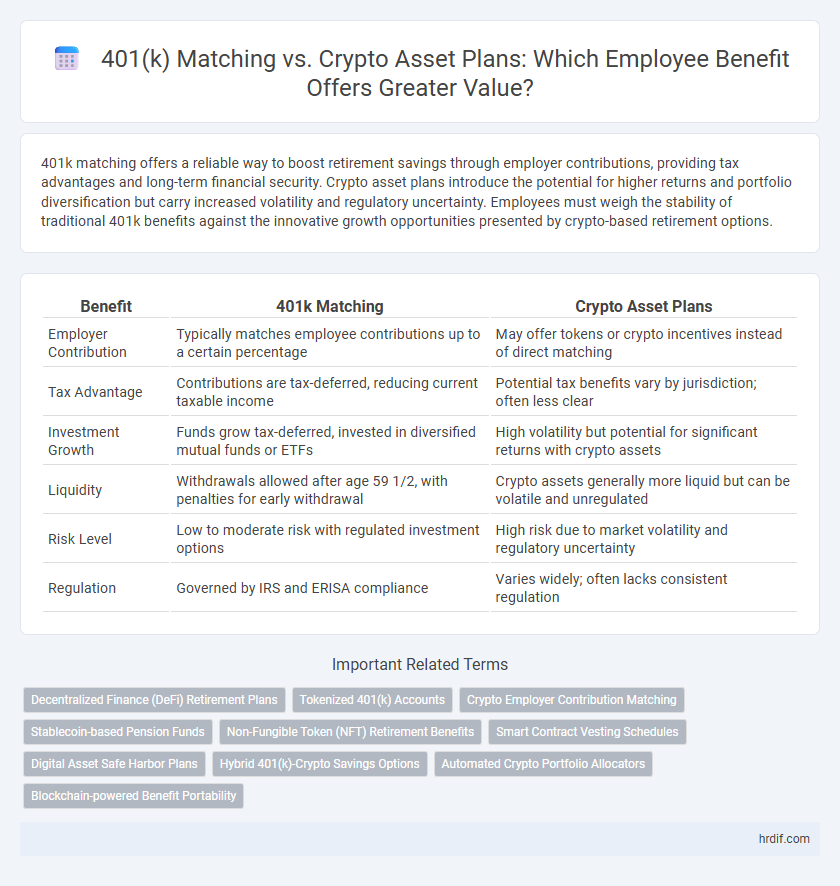

401k matching offers a reliable way to boost retirement savings through employer contributions, providing tax advantages and long-term financial security. Crypto asset plans introduce the potential for higher returns and portfolio diversification but carry increased volatility and regulatory uncertainty. Employees must weigh the stability of traditional 401k benefits against the innovative growth opportunities presented by crypto-based retirement options.

Table of Comparison

| Benefit | 401k Matching | Crypto Asset Plans |

|---|---|---|

| Employer Contribution | Typically matches employee contributions up to a certain percentage | May offer tokens or crypto incentives instead of direct matching |

| Tax Advantage | Contributions are tax-deferred, reducing current taxable income | Potential tax benefits vary by jurisdiction; often less clear |

| Investment Growth | Funds grow tax-deferred, invested in diversified mutual funds or ETFs | High volatility but potential for significant returns with crypto assets |

| Liquidity | Withdrawals allowed after age 59 1/2, with penalties for early withdrawal | Crypto assets generally more liquid but can be volatile and unregulated |

| Risk Level | Low to moderate risk with regulated investment options | High risk due to market volatility and regulatory uncertainty |

| Regulation | Governed by IRS and ERISA compliance | Varies widely; often lacks consistent regulation |

Understanding 401k Matching: Traditional Retirement Security

401k matching programs provide employees with a reliable, tax-advantaged way to grow retirement savings through employer contributions based on employee deferrals. This traditional benefit enhances long-term financial security by compounding investment returns within regulated retirement accounts, offering predictable growth and withdrawal options. Understanding the structure and limits of 401k matching helps employees maximize tax efficiency and retirement readiness.

