Starting bonus negotiation offers immediate cash incentives that enhance short-term financial appeal, while sign-on equity negotiation provides long-term value through company ownership and potential stock appreciation. Candidates prioritizing immediate liquidity often favor signing bonuses, whereas those confident in the company's growth may opt for equity to maximize future wealth. Balancing these options depends on personal financial goals and risk tolerance during onboarding incentives negotiation.

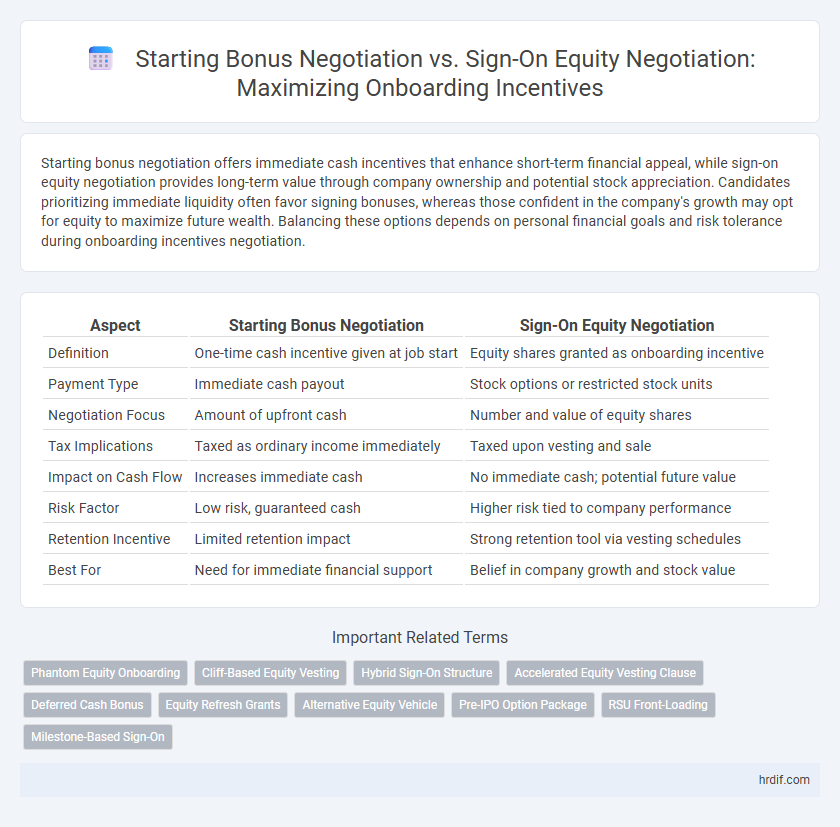

Table of Comparison

| Aspect | Starting Bonus Negotiation | Sign-On Equity Negotiation |

|---|---|---|

| Definition | One-time cash incentive given at job start | Equity shares granted as onboarding incentive |

| Payment Type | Immediate cash payout | Stock options or restricted stock units |

| Negotiation Focus | Amount of upfront cash | Number and value of equity shares |

| Tax Implications | Taxed as ordinary income immediately | Taxed upon vesting and sale |

| Impact on Cash Flow | Increases immediate cash | No immediate cash; potential future value |

| Risk Factor | Low risk, guaranteed cash | Higher risk tied to company performance |

| Retention Incentive | Limited retention impact | Strong retention tool via vesting schedules |

| Best For | Need for immediate financial support | Belief in company growth and stock value |

Introduction: Understanding Onboarding Incentives

Starting bonus negotiation typically offers immediate cash incentives that enhance upfront financial rewards, appealing to candidates seeking quick compensation boosts. Sign-on equity negotiation involves granting stock options or shares, aligning long-term employee interests with company growth and creating potential for substantial future gains. Both onboarding incentives serve distinct purposes--starting bonuses provide instant value, while sign-on equity fosters loyalty and investment in the company's success.

Defining Starting Bonus and Sign-On Equity

Starting bonus refers to a one-time cash payment offered upfront as an incentive to join a company, typically designed to provide immediate financial benefit and offset compensation gaps. Sign-on equity involves granting stock options or restricted shares that vest over time, aligning the employee's financial interests with the company's long-term growth and performance. Understanding these distinct onboarding incentives helps candidates and employers strategically negotiate initial compensation packages based on immediate cash needs versus potential future value creation.

Key Differences Between Starting Bonus and Sign-On Equity

Starting bonus negotiation typically involves a fixed cash amount paid upfront, providing immediate financial incentive for new hires. Sign-on equity negotiation offers stock options or shares, aligning long-term employee interests with company performance and potential future value. Key differences include liquidity, tax implications, and impact on employee motivation and retention strategies.

Evaluating the Value: Cash vs. Equity

Starting bonus negotiation provides immediate, guaranteed cash, offering liquidity and financial security upon onboarding. Sign-on equity negotiation, often in the form of stock options or restricted shares, aligns long-term incentives with company performance but carries market risk and vesting conditions. Evaluating the value between cash and equity requires assessing personal financial needs, risk tolerance, and the potential growth trajectory of the company's stock.

Short-Term vs. Long-Term Financial Impact

Starting bonus negotiation provides immediate financial benefit, offering new hires a lump sum to address short-term needs or expenses. Sign-on equity negotiation, however, aligns employee incentives with company growth, delivering potential long-term wealth accumulation through stock appreciation. Balancing these onboarding incentives depends on prioritizing quick financial support versus sustained value tied to company performance.

Negotiation Strategies for Starting Bonuses

Starting bonus negotiation strategies focus on emphasizing immediate cash value and leveraging competitive offers to secure upfront financial incentives. Negotiators prioritize quantifiable benefits such as guaranteed lump sums over future equity projections, appealing to candidates' desire for liquidity and risk mitigation. Highlighting market benchmarks and aligning bonus proposals with candidate expectations enhances the effectiveness of starting bonus agreements.

Negotiation Strategies for Sign-On Equity

Negotiation strategies for sign-on equity require thorough research on company valuation and equity dilution to accurately assess offer value. Prioritizing clarity on vesting schedules, potential exit scenarios, and liquidity events strengthens bargaining power. Emphasizing long-term growth potential and alignment with company goals enhances the appeal of equity-based onboarding incentives.

Assessing Employer Flexibility for Both Options

Assessing employer flexibility in starting bonus negotiation often reveals a preference for one-time cash incentives that align with budget constraints and immediate onboarding goals. In contrast, sign-on equity negotiation typically requires employers to consider long-term company valuation and stock option frameworks, which may involve more complex approval processes. Understanding these dynamics helps candidates tailor their negotiation strategies to optimize onboarding incentives within the employer's flexibility spectrum.

Market Trends: Industry Preferences in Onboarding Incentives

Market trends indicate a growing preference for sign-on equity over starting bonuses as onboarding incentives, especially in technology and startup sectors where long-term value alignment is critical. Companies leverage sign-on equity to attract talent seeking ownership and future growth potential, while traditional industries often still favor upfront starting bonuses for immediate financial reward. Data from recent compensation reports show a 25% increase in sign-on equity offers compared to a 10% rise in starting bonuses, reflecting shifting industry priorities toward sustainable employee investment.

Making the Best Choice: Personal and Professional Considerations

Starting bonus negotiation offers immediate financial reward, enhancing short-term liquidity for personal expenses or investment, while sign-on equity negotiation provides long-term growth potential aligned with company success, appealing to those prioritizing wealth accumulation and professional commitment. Evaluating personal financial needs against career goals and risk tolerance is crucial in choosing between upfront cash and equity stakes. Understanding company valuation, vesting schedules, and potential exit scenarios helps optimize onboarding incentives for maximum personal and professional benefit.

Related Important Terms

Phantom Equity Onboarding

Phantom equity onboarding incentives offer a strategic advantage over signing bonuses by aligning employee interests with company performance without immediate cash outflow. Negotiating phantom equity grants enables employees to benefit from long-term value creation, fostering commitment and retention while startups preserve liquidity during critical growth phases.

Cliff-Based Equity Vesting

Starting bonus negotiation typically involves immediate cash incentives crucial for onboarding, while sign-on equity negotiation centers around long-term value through cliff-based equity vesting, which requires employees to stay a set period before earning shares. Cliff-based vesting aligns employee retention with company growth, making equity a strategically timed incentive compared to the upfront nature of signing bonuses.

Hybrid Sign-On Structure

A hybrid sign-on structure combines a starting bonus with sign-on equity, balancing immediate cash incentives with long-term investment in the company's success to maximize candidate appeal and retention. Negotiating a hybrid package allows flexibility, aligning onboarding incentives with both short-term financial needs and long-term wealth-building potential.

Accelerated Equity Vesting Clause

Starting bonus negotiations primarily offer immediate financial rewards without impacting future equity value, while sign-on equity negotiations incorporate accelerated equity vesting clauses that enable new hires to gain faster ownership in company shares. Accelerated equity vesting clauses provide onboarding incentives by reducing the vesting period, enhancing employee retention and aligning interests between new hires and the company's long-term performance.

Deferred Cash Bonus

Deferred cash bonuses in starting bonus negotiations offer immediate financial incentives that are easier to quantify and guarantee compared to sign-on equity, which relies on company performance and vesting schedules. Prioritizing deferred cash bonuses can effectively secure candidate commitment by providing upfront, tangible rewards during onboarding, reducing uncertainty associated with equity's long-term value.

Equity Refresh Grants

Starting bonus negotiations provide immediate cash incentives that enhance upfront compensation, while sign-on equity negotiations, particularly equity refresh grants, offer long-term value by aligning employee interests with company growth through stock options or restricted stock units. Equity refresh grants serve as ongoing rewards that motivate retention and performance, making them a critical component in onboarding incentives beyond the initial signing bonuses.

Alternative Equity Vehicle

Starting bonus negotiation often involves a fixed cash incentive that provides immediate financial value, while sign-on equity negotiation leverages alternative equity vehicles such as restricted stock units (RSUs), stock options, or performance shares to align employee incentives with long-term company growth. Alternative equity vehicles offer tax-efficient compensation structures and potential upside tied to company valuation, making them a strategic tool for startups and high-growth firms aiming to conserve cash while motivating talent.

Pre-IPO Option Package

Starting bonus negotiation typically involves a one-time cash payment that provides immediate financial incentive during onboarding, whereas sign-on equity negotiation for a pre-IPO option package offers long-term ownership potential and alignment with company growth. Pre-IPO option packages often carry significant upside value contingent on the company's successful public offering, making them a strategic component of total compensation in early-stage startups.

RSU Front-Loading

Starting bonus negotiation offers immediate cash incentives, while sign-on equity negotiation, especially through RSU front-loading, provides long-term value by accelerating restricted stock units vesting schedules. Front-loading RSUs enhances onboarding incentives by increasing early equity ownership, aligning employee interests with company performance over time.

Milestone-Based Sign-On

Milestone-based sign-on equity negotiation aligns onboarding incentives with company performance goals, offering equity tied to achieving specific targets, which can foster long-term commitment and value creation. Starting bonus negotiation, typically a fixed upfront cash amount, provides immediate financial reward but may not motivate sustained engagement as effectively as milestone-based equity incentives.

Starting bonus negotiation vs Sign-on equity negotiation for onboarding incentives. Infographic

hrdif.com

hrdif.com