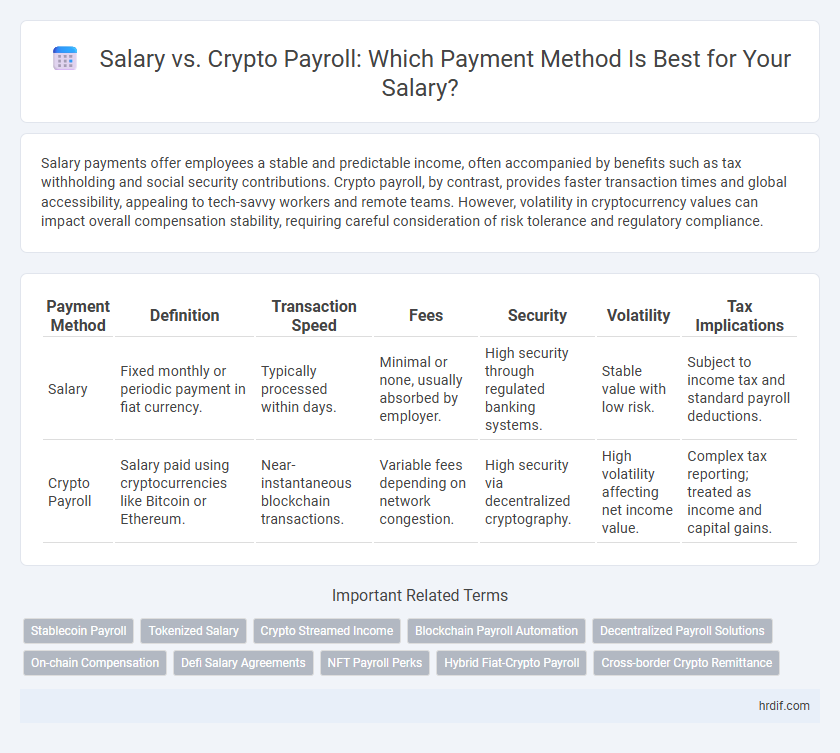

Salary payments offer employees a stable and predictable income, often accompanied by benefits such as tax withholding and social security contributions. Crypto payroll, by contrast, provides faster transaction times and global accessibility, appealing to tech-savvy workers and remote teams. However, volatility in cryptocurrency values can impact overall compensation stability, requiring careful consideration of risk tolerance and regulatory compliance.

Table of Comparison

| Payment Method | Definition | Transaction Speed | Fees | Security | Volatility | Tax Implications |

|---|---|---|---|---|---|---|

| Salary | Fixed monthly or periodic payment in fiat currency. | Typically processed within days. | Minimal or none, usually absorbed by employer. | High security through regulated banking systems. | Stable value with low risk. | Subject to income tax and standard payroll deductions. |

| Crypto Payroll | Salary paid using cryptocurrencies like Bitcoin or Ethereum. | Near-instantaneous blockchain transactions. | Variable fees depending on network congestion. | High security via decentralized cryptography. | High volatility affecting net income value. | Complex tax reporting; treated as income and capital gains. |

Traditional Salary vs Crypto Payroll: Key Differences

Traditional salary payments offer fixed, predictable income, regulated by labor laws and typically disbursed through direct deposit or checks. Crypto payroll introduces decentralized payments using cryptocurrencies, enabling fast cross-border transactions but with higher volatility and regulatory uncertainties. Businesses must weigh the stability and compliance of traditional salary against the innovation and potential benefits of blockchain-based crypto payroll systems.

Pros and Cons of Salary Payments

Salary payments offer consistent, predictable income with straightforward tax withholding, providing financial stability and ease of budgeting for employees. However, traditional salary payments can involve slower processing times and higher transaction fees, especially for international transfers. Unlike crypto payroll, salaries lack the benefits of fast, low-cost cross-border payments and potential investment gains tied to cryptocurrency volatility.

Advantages and Risks of Crypto Payroll

Crypto payroll offers faster cross-border payments with lower transaction fees compared to traditional salary transfers, enhancing cost efficiency for global businesses. It provides increased payment transparency and security through blockchain technology, reducing the risk of fraud and errors. However, volatility in cryptocurrency values poses a significant risk to both employers and employees, potentially affecting income stability and financial planning.

Tax Implications: Salary vs Crypto Compensation

Traditional salary payments are subject to standard income tax withholding, social security, and Medicare taxes, ensuring compliance with local tax regulations. Crypto payroll compensation introduces complex tax implications, including potential capital gains taxes upon conversion or sale of cryptocurrency, and requires meticulous record-keeping for valuation at the time of payment. Employers and employees must navigate varying jurisdictional guidelines, as crypto payments may trigger taxable events differently compared to conventional salary disbursements.

Currency Volatility: Managing Risk in Crypto Payroll

Currency volatility in crypto payroll poses significant risk due to rapid fluctuations in cryptocurrency values, impacting employees' net income unpredictably. Implementing automated conversion tools or stablecoin payments helps stabilize compensation, reducing exposure to price swings. Employers managing risk effectively balance timely payroll processing with market volatility monitoring to ensure consistent, fair payouts.

