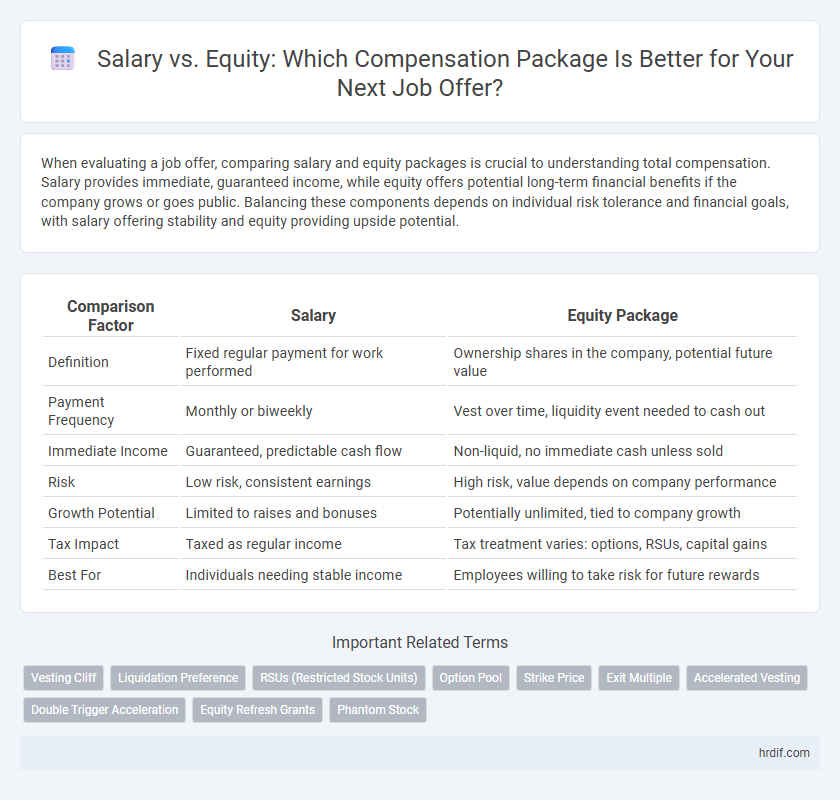

When evaluating a job offer, comparing salary and equity packages is crucial to understanding total compensation. Salary provides immediate, guaranteed income, while equity offers potential long-term financial benefits if the company grows or goes public. Balancing these components depends on individual risk tolerance and financial goals, with salary offering stability and equity providing upside potential.

Table of Comparison

| Comparison Factor | Salary | Equity Package |

|---|---|---|

| Definition | Fixed regular payment for work performed | Ownership shares in the company, potential future value |

| Payment Frequency | Monthly or biweekly | Vest over time, liquidity event needed to cash out |

| Immediate Income | Guaranteed, predictable cash flow | Non-liquid, no immediate cash unless sold |

| Risk | Low risk, consistent earnings | High risk, value depends on company performance |

| Growth Potential | Limited to raises and bonuses | Potentially unlimited, tied to company growth |

| Tax Impact | Taxed as regular income | Tax treatment varies: options, RSUs, capital gains |

| Best For | Individuals needing stable income | Employees willing to take risk for future rewards |

Understanding Salary vs Equity: Key Differences

Salary represents a fixed, guaranteed income paid regularly, while equity offers ownership stakes in the company that can appreciate in value over time. Equity packages often include stock options or shares that align employee incentives with company performance but carry higher risk compared to the stable cash flow of a salary. Evaluating a job offer requires balancing immediate financial needs from a salary against potential long-term wealth from equity growth.

Evaluating Immediate Compensation: Salary Considerations

Evaluating immediate compensation in a job offer requires a thorough analysis of the salary component, which provides guaranteed income and financial stability. Salary ensures predictable cash flow, essential for meeting daily expenses, saving, and planning short-term financial goals. When assessing the offer, consider salary benchmarks for the industry, location, and role to determine if the base pay aligns with market standards and your immediate financial needs.

Long-Term Rewards: How Equity Packages Work

Equity packages offer long-term rewards by granting employees ownership stakes that can appreciate significantly over time, aligning interests with company growth and success. Unlike fixed salaries, equity compensation often vests over several years, encouraging retention and sustained performance. This potential for substantial financial gain adds value beyond immediate monetary income, especially in startups or high-growth firms where stock value may increase exponentially.

Assessing Risk and Stability in Compensation

Evaluating a job offer requires careful assessment of salary versus equity package to balance immediate income with long-term financial gain. Salary provides predictable and stable cash flow, essential for covering living expenses and reducing financial stress. Equity offers potential for significant wealth if the company performs well but carries risks due to market volatility and uncertain liquidity events.

Tax Implications: Salary vs Equity Explained

A salary is subject to regular income tax rates, resulting in predictable tax liabilities each pay period, while equity compensation, such as stock options or restricted stock units (RSUs), is typically taxed upon vesting or exercise, potentially leading to capital gains tax advantages if held long-term. Equity packages can create significant tax planning opportunities but also carry risks of tax exposure without immediate cash liquidity. Understanding the timing and type of taxation on equity versus salary is crucial for maximizing overall compensation and minimizing unexpected tax burdens.

