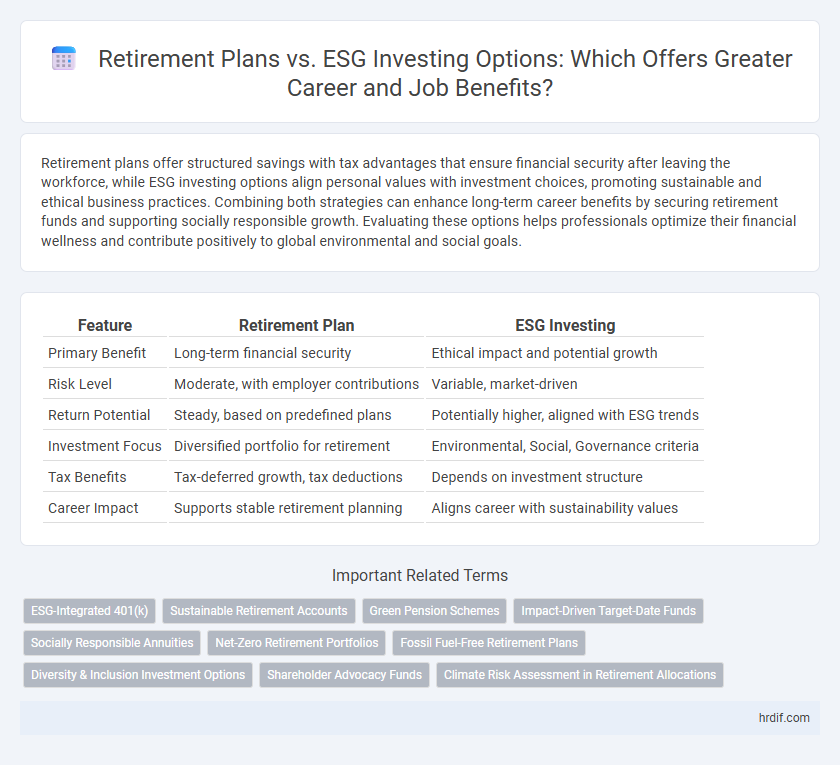

Retirement plans offer structured savings with tax advantages that ensure financial security after leaving the workforce, while ESG investing options align personal values with investment choices, promoting sustainable and ethical business practices. Combining both strategies can enhance long-term career benefits by securing retirement funds and supporting socially responsible growth. Evaluating these options helps professionals optimize their financial wellness and contribute positively to global environmental and social goals.

Table of Comparison

| Feature | Retirement Plan | ESG Investing |

|---|---|---|

| Primary Benefit | Long-term financial security | Ethical impact and potential growth |

| Risk Level | Moderate, with employer contributions | Variable, market-driven |

| Return Potential | Steady, based on predefined plans | Potentially higher, aligned with ESG trends |

| Investment Focus | Diversified portfolio for retirement | Environmental, Social, Governance criteria |

| Tax Benefits | Tax-deferred growth, tax deductions | Depends on investment structure |

| Career Impact | Supports stable retirement planning | Aligns career with sustainability values |

Understanding Retirement Plans: Securing Your Future

Retirement plans offer structured savings options that provide financial security and tax advantages for long-term wealth accumulation. Understanding the difference between defined benefit and defined contribution plans helps employees make informed decisions to optimize their retirement income. Incorporating ESG investing options within retirement portfolios allows for alignment of personal values with sustainable growth opportunities.

ESG Investing: Aligning Careers with Values

ESG investing enables professionals to align their careers with personal values by supporting companies that prioritize environmental, social, and governance factors. Unlike traditional retirement plans, ESG options integrate ethical impact with financial growth, promoting sustainable business practices. Choosing ESG-focused funds can enhance long-term returns while advancing corporate responsibility initiatives within one's industry.

Comparing Retirement Plan Benefits and ESG Investments

Retirement plans offer structured, tax-advantaged savings with predictable growth tailored for long-term financial security, while ESG investing focuses on aligning portfolios with environmental, social, and governance criteria to drive positive social impact alongside potential returns. Comparing these options, retirement plans provide stability and employer-sponsored benefits such as matching contributions, whereas ESG investments may appeal to employees prioritizing ethical considerations and sustainable business practices. Career benefits from retirement plans often include guaranteed income streams, whereas ESG investments can enhance job satisfaction by supporting corporate responsibility values.

Impact of Retirement Planning on Career Choices

Retirement planning influences career decisions by encouraging individuals to select jobs offering robust retirement benefits, such as 401(k) matching or pension plans, which can enhance long-term financial security. Incorporating ESG investing options within retirement plans aligns career choices with personal values, promoting work in companies committed to environmental, social, and governance principles. This alignment not only supports sustainable investing but also fosters job satisfaction and motivates commitment to employers prioritizing ethical practices.

ESG Investing: Career Opportunities and Benefits

ESG investing offers career opportunities in sustainable finance, impact analysis, and corporate social responsibility, reflecting growing demand for ethical business practices. Professionals skilled in ESG criteria can influence long-term risk management and drive positive environmental and social outcomes, enhancing their career prospects. Pursuing ESG roles aligns with shifting market trends toward responsible investment, increasing job stability and professional growth potential.