Crypto Asset Plans: A Modern Alternative for Employees

Crypto asset plans offer employees a modern alternative to traditional 401k matching programs by enabling investments in digital currencies like Bitcoin and Ethereum, which have shown significant growth potential. These plans provide enhanced portfolio diversification and potential for higher returns, appealing to tech-savvy employees and those seeking innovative financial benefits. As corporate interest in blockchain technology expands, crypto asset plans are increasingly viewed as forward-thinking employee benefits that align with emerging market trends.

Comparing Growth Potential: 401k vs Crypto Assets

401k matching offers steady, long-term growth with tax advantages and employer contributions that enhance retirement savings consistently. Crypto assets present high volatility but potential for exponential returns, appealing to investors seeking aggressive growth beyond traditional portfolios. Balancing 401k stability with selective crypto exposure can optimize overall retirement benefit growth.

Risk Assessment: Volatility in Crypto vs Stability in 401k

401k matching plans offer consistent, regulated retirement benefits with historically stable returns and predictable growth, minimizing long-term investment risk. In contrast, crypto asset plans involve high volatility and unpredictable market swings, posing greater risk but potential for substantial gains. Evaluating risk tolerance is crucial when choosing between the reliable stability of 401k matching and the speculative nature of cryptocurrency investments.

Employer Contributions: Maximizing 401k Matching Benefits

Employer contributions in 401k matching plans significantly enhance retirement savings by directly increasing the employee's investment without additional cost. Maximizing 401k matching benefits ensures a guaranteed return and tax advantages, providing a stable foundation for long-term financial security compared to the volatility of crypto asset plans. Leveraging these employer-funded matches optimizes wealth accumulation and reduces retirement funding risk.

Tax Advantages: 401k Matching and Crypto Plans Explained

401k matching offers tax-deferred growth, allowing contributions to reduce taxable income while employer matches boost retirement savings without immediate tax liability. Crypto asset plans may provide tax advantages like potential capital gains treatment and opportunities for tax-loss harvesting, but they lack the guaranteed employer contributions found in 401k matching. Understanding the distinct tax implications of both options is crucial for optimizing long-term financial benefits.

Portability and Accessibility: Navigating Plan Flexibility

401(k) matching plans offer predictable growth with easy portability through rollovers to IRAs or new employers' plans, ensuring long-term retirement stability. Crypto asset plans provide dynamic accessibility and the ability to trade assets anytime but may face regulatory hurdles and limited acceptance across financial institutions. Balancing plan flexibility, 401(k) matching excels in seamless transfer options, while crypto plans deliver fast access and innovative portfolio diversification.

Future-Proofing Benefits: Crypto Assets in Evolving Markets

Crypto asset plans offer dynamic future-proofing benefits by leveraging blockchain technology for transparency and potential high returns in volatile markets. Unlike traditional 401k matching, crypto investments provide diversification opportunities tailored to evolving digital economies and emerging financial trends. Employers integrating crypto options demonstrate commitment to innovative retirement strategies, aligning employee benefits with next-generation asset growth.

Employee Preferences: Generational Shifts in Benefit Choices

Millennial and Gen Z employees increasingly favor crypto asset plans over traditional 401k matching due to their interest in digital currencies and potential high returns. Data shows younger generations prioritize flexibility and innovation in retirement benefits, reflecting a shift from conventional options toward blockchain-based investments. Employers adapting to these preferences can enhance recruitment and retention by offering hybrid plans that combine stable 401k matching with crypto asset opportunities.

Building a Comprehensive Benefits Package: 401k and Crypto Combined

Combining 401k matching with crypto asset plans enhances a comprehensive benefits package by diversifying retirement savings and investment opportunities for employees. This hybrid approach maximizes tax advantages through traditional retirement accounts while offering potential high-growth assets via cryptocurrencies. Employers attract and retain top talent by addressing varying risk tolerances and financial goals, ultimately fostering long-term financial wellness.

