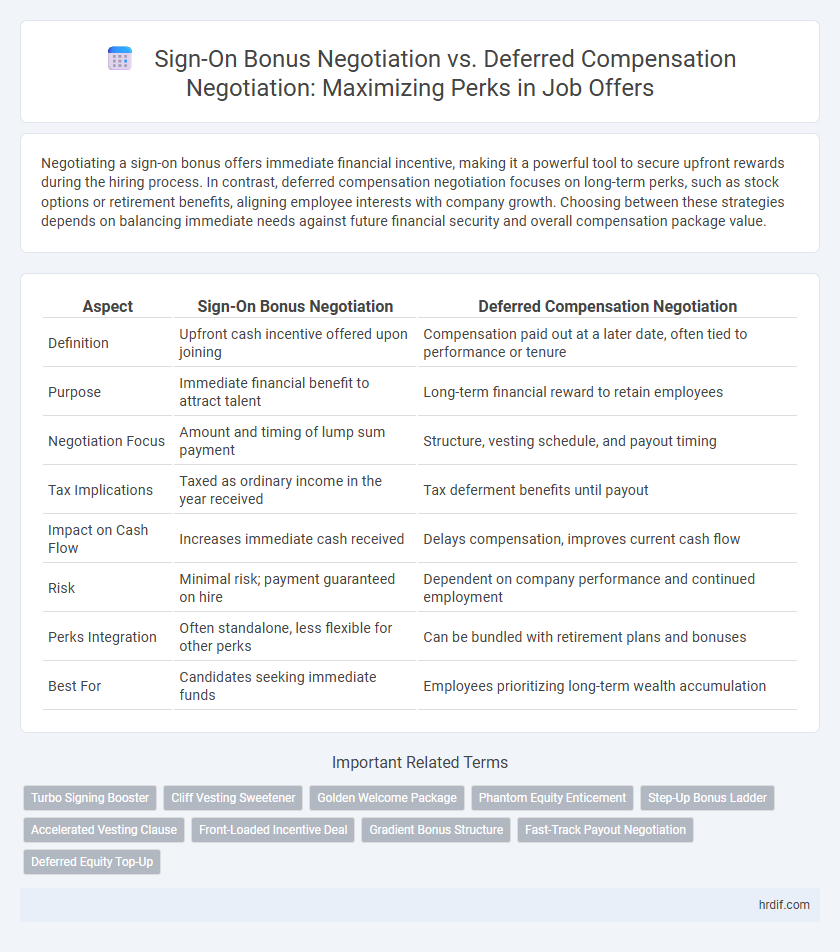

Negotiating a sign-on bonus offers immediate financial incentive, making it a powerful tool to secure upfront rewards during the hiring process. In contrast, deferred compensation negotiation focuses on long-term perks, such as stock options or retirement benefits, aligning employee interests with company growth. Choosing between these strategies depends on balancing immediate needs against future financial security and overall compensation package value.

Table of Comparison

| Aspect | Sign-On Bonus Negotiation | Deferred Compensation Negotiation |

|---|---|---|

| Definition | Upfront cash incentive offered upon joining | Compensation paid out at a later date, often tied to performance or tenure |

| Purpose | Immediate financial benefit to attract talent | Long-term financial reward to retain employees |

| Negotiation Focus | Amount and timing of lump sum payment | Structure, vesting schedule, and payout timing |

| Tax Implications | Taxed as ordinary income in the year received | Tax deferment benefits until payout |

| Impact on Cash Flow | Increases immediate cash received | Delays compensation, improves current cash flow |

| Risk | Minimal risk; payment guaranteed on hire | Dependent on company performance and continued employment |

| Perks Integration | Often standalone, less flexible for other perks | Can be bundled with retirement plans and bonuses |

| Best For | Candidates seeking immediate funds | Employees prioritizing long-term wealth accumulation |

Understanding Sign-On Bonuses and Deferred Compensation

Sign-on bonuses provide immediate financial incentives to attract talent, often used to offset relocation costs or compensate for lost bonuses with previous employers. Deferred compensation, on the other hand, involves earnings paid out at a later date, offering tax advantages and enhancing long-term financial security. An effective negotiation strategy balances upfront rewards with future benefits, aligning with both the candidate's immediate needs and long-term career goals.

