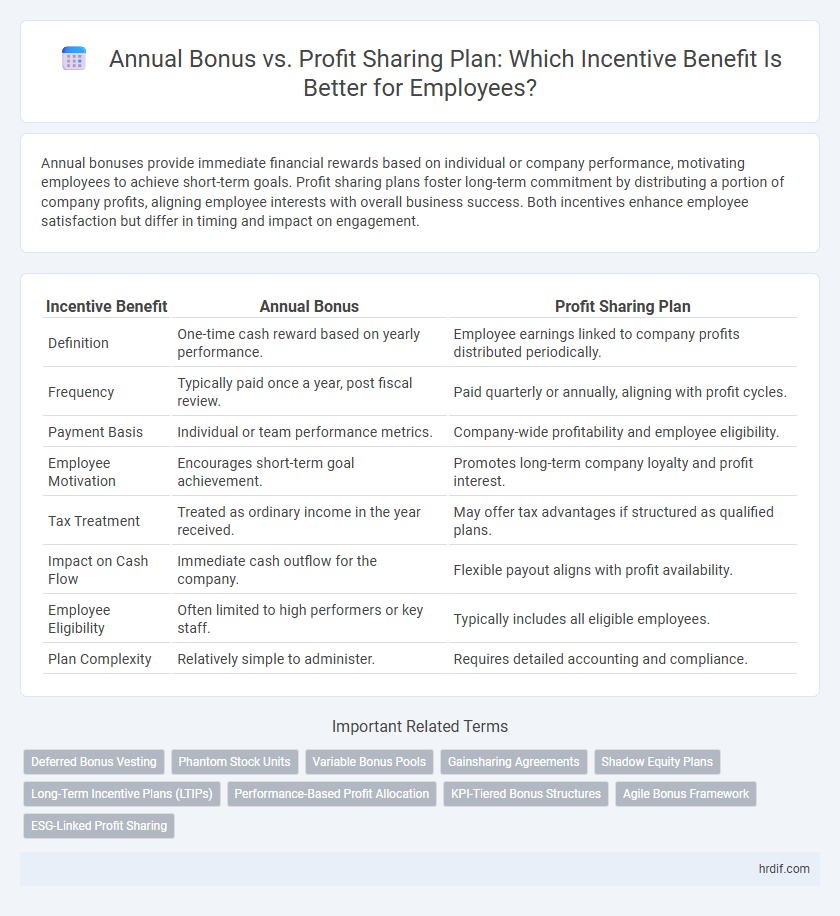

Annual bonuses provide immediate financial rewards based on individual or company performance, motivating employees to achieve short-term goals. Profit sharing plans foster long-term commitment by distributing a portion of company profits, aligning employee interests with overall business success. Both incentives enhance employee satisfaction but differ in timing and impact on engagement.

Table of Comparison

| Incentive Benefit | Annual Bonus | Profit Sharing Plan |

|---|---|---|

| Definition | One-time cash reward based on yearly performance. | Employee earnings linked to company profits distributed periodically. |

| Frequency | Typically paid once a year, post fiscal review. | Paid quarterly or annually, aligning with profit cycles. |

| Payment Basis | Individual or team performance metrics. | Company-wide profitability and employee eligibility. |

| Employee Motivation | Encourages short-term goal achievement. | Promotes long-term company loyalty and profit interest. |

| Tax Treatment | Treated as ordinary income in the year received. | May offer tax advantages if structured as qualified plans. |

| Impact on Cash Flow | Immediate cash outflow for the company. | Flexible payout aligns with profit availability. |

| Employee Eligibility | Often limited to high performers or key staff. | Typically includes all eligible employees. |

| Plan Complexity | Relatively simple to administer. | Requires detailed accounting and compliance. |

Understanding Annual Bonuses: Definition and Key Features

Annual bonuses are fixed incentive payments awarded to employees based on individual performance, company profitability, or predetermined targets. These bonuses provide immediate financial rewards, motivate employees, and enhance retention by recognizing short-term achievements. Key features include predetermined amounts or percentage of salary, clear performance criteria, and typically annual distribution.

