Pension plans provide a guaranteed income stream after retirement, ensuring long-term financial security for employees. Financial wellness programs enhance retirement readiness by offering personalized education, budgeting tools, and investment guidance to help employees manage their finances effectively. Combining both benefits creates a comprehensive approach, balancing steady retirement income with proactive financial management.

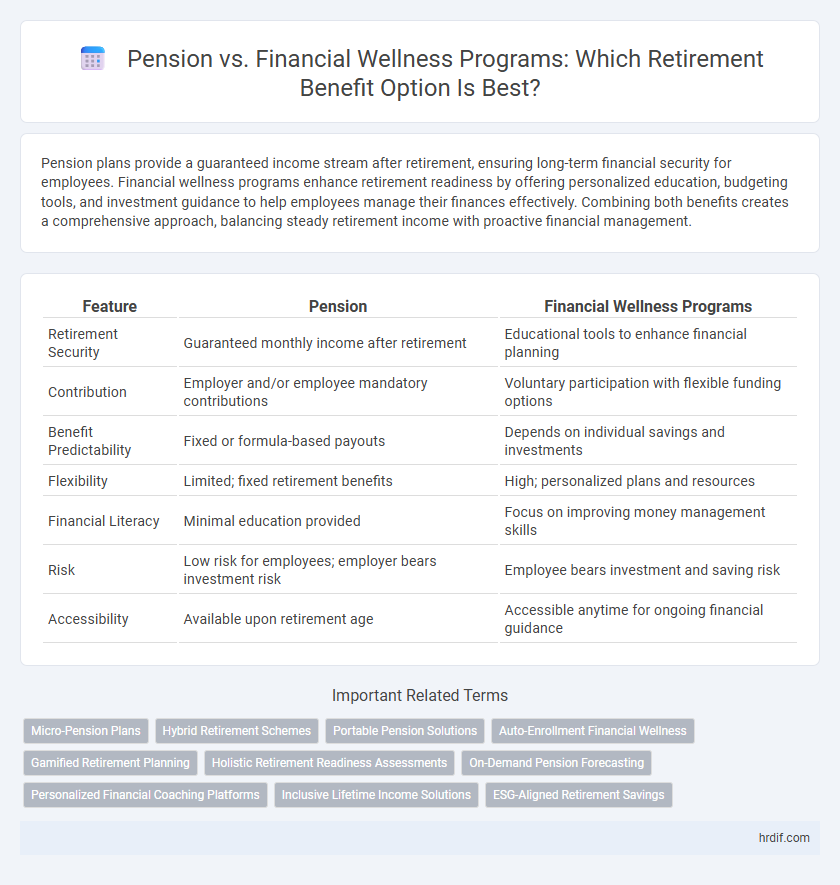

Table of Comparison

| Feature | Pension | Financial Wellness Programs |

|---|---|---|

| Retirement Security | Guaranteed monthly income after retirement | Educational tools to enhance financial planning |

| Contribution | Employer and/or employee mandatory contributions | Voluntary participation with flexible funding options |

| Benefit Predictability | Fixed or formula-based payouts | Depends on individual savings and investments |

| Flexibility | Limited; fixed retirement benefits | High; personalized plans and resources |

| Financial Literacy | Minimal education provided | Focus on improving money management skills |

| Risk | Low risk for employees; employer bears investment risk | Employee bears investment and saving risk |

| Accessibility | Available upon retirement age | Accessible anytime for ongoing financial guidance |

Understanding Pensions and Financial Wellness Programs

Pensions provide a defined benefit retirement plan ensuring consistent income based on salary and years of service, offering long-term financial security. Financial wellness programs focus on educating employees about budgeting, savings, and investment strategies to enhance personal retirement planning and financial decision-making. Combining pensions with financial wellness initiatives maximizes retirement readiness by addressing both guaranteed income and individualized financial literacy.

Key Differences Between Pension Plans and Financial Wellness Initiatives

Pension plans guarantee a fixed, predetermined retirement income based on salary and years of service, providing predictable financial security. Financial wellness programs offer personalized education, budgeting tools, and investment guidance, empowering employees to manage their retirement savings effectively. Unlike pensions, wellness initiatives focus on holistic financial health and flexibility rather than guaranteed payouts.

The Shift from Traditional Pensions to Modern Financial Wellness Programs

The shift from traditional pension plans to modern financial wellness programs reflects changing priorities in retirement benefits, emphasizing personalized financial education and holistic well-being over fixed monthly payouts. Financial wellness programs offer flexible support, including savings strategies, debt management, and investment guidance tailored to individual needs, contrasting with the predictable but inflexible nature of pensions. This transition enables employees to take greater control of their retirement planning, aligning with evolving workforce demographics and economic uncertainty.

Evaluating Long-term Security: Pensions vs Financial Wellness

Pensions provide guaranteed lifetime income, offering long-term financial security through defined benefit plans that reduce retirement income uncertainty. Financial wellness programs enhance individual retirement readiness by promoting savings habits, investment education, and personalized planning, but their effectiveness depends on employee engagement and market performance. Evaluating long-term security involves weighing the predictable income of pensions against the flexible, self-managed nature of financial wellness programs that empower employees but carry potential risks.

How Financial Wellness Programs Support Retirement Readiness

Financial wellness programs enhance retirement readiness by providing employees with personalized financial education, budgeting tools, and access to retirement planning resources. These programs foster proactive financial behavior, helping individuals manage debt, save consistently, and understand investment options beyond traditional pension plans. By integrating financial wellness into workplace benefits, organizations improve employees' overall retirement security and reduce future financial stress.

