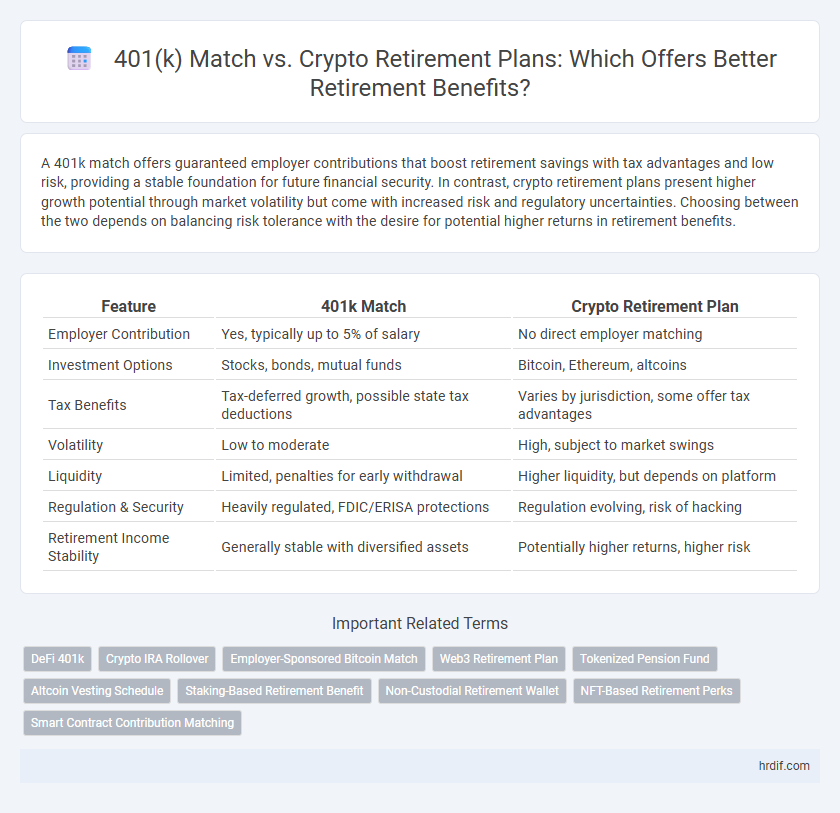

A 401k match offers guaranteed employer contributions that boost retirement savings with tax advantages and low risk, providing a stable foundation for future financial security. In contrast, crypto retirement plans present higher growth potential through market volatility but come with increased risk and regulatory uncertainties. Choosing between the two depends on balancing risk tolerance with the desire for potential higher returns in retirement benefits.

Table of Comparison

| Feature | 401k Match | Crypto Retirement Plan |

|---|---|---|

| Employer Contribution | Yes, typically up to 5% of salary | No direct employer matching |

| Investment Options | Stocks, bonds, mutual funds | Bitcoin, Ethereum, altcoins |

| Tax Benefits | Tax-deferred growth, possible state tax deductions | Varies by jurisdiction, some offer tax advantages |

| Volatility | Low to moderate | High, subject to market swings |

| Liquidity | Limited, penalties for early withdrawal | Higher liquidity, but depends on platform |

| Regulation & Security | Heavily regulated, FDIC/ERISA protections | Regulation evolving, risk of hacking |

| Retirement Income Stability | Generally stable with diversified assets | Potentially higher returns, higher risk |

Understanding 401(k) Match: Traditional Retirement Security

A 401(k) match provides employees with guaranteed contributions from their employer, offering a reliable boost to retirement savings through traditional investment options like stocks and bonds. This match effectively increases the total retirement fund without additional personal cost, ensuring steady growth aligned with proven market performance. Compared to crypto retirement plans, a 401(k) match emphasizes stability, regulated benefits, and tax advantages critical for long-term financial security.

Crypto Retirement Plans: A Modern Alternative

Crypto retirement plans offer innovative investment opportunities beyond traditional 401k match programs by integrating digital assets like Bitcoin and Ethereum into portfolios, potentially enhancing growth through market appreciation. These plans provide increased flexibility, lower fees, and diversification that aligns with evolving financial technologies and investor preferences. Embracing crypto retirement options may yield substantial long-term benefits while addressing the limitations of conventional retirement savings models.

Contribution Limits and Employer Involvement

401(k) match plans typically have contribution limits set by the IRS, currently $22,500 annually for individuals under 50, with employer contributions often matching up to 6% of employee salary, ensuring steady growth through traditional investments. In contrast, crypto retirement plans offer flexible contribution limits based on the specific plan structure but lack standardized employer matching, making employer involvement minimal or non-existent. The 401(k) match leverages employer funds as a direct benefit to employees, while crypto plans rely more on individual contributions and market risk exposure.

Investment Growth Potential: Stocks vs Crypto

401k match programs offer steady investment growth through diversified stock portfolios, benefiting from historical market stability and compound interest. Crypto retirement plans provide higher growth potential due to market volatility and emerging blockchain technologies, but they carry increased risk and regulatory uncertainty. Balancing a 401k with traditional stock investments ensures consistent returns, while integrating crypto assets can maximize long-term growth opportunities.

Risk Assessment: Stability versus Volatility

401(k) match plans offer stable, employer-backed contributions with lower market volatility, providing predictable growth and reduced risk for retirement savings. Crypto retirement plans exhibit high price volatility and regulatory uncertainties, leading to greater risk but potential for significant returns. Prioritizing risk tolerance and the need for financial security is crucial when choosing between stable traditional plans and volatile digital asset options.