What Is a Profit Sharing Plan? Core Principles Explained

A Profit Sharing Plan is a company-sponsored benefit that distributes a portion of business profits to employees, aligning their financial rewards directly with company performance. Core principles include contributions based on company earnings, flexibility in allocation methods, and potential tax advantages for both employers and employees. This plan incentivizes workforce productivity by linking compensation to overall profitability rather than fixed salary increases or annual bonuses.

How Annual Bonuses Motivate Employees

Annual bonuses directly reward employees based on individual or company performance, creating a clear link between effort and financial gain that enhances motivation. This immediate recognition of contributions encourages higher productivity and aligns employee goals with business objectives. Compared to profit sharing plans, annual bonuses offer more predictable and timely incentives, fostering sustained employee engagement and satisfaction.

Profit Sharing Plan: Driving Long-Term Engagement

Profit sharing plans enhance employee motivation by directly linking compensation to company performance, fostering a sense of ownership and alignment with long-term business goals. Unlike annual bonuses, which offer short-term rewards, profit sharing incentivizes sustained contribution and stability by distributing a portion of profits over time. This structure encourages employees to focus on collective success, driving engagement and retention through shared financial growth.

Annual Bonus vs Profit Sharing: Key Differences

Annual bonuses provide employees with fixed, predetermined rewards based on individual or company performance metrics, typically distributed annually. Profit-sharing plans allocate a portion of the company's profits among employees, linking compensation directly to organizational financial success and fostering collective ownership. Unlike annual bonuses, profit-sharing can vary significantly with company earnings, offering more fluctuating but potentially higher incentives aligned with long-term business growth.

Financial Impact on Employees: Bonus vs Profit Sharing

Annual bonuses provide employees with immediate financial rewards tied to individual or company performance, resulting in short-term income boosts and enhanced motivation. Profit sharing plans distribute a portion of company profits to employees, aligning their financial interests with long-term business success and potentially increasing overall earnings over time. Choosing between these incentives impacts employees' financial stability, with bonuses offering predictable payments and profit sharing introducing fluctuations based on company profitability.

Tax Implications: Annual Bonus and Profit Sharing Compared

Annual bonuses are typically taxed as ordinary income in the year they are received, subjecting employees to immediate income tax withholding and potentially higher marginal tax rates. Profit sharing plans often offer tax deferral benefits, allowing employees to delay taxation until funds are withdrawn, usually during retirement when income tax rates may be lower. Understanding the distinct tax implications of annual bonuses versus profit sharing can help both employers and employees optimize their incentive compensation strategies for maximum financial efficiency.

Employer Considerations: Choosing the Right Incentive

Employers must evaluate cash flow stability and long-term financial goals when choosing between annual bonuses and profit-sharing plans, as bonuses provide immediate rewards while profit-sharing aligns employee incentives with company profitability. Profit-sharing plans can improve employee retention by fostering a sense of ownership, whereas annual bonuses offer flexibility in merit-based recognition. Selecting the appropriate incentive depends on the company's size, industry volatility, and desired impact on workforce motivation and engagement.

Employee Preferences: Which Benefit Do Workers Value More?

Employees often prefer annual bonuses over profit-sharing plans due to the immediate and guaranteed nature of the payout, which provides a clear reward for individual performance within a specific period. Profit-sharing plans, while potentially more lucrative in profitable years, carry uncertainty and depend heavily on company financial success, making them less attractive to workers seeking predictable income boosts. Surveys indicate that workers value the consistency and direct link to their efforts found in annual bonuses more than the long-term, variable benefits of profit-sharing programs.

