Commuter benefits reduce the financial burden of daily travel expenses, promoting eco-friendly transportation and improving employee punctuality. Remote work stipends offset home office costs such as internet, equipment, and utilities, enhancing productivity and comfort for telecommuters. Choosing between these benefits depends on an organization's workforce structure and goals to maximize employee satisfaction and operational efficiency.

Table of Comparison

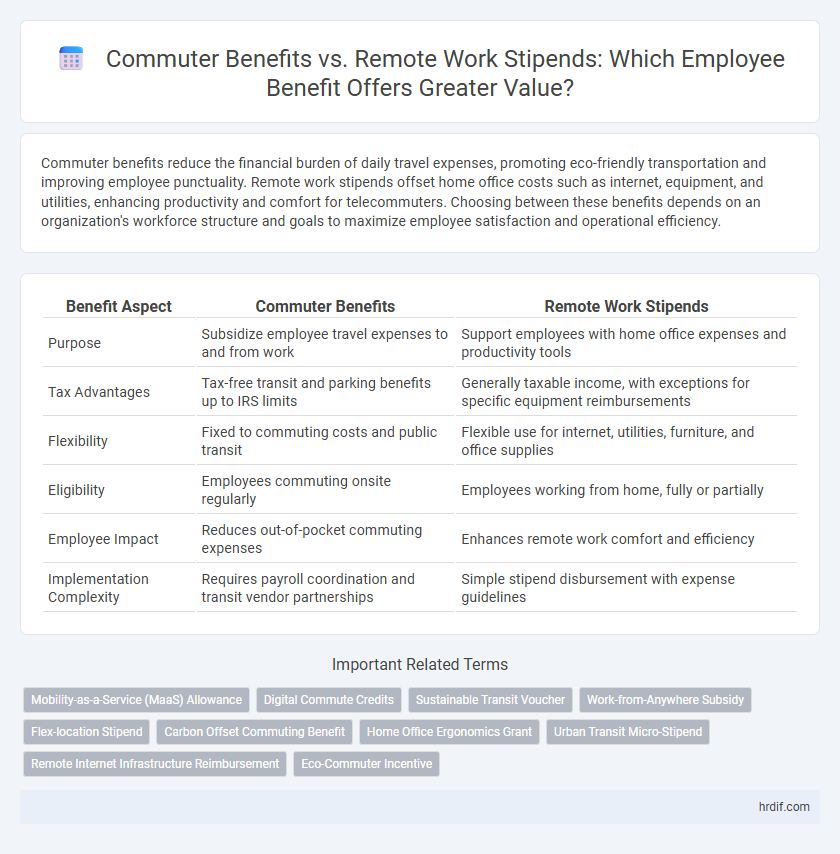

| Benefit Aspect | Commuter Benefits | Remote Work Stipends |

|---|---|---|

| Purpose | Subsidize employee travel expenses to and from work | Support employees with home office expenses and productivity tools |

| Tax Advantages | Tax-free transit and parking benefits up to IRS limits | Generally taxable income, with exceptions for specific equipment reimbursements |

| Flexibility | Fixed to commuting costs and public transit | Flexible use for internet, utilities, furniture, and office supplies |

| Eligibility | Employees commuting onsite regularly | Employees working from home, fully or partially |

| Employee Impact | Reduces out-of-pocket commuting expenses | Enhances remote work comfort and efficiency |

| Implementation Complexity | Requires payroll coordination and transit vendor partnerships | Simple stipend disbursement with expense guidelines |

Comparing Commuter Benefits and Remote Work Stipends

Commuter benefits offer employees subsidized transit passes, parking, or bike-share programs, reducing transportation costs and encouraging eco-friendly travel. Remote work stipends provide financial support for home office equipment, internet, or utilities, enhancing productivity and comfort in a remote setting. Comparing both, commuter benefits are ideal for onsite employees to ease daily travel expenses, while remote stipends cater to offsite workers' needs, promoting flexible work environments and overall job satisfaction.

Financial Impact: Commuter Benefits vs Remote Stipends

Commuter benefits can significantly reduce an employee's taxable income by covering transit costs, resulting in substantial monthly savings and lowering employer payroll taxes. Remote work stipends, while providing flexibility for home office expenses, often lack tax advantages and are treated as taxable income, increasing the employee's tax burden. Companies optimizing benefits packages should evaluate the financial impact on both parties, balancing tax savings from commuter benefits against the direct support offered by remote work stipends.

Employee Satisfaction: Which Perk Wins?

Commuter benefits improve employee satisfaction by reducing daily travel costs and stress, fostering a more pleasant workday experience for on-site staff. Remote work stipends enhance satisfaction by offering flexibility and resources to create a productive home office environment, catering to diverse workstyles. Studies show remote work stipends often lead to higher overall satisfaction due to increased autonomy and personalized support compared to commuter benefits focused solely on physical presence.

Attracting Talent with Modern Benefits Packages

Commuter benefits such as transit passes and pre-tax commuting expenses appeal to urban professionals seeking cost-effective and sustainable transportation options, enhancing a company's appeal in metropolitan job markets. Remote work stipends covering home office equipment and internet expenses cater to a growing remote workforce prioritizing flexibility and comfort, signaling employer support for modern work environments. Offering both commuter benefits and remote work stipends demonstrates a comprehensive benefits strategy that attracts top talent by addressing diverse employee needs and work preferences.

Tax Implications of Commuter and Remote Work Benefits

Commuter benefits typically offer tax advantages by allowing employees to use pre-tax dollars for transportation expenses such as transit passes and parking, reducing their taxable income. Remote work stipends, while providing flexibility for home office expenses, are generally considered taxable income unless specifically excluded by the IRS, resulting in higher tax liability. Employers and employees should carefully evaluate the tax implications of each benefit type to maximize savings and compliance with current tax laws.

