Salary provides a stable and predictable income, ensuring financial security regardless of company performance, while stakeholder bonuses directly link rewards to individual or team achievements, motivating higher performance. Employers often balance salary with bonuses to attract talent and incentivize productivity, aligning employee interests with company success. Performance-based bonuses can drive engagement but may fluctuate, making a reliable salary essential for employee satisfaction.

Table of Comparison

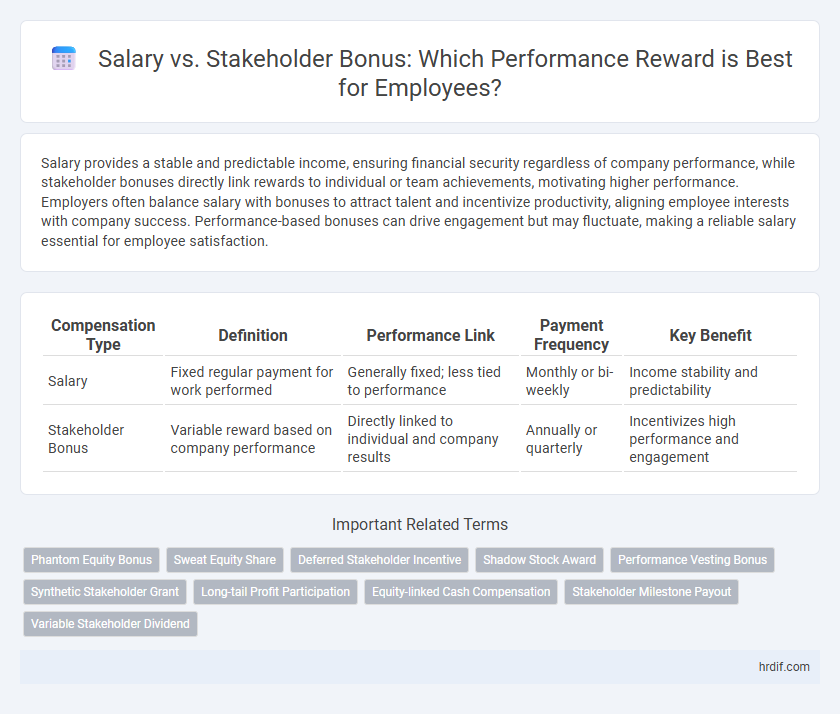

| Compensation Type | Definition | Performance Link | Payment Frequency | Key Benefit |

|---|---|---|---|---|

| Salary | Fixed regular payment for work performed | Generally fixed; less tied to performance | Monthly or bi-weekly | Income stability and predictability |

| Stakeholder Bonus | Variable reward based on company performance | Directly linked to individual and company results | Annually or quarterly | Incentivizes high performance and engagement |

Introduction: Understanding Salary and Stakeholder Bonus

Salary is a fixed regular payment, typically expressed as an annual amount, that employees receive for their work regardless of company performance. Stakeholder bonuses are variable rewards linked to individual or organizational achievements, designed to align employee incentives with business success. Understanding the distinction between guaranteed salary and performance-based stakeholder bonuses is key for effective compensation management and motivating workforce productivity.

Defining Salary and Stakeholder Bonus

Salary refers to a fixed, regular payment typically disbursed monthly or biweekly to employees as compensation for their work. Stakeholder Bonus is a variable reward linked to company performance and stakeholder value, distributed based on achieving specific business goals or financial targets. Understanding the distinction helps align employee incentives with organizational success and personal financial stability.

Fixed Compensation vs Performance-Based Rewards

Fixed salary provides employees with stable, predictable income regardless of company performance, ensuring financial security and steady budgeting for both employees and employers. Stakeholder bonuses, tied directly to individual or company performance metrics, incentivize higher productivity and align employee interests with organizational goals. Balancing fixed compensation with performance-based rewards optimizes motivation while maintaining baseline financial stability.

Financial Security: Salary Stability Compared to Bonuses

Salary provides consistent financial security by offering a fixed income that supports everyday living expenses and long-term budgeting. Stakeholder bonuses, though potentially lucrative, introduce variability and uncertainty, making it challenging to rely on them for essential financial commitments. Stable salaries form a reliable foundation for financial planning, while bonuses serve as supplementary rewards tied to company performance.

Motivational Impact: Salaries Versus Variable Incentives

Fixed salaries provide consistent financial security that fosters employee loyalty and stable motivation, while stakeholder bonuses linked to performance create strong incentives for exceeding targets by directly rewarding individual or team achievements. Variable incentives such as bonuses enhance motivation by aligning employee goals with company success, encouraging proactive behavior and higher productivity. Combining competitive salaries with performance-based bonuses effectively balances stability and motivation, driving sustained organizational performance.

Aligning Employee Goals with Organizational Success

Salary provides a stable and predictable income that supports employee retention and motivation, while stakeholder bonuses directly tie financial rewards to organizational performance, encouraging employees to prioritize company success. Performance-based bonuses align employee objectives with key business outcomes, fostering a shared commitment to achieving corporate goals. Integrating salary with stakeholder bonuses creates a balanced compensation strategy that drives engagement, productivity, and long-term growth.