Employer Considerations: Implementing Payroll Systems

Employers evaluating salary versus crypto payroll systems must consider regulatory compliance, tax reporting, and employee preferences. Traditional salary systems offer stability and clear legal frameworks, while crypto payroll introduces volatility and evolving tax implications. Integration complexity and security measures are critical factors when implementing crypto payroll solutions to ensure smooth and compliant payment processing.

Employee Perspective: Preferences and Flexibility

Employees increasingly value flexibility in payment methods, with many showing a growing preference for crypto payroll due to faster transactions and borderless access. Traditional salaries offer stability and regulatory clarity, but crypto payments provide enhanced control over funds and potential for asset appreciation. Balancing conventional salary benefits with the innovative advantages of cryptocurrency can address diverse employee needs and improve overall satisfaction.

Regulatory Challenges in Crypto Payroll

Salary payments through traditional payroll systems comply with established labor and tax regulations, ensuring consistent legal oversight and employee protections. In contrast, crypto payroll faces significant regulatory challenges, including unclear tax reporting requirements, anti-money laundering (AML) compliance, and jurisdictional variations that complicate cross-border payments. These hurdles limit widespread adoption of cryptocurrency as a payroll method despite its potential benefits in speed and lower transaction costs.

Security and Privacy in Payment Methods

Salary payments through traditional methods offer regulated security protocols and established privacy protections, ensuring employee data confidentiality under labor laws. Crypto payroll systems enhance privacy by utilizing blockchain's decentralized ledger and encryption, reducing risks of data breaches and unauthorized access. Both methods require robust security measures, but crypto payroll provides added anonymity and resistance to fraud due to cryptographic security features.

Future Trends: Is Crypto Payroll the Next Big Thing?

Crypto payroll is gaining traction as companies explore decentralized payment systems that offer faster transactions and lower fees compared to traditional salary methods. Blockchain technology enhances transparency and security, making crypto payments an attractive option for remote and global employees. As digital currencies become more widely accepted, crypto payroll could revolutionize salary distribution, aligning with future trends in financial innovation and workforce flexibility.

Related Important Terms

Stablecoin Payroll

Stablecoin payroll offers a secure, transparent alternative to traditional salary payments by leveraging blockchain technology to reduce transaction fees and processing times globally. Employers and employees benefit from faster settlements, minimized currency volatility, and increased financial inclusion compared to conventional fiat salary disbursements.

Tokenized Salary

Tokenized salary enables employees to receive payments in cryptocurrency, offering faster transactions and borderless access compared to traditional salary methods. This innovative payment method increases financial inclusivity and transparency while reducing fees and settlement times associated with fiat payroll systems.

Crypto Streamed Income

Crypto streamed income offers continuous, real-time salary payments, enhancing cash flow flexibility compared to traditional fixed monthly salary disbursements. This payment method leverages blockchain technology to reduce transaction delays and fees, providing employees with immediate access to earned wages.

Blockchain Payroll Automation

Blockchain payroll automation streamlines salary payments by enabling secure, transparent, and instant transactions through cryptocurrency, reducing administrative costs and eliminating delays common in traditional payroll systems. Implementing crypto payroll solutions enhances financial inclusivity for remote workers and global teams by bypassing banking intermediaries and minimizing currency conversion fees.

Decentralized Payroll Solutions

Decentralized payroll solutions offer increased transparency and security compared to traditional salary payments by leveraging blockchain technology to facilitate instant, tamper-proof transactions. These crypto payroll systems reduce processing fees and eliminate intermediaries, enabling businesses to execute cross-border payments efficiently while providing employees with direct access to digital assets.

On-chain Compensation

On-chain compensation leverages blockchain technology to provide secure, transparent, and instant salary payments using cryptocurrencies, eliminating intermediaries and reducing transaction costs. This method offers employees real-time access to their earnings with immutable records, contrasting traditional salary systems that rely on slower, centralized banking processes.

Defi Salary Agreements

DeFi salary agreements enable decentralized finance protocols to automate and secure payroll through smart contracts, offering transparency and instant payments in cryptocurrency. This method reduces reliance on traditional banking systems while providing employees with real-time access to their earnings and reduced transaction fees compared to conventional salary payments.

NFT Payroll Perks

NFT payroll perks offer unique benefits such as exclusive digital assets and enhanced transparency compared to traditional salary payments. Integrating NFT payroll in crypto payments enables seamless verification and potential appreciation in value, creating innovative compensation opportunities beyond fixed salaries.

Hybrid Fiat-Crypto Payroll

Hybrid fiat-crypto payroll systems combine traditional salary payments with cryptocurrency options, offering employees flexibility and faster cross-border transactions while mitigating volatility through partial crypto allocation. This blended approach enhances payroll efficiency, reduces transaction costs, and supports compliance with regulatory frameworks in both fiat and digital currency domains.

Cross-border Crypto Remittance

Cross-border crypto remittance offers faster, lower-cost transactions compared to traditional salary payments, eliminating intermediaries and currency conversion fees. Businesses leveraging crypto payroll benefit from real-time settlements and enhanced transparency, making international salary distribution more efficient and secure.

Salary vs Crypto Payroll for payment method. Infographic

hrdif.com

hrdif.com