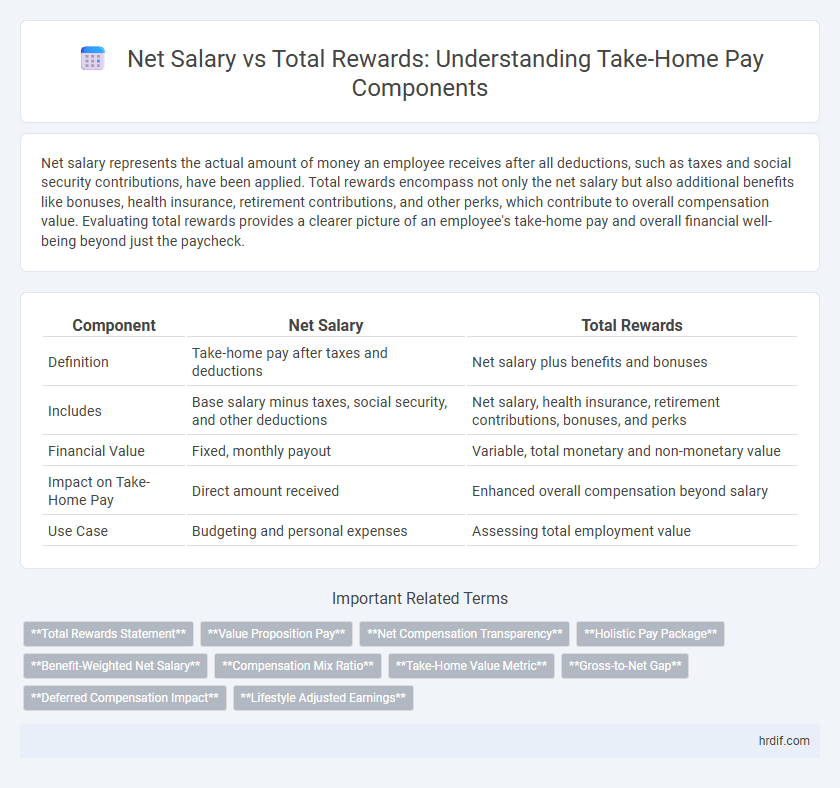

Net salary represents the actual amount of money an employee receives after all deductions, such as taxes and social security contributions, have been applied. Total rewards encompass not only the net salary but also additional benefits like bonuses, health insurance, retirement contributions, and other perks, which contribute to overall compensation value. Evaluating total rewards provides a clearer picture of an employee's take-home pay and overall financial well-being beyond just the paycheck.

Table of Comparison

| Component | Net Salary | Total Rewards |

|---|---|---|

| Definition | Take-home pay after taxes and deductions | Net salary plus benefits and bonuses |

| Includes | Base salary minus taxes, social security, and other deductions | Net salary, health insurance, retirement contributions, bonuses, and perks |

| Financial Value | Fixed, monthly payout | Variable, total monetary and non-monetary value |

| Impact on Take-Home Pay | Direct amount received | Enhanced overall compensation beyond salary |

| Use Case | Budgeting and personal expenses | Assessing total employment value |

Understanding Net Salary: What You Really Take Home

Net salary represents the actual amount employees receive after all mandatory deductions such as taxes, social security, and health insurance contributions are subtracted from the gross salary. Understanding net salary is crucial for employees to accurately assess their take-home pay, budget effectively, and compare job offers. Total rewards encompass net salary plus additional benefits like bonuses, retirement contributions, and paid leave, offering a comprehensive view of overall compensation beyond just take-home pay.

Beyond the Paycheck: Defining Total Rewards

Total rewards encompass more than net salary by including benefits such as health insurance, retirement plans, bonuses, and paid time off, all of which contribute to overall employee compensation. These components enhance the value of take-home pay by offering financial security, work-life balance, and long-term savings opportunities. Understanding total rewards allows employees to appreciate the full scope of their compensation package beyond just the money deposited in their account.

Net Salary vs Total Rewards: Key Differences

Net salary refers to the actual amount an employee receives after taxes, deductions, and withholdings, representing the take-home pay. Total rewards encompass not only net salary but also benefits such as health insurance, retirement contributions, bonuses, and other non-cash compensations that contribute to the overall value of an employee's package. Understanding the key differences between net salary and total rewards is essential for evaluating the true compensation and making informed financial decisions.

Components of Net Salary: What’s Included?

Net salary includes base salary, bonuses, and allowances after deductions such as income tax, social security, and retirement contributions, representing the actual take-home pay. Components like health insurance premiums or loan repayments may also be deducted, further affecting the net amount received by employees. Understanding these elements clarifies the distinction between net salary and total rewards, which encompass non-monetary benefits beyond take-home pay.

Elements of Total Rewards: More Than Money

Net salary represents the actual take-home pay after deducting taxes and benefits, while total rewards encompass a broader range of compensation elements beyond base salary. These elements include bonuses, health insurance, retirement contributions, paid time off, and other non-monetary benefits that significantly enhance an employee's overall compensation package. Understanding total rewards provides a clearer picture of the true value employees receive, which often exceeds their net salary alone.