Tax Implications: Regular Salary Versus Bonuses

Regular salary payments are subject to standard income tax withholding and Social Security contributions, providing consistent tax planning for employees. Stakeholder bonuses, often treated as supplemental income, may face higher withholding rates, potentially increasing the immediate tax burden. Employers must carefully structure these bonuses to optimize tax efficiency and employee net income.

Retention Strategies: Salary Increases vs Bonus Incentives

Salary increases provide long-term financial security that strengthens employee retention by fostering loyalty and stability, while stakeholder bonuses offer short-term performance rewards that motivate immediate results but may not guarantee sustained commitment. Companies aiming to enhance retention often prioritize structured salary growth to build trust and reduce turnover, whereas bonuses serve as supplementary incentives to recognize exceptional achievements. Balancing these compensation methods strategically aligns employee interests with organizational goals, optimizing both motivation and retention outcomes.

Employee Perceptions: Fairness and Transparency

Employees often perceive salary as a consistent and transparent form of compensation, providing a clear baseline for their financial security, whereas stakeholder bonuses can evoke mixed reactions due to their variability and perceived subjectivity. Fairness concerns arise when bonus criteria lack transparency or appear biased, potentially undermining motivation and trust in performance rewards. Transparent communication of bonus policies and objective performance metrics enhances employee confidence in the equity of rewards compared to fixed salary structures.

Choosing the Right Model: Industry Best Practices

Selecting between salary increments and stakeholder bonuses for performance rewards depends on aligning compensation with company goals and employee motivation. Industry best practices suggest using salary increases for long-term talent retention and stability, while stakeholder bonuses effectively drive short-term performance and align employees' interests with organizational success. Combining both models can optimize incentive programs, balancing guaranteed income with performance-driven rewards to enhance overall engagement and productivity.

Related Important Terms

Phantom Equity Bonus

Phantom Equity Bonuses offer performance rewards aligned with company valuation growth without diluting ownership, providing a tax-efficient alternative to direct salary increases for stakeholders. This compensation method motivates key contributors by simulating equity benefits, ensuring long-term value creation while maintaining cash flow stability.

Sweat Equity Share

Sweat equity shares align employee incentives with company growth by granting ownership stakes linked to performance, offering long-term value beyond fixed salary compensation. Unlike stakeholder bonuses, which provide immediate but often short-term rewards, sweat equity fosters commitment by directly correlating efforts with equity appreciation.

Deferred Stakeholder Incentive

Deferred stakeholder incentives align employee performance with long-term company goals by offering bonuses tied to sustained success rather than immediate salary increases. This approach enhances retention and encourages a focus on value creation, contrasting with traditional salary-based rewards that prioritize short-term achievements.

Shadow Stock Award

Shadow Stock Awards provide performance-based rewards by granting employees value-linked units that mirror company stock without actual equity ownership, enabling direct alignment with stakeholder interests without immediate cash outflow. Unlike fixed salaries or traditional stakeholder bonuses, Shadow Stock Awards incentivize long-term commitment and company growth by allowing employees to benefit from stock value appreciation upon vesting or liquidity events.

Performance Vesting Bonus

Performance vesting bonuses align employee rewards directly with company milestones, ensuring compensation grows with measurable contributions rather than fixed salary increments. Unlike traditional salary or stakeholder bonuses, performance vesting bonuses incentivize long-term commitment by granting rewards only when predetermined goals are achieved.

Synthetic Stakeholder Grant

Synthetic Stakeholder Grants offer performance rewards that align employee incentives with company success, often providing more substantial long-term gains than fixed salaries. Unlike traditional stakeholder bonuses, these synthetic grants simulate equity ownership without diluting company shares, enhancing motivation and retention.

Long-tail Profit Participation

Salary ensures consistent income regardless of company performance, while stakeholder bonuses tied to long-tail profit participation align employee rewards with sustained profitability over multiple fiscal periods, incentivizing long-term value creation and enhancing retention among key contributors. This performance reward approach leverages delayed profit-sharing structures to motivate ongoing commitment and strategic decision-making beyond immediate financial gains.

Equity-linked Cash Compensation

Equity-linked cash compensation aligns employee incentives with company performance more effectively than traditional fixed salaries by offering bonuses tied to shareholder value and stock price appreciation. This approach enhances long-term motivation and retention among key stakeholders, bridging the gap between immediate salary rewards and lasting financial gains.

Stakeholder Milestone Payout

Stakeholder Milestone Payouts incentivize performance by directly aligning rewards with specific project achievements, often resulting in higher motivation and accountability than fixed salaries. These milestone-based bonuses provide flexible, outcome-driven compensation that can outperform traditional salary structures in driving team productivity and meeting strategic goals.

Variable Stakeholder Dividend

Variable Stakeholder Dividend aligns performance rewards with company success, offering a flexible complement to fixed salary by distributing profits based on stakeholder impact. This dividend model incentivizes long-term value creation and directly ties compensation to stakeholder contributions rather than static salary increments.

Salary vs Stakeholder Bonus for performance rewards. Infographic

hrdif.com

hrdif.com