A comprehensive retirement plan provides structured savings and investment options to secure financial stability after leaving the workforce. In contrast, a financial wellness program offers ongoing education and personalized tools to improve employees' money management skills, reducing stress and promoting healthier financial habits. Combining both ensures long-term benefits by addressing immediate financial behavior and future retirement readiness.

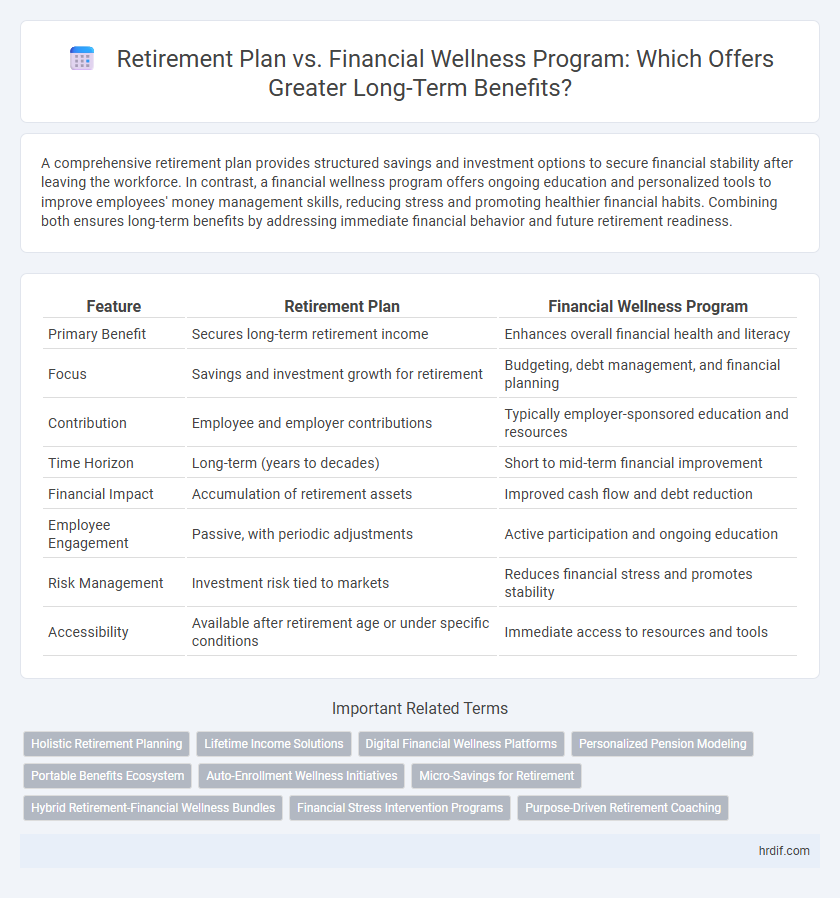

Table of Comparison

| Feature | Retirement Plan | Financial Wellness Program |

|---|---|---|

| Primary Benefit | Secures long-term retirement income | Enhances overall financial health and literacy |

| Focus | Savings and investment growth for retirement | Budgeting, debt management, and financial planning |

| Contribution | Employee and employer contributions | Typically employer-sponsored education and resources |

| Time Horizon | Long-term (years to decades) | Short to mid-term financial improvement |

| Financial Impact | Accumulation of retirement assets | Improved cash flow and debt reduction |

| Employee Engagement | Passive, with periodic adjustments | Active participation and ongoing education |

| Risk Management | Investment risk tied to markets | Reduces financial stress and promotes stability |

| Accessibility | Available after retirement age or under specific conditions | Immediate access to resources and tools |

Understanding Retirement Plans: Core Features and Advantages

Retirement plans offer structured savings with tax advantages, employer contributions, and defined benefits that support long-term financial security. These plans provide disciplined investment options and often include matching contributions that significantly boost retirement savings growth. Understanding the core features, such as vesting schedules, contribution limits, and payout options, equips individuals to maximize their benefits and build a stable financial future.

Financial Wellness Programs: Comprehensive Support Explained

Financial Wellness Programs offer comprehensive support by providing personalized financial education, budgeting tools, and ongoing counseling to enhance employees' financial literacy and resilience. Unlike traditional Retirement Plans that primarily focus on long-term savings accumulation, these programs address immediate financial challenges, reduce stress, and promote healthier money management behavior. Investing in Financial Wellness Programs leads to improved employee productivity, reduced absenteeism, and better overall financial security throughout all career stages.

Comparing Long-Term Security: Retirement Plan vs Financial Wellness

Retirement plans provide structured long-term financial security through consistent contributions and employer matching, ensuring a reliable income post-retirement. Financial wellness programs complement this by offering education, budgeting tools, and debt management strategies that improve overall financial health and resilience. Combining both approaches maximizes long-term security by addressing immediate financial behaviors and future retirement preparedness.

Employee Engagement: Impact of Financial Wellness Programs

Financial wellness programs significantly enhance employee engagement by providing personalized financial education and resources that address individual needs and reduce stress. Studies show companies with comprehensive financial wellness initiatives experience up to 30% higher employee participation and improved productivity compared to those relying solely on traditional retirement plans. This proactive approach fosters long-term commitment and job satisfaction, directly impacting organizational retention rates.

Retirement Plan Tax Benefits: Maximizing Future Savings

Retirement plans offer significant tax benefits that enhance long-term savings through tax-deferred growth, lowering taxable income during working years. Contributions to traditional 401(k) or IRA accounts reduce current taxable income, allowing more capital to accumulate over time. These tax advantages create a powerful incentive for employees to invest consistently, maximizing their future financial security.