How Benefits Impact Your Real Income

Net salary represents the actual take-home pay after taxes and deductions, but total rewards encompass both net salary and the monetary value of benefits like health insurance, retirement contributions, and bonuses. Benefits significantly impact real income by reducing out-of-pocket expenses and enhancing financial security, effectively increasing overall compensation beyond the paycheck. Evaluating total rewards provides a clearer picture of true earnings and long-term financial well-being.

Evaluating Job Offers: Looking Past Net Salary

Evaluating job offers requires analyzing total rewards beyond net salary to understand true take-home value, including benefits like health insurance, retirement plans, bonuses, and stock options. These components can significantly boost overall compensation and improve financial security, often exceeding the immediate paycheck. Considering factors such as tax implications, job stability, and work-life balance ensures a comprehensive assessment of the total rewards package.

Comparing Net Salary Across Employers

Net salary, representing actual take-home pay after taxes and deductions, often varies significantly across employers even when total rewards packages appear similar. Employers with comparable gross salaries may offer different benefits, bonuses, and allowances, affecting the net salary and overall financial outcome for employees. Understanding these differences is crucial for accurately comparing take-home pay and evaluating true compensation value.

Prioritizing Total Rewards in Career Decisions

Net salary represents the actual take-home pay after taxes and deductions, while total rewards encompass the full value of compensation, including bonuses, benefits, stock options, and retirement plans. Prioritizing total rewards in career decisions ensures a comprehensive understanding of financial and non-financial benefits that impact long-term wealth and job satisfaction. Evaluating total rewards alongside net salary provides a clearer picture of overall compensation and supports informed career growth choices.

Maximizing Your Take-Home Value

Maximizing your take-home value involves understanding the distinction between net salary and total rewards to fully appreciate your compensation package. Net salary refers to the amount received after taxes and deductions, while total rewards include benefits like health insurance, retirement contributions, bonuses, and stock options, which add significant monetary value. Evaluating both components helps employees optimize financial planning and make informed decisions about job offers and career growth.

Related Important Terms

Total Rewards Statement

A Total Rewards Statement provides a comprehensive overview of an employee's full compensation package, including base salary, bonuses, benefits, retirement contributions, and other perks, offering a clearer picture than net salary alone. This detailed summary helps employees understand the true value of their take-home pay by quantifying both direct earnings and indirect financial benefits.

Value Proposition Pay

Value Proposition Pay encompasses not only net salary but also the total rewards package, including benefits, bonuses, and incentives that enhance employee take-home pay value. This comprehensive approach emphasizes the overall compensation experience rather than just base salary, driving employee satisfaction and retention.

Net Compensation Transparency

Net salary represents the actual take-home pay after deductions such as taxes and benefits, providing a clear figure for employees' immediate earnings. Total rewards encompass net salary plus additional benefits like bonuses, health insurance, and retirement contributions, offering a comprehensive view of net compensation transparency that helps employees understand their full financial value from employment.

Holistic Pay Package

Net salary reflects the actual take-home pay after taxes and deductions, while total rewards encompass the holistic pay package, including bonuses, benefits, retirement contributions, and non-monetary perks. Evaluating the holistic pay package provides a comprehensive understanding of an employee's overall financial and non-financial compensation beyond just net salary.

Benefit-Weighted Net Salary

Benefit-weighted net salary combines base pay with the monetary value of employee benefits, providing a more accurate measure of total take-home compensation. This approach helps employees understand the full economic value of their rewards package beyond direct cash salary.

Compensation Mix Ratio

The Compensation Mix Ratio plays a crucial role in determining net salary by balancing direct wages with indirect benefits like bonuses and health insurance, influencing the overall take-home pay. Understanding this ratio helps employees and employers optimize total rewards to align compensation strategies with financial and motivational goals.

Take-Home Value Metric

The Take-Home Value Metric measures net salary alongside comprehensive total rewards to provide a clearer picture of actual employee compensation after taxes, deductions, and benefits are accounted for. This metric emphasizes the true economic value employees receive, facilitating more informed decisions regarding job offers and compensation packages.

Gross-to-Net Gap

The gross-to-net gap highlights the difference between gross salary and net salary, reflecting mandatory deductions such as taxes, social security, and healthcare contributions that reduce take-home pay. Total rewards encompass not only net salary but also benefits, bonuses, and non-cash compensation, providing a more comprehensive view of an employee's overall remuneration.

Deferred Compensation Impact

Deferred compensation reduces the immediate net salary by allocating a portion of earnings to future benefits, impacting take-home pay calculations. Understanding this distinction is crucial for accurately assessing total rewards and long-term financial planning.

Lifestyle Adjusted Earnings

Lifestyle Adjusted Earnings measure take-home pay by factoring in net salary after taxes, benefits, and cost-of-living adjustments, providing a more accurate reflection of purchasing power and quality of life. This approach highlights the true value of total rewards beyond base salary, capturing how compensation translates into real-world financial flexibility.

Net Salary vs Total Rewards for take-home pay. Infographic

hrdif.com

hrdif.com