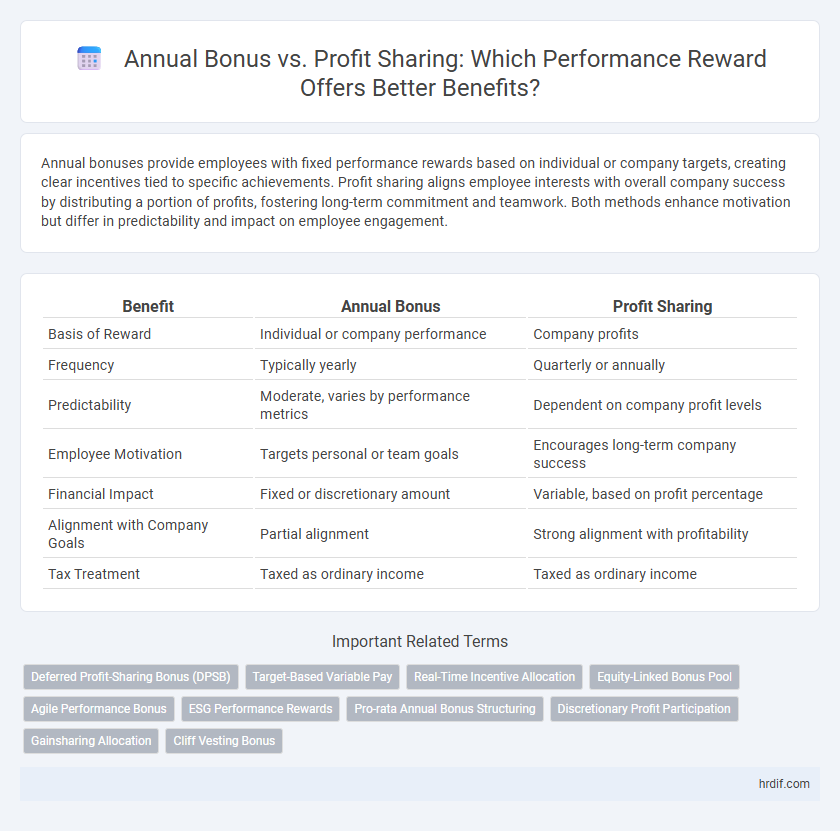

Annual bonuses provide employees with fixed performance rewards based on individual or company targets, creating clear incentives tied to specific achievements. Profit sharing aligns employee interests with overall company success by distributing a portion of profits, fostering long-term commitment and teamwork. Both methods enhance motivation but differ in predictability and impact on employee engagement.

Table of Comparison

| Benefit | Annual Bonus | Profit Sharing |

|---|---|---|

| Basis of Reward | Individual or company performance | Company profits |

| Frequency | Typically yearly | Quarterly or annually |

| Predictability | Moderate, varies by performance metrics | Dependent on company profit levels |

| Employee Motivation | Targets personal or team goals | Encourages long-term company success |

| Financial Impact | Fixed or discretionary amount | Variable, based on profit percentage |

| Alignment with Company Goals | Partial alignment | Strong alignment with profitability |

| Tax Treatment | Taxed as ordinary income | Taxed as ordinary income |

Understanding Annual Bonuses in the Workplace

Annual bonuses provide employees with a predetermined financial reward based on individual or company performance metrics, serving as an immediate recognition tool. These bonuses are typically calculated as a percentage of salary, motivating employees to meet short-term goals and enhancing job satisfaction. Unlike profit sharing, annual bonuses offer more predictable compensation, aiding in financial planning and reinforcing a performance-driven culture.

What Is Profit Sharing and How Does It Work?

Profit sharing is a compensation strategy where companies distribute a portion of their profits to employees, aligning team performance with business success. This method motivates employees by creating a direct link between individual contributions and company profitability, often paid as a percentage of salary or a fixed amount based on profit levels. Unlike fixed annual bonuses, profit sharing fluctuates with the company's earnings, encouraging sustained productivity and long-term commitment.

Key Differences Between Annual Bonuses and Profit Sharing

Annual bonuses are fixed incentives typically based on individual or company performance during a specific year, providing immediate financial rewards. Profit sharing distributes a portion of company profits to employees, aligning compensation with overall business success and fostering long-term commitment. The key difference lies in timing and dependency: bonuses are often predetermined and short-term, while profit sharing fluctuates with company profitability and promotes collective interest.

Financial Impact on Employees: Bonus vs. Profit Sharing

Annual bonuses provide employees with immediate, predictable financial rewards based on individual or company performance, enhancing short-term motivation and cash flow. Profit sharing aligns employee interests with company profitability by distributing a portion of earnings, fostering long-term commitment and potentially yielding higher cumulative financial benefits. Evaluating the financial impact involves comparing guaranteed lump-sum payments from bonuses against variable, performance-tied profit sharing that can fluctuate with business results.

Motivational Effects of Annual Bonuses vs. Profit Sharing

Annual bonuses provide immediate financial gratification that directly correlates with individual performance, boosting short-term motivation and encouraging goal-oriented behavior. Profit sharing fosters a collective sense of ownership by linking rewards to company-wide success, promoting teamwork and long-term commitment. Both mechanisms enhance employee engagement, but annual bonuses tend to drive sharper focus on personal targets, while profit sharing cultivates loyalty through shared financial outcomes.