Negotiating Your Offer: Tips for Balancing Salary and Equity

Balancing salary and equity in a job offer requires understanding the long-term growth potential of the company's stock alongside immediate cash compensation. Negotiation strategies include researching market salary benchmarks, assessing the startup's valuation and equity vesting schedule, and clearly communicating your financial needs and risk tolerance. Prioritizing a mix that aligns with your career goals and financial security enhances both short-term income and potential future wealth.

Startup vs Corporate Offers: Which One Wins?

Startup job offers often include lower base salaries but compensate with equity packages that may significantly increase in value if the company succeeds; corporate offers typically provide higher and more stable salaries with limited or no equity options. Equity in startups offers potential for substantial long-term financial gain through stock options or shares, though it carries higher risk due to company volatility. Corporate roles deliver predictable income and benefits, appealing to professionals prioritizing immediate financial security over speculative future profits.

How Equity Impacts Career Growth and Wealth

Equity packages in job offers provide employees with ownership stakes, aligning their interests with the company's long-term success and potentially yielding significant financial gains through stock appreciation. Unlike fixed salaries, equity fosters wealth accumulation and incentivizes innovation, driving career growth by offering a direct share in the company's value creation. Understanding the balance between upfront salary and equity is crucial for optimizing income stability while maximizing future wealth and career advancement opportunities.

Real-World Scenarios: Salary and Equity Trade-offs

In real-world job offers, evaluating the trade-offs between salary and equity is crucial for financial planning and long-term wealth accumulation. A higher salary provides immediate, predictable income to cover living expenses, while equity offers potential future gains tied to company performance and growth. Candidates should assess their risk tolerance, financial needs, and the startup or company's growth prospects to balance guaranteed income against possible equity appreciation.

Making the Right Choice: Factors to Consider in Decision

Evaluating a job offer requires balancing the immediate financial security of a competitive salary against the potential long-term gains of an equity package, which can significantly increase net worth if the company performs well. Factors such as company stability, growth potential, risk tolerance, and personal financial goals should guide the decision-making process. Understanding tax implications and vesting schedules for equity is crucial for maximizing overall compensation benefits.

Related Important Terms

Vesting Cliff

A vesting cliff in an equity package delays the initial access to stock options, typically by one year, ensuring employees earn their shares through continued service, impacting overall compensation realization timing. Evaluating a salary versus equity package requires considering the vesting cliff's influence on liquidity and risk, as immediate cash salary offers stable income compared to the deferred and potentially fluctuating value of equity.

Liquidation Preference

A salary provides immediate, guaranteed income, while an equity package, often subject to a liquidation preference, offers potential upside based on company performance during exit events. Understanding liquidation preference is crucial as it determines the order and amount of payout equity holders receive before common shareholders in a liquidation or acquisition scenario.

RSUs (Restricted Stock Units)

Restricted Stock Units (RSUs) offer long-term financial growth potential by granting company shares that vest over time, complementing a base salary by aligning employee incentives with corporate performance. While a salary provides immediate, guaranteed income, RSUs can significantly increase total compensation value if the company's stock appreciates, balancing upfront cash needs with future wealth accumulation.

Option Pool

The option pool size directly impacts the equity percentage offered to employees, with larger pools diluting individual ownership but attracting top talent through shared company upside. A competitive salary combined with a well-structured option pool balance immediate financial needs and long-term wealth potential in job offers.

Strike Price

Evaluating a job offer requires careful consideration of the strike price within the equity package, as it determines the cost to buy stock options and directly affects potential financial gains. A lower strike price increases the likelihood of profitable exercise, making equity more valuable compared to a higher salary with no ownership stake.

Exit Multiple

Equity packages often provide significant upside potential tied to the company's exit multiple, meaning the ultimate value of stock options can vastly exceed initial salary compensation if the company achieves a high valuation at exit. Salary offers immediate, guaranteed income, while equity rewards depend on the success and exit multiple of the business, aligning employee incentives with long-term company performance.

Accelerated Vesting

Accelerated vesting in equity packages provides employees with quicker access to stock options or shares, often triggered by events such as company acquisition or termination without cause, enhancing the overall compensation value compared to a fixed salary. This feature can significantly increase total remuneration, especially in startups or high-growth companies, making equity an attractive component alongside base salary.

Double Trigger Acceleration

Double Trigger Acceleration significantly enhances the value of equity packages by enabling employees to vest shares rapidly upon two specific events, usually a company acquisition followed by termination without cause. Comparing salary versus equity, candidates should consider how double trigger acceleration mitigates risk and increases financial upside beyond fixed salary compensation during corporate transitions.

Equity Refresh Grants

Equity refresh grants provide employees the opportunity to increase their ownership stake over time, often aligning long-term incentives with company performance beyond the initial equity package at hire. Compared to a higher immediate salary, these refresh grants can significantly enhance total compensation through potential appreciation in stock value, especially in high-growth companies.

Phantom Stock

Phantom stock offers employees the financial benefits tied to company equity without granting actual shares, providing a salary complement with potential future value based on company performance. This arrangement can enhance overall compensation by aligning incentives with long-term growth while preserving cash flow compared to direct salary increases.

Salary vs Equity Package for job offer. Infographic

hrdif.com

hrdif.com