Related Important Terms

Decentralized Finance (DeFi) Retirement Plans

401k matching offers a traditional employer-sponsored retirement benefit with predictable contributions and tax advantages, whereas crypto asset plans within Decentralized Finance (DeFi) retirement options provide increased liquidity, decentralized control, and potential for higher yields through blockchain-based smart contracts. DeFi retirement plans enable users to diversify portfolios with tokenized assets and automated yield farming strategies, presenting innovative opportunities beyond conventional 401k structures.

Tokenized 401(k) Accounts

Tokenized 401(k) accounts blend traditional retirement savings with blockchain technology, offering enhanced transparency and liquidity compared to conventional 401(k) matching programs. These plans enable employees to diversify portfolios by integrating crypto assets while maintaining regulatory compliance and tax advantages inherent to 401(k) structures.

Crypto Employer Contribution Matching

Crypto employer contribution matching offers employees the potential for higher returns through exposure to appreciating digital assets, diversifying retirement portfolios beyond traditional 401k matching plans. This innovative benefit aligns with growing interest in blockchain technology, providing tax-advantaged growth opportunities and enhancing overall compensation packages.

Stablecoin-based Pension Funds

Stablecoin-based pension funds offer a hybrid approach to retirement benefits by combining the stability of fiat-pegged digital assets with potential yield generation, providing an alternative to traditional 401k matching programs. These plans leverage blockchain technology to ensure transparency, reduce fees, and enable easier asset liquidity compared to conventional retirement savings options.

Non-Fungible Token (NFT) Retirement Benefits

Non-Fungible Token (NFT) retirement benefits offer unique diversification opportunities compared to traditional 401k matching plans by allowing employees to invest in digital assets with potential for high long-term value appreciation. NFTs provide a novel way to enhance retirement portfolios through blockchain-secured ownership, increasing asset liquidity and offering exposure to emerging markets beyond conventional financial instruments.

Smart Contract Vesting Schedules

401k matching plans offer traditional retirement benefits with employer contributions tied to employee deferrals, while crypto asset plans utilize smart contract vesting schedules that automate and enforce gradual token release based on predefined conditions, enhancing transparency and flexibility. Smart contract vesting schedules minimize administrative overhead and reduce risk by ensuring precise, tamper-proof compliance with vesting terms, making them a cutting-edge alternative for employee benefit management.

Digital Asset Safe Harbor Plans

Digital Asset Safe Harbor Plans combine traditional 401k matching benefits with crypto asset investment opportunities, offering employees diversified retirement portfolios and potential tax advantages. These plans leverage regulatory compliance to provide safe harbor protections while enabling access to digital asset growth within employer-sponsored benefits.

Hybrid 401(k)-Crypto Savings Options

Hybrid 401(k)-crypto savings options combine traditional retirement plan benefits with exposure to cryptocurrency assets, offering diversified growth potential while maintaining tax-advantaged status. Employers matching contributions in both conventional 401(k) funds and crypto assets create innovative benefits that attract tech-savvy employees seeking long-term wealth accumulation.

Automated Crypto Portfolio Allocators

Automated crypto portfolio allocators in employee benefit programs offer dynamic diversification and real-time rebalancing, enhancing potential returns beyond traditional 401k matching schemes. These advanced algorithms optimize crypto asset allocation, reducing volatility and providing personalized growth strategies aligned with individual risk profiles.

Blockchain-powered Benefit Portability

Blockchain-powered benefit portability enhances 401k matching plans by enabling seamless transfer and real-time verification of assets across platforms, reducing administrative friction and increasing employee control. Crypto asset plans leverage decentralized ledgers to offer transparent, secure, and instantly accessible benefits, promoting greater flexibility compared to traditional 401k matching structures.

401k Matching vs Crypto Asset Plans for benefit. Infographic

hrdif.com

hrdif.com