Short-Term vs. Long-Term Employee Incentives

Annual bonuses provide immediate financial rewards tied to short-term performance metrics, boosting motivation and retention in the current fiscal year. Profit sharing aligns employees with long-term company success by distributing a portion of profits, encouraging sustained commitment and collective ownership. Balancing these incentives helps companies optimize workforce productivity and loyalty across different performance horizons.

Tax Implications for Bonuses and Profit Sharing

Annual bonuses are typically taxed as ordinary income in the year they are received, subject to federal and state income taxes and payroll taxes such as Social Security and Medicare. Profit sharing contributions may be tax-deferred if placed into qualified retirement plans like 401(k)s, reducing current taxable income until withdrawal. Understanding these tax implications helps employees and employers optimize compensation packages for performance rewards effectively.

Which Industries Prefer Annual Bonuses or Profit Sharing?

Tech and finance industries often prefer annual bonuses to reward individual performance and retain top talent through immediate cash incentives. Manufacturing and retail sectors lean towards profit sharing to foster teamwork and align employee goals with company profitability, promoting long-term commitment. Service industries may use a hybrid approach, combining both methods to balance short-term motivation and shared success.

Employee Preferences: Surveys and Research Insights

Employee preferences reveal a strong inclination towards annual bonuses for immediate financial recognition, with 68% of surveyed workers favoring this method over profit sharing. Research indicates that while profit sharing fosters long-term engagement, 54% of employees express uncertainty about its direct impact on their personal rewards. Studies also show clear demographic variations, where younger employees prioritize annual bonuses for short-term gains, whereas older employees value profit sharing as a retirement supplement.

Choosing the Right Performance Reward for Your Business

Choosing the right performance reward between an annual bonus and profit sharing depends on your business goals and employee motivation. Annual bonuses provide fixed incentives tied to individual or company performance, fostering short-term productivity, while profit sharing aligns employees with long-term business success by distributing a portion of profits. Evaluating your company's financial stability, culture, and desired employee engagement will help determine the most effective reward strategy.

Related Important Terms

Deferred Profit-Sharing Bonus (DPSB)

Deferred Profit-Sharing Bonus (DPSB) offers long-term financial incentives by allocating a portion of company profits to employee bonuses, which are paid out after a set vesting period, enhancing retention and alignment with corporate performance. Unlike annual bonuses that reward short-term achievements, DPSB emphasizes sustained company growth, promoting employee commitment and shared success over multiple years.

Target-Based Variable Pay

Target-based variable pay through annual bonuses provides employees with clear, measurable goals and immediate financial incentives linked directly to individual or team performance metrics. Profit sharing aligns employees' interests with overall company success, distributing a portion of profits as rewards, which can foster long-term commitment but may result in less predictable compensation compared to annual bonuses.

Real-Time Incentive Allocation

Annual bonuses provide fixed rewards based on predetermined metrics, while profit sharing enables real-time incentive allocation by directly linking employee compensation to the company's ongoing financial performance. Real-time profit sharing enhances motivation and aligns employee efforts with business goals, fostering a dynamic and responsive reward system.

Equity-Linked Bonus Pool

Equity-linked bonus pools align employee rewards with company performance by distributing shares or stock options based on profitability, enhancing long-term commitment and ownership. Annual bonuses provide fixed cash rewards tied to individual or company performance but lack the direct equity stake that profit sharing through equity can offer for sustained motivation.

Agile Performance Bonus

Agile Performance Bonus programs deliver targeted, flexible incentives by aligning rewards with real-time achievements and project milestones, enhancing motivation and responsiveness in dynamic work environments. Compared to traditional Annual Bonus or Profit Sharing, agile bonuses enable timely recognition of individual and team contributions, driving continuous improvement and superior organizational performance.

ESG Performance Rewards

Annual bonuses tied to ESG performance provide immediate recognition of individual contributions to environmental, social, and governance goals, incentivizing employees to align with corporate sustainability strategies. Profit sharing based on ESG metrics fosters long-term commitment by rewarding collective success in achieving measurable sustainability targets, enhancing overall corporate responsibility and stakeholder value.

Pro-rata Annual Bonus Structuring

Pro-rata annual bonus structuring ensures equitable performance rewards by aligning bonus payouts with the exact duration of employee participation during the fiscal year, enhancing motivation and retention. This approach contrasts with profit sharing, which distributes earnings based on overall company profitability, making pro-rata bonuses more predictable and directly tied to individual performance metrics.

Discretionary Profit Participation

Discretionary profit participation offers employees variable rewards tied directly to company profitability, aligning individual incentives with business success and promoting a collaborative work environment. Unlike fixed annual bonuses, this approach enhances motivation through transparent profit allocation, fostering long-term commitment and financial engagement.

Gainsharing Allocation

Gainsharing allocation in profit sharing directly links employee rewards to company performance metrics, fostering a collective focus on productivity and profitability. Unlike annual bonuses, which are typically fixed or discretionary, gainsharing adjusts payouts based on measurable performance improvements, enhancing motivation and aligning incentives with organizational goals.

Cliff Vesting Bonus

Cliff vesting bonuses provide employees with full ownership of performance rewards after a set period, offering strong retention incentives compared to annual bonuses that are paid out regardless of tenure. Profit sharing tied to cliff vesting encourages long-term commitment by aligning rewards directly with company profitability and employee loyalty.

Annual Bonus vs Profit Sharing for Performance Rewards. Infographic

hrdif.com

hrdif.com