Key Differences Between Sign-On Bonuses and Deferred Compensation

Sign-on bonuses provide immediate financial incentives that enhance upfront employee satisfaction, whereas deferred compensation offers delayed rewards tied to long-term retention and performance. Negotiating a sign-on bonus typically centers on securing a guaranteed lump sum at hiring, while deferred compensation negotiations focus on structuring vesting schedules, tax advantages, and alignment with company goals. Understanding these differences aids in optimizing negotiation strategy to balance short-term benefits with sustained employee motivation.

Evaluating the Benefits: Immediate Reward vs Long-Term Gain

Negotiating a sign-on bonus provides an immediate financial reward, enhancing cash flow and offering quick gratification, which can be crucial for new hires with upfront expenses. Deferred compensation negotiations focus on long-term financial stability, promoting benefits like retirement plans, stock options, or performance bonuses that accrue value over time. Evaluating the benefits requires assessing personal financial needs, risk tolerance, and career trajectory to balance immediate perks against sustained wealth accumulation.

Negotiation Strategies for Sign-On Bonuses

Effective negotiation strategies for sign-on bonuses emphasize clear communication of value and alignment with company goals to secure immediate financial incentives. Candidates should leverage market research and demonstrate how a sign-on bonus addresses transition costs or forgone benefits, increasing their bargaining power. Prioritizing a sign-on bonus over deferred compensation can provide upfront security and reduce uncertainty, making it a critical component in compensation negotiations.

Approaches to Deferred Compensation Negotiation

Approaches to deferred compensation negotiation emphasize aligning long-term incentives with both employer goals and employee financial planning, often involving structured payouts tied to performance milestones or tenure. Negotiators prioritize clarity on vesting schedules, tax implications, and potential liquidity events to maximize benefit and minimize risk. Tailoring deferred compensation packages to individual priorities and company strategies fosters mutual commitment and retention beyond the initial sign-on bonus phase.

Tax Implications: Sign-On Bonus vs Deferred Compensation

Negotiating a sign-on bonus typically results in immediate taxable income, subject to payroll taxes in the year received, while deferred compensation allows tax deferral until the payout date, potentially reducing current tax liability. Employers may prefer deferred compensation to align employee incentives with long-term company performance, but employees must consider future tax brackets and the risk of forfeiture. Strategically balancing these perks requires understanding the differing tax treatments and implications on personal income timing and amounts.

Assessing Employer Flexibility in Perk Negotiations

Assessing employer flexibility in sign-on bonus negotiation versus deferred compensation negotiation requires evaluating the company's financial policies and historical willingness to customize perks. Employers often have predefined budgets for upfront incentives like sign-on bonuses but may show greater adaptability in structuring deferred compensation to align long-term interests. Understanding these flexibilities enables candidates to strategically prioritize which perk negotiation leverages higher value and mutual benefit.

Aligning Compensation Perks with Career Goals

Negotiating a sign-on bonus offers immediate financial gain that can support short-term career transitions or personal needs, while deferred compensation aligns long-term rewards with future performance and company growth. Prioritizing perks such as stock options, retirement plans, or performance-based incentives ensures alignment between compensation and career objectives, fostering sustained motivation and professional development. Tailoring negotiation strategies to emphasize career progression and financial planning enhances the overall value and impact of compensation packages.

Pitfalls to Avoid in Bonus and Deferred Offer Negotiations

Negotiating sign-on bonuses and deferred compensation requires clear understanding of tax implications and vesting schedules to avoid hidden costs or delayed payouts. Overlooking the impact of clawback clauses or failing to clarify performance metrics tied to deferred perks can lead to forfeited benefits. Emphasizing transparent communication and thorough contract review prevents common pitfalls in bonus and deferred compensation negotiations.

Making the Right Choice: Sign-On or Deferred Perks?