Productivity Outcomes: Onsite vs Remote Advantages

Commuter benefits often enhance onsite productivity by reducing stress and commute time, fostering punctuality and focus during work hours. Remote work stipends contribute to increased productivity by enabling employees to create comfortable, personalized workspaces and invest in technology that supports efficient remote tasks. Both benefits address different productivity drivers: commuter perks boost physical presence and collaboration, while remote stipends empower autonomy and flexibility.

Flexibility and Work-Life Balance: A Benefit Analysis

Commuter benefits provide financial relief and reduce stress for employees who travel daily, enhancing punctuality and overall productivity, while remote work stipends support home office setups and internet costs, promoting a comfortable and efficient remote environment. Both options improve work-life balance, but remote work stipends offer greater flexibility by allowing employees to customize their workspace according to their needs, encouraging better time management and reduced commuting hours. Employers can optimize employee satisfaction by balancing these benefits to accommodate diverse work arrangements and personal preferences.

Cost to Employers: Evaluating Benefit Investments

Employers face distinct cost implications when choosing between commuter benefits and remote work stipends. Commuter benefits often involve tax-advantaged programs that can reduce payroll taxes, whereas remote work stipends provide direct financial support without similar tax incentives. Analyzing total expenditures, including tax savings and employee satisfaction metrics, helps organizations optimize their benefit investments effectively.

Environmental Impact: Commuting vs Remote Stipends

Commuter benefits reduce environmental impact by encouraging the use of public transportation, carpooling, and biking, which lowers carbon emissions from individual car use. Remote work stipends enable employees to maintain energy-efficient home offices, potentially decreasing overall workplace energy consumption but may increase residential energy use. Comparing these, commuter benefits offer more direct reductions in transportation-related emissions, while remote stipends support sustainability through decentralized work environments.

Adapting Benefits for the Future of Work

Commuter benefits traditionally support employees traveling to physical offices, offering tax advantages and cost savings for public transit or parking expenses. Remote work stipends address home office necessities, covering equipment, internet, and utilities to enhance productivity outside the traditional workplace. Adapting benefits by integrating flexible commuter options with remote work allowances reflects evolving workforce needs and promotes employee satisfaction and retention.

Related Important Terms

Mobility-as-a-Service (MaaS) Allowance

Mobility-as-a-Service (MaaS) Allowance integrates various transportation modes into a single payment system, offering greater flexibility compared to traditional commuter benefits tied to specific transit passes. Remote work stipends often cover home office expenses but may lack the comprehensive travel options enabled by MaaS, making the allowance a more versatile solution for employee mobility needs.

Digital Commute Credits

Digital Commute Credits provide a flexible and tax-efficient alternative to traditional commuter benefits, allowing employees to offset transportation costs regardless of their work location. Unlike remote work stipends that often cover miscellaneous home office expenses, Digital Commute Credits specifically target travel-related costs, enhancing employee satisfaction and promoting sustainable commuting options.

Sustainable Transit Voucher

Sustainable Transit Vouchers provide a targeted commuter benefit that encourages eco-friendly transportation by subsidizing public transit costs, reducing carbon emissions and urban traffic congestion. Remote work stipends offer flexible support for home office expenses but lack the direct environmental impact incentivized by commuter benefits like Sustainable Transit Vouchers.

Work-from-Anywhere Subsidy

Work-from-Anywhere Subsidies offer employees financial support regardless of location, contrasting with commuter benefits that specifically cover transportation expenses for on-site work. These stipends enhance flexibility and attract talent by accommodating remote work setups beyond traditional commuting needs.

Flex-location Stipend

Flex-location stipends offer employees financial support regardless of their work setting, providing greater flexibility compared to traditional commuter benefits that primarily cover transit expenses. These stipends empower workers to customize their work environment expenses, promoting productivity and satisfaction across diverse work locations.

Carbon Offset Commuting Benefit

Commuter benefits that include carbon offset programs actively reduce a company's overall environmental impact by incentivizing sustainable transportation options such as biking, public transit, and carpooling. Remote work stipends generally support home-office setup costs but lack direct mechanisms to decrease carbon emissions associated with daily commutes, making commuter benefits more effective for carbon offsetting initiatives.

Home Office Ergonomics Grant

Home Office Ergonomics Grants provide employees with financial support to improve their remote work setup, enhancing comfort and productivity while reducing health risks associated with poor ergonomics. Unlike commuter benefits that focus on travel expenses, these grants prioritize long-term wellness by funding ergonomic chairs, desks, and accessories tailored for home office environments.

Urban Transit Micro-Stipend

Urban Transit Micro-Stipends provide targeted financial support for employees using public transportation in metropolitan areas, optimizing commuter benefits by reducing out-of-pocket transit costs and encouraging sustainable travel. Remote work stipends cover home office expenses but lack the direct incentive for eco-friendly urban transit options that micro-stipends uniquely promote.

Remote Internet Infrastructure Reimbursement

Remote Internet Infrastructure Reimbursement offers a more flexible and direct support for remote employees by covering essential costs such as high-speed internet installation and upgraded routers, ensuring consistent connectivity. This targeted benefit enhances productivity and reduces out-of-pocket expenses, outperforming traditional commuter benefits which primarily aid in physical travel costs.

Eco-Commuter Incentive

Eco-Commuter Incentives offer significant environmental benefits by encouraging employees to use sustainable transportation methods such as biking, carpooling, or public transit, reducing carbon emissions and traffic congestion. Remote work stipends support eco-friendly practices indirectly by reducing daily commutes but lack the targeted impact on promoting green transportation options that Eco-Commuter Incentives provide.

Commuter benefits vs Remote work stipends for benefit. Infographic

hrdif.com

hrdif.com