Maximizing Incentive Effectiveness: Best Practices for Implementation

Maximizing incentive effectiveness requires aligning annual bonuses with clearly defined performance metrics to ensure immediate motivation, while integrating profit sharing plans fosters long-term engagement by linking employee rewards to company success. Combining these incentives allows organizations to balance short-term achievements with sustained growth, enhancing overall productivity and retention. Implementing transparent communication and regular performance reviews strengthens employee understanding and commitment to both incentive structures.

Related Important Terms

Deferred Bonus Vesting

Deferred bonus vesting in annual bonus plans typically requires employees to meet specific tenure or performance milestones before receiving full payout, incentivizing long-term commitment and aligned goals. Profit sharing plans often distribute earnings based on company profitability, with vesting schedules tied to sustained profitability and employee retention, enhancing motivation for ongoing business success.

Phantom Stock Units

Phantom Stock Units offer a unique incentive benefit by providing employees with the value appreciation of company shares without actual equity transfer, combining elements of both annual bonuses and profit sharing plans to align employee interests with company performance. Unlike traditional annual bonuses that are fixed or profit sharing plans that depend solely on company profits, Phantom Stock Units deliver potential long-term value tied directly to stock price growth, enhancing retention and motivation.

Variable Bonus Pools

Variable bonus pools in annual bonus plans offer employees fixed incentives based on individual or company performance metrics, providing predictable rewards within a specified period. Profit-sharing plans allocate a portion of company profits to employees, creating variable bonuses that directly link employee earnings to overall business success and financial health.

Gainsharing Agreements

Annual bonuses offer fixed incentive amounts based on individual or company performance metrics, while profit sharing plans distribute a portion of company profits to employees, directly aligning their earnings with business success. Gainsharing agreements enhance these incentives by incorporating collaborative performance improvements, encouraging teams to increase productivity and share financial benefits from cost savings or efficiency gains.

Shadow Equity Plans

Shadow equity plans provide employees with financial incentives linked to company valuation without actual stock ownership, serving as a hybrid between annual bonuses and profit-sharing plans. Unlike annual bonuses that offer fixed rewards and profit-sharing plans that depend on company profits, shadow equity aligns employee interests with long-term company growth and value appreciation.

Long-Term Incentive Plans (LTIPs)

Annual bonuses provide immediate financial rewards based on short-term performance metrics, whereas profit sharing plans align employee incentives with company profitability over time, fostering long-term value creation. Long-Term Incentive Plans (LTIPs) often incorporate profit sharing elements to motivate sustained employee engagement and retention by linking compensation directly to the company's long-term success.

Performance-Based Profit Allocation

Performance-based profit allocation enhances employee motivation by directly linking rewards to company profitability, ensuring bonuses reflect actual financial outcomes rather than predetermined amounts. Unlike fixed annual bonuses, profit sharing plans foster a sense of ownership and encourage sustained performance by distributing a portion of profits proportionally among employees.

KPI-Tiered Bonus Structures

KPI-tiered bonus structures in annual bonuses provide clear performance targets linked to specific metrics, driving individual accountability and motivation through graduated reward levels. Profit sharing plans distribute company earnings based on overall profitability, fostering collective ownership but may lack the direct performance alignment of tiered bonus incentives.

Agile Bonus Framework

The Agile Bonus Framework enhances incentive benefits by combining the immediate rewards of an Annual Bonus with the long-term gains of a Profit Sharing Plan, promoting both short-term performance and sustained company growth. This hybrid approach aligns employee motivation with business objectives, fostering agility and adaptability in rewarding contributions.

ESG-Linked Profit Sharing

ESG-linked profit sharing plans align employee incentives with environmental, social, and governance performance, promoting sustainable business practices while enhancing corporate responsibility. Unlike traditional annual bonuses, these plans tie compensation directly to measurable ESG outcomes, driving long-term value creation and stakeholder trust.

Annual Bonus vs Profit Sharing Plan for incentive benefits. Infographic

hrdif.com

hrdif.com