Choosing between sign-on bonuses and deferred compensation requires evaluating immediate financial needs against long-term benefits. Sign-on bonuses provide upfront cash that can address urgent expenses, while deferred perks often include stock options or retirement contributions that enhance total compensation over time. Analyzing job security, company growth prospects, and personal financial goals ensures making the right decision in negotiations.

Related Important Terms

Turbo Signing Booster

Turbo Signing Booster significantly enhances sign-on bonus negotiation by providing immediate, upfront financial incentives that attract top talent and secure faster commitments. Deferred compensation negotiation emphasizes long-term rewards, but the Turbo Signing Booster's upfront perks offer a more compelling and flexible advantage in competitive hiring scenarios.

Cliff Vesting Sweetener

Negotiating a sign-on bonus provides immediate financial incentive, while deferred compensation tied to cliff vesting incentivizes long-term commitment by vesting perks only after a specified period. Incorporating a cliff vesting sweetener in deferred compensation negotiations enhances retention by ensuring employees receive full benefits only after meeting time-based criteria.

Golden Welcome Package

Negotiating a sign-on bonus offers immediate financial incentive, enhancing upfront value, while deferred compensation focuses on long-term rewards often tied to performance milestones, aligning employee and company goals. The Golden Welcome Package strategically combines these elements to maximize overall attractiveness and retention potential in executive contracts.

Phantom Equity Enticement

Negotiating a sign-on bonus offers immediate financial gain, while negotiating deferred compensation through Phantom Equity provides long-term incentive aligned with company growth, enhancing retention and motivation. Phantom Equity enticement leverages virtual shares tied to company valuation, creating a compelling perk that aligns employee interests with shareholder value without diluting equity.

Step-Up Bonus Ladder

Negotiating a Step-Up Bonus Ladder often yields more immediate financial reward compared to deferred compensation, as it provides incremental sign-on bonuses tied to performance milestones, enhancing motivation and retention. This approach aligns employer incentives with employee achievements, creating a structured path for earning perks while securing early-stage benefits.

Accelerated Vesting Clause

Negotiating a sign-on bonus offers immediate financial incentive, while focusing on deferred compensation with an accelerated vesting clause ensures faster access to equity-based perks upon certain triggering events. Emphasizing accelerated vesting during negotiations protects employee interests by allowing quicker ownership transfer in cases like termination or acquisition.

Front-Loaded Incentive Deal

Negotiating a sign-on bonus offers immediate financial reward, enhancing upfront cash flow and serving as a strong motivator during offer acceptance, while deferred compensation negotiations focus on long-term value accumulation tied to performance or tenure, often benefiting from tax advantages. A front-loaded incentive deal strategically maximizes initial earnings through a substantial sign-on bonus, aligning employee motivation with immediate company goals and reducing reliance on uncertain future payouts.

Gradient Bonus Structure

Sign-on bonus negotiation secures immediate financial incentives, while deferred compensation negotiation emphasizes long-term rewards aligned with performance metrics, often structured through a Gradient Bonus Structure that increases payouts based on tenure or achievement milestones. The Gradient Bonus Structure incentivizes sustained employee commitment by escalating bonus amounts progressively, enhancing retention and aligning perks with company growth goals.

Fast-Track Payout Negotiation

Negotiating a fast-track payout within sign-on bonuses provides immediate financial incentives that enhance candidate confidence and retention, whereas deferred compensation negotiations prioritize long-term value and tax efficiency but may delay gratification. Emphasizing fast-track payout clauses in sign-on bonus negotiations aligns with candidates' preference for upfront rewards, supporting accelerated onboarding and motivation.

Deferred Equity Top-Up

Negotiating a Deferred Equity Top-Up leverages future company growth and aligns employee incentives with long-term success, often providing more substantial value than immediate sign-on bonuses. Deferred compensation negotiations allow for enhanced perks tied to equity appreciation, offering tax advantages and fostering stronger retention compared to upfront cash incentives.

sign-on bonus negotiation vs deferred compensation negotiation for perks Infographic

hrdif.com

hrdif.com