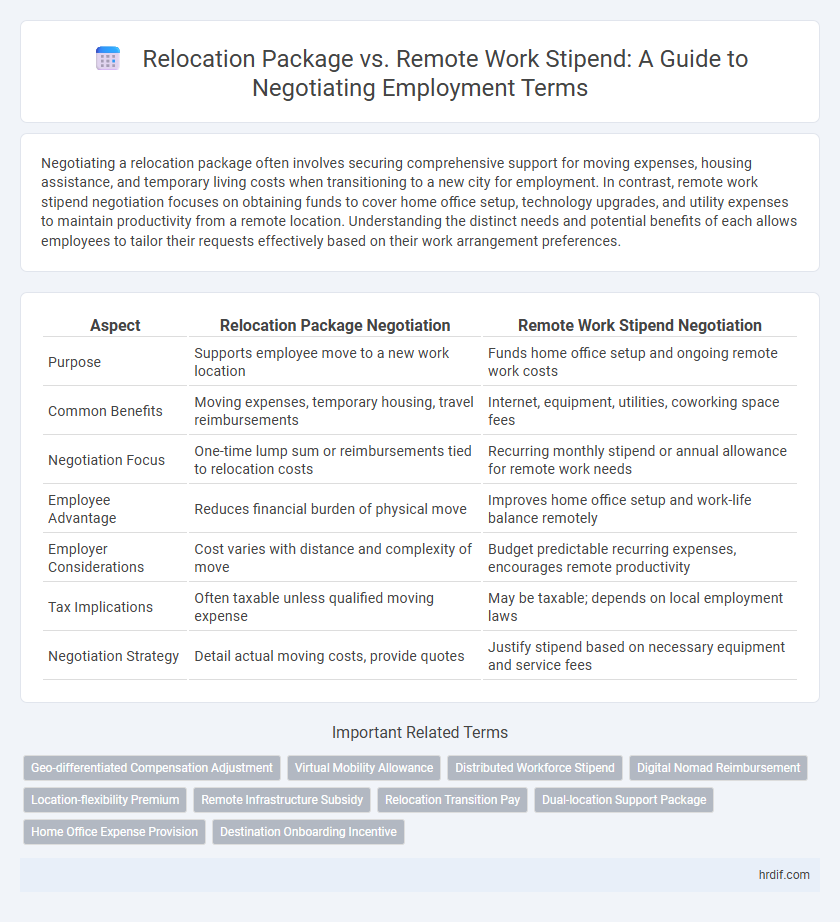

Negotiating a relocation package often involves securing comprehensive support for moving expenses, housing assistance, and temporary living costs when transitioning to a new city for employment. In contrast, remote work stipend negotiation focuses on obtaining funds to cover home office setup, technology upgrades, and utility expenses to maintain productivity from a remote location. Understanding the distinct needs and potential benefits of each allows employees to tailor their requests effectively based on their work arrangement preferences.

Table of Comparison

| Aspect | Relocation Package Negotiation | Remote Work Stipend Negotiation |

|---|---|---|

| Purpose | Supports employee move to a new work location | Funds home office setup and ongoing remote work costs |

| Common Benefits | Moving expenses, temporary housing, travel reimbursements | Internet, equipment, utilities, coworking space fees |

| Negotiation Focus | One-time lump sum or reimbursements tied to relocation costs | Recurring monthly stipend or annual allowance for remote work needs |

| Employee Advantage | Reduces financial burden of physical move | Improves home office setup and work-life balance remotely |

| Employer Considerations | Cost varies with distance and complexity of move | Budget predictable recurring expenses, encourages remote productivity |

| Tax Implications | Often taxable unless qualified moving expense | May be taxable; depends on local employment laws |

| Negotiation Strategy | Detail actual moving costs, provide quotes | Justify stipend based on necessary equipment and service fees |

Understanding Relocation Packages: What’s Included?

Relocation packages typically cover moving expenses, temporary housing, travel costs, and sometimes real estate assistance, providing comprehensive support for employees transitioning to a new location. These packages often include lump-sum payments or reimbursement options for costs like packing, transportation, and settling-in allowances to ease the financial burden of relocation. Understanding these elements helps employees negotiate effectively by comparing the tangible benefits against remote work stipends, which usually focus on home office setup and internet costs without addressing physical move expenses.

Remote Work Stipends: Scope and Typical Benefits

Remote work stipends typically cover expenses such as high-speed internet, ergonomic office furniture, and technology upgrades to support productivity outside the traditional office. These stipends often range from $50 to $200 per month, reflecting the varied needs of remote employees across industries. Offering a remote work stipend can enhance employee satisfaction and retention by directly addressing the costs associated with a home office environment.

Key Factors Influencing Relocation Package Negotiations

Relocation package negotiations often hinge on factors such as the total cost of moving, housing market variations, and the employee's family needs. Employers may consider local living expenses, the duration of the assignment, and potential tax implications when structuring relocation offers. Understanding these key elements helps employees negotiate more effectively for comprehensive support beyond a simple remote work stipend.

Essential Components of Remote Work Stipend Negotiations

Remote work stipend negotiations typically focus on covering essential expenses such as high-speed internet, ergonomic office furniture, and technology upgrades to maintain productivity. Clear agreement on stipend amount, reimbursement policies, and eligibility criteria ensures alignment between employer and employee expectations. Emphasizing flexibility and transparency in the stipend use supports employee satisfaction and long-term remote work success.

Comparing Costs: Relocation vs. Remote Work Support

Relocation package negotiation often involves higher upfront costs, including moving expenses, housing allowances, and temporary living support, which can amount to thousands of dollars per employee. Remote work stipend negotiation typically includes monthly or annual allowances for home office equipment, internet, and utility expenses, usually resulting in lower overall expenses for employers. Comparing these costs, employers may find remote work support more budget-friendly and scalable, while relocation packages offer long-term value through workforce proximity and onsite collaboration.

Tax Implications: Relocation Packages vs. Remote Stipends

Relocation packages often include lump-sum payments or reimbursements subject to different tax treatments depending on IRS guidelines, potentially resulting in taxable income for the employee. Remote work stipends are generally considered taxable income but may vary based on company policies and local tax laws, affecting net compensation. Understanding the distinct tax implications of each can influence negotiation strategies to maximize take-home pay and minimize unexpected tax liabilities.

How to Assess Your Needs: Relocation or Remote Work?

Assess your personal and professional priorities by evaluating factors such as housing costs, commute