Cost Implications for Employers: Pension Plans vs Wellness Programs

Pension plans require significant long-term financial commitments and actuarial management, leading to higher fixed costs and potential liabilities for employers. Financial wellness programs typically involve lower upfront and ongoing expenses, focusing on education and resources that promote employee financial health without guaranteeing retirement income. Employers often find wellness programs more cost-effective due to their scalability and reduced financial risk compared to maintaining defined benefit pension obligations.

Employee Preferences: Guaranteed Pensions or Flexible Wellness Solutions?

Employees increasingly show a preference for flexible financial wellness programs over traditional guaranteed pensions, valuing personalized retirement planning and access to diverse investment options. Pension plans offer dependable income streams, providing financial stability and peace of mind during retirement. However, financial wellness programs empower employees to take control of their retirement savings, promoting engagement and adapting to individual risk tolerance and lifestyle needs.

Impact on Recruitment and Retention: Choosing the Right Benefit

Offering a pension plan significantly enhances recruitment and retention by providing employees with long-term financial security and predictable retirement income. Financial wellness programs complement this by promoting overall financial literacy, reducing stress, and increasing employee engagement, which can improve workplace satisfaction and loyalty. Employers who integrate both benefits create a comprehensive retirement strategy that appeals to a diverse workforce and strengthens talent attraction and retention.

Legal and Regulatory Considerations in Retirement Benefits

Pension plans are governed by stringent legal frameworks such as the Employee Retirement Income Security Act (ERISA), ensuring fiduciary responsibility and participant protection, while financial wellness programs face fewer regulatory requirements but must comply with data privacy and consumer protection laws. Legal oversight of pensions mandates regular funding disclosures and adherence to anti-discrimination regulations, which can create administrative complexity but provide guaranteed retirement benefits. Financial wellness programs offer flexibility and personalized financial education, yet they require careful implementation to avoid inadvertent violations of securities laws and to maintain compliance with labor standards.

Integrating Pension and Financial Wellness Programs for Holistic Retirement Planning

Integrating pension plans with financial wellness programs enhances holistic retirement planning by addressing both long-term income security and immediate financial literacy needs. Combining guaranteed pension benefits with personalized financial education empowers employees to make informed decisions, optimize savings, and manage retirement readiness more effectively. This integrated approach supports sustainable financial well-being and reduces retirement income gaps.

Related Important Terms

Micro-Pension Plans

Micro-pension plans offer a flexible and accessible alternative to traditional pension schemes, enabling individuals with irregular incomes to build retirement savings efficiently. These plans complement financial wellness programs by providing targeted contributions and personalized growth opportunities, enhancing long-term security and retirement readiness.

Hybrid Retirement Schemes

Hybrid retirement schemes combine the guaranteed income features of traditional pensions with the flexibility and growth potential of financial wellness programs, offering a balanced approach to retirement benefits. These plans optimize employee security by providing stable income streams alongside personalized financial planning tools, enhancing overall retirement readiness.

Portable Pension Solutions

Portable pension solutions offer employees the flexibility to maintain and manage retirement savings across multiple jobs, enhancing long-term financial security without disruption. Unlike some financial wellness programs that focus on short-term budgeting and debt management, portable pensions ensure consistent asset accumulation and tax advantages tailored for sustained retirement benefits.

Auto-Enrollment Financial Wellness

Auto-enrollment financial wellness programs significantly enhance retirement preparedness by automatically integrating employees into personalized savings plans, leading to higher participation rates compared to traditional pension schemes. These programs also offer flexible contributions and real-time financial education, empowering employees to make informed decisions and optimize their retirement benefits.

Gamified Retirement Planning

Gamified retirement planning enhances engagement and improves financial literacy among employees, leading to better retirement outcomes compared to traditional pension schemes. Financial wellness programs leveraging game mechanics motivate consistent saving behaviors and help participants understand complex investment options, ultimately increasing retirement readiness.

Holistic Retirement Readiness Assessments

Holistic Retirement Readiness Assessments provide a comprehensive evaluation of an individual's financial health, combining pension benefits with personalized financial wellness programs to ensure sustainable income throughout retirement. These assessments integrate savings, investment strategies, and risk management, empowering employees to make informed decisions for long-term retirement security.

On-Demand Pension Forecasting

On-demand pension forecasting empowers employees to accurately project their retirement income by integrating real-time data from both pension plans and personal financial wellness programs, enhancing informed decision-making. This dynamic approach enables personalized adjustments to savings strategies, significantly improving long-term financial security compared to traditional pension benefits alone.

Personalized Financial Coaching Platforms

Personalized financial coaching platforms enhance retirement benefits by tailoring pension strategies to individual goals, improving long-term savings and investment outcomes. These platforms integrate behavioral insights and real-time data to optimize financial wellness, surpassing traditional pension plans in adaptability and participant engagement.

Inclusive Lifetime Income Solutions

Inclusive lifetime income solutions within pension plans provide guaranteed, stable income streams that protect against longevity risk, ensuring financial security throughout retirement. Financial wellness programs complement these benefits by offering personalized education and tools that enhance retirement readiness and promote sustained financial health.

ESG-Aligned Retirement Savings

ESG-aligned retirement savings programs integrate environmental, social, and governance criteria into pension plans, promoting sustainable investing while supporting long-term financial security. These programs enhance financial wellness by offering participants opportunities to invest in companies with responsible practices, aligning retirement benefits with values-driven, impactful growth.

Pension vs Financial Wellness Programs for retirement benefit. Infographic

hrdif.com

hrdif.com