Tax Advantages of 401(k) Accounts

401(k) accounts provide significant tax advantages by allowing contributions to be made with pre-tax dollars, reducing taxable income in the contribution year and deferring taxes until withdrawal during retirement. Employer matching contributions further enhance retirement savings without additional tax liability at the time of matching. These tax benefits make 401(k) plans a reliable and efficient option for long-term retirement growth compared to the more volatile and less regulated crypto retirement plans.

Tax Implications of Crypto Retirement Investments

Crypto retirement investments often offer unique tax advantages, such as deferring capital gains taxes until withdrawal, similar to traditional 401k plans. Unlike 401k matches, which are typically tax-deferred, crypto holdings may benefit from long-term capital gains rates if held beyond a year, potentially reducing tax burdens. However, fluctuating valuations and evolving regulations create complexities in tax reporting and compliance for crypto retirement plans.

Withdrawal Rules and Penalties: What to Know

401k plans impose strict withdrawal rules, typically penalizing early withdrawals before age 59 1/2 with a 10% penalty plus income taxes, making it essential to plan distributions carefully. Crypto retirement plans often offer more flexible withdrawal options but may lack standardized regulations, increasing the risk of unexpected tax liabilities or penalties. Understanding these differences in withdrawal rules and associated penalties is crucial for optimizing retirement benefits and avoiding costly mistakes.

Long-Term Security: Trustworthiness and Regulation

401(k) match programs offer long-term security through strict regulatory oversight by the Department of Labor and IRS, ensuring trustworthy and stable retirement savings growth. Crypto retirement plans, while innovative, often lack comprehensive regulation and may expose investors to higher volatility and security risks, potentially compromising retirement stability. Prioritizing regulated 401(k) matches can enhance retirement benefits with reliable protections and predictable growth.

Choosing the Right Fit: 401(k) Match or Crypto for Your Retirement

Choosing between a 401(k) match and a crypto retirement plan depends on risk tolerance and long-term growth goals. A 401(k) match offers employer contributions and tax advantages with lower volatility, while crypto plans provide high growth potential alongside significant market risk. Assessing your retirement timeline and comfort with volatility helps determine whether stable returns or aggressive growth aligns best with your financial future.

Related Important Terms

DeFi 401k

DeFi 401k leverages decentralized finance protocols to offer higher potential returns and enhanced transparency compared to traditional 401k matches, enabling participants to invest in a diversified portfolio including cryptocurrencies. By integrating blockchain technology, DeFi 401k plans reduce fees and provide real-time asset tracking, making them an innovative option for maximizing retirement benefits.

Crypto IRA Rollover

A Crypto IRA rollover offers tax advantages and diversified retirement benefits by enabling the transfer of traditional retirement funds into cryptocurrency assets, potentially increasing growth opportunities beyond typical 401k match limits. This strategy combines the stability of tax-deferred growth with the high-return potential of digital assets, making it a compelling option for maximizing retirement savings flexibility and long-term wealth accumulation.

Employer-Sponsored Bitcoin Match

Employer-sponsored Bitcoin match programs combine traditional 401k contributions with cryptocurrency investments, offering employees diversified retirement benefits and potential high returns from Bitcoin's market growth. These hybrid plans enhance long-term savings by leveraging employer matches in Bitcoin, increasing retirement portfolios beyond conventional stock and bond allocations.

Web3 Retirement Plan

Web3 retirement plans leverage blockchain technology to provide transparent, decentralized, and potentially higher-yielding investment options compared to traditional 401k match programs, allowing participants to diversify assets with cryptocurrencies and tokens. These plans offer enhanced security, reduced fees, and programmable smart contracts, optimizing retirement benefits through automated portfolio management and seamless integration with decentralized finance (DeFi) ecosystems.

Tokenized Pension Fund

Tokenized pension funds offer enhanced transparency and liquidity compared to traditional 401k match programs, enabling investors to diversify retirement portfolios with blockchain-backed assets. Unlike conventional plans, these crypto-backed funds provide real-time asset valuation and reduced transaction costs, potentially increasing long-term retirement benefits.

Altcoin Vesting Schedule

A 401k match offers predictable employer contributions and tax advantages, while a crypto retirement plan with an altcoin vesting schedule provides potential for high growth through phased token releases that reduce market volatility risks. Carefully managing altcoin vesting schedules ensures steady portfolio diversification and long-term value accumulation aligned with retirement goals.

Staking-Based Retirement Benefit

Staking-based crypto retirement plans offer potential for compounding returns through active participation in blockchain networks, often exceeding traditional 401k match growth rates. Unlike fixed employer matches, staking rewards fluctuate with network performance, introducing both higher risk and possibly greater long-term benefits for retirement portfolios.

Non-Custodial Retirement Wallet

Non-custodial retirement wallets offer enhanced security and control over assets compared to traditional 401(k) matches, allowing users to directly manage their crypto retirement funds without relying on third-party custodians. This self-sovereign approach reduces exposure to institutional risks and provides greater flexibility in choosing diversified investment strategies within the decentralized finance ecosystem.

NFT-Based Retirement Perks

NFT-based retirement perks offer unique, blockchain-verified ownership benefits that enhance the transparency and security of retirement planning compared to traditional 401k matches. These digital assets can provide customizable dividends and exclusive access to investment opportunities, creating innovative income streams and potentially higher returns for crypto-savvy retirees.

Smart Contract Contribution Matching

Smart contract contribution matching in crypto retirement plans offers automated, transparent, and immutable matching benefits, reducing administrative costs and errors compared to traditional 401k match programs. This approach leverages blockchain technology to ensure real-time verification and distribution of employer matches, enhancing trust and efficiency in retirement benefit management.

401k Match vs Crypto Retirement Plan for retirement benefits. Infographic

hrdif.com

hrdif.com