Risk Management in Retirement Plans vs ESG Investments

Retirement plans prioritize risk management through diversified asset allocation and stable growth projections to secure long-term financial stability for employees. ESG investing options emphasize managing environmental, social, and governance risks by investing in sustainable companies, which can mitigate reputational and regulatory risks. Balancing traditional retirement plan risk management with the dynamic risk factors of ESG investments offers a comprehensive approach to employee financial security and ethical impact.

Financial Growth: Retirement Plans vs ESG Investing

Retirement plans provide structured financial growth through tax advantages and employer contributions, ensuring a stable income post-retirement. ESG investing focuses on long-term value by integrating environmental, social, and governance factors, potentially enhancing portfolio resilience and aligning investments with ethical values. Comparing both, retirement plans offer predictable growth, while ESG options may deliver competitive returns alongside positive societal impact.

Employee Satisfaction: ESG Investing as a Workplace Benefit

Offering ESG investing options as part of a retirement plan significantly boosts employee satisfaction by aligning personal values with financial goals. Studies show companies integrating ESG funds experience higher retention rates and stronger workplace engagement. Employees increasingly prioritize sustainable investment opportunities, viewing them as a reflection of their employer's commitment to social responsibility.

Integrating ESG Investing into Retirement Portfolios

Integrating ESG investing into retirement portfolios enhances long-term financial resilience by aligning investment choices with environmental, social, and governance principles that reflect personal values. Retirement plans incorporating ESG options offer diversified asset allocation while promoting sustainable corporate practices, potentially improving risk-adjusted returns. Job seekers prioritize employers who provide retirement plans with ESG integration, as these benefits demonstrate commitment to responsible investing and future-focused career growth.

Future Trends: Retirement Planning and ESG in Careers

Future trends in retirement planning highlight a growing integration of ESG (Environmental, Social, and Governance) investing options, reflecting an increased demand for sustainable and ethically responsible investment portfolios. Employers are incorporating ESG criteria into retirement plans, offering employees opportunities to align their financial goals with broader social impact objectives. This shift supports career growth by promoting financial security through retirement funds that prioritize long-term sustainability and corporate responsibility.

Related Important Terms

ESG-Integrated 401(k)

ESG-integrated 401(k) plans offer retirement savings with a focus on environmental, social, and governance criteria, aligning investment choices with ethical values while targeting long-term financial growth. Employees benefit from sustainable investment options that promote corporate responsibility and potentially enhance portfolio resilience against market volatility.

Sustainable Retirement Accounts

Sustainable Retirement Accounts integrate ESG investing options to align long-term financial goals with environmental and social responsibility, offering employees a future-focused benefit that supports sustainable development. These accounts enhance traditional retirement plans by enabling investments in companies with strong governance, ethical practices, and positive ecological impact, fostering both personal wealth growth and global sustainability.

Green Pension Schemes

Green Pension Schemes offer a sustainable retirement plan by integrating ESG investing options that prioritize environmental responsibility and long-term financial growth. These plans align career benefits with ethical investing, enabling employees to support climate-conscious projects while securing their financial future.

Impact-Driven Target-Date Funds

Impact-driven target-date funds integrate ESG investing principles with retirement planning, aligning long-term financial goals with sustainable and ethical investment practices. This approach empowers employees to support environmental, social, and governance initiatives while optimizing retirement savings tailored to their career timeline.

Socially Responsible Annuities

Socially Responsible Annuities integrate Environmental, Social, and Governance (ESG) criteria into retirement plans, offering employees the dual benefit of ethical investment and financial security. These annuities align long-term financial growth with social impact goals, enhancing career satisfaction through responsible wealth building.

Net-Zero Retirement Portfolios

Net-zero retirement portfolios integrate ESG investing options into retirement plans, aligning job benefits with sustainable finance to reduce carbon footprints while securing long-term financial growth. These portfolios prioritize investments in companies committed to carbon neutrality, offering employees environmentally responsible retirement savings aligned with evolving corporate social responsibility standards.

Fossil Fuel-Free Retirement Plans

Fossil fuel-free retirement plans prioritize sustainable investing by excluding companies involved in coal, oil, and gas extraction, aligning career benefits with environmental values and reducing long-term financial risks linked to climate change. These plans enhance portfolio resilience and support ethical employer branding, attracting professionals committed to green finance and responsible retirement savings.

Diversity & Inclusion Investment Options

Retirement plans that incorporate ESG investing options emphasize diversity and inclusion by directing funds toward companies with strong commitments to equitable workplace practices and representation. These plans not only support long-term financial growth but also promote social responsibility by prioritizing investments in organizations advancing diversity across industries.

Shareholder Advocacy Funds

Shareholder advocacy funds within retirement plans empower employees to influence corporate policies on environmental, social, and governance (ESG) issues, aligning investment choices with personal values while potentially enhancing long-term returns. Incorporating ESG options in retirement plans supports sustainable career growth by promoting responsible business practices that can improve organizational stability and employee satisfaction.

Climate Risk Assessment in Retirement Allocations

Integrating Climate Risk Assessment in retirement plan allocations enhances long-term portfolio resilience by identifying and mitigating exposure to carbon-intensive industries and climate-vulnerable assets. ESG investing options enable employees to align their retirement savings with sustainable practices, reducing financial risks linked to climate change and supporting a green economy.

Retirement Plan vs ESG Investing Options for job and career. Infographic

hrdif.com

hrdif.com