Holistic Financial Health: The Scope of Wellness Programs

Retirement plans primarily focus on securing income for post-employment years, offering long-term financial stability through structured savings and investment options. Financial wellness programs encompass a broader scope by addressing holistic financial health, including budgeting, debt management, and financial literacy, which contribute to improved overall well-being and reduced stress. Integrating these programs enhances employee engagement and promotes sustainable financial behavior beyond retirement planning alone.

Flexibility and Customization: Tailoring Benefits for Employees

Retirement plans offer structured, long-term savings options primarily focused on future financial security, while financial wellness programs provide flexible, customizable resources addressing employees' immediate and evolving financial needs. Incorporating personalized counseling, educational tools, and diverse financial products, wellness programs adapt to individual circumstances, enhancing engagement and overall well-being. Employers benefit from increased retention and productivity by tailoring these benefits to align with workforce demographics and preferences.

Cost-Effectiveness: Assessing Employer Investment and ROI

Retirement plans typically offer long-term financial security by providing structured savings with tax advantages, often requiring significant employer contributions and administrative costs. Financial wellness programs focus on improving employees' overall financial literacy, potentially reducing stress and increasing productivity with a lower direct investment from employers. Evaluating cost-effectiveness involves analyzing the return on investment through improved employee retention, reduced absenteeism, and enhanced financial health outcomes, where financial wellness programs often deliver broader benefits at a lower cost.

Integrating Both: Synergy for Maximum Long-Term Benefit

Integrating a retirement plan with a financial wellness program creates a comprehensive approach that enhances employees' long-term financial security and reduces stress related to future financial uncertainty. Research indicates that companies offering both see a 30% increase in employee engagement and a 25% improvement in retirement readiness. This synergy leverages retirement savings strategies alongside debt management and budgeting education, maximizing overall benefits and promoting sustained financial well-being.

Choosing the Right Path: Key Considerations for Employers and Employees

Employers and employees should evaluate retirement plans and financial wellness programs based on factors such as long-term financial security, employee engagement, and overall cost-effectiveness. Retirement plans offer structured savings and tax advantages, while financial wellness programs provide education and tools to improve financial literacy and decision-making. Selecting the right path depends on aligning program benefits with workforce needs and organizational goals for sustainable financial well-being.

Related Important Terms

Holistic Retirement Planning

A Retirement Plan provides structured savings and investment options to secure financial stability after retirement, while a Financial Wellness Program offers comprehensive education and resources that address budgeting, debt management, and long-term financial goals. Holistic retirement planning integrates both approaches, ensuring individuals not only accumulate sufficient retirement funds but also develop sustainable financial habits and resilience for lifelong economic well-being.

Lifetime Income Solutions

Retirement plans provide structured lifetime income solutions ensuring steady financial support after career cessation, while financial wellness programs enhance employees' long-term benefit by promoting proactive money management and personalized financial education. Combining both approaches maximizes retirement security through guaranteed income streams and improved overall financial health.

Digital Financial Wellness Platforms

Digital financial wellness platforms integrated within retirement plans enhance long-term benefits by providing personalized, real-time financial guidance and automated savings tools that improve employee engagement and financial literacy. Compared to standalone financial wellness programs, these platforms deliver scalable, data-driven solutions that foster sustained financial security and retirement readiness.

Personalized Pension Modeling

Personalized pension modeling within retirement plans offers tailored forecasts that optimize long-term savings strategies based on individual financial goals and risk tolerance. Financial wellness programs enhance these benefits by providing continuous education and behavioral insights, promoting consistent contributions and informed retirement decisions.

Portable Benefits Ecosystem

Retirement plans offer structured, tax-advantaged savings specifically designed for long-term financial security, while financial wellness programs provide personalized tools and education to improve overall financial health, enhancing participants' ability to manage resources effectively. Integrating these within a Portable Benefits Ecosystem ensures continuous, adaptable benefits that support workers across multiple jobs and career changes, maximizing long-term financial resilience.

Auto-Enrollment Wellness Initiatives

Auto-enrollment wellness initiatives within financial wellness programs significantly increase participation rates, driving long-term benefits by promoting consistent retirement savings habits and improving overall financial security. Compared to traditional retirement plans, these programs offer proactive engagement and tailored support, maximizing employee retention and enhancing financial outcomes over time.

Micro-Savings for Retirement

Micro-savings for retirement, embedded within financial wellness programs, provide accessible and flexible contributions that enhance long-term financial security compared to traditional retirement plans with fixed contribution structures. These micro-savings initiatives encourage consistent saving behaviors, reducing the risk of retirement insecurity by promoting gradual wealth accumulation and improved financial habits over time.

Hybrid Retirement-Financial Wellness Bundles

Hybrid Retirement-Financial Wellness Bundles combine personalized retirement plans with comprehensive financial wellness programs, offering long-term benefits such as improved financial security and enhanced employee engagement. These integrated solutions promote holistic financial health by addressing retirement savings, debt management, and budgeting, resulting in better preparedness for retirement and reduced financial stress.

Financial Stress Intervention Programs

Retirement plans offer structured savings options with tax advantages to secure financial stability during retirement, while financial wellness programs incorporate financial stress intervention initiatives that improve employees' overall mental health and productivity by providing counseling and educational resources. Companies investing in financial wellness programs see reduced financial stress among employees, leading to long-term benefits such as lower healthcare costs, increased retention, and enhanced workplace morale.

Purpose-Driven Retirement Coaching

Purpose-driven retirement coaching enhances long-term financial security by aligning individual retirement goals with personalized strategies, surpassing traditional retirement plans focused solely on savings accumulation. Financial wellness programs complement these efforts by addressing holistic money management, reducing stress, and promoting sustained financial health throughout retirement.

Retirement Plan vs Financial Wellness Program for long-term benefit. Infographic

hrdif.com

hrdif.com