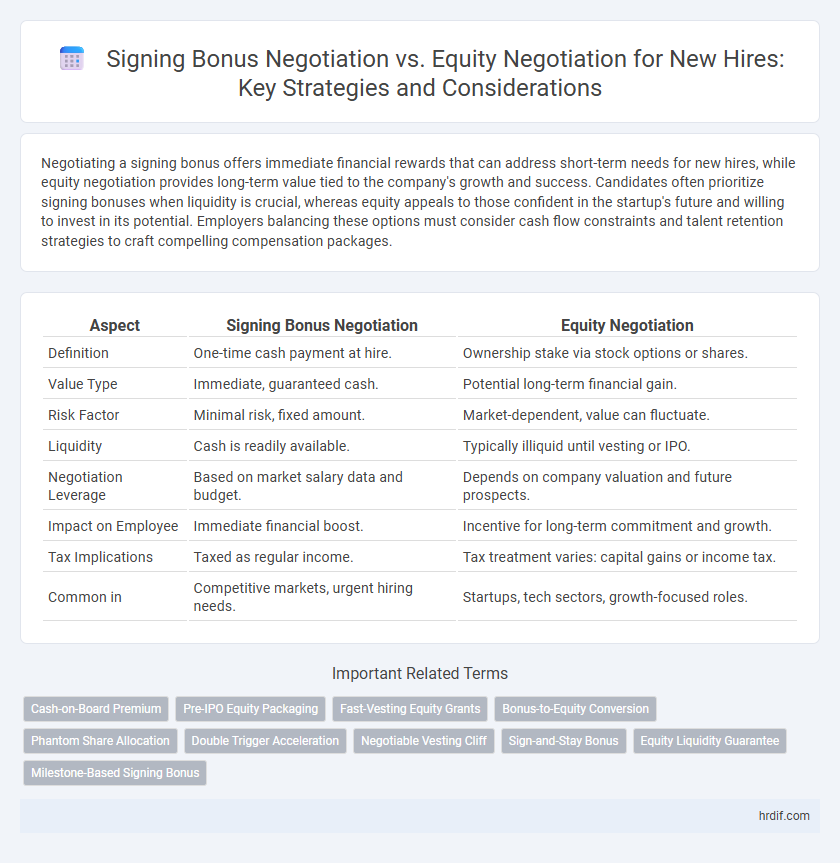

Negotiating a signing bonus offers immediate financial rewards that can address short-term needs for new hires, while equity negotiation provides long-term value tied to the company's growth and success. Candidates often prioritize signing bonuses when liquidity is crucial, whereas equity appeals to those confident in the startup's future and willing to invest in its potential. Employers balancing these options must consider cash flow constraints and talent retention strategies to craft compelling compensation packages.

Table of Comparison

| Aspect | Signing Bonus Negotiation | Equity Negotiation |

|---|---|---|

| Definition | One-time cash payment at hire. | Ownership stake via stock options or shares. |

| Value Type | Immediate, guaranteed cash. | Potential long-term financial gain. |

| Risk Factor | Minimal risk, fixed amount. | Market-dependent, value can fluctuate. |

| Liquidity | Cash is readily available. | Typically illiquid until vesting or IPO. |

| Negotiation Leverage | Based on market salary data and budget. | Depends on company valuation and future prospects. |

| Impact on Employee | Immediate financial boost. | Incentive for long-term commitment and growth. |

| Tax Implications | Taxed as regular income. | Tax treatment varies: capital gains or income tax. |

| Common in | Competitive markets, urgent hiring needs. | Startups, tech sectors, growth-focused roles. |

Understanding Signing Bonuses and Equity Offers

Signing bonuses provide immediate, guaranteed cash incentives that can attract top talent and compensate for lower base salaries during recruitment. Equity offers, often in the form of stock options or restricted stock units, align employee interests with company growth but carry long-term risk and potential reward. Evaluating the trade-offs between upfront cash through signing bonuses and future financial gain through equity helps candidates negotiate effectively based on their financial needs and risk tolerance.

Key Differences Between Signing Bonuses and Equity

Signing bonuses provide immediate, guaranteed cash incentives often appealing to candidates seeking short-term financial security, whereas equity offers long-term ownership stakes that align employees' interests with company growth and future value. Signing bonuses are fixed amounts paid upfront, offering liquidity without dilution, while equity grants fluctuate with company performance and vest over time, impacting overall compensation value. Choosing between these depends on candidate priorities: immediate financial gain versus potential wealth accumulation through company success.

When to Prioritize a Signing Bonus Over Equity

New hires should prioritize a signing bonus over equity when immediate financial needs or personal cash flow stability are critical, as signing bonuses provide upfront guaranteed compensation. This approach is beneficial in industries with volatile equity values or when the company's stock is not expected to appreciate significantly in the near term. Prioritizing a signing bonus also makes sense if the employee prefers liquidity and risk mitigation instead of potential long-term gains tied to stock performance.

Advantages of Negotiating a Signing Bonus

Negotiating a signing bonus provides immediate financial benefits for new hires, offering guaranteed cash flow without the uncertainty tied to equity valuation or company performance. This upfront payment enhances financial security and can be used to address relocation costs, personal expenses, or initial investments. Unlike equity, signing bonuses are not subject to vesting schedules or market fluctuations, making them a more reliable form of compensation during the transition into a new role.

Benefits of Equity Negotiation for Long-Term Wealth

Equity negotiation for new hires offers significant benefits for long-term wealth accumulation by providing ownership stakes that can appreciate over time, aligning employee incentives with company success. Unlike signing bonuses, which are one-time cash payments, equity can grow in value and generate substantial financial returns through dividends or capital gains upon company growth or exit events. This approach fosters commitment and motivation, ultimately enhancing retention and potential wealth beyond immediate compensation.

Evaluating Company Stage: Bonus vs. Equity Considerations

Early-stage startups often emphasize equity negotiation over signing bonuses to align new hires with long-term growth potential and company valuation upside. Established companies typically offer signing bonuses as a way to attract talent without diluting equity or tying compensation to stock market volatility. Evaluating company stage is crucial, as founders need to balance immediate cash incentives against future equity value, depending on the startup's funding status, runway, and projected exit timeline.

Negotiation Strategies for Signing Bonuses

Negotiation strategies for signing bonuses often involve leveraging market data and candidate value to secure a competitive upfront incentive, balancing immediate financial reward against potential long-term equity gains. Employers may offer signing bonuses to attract top talent quickly, especially in highly competitive industries, while ensuring the bonus aligns with overall compensation strategy and company budget. Effective negotiation techniques include clearly communicating the bonus's structure and timing, emphasizing its role in immediate financial security compared to the longer vesting period and uncertain valuation of equity.

Effective Tactics for Equity Negotiation

Effective tactics for equity negotiation involve thorough market research to understand industry standards and company valuation, ensuring informed decision-making. Candidates should clearly articulate their long-term commitment and the strategic value they bring to justify a higher equity stake. Leveraging milestone-based vesting schedules and aligning equity terms with performance metrics can create mutually beneficial agreements that secure both immediate and future gains.

Common Mistakes in Signing Bonus and Equity Negotiations

Common mistakes in signing bonus negotiations include undervaluing the immediate financial impact and failing to clarify tax implications, causing unexpected costs for new hires. In equity negotiations, errors often involve misunderstanding vesting schedules and overestimating company valuation, leading to unrealistic expectations. Both require thorough preparation and clear communication to align interests and secure fair compensation.

Deciding What’s Right for Your Career Goals

Evaluating signing bonus negotiation versus equity negotiation depends on immediate financial needs versus long-term wealth potential aligned with your career goals. Signing bonuses offer upfront cash, ideal for those prioritizing liquidity and short-term financial stability. Equity negotiation benefits professionals focused on growth, ownership, and the possibility of significant future returns tied to the company's success.

Related Important Terms

Cash-on-Board Premium

Signing bonus negotiation provides immediate cash-on-board premium, appealing to new hires who prioritize upfront liquidity and financial security at the start of their employment. Equity negotiation, while offering long-term growth potential, often lacks immediate cash value, making signing bonuses a key factor for candidates seeking guaranteed short-term compensation.

Pre-IPO Equity Packaging

Pre-IPO equity packaging offers new hires significant upside potential through stock options or restricted shares, aligning their interests with company growth and future valuation. Signing bonuses provide immediate financial incentives but lack the long-term wealth creation and retention benefits inherent in equity negotiations.

Fast-Vesting Equity Grants

Fast-vesting equity grants provide new hires with immediate ownership stakes that can accelerate wealth accumulation compared to traditional signing bonuses, which offer upfront but finite financial incentives. Negotiating for fast-vesting equity aligns employee incentives with company growth and long-term value creation, often resulting in higher overall compensation potential than a one-time signing bonus.

Bonus-to-Equity Conversion

Bonus-to-equity conversion in negotiation often hinges on assessing long-term value versus immediate cash benefits, with signing bonuses providing upfront financial incentives while equity offers potential future growth tied to company performance. Candidates must evaluate factors like company valuation, vesting schedules, and tax implications to determine if converting a portion of their signing bonus into equity aligns better with their career and financial goals.

Phantom Share Allocation

Phantom share allocation during negotiation offers new hires a performance-tied equity alternative without actual stock dilution, appealing in early-stage startups prioritizing cash flow. Compared to signing bonuses, phantom shares align employee incentives with company growth, fostering long-term commitment rather than immediate financial gain.

Double Trigger Acceleration

Double Trigger Acceleration in equity negotiations offers new hires enhanced protection by accelerating stock vesting upon a change of control combined with termination, creating a potentially more valuable long-term incentive compared to a signing bonus, which provides immediate but one-time financial gain. Prioritizing equity with Double Trigger Acceleration aligns employee retention and company success, typically outperforming signing bonuses in securing top talent motivated by future growth.

Negotiable Vesting Cliff

Negotiable vesting cliffs in equity negotiation provide new hires flexibility to reduce or eliminate the initial waiting period before equity ownership begins, enhancing alignment with their career goals and financial needs. In contrast, signing bonus negotiations offer immediate cash incentives but lack long-term retention incentives tied to performance and tenure.

Sign-and-Stay Bonus

A sign-and-stay bonus offers immediate financial incentives to new hires, enhancing retention during critical early employment stages, while equity negotiations typically provide long-term ownership benefits that may take years to vest and yield value. Prioritizing sign-and-stay bonuses can reduce early turnover risks and improve employee commitment, especially in competitive industries where upfront cash incentives are more attractive than deferred equity awards.

Equity Liquidity Guarantee

Equity liquidity guarantees provide new hires with a secure exit strategy, enhancing the perceived value of stock options compared to signing bonuses that offer immediate but one-time financial benefits. Negotiating equity with liquidity provisions can align long-term incentives and increase employee retention by ensuring access to cash without compromising ownership stakes.

Milestone-Based Signing Bonus

Milestone-based signing bonuses provide new hires with financial incentives tied to specific performance goals, aligning their contributions with company objectives and offering immediate rewards compared to the potential long-term gains of equity. This approach can enhance motivation and retention by delivering clear, measurable targets and reducing the uncertainty associated with stock value fluctuations.

Signing bonus negotiation vs Equity negotiation for new hires. Infographic

hrdif.com

hrdif.com