatory frameworks, and value volatility, with stock options subject to traditional securities laws and tokens leveraging decentralized technology for faster transferability and innovative incentive structures.

Advantages of Offering Stock Options to Employees

Stock options provide employees with long-term financial incentives by allowing them to purchase company shares at a fixed price, aligning their interests with company growth and profitability. They offer potential for significant capital gains if the company's stock value increases, fostering employee retention and motivation. Unlike employee token rewards, stock options are often backed by well-established regulatory frameworks, enhancing their perceived value and security.

Benefits of Employee Token Rewards in Modern Workplaces

Employee token rewards offer real-time value and liquidity, enabling employees to participate directly in the company's growth without waiting for stock vesting periods. These tokens enhance transparency and engagement through blockchain technology, providing verifiable ownership and instant transferability. Modern workplaces benefit from employee token rewards by fostering a sense of inclusion and motivation, driving productivity and long-term loyalty.

Potential Financial Outcomes for Employees

Stock options offer employees the potential for significant financial gains through equity appreciation if the company's stock price increases, aligning employee incentives with long-term company performance. Employee token rewards provide liquidity and flexibility by enabling trade or use within digital ecosystems, potentially yielding rapid returns depending on market demand and token utility. Both methods carry risks tied to market volatility and company success, but tokens may offer faster realization of value compared to stock options, which often require vesting periods and favorable exit events.

Tax Implications: Stock Options vs Token Rewards

Stock options typically incur capital gains tax upon exercise and sale, often benefiting from favorable long-term capital gains rates if held sufficiently long. Employee token rewards may be taxed as ordinary income at the time of receipt or vesting, with additional capital gains tax applying to subsequent sales, depending on jurisdiction. Understanding the timing and nature of taxation is crucial for employees to maximize after-tax benefits from either stock options or token rewards.

Liquidity and Vesting Considerations

Stock options often have longer vesting periods and limited liquidity until a company goes public or is acquired, creating potential delays in realizing financial gains for employees. In contrast, employee token rewards typically offer faster liquidity through secondary markets or exchanges, enabling more immediate access to value. Vesting schedules for tokens can be more flexible, enhancing the appeal of token rewards compared to the rigid timelines associated with traditional stock options.

Impact on Company Culture and Employee Retention

Stock options align employee interests with company growth, fostering long-term commitment and a unified culture centered on business success. Employee token rewards create a sense of immediate ownership and engagement, promoting innovation and collaboration through blockchain-enabled transparency. Both incentives enhance retention, but tokens often appeal to a digitally savvy workforce seeking flexible, real-time value recognition.

Risks and Challenges for Employers and Employees

Stock options pose risks such as market volatility and dilution, potentially impacting employee motivation and company valuation, while employees face tax complexities and uncertain liquidity. Employee token rewards introduce challenges like regulatory ambiguity, security vulnerabilities, and fluctuating token value, which may affect employee trust and long-term retention. Employers must navigate compliance issues and establish secure, transparent management systems to mitigate risks and maintain effective incentive programs.

Future Trends in Employee Stock and Token Benefits

Future trends in employee benefits indicate a growing shift from traditional stock options to employee token rewards, leveraging blockchain technology for enhanced liquidity and transparency. Token-based rewards offer real-time vesting and fractional ownership, appealing to employees seeking flexible compensation models. Companies adopting hybrid models combining stock options and tokens can optimize talent retention and align incentives with evolving digital economies.

Related Important Terms

Tokenized Equity

Tokenized equity through employee token rewards offers enhanced liquidity and fractional ownership compared to traditional stock options, enabling employees to trade or utilize their rewards on blockchain platforms seamlessly. This approach provides immediate transparency and potential value appreciation, making it a more flexible and innovative benefit in modern compensation structures.

Vesting Smart Contracts

Stock options and employee token rewards both offer significant job benefits by leveraging vesting smart contracts that automate ownership transfer and ensure compliance with vesting schedules. Vesting smart contracts enhance transparency, reduce administrative overhead, and enable real-time tracking of granted assets, empowering employees with verifiable and liquid incentives.

Liquidity Event Tokens

Stock options offer employees potential equity growth tied to company valuation but typically require a liquidity event like an IPO or acquisition for realization, whereas employee token rewards provide immediate tradable assets on blockchain platforms, enhancing liquidity without dependence on traditional exit events. Liquidity event tokens enable faster access to value by allowing employees to sell or transfer tokens directly on decentralized exchanges, increasing financial flexibility and reducing wait times associated with conventional stock options.

Employee Governance Tokens

Employee governance tokens offer a unique advantage over traditional stock options by providing workers direct voting power and influence in company decisions, aligning their interests with the long-term growth of the organization. These tokens enhance transparency, foster a decentralized ownership structure, and can deliver liquidity opportunities outside standard market hours, making them an innovative benefit in modern employment packages.

Non-Dilutive Rewards

Employee token rewards provide a non-dilutive alternative to traditional stock options by granting company tokens that retain value without reducing equity shares or diluting ownership percentages. These token rewards offer flexible liquidity and immediate market access, enhancing employee benefits while preserving corporate control.

Dynamic Option Pools

Dynamic option pools enhance employee incentivization by adjusting stock option availability based on company valuation and hiring needs, ensuring fair equity distribution. Compared to static employee token rewards, these pools offer scalable, performance-aligned benefits that better retain talent and drive long-term commitment.

On-chain Compensation

On-chain compensation through employee token rewards offers enhanced transparency and immediate liquidity compared to traditional stock options, leveraging blockchain technology for real-time tracking and transferability of assets. Token rewards reduce administrative complexity and align employee incentives with company growth by enabling fractional ownership and seamless global accessibility.

Market-Tradable Rewards

Stock options and employee token rewards both provide market-tradable benefits that can enhance financial gains through equity appreciation, with stock options typically tied to company shares and token rewards often linked to blockchain-based assets offering higher liquidity and faster trading opportunities. Employee token rewards enable more flexible market access, allowing recipients to monetize their compensation immediately on various digital asset exchanges, while stock options may impose vesting periods and exercise constraints.

Phantom Token Shares

Phantom Token Shares offer employees stock option-like benefits without requiring actual equity ownership, providing value tied to company performance and token price appreciation. Compared to traditional stock options, phantom tokens simplify regulatory issues and liquidity by delivering cash or token payouts upon vesting, aligning employee incentives with company growth.

Crypto RSUs (Restricted Stock Units)

Crypto RSUs offer employees a unique advantage by providing ownership stakes in tokens with potential for significant appreciation, aligning incentives closely with company growth in the blockchain sector. Unlike traditional stock options, employee token rewards grant immediate liquidity and flexibility, reducing vesting risks and enhancing long-term wealth creation in volatile crypto markets.

Stock Options vs Employee Token Rewards for job benefit Infographic

hrdif.com

hrdif.com