Childcare reimbursement provides financial relief for families by offsetting the high costs of daycare, enabling employees to maintain productivity without worrying about childcare expenses. Pet insurance offers peace of mind by covering unexpected veterinary bills, which reduces stress and helps employees focus on work. Both benefits enhance employee well-being but target different aspects of personal and family care needs.

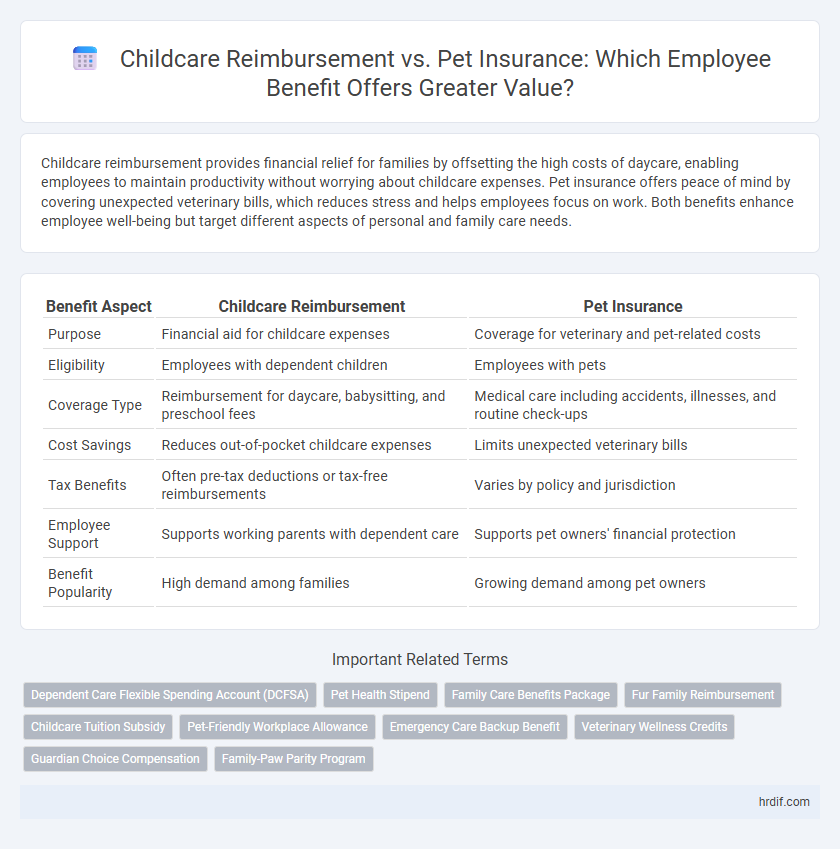

Table of Comparison

| Benefit Aspect | Childcare Reimbursement | Pet Insurance |

|---|---|---|

| Purpose | Financial aid for childcare expenses | Coverage for veterinary and pet-related costs |

| Eligibility | Employees with dependent children | Employees with pets |

| Coverage Type | Reimbursement for daycare, babysitting, and preschool fees | Medical care including accidents, illnesses, and routine check-ups |

| Cost Savings | Reduces out-of-pocket childcare expenses | Limits unexpected veterinary bills |

| Tax Benefits | Often pre-tax deductions or tax-free reimbursements | Varies by policy and jurisdiction |

| Employee Support | Supports working parents with dependent care | Supports pet owners' financial protection |

| Benefit Popularity | High demand among families | Growing demand among pet owners |

Understanding Childcare Reimbursement as an Employee Benefit

Childcare reimbursement as an employee benefit helps offset the high costs of daycare and after-school programs, directly supporting working parents' financial stability. This benefit often includes tax advantages, reducing overall expenses compared to out-of-pocket payments. Unlike pet insurance, which covers veterinary care for animals, childcare reimbursement addresses essential family needs, improving employee productivity and retention.

The Growing Popularity of Pet Insurance in Workplace Benefits

Pet insurance is rapidly gaining traction as a valuable workplace benefit, with over 30% of employers now offering it alongside traditional childcare reimbursement programs. This shift reflects increasing employee demand for comprehensive support that extends beyond family care to include pet health coverage. Companies integrating pet insurance into their benefits packages report higher employee satisfaction and engagement, highlighting its growing importance in holistic employee well-being strategies.

Key Differences Between Childcare Reimbursement and Pet Insurance

Childcare reimbursement typically covers expenses related to daycare, babysitting, and early education, providing direct financial support for employee families. Pet insurance, on the other hand, focuses on veterinary care costs, including treatments, surgeries, and preventive services for pets. The key difference lies in the target beneficiary--childcare reimbursement supports human dependents, while pet insurance safeguards the health of employees' animals.

Employee Demographics: Who Benefits Most?

Childcare reimbursement primarily benefits employees with young children, particularly working parents and guardians balancing career and family responsibilities, leading to increased retention and job satisfaction within this demographic. Pet insurance appeals mostly to pet owners across diverse age groups, offering financial peace of mind for unexpected veterinary expenses and attracting employees who value comprehensive personal benefits. Employers tailoring benefits to these specific demographics achieve higher engagement and demonstrate commitment to employee well-being.

Financial Impact: Cost-Effectiveness of Childcare vs. Pet Coverage

Childcare reimbursement typically provides a higher return on investment by significantly reducing out-of-pocket expenses for working parents, making it a more cost-effective benefit compared to pet insurance. The average annual cost of childcare in the U.S. exceeds $10,000, while pet insurance premiums generally range between $200 and $600 per year. Employers offering childcare reimbursement can enhance employee retention and productivity by alleviating substantial financial burdens, whereas pet insurance primarily covers non-essential expenses with limited financial impact.

Retention and Recruitment: Attracting Talent with Unique Benefits

Offering childcare reimbursement enhances employee retention by addressing a critical family need, making the workplace more supportive and attractive to parents. Pet insurance, while less essential, appeals to pet owners and can differentiate a benefits package, promoting a compassionate company culture. Combining both options provides a diverse benefits portfolio that attracts a wider talent pool and boosts recruitment in competitive job markets.

Legal and Compliance Considerations for Employers

Childcare reimbursement programs and pet insurance both require careful legal and compliance considerations for employers, including adherence to tax regulations and nondiscrimination laws. Employers must ensure childcare benefits comply with IRS guidelines under dependent care flexible spending accounts, while pet insurance benefits must be structured to avoid unintended taxable income for employees. Proper documentation and clear policy communication help maintain compliance and mitigate risks associated with employee benefit offerings.

Employee Satisfaction: Measuring the Value of Each Benefit

Employee satisfaction linked to childcare reimbursement often scores higher due to its direct impact on work-life balance and reduced stress for working parents. Pet insurance benefits contribute to morale by addressing employees' emotional attachments and financial concerns regarding pet healthcare. Measuring value requires assessing utilization rates, employee feedback, and overall mental well-being improvements from each benefit.

Customizing Benefits for a Diverse Workforce

Customizing benefits for a diverse workforce involves balancing childcare reimbursement and pet insurance to address varied employee needs and improve satisfaction. Childcare reimbursement supports working parents by easing financial burdens, enhancing productivity and retention, while pet insurance appeals to pet owners seeking to protect their animals without unexpected expenses. Tailoring these options ensures inclusivity and maximizes the value of employee benefits programs.

Future Trends: Evolving Workplace Benefits Beyond 2024

Future workplace benefits increasingly prioritize holistic support, with childcare reimbursement and pet insurance emerging as significant offerings. Childcare reimbursement addresses growing demands for family support, enhancing employee retention and productivity. Pet insurance gains traction as pets become integral family members, reflecting evolving employee priorities and well-being trends beyond 2024.

Related Important Terms

Dependent Care Flexible Spending Account (DCFSA)

Dependent Care Flexible Spending Account (DCFSA) offers pre-tax savings specifically for childcare expenses, providing a cost-effective benefit compared to pet insurance, which typically covers veterinary costs without tax advantages. Utilizing a DCFSA maximizes financial support for dependents' care, directly reducing out-of-pocket childcare expenses while pet insurance remains a discretionary health benefit for pets.

Pet Health Stipend

A Pet Health Stipend offers employees financial support specifically for veterinary care, wellness treatments, and preventive pet health services, enhancing overall pet well-being. Unlike childcare reimbursement, which addresses dependent care costs, a Pet Health Stipend directly promotes pet health management and can improve employee satisfaction by addressing pet-related expenses.

Family Care Benefits Package

Childcare reimbursement provides financial support for families managing caregiving expenses, directly reducing the cost burden of daycare and early education. Pet insurance offers coverage for veterinary costs, promoting pet health but generally holds less priority than childcare in comprehensive family care benefits packages.

Fur Family Reimbursement

Fur Family Reimbursement offers financial support for pet-related expenses, providing a unique benefit that complements traditional childcare reimbursement by addressing the growing needs of pet owners. This benefit enhances employee well-being by covering costs such as veterinary bills and pet care services, which are often overlooked compared to childcare expenses.

Childcare Tuition Subsidy

Childcare Tuition Subsidy offers significant financial relief for families by covering a portion of childcare expenses, promoting employee retention and productivity. Unlike Pet Insurance, which solely addresses pet health costs, childcare reimbursement directly supports workforce stability and work-life balance through essential family care assistance.

Pet-Friendly Workplace Allowance

Pet insurance enhances employee satisfaction and retention by providing financial support for unexpected veterinary expenses, aligning with a Pet-Friendly Workplace Allowance that fosters a supportive work environment. Childcare reimbursement primarily addresses family needs but lacks the direct engagement and morale boost that pet-related benefits offer in pet-friendly workplaces.

Emergency Care Backup Benefit

Emergency Care Backup Benefit offers critical support by covering unforeseen childcare expenses, ensuring parents can handle urgent situations without financial strain. In contrast, pet insurance primarily covers veterinary emergencies, making childcare reimbursement more directly beneficial for employees with dependent care needs.

Veterinary Wellness Credits

Childcare reimbursement helps families offset childcare expenses, boosting employee satisfaction and retention, while pet insurance provides financial protection for unexpected veterinary costs. Veterinary Wellness Credits specifically enhance pet insurance benefits by covering routine check-ups and preventive care, promoting pet health and reducing overall veterinary expenses.

Guardian Choice Compensation

Guardian Choice Compensation offers childcare reimbursement to ease family-related financial burdens, covering expenses like daycare and after-school programs. This benefit enhances employee satisfaction by supporting child care needs, whereas pet insurance primarily addresses veterinary costs and lacks equivalent impact on work-life balance.

Family-Paw Parity Program

The Family-Paw Parity Program offers equitable benefits by providing childcare reimbursement and pet insurance, recognizing the essential support both caregiving responsibilities and pet wellness contribute to employee well-being. This program enhances work-life balance by offsetting childcare costs and covering veterinary expenses, fostering loyalty and reducing financial stress for families and pet owners alike.

Childcare reimbursement vs Pet insurance for benefit. Infographic

hrdif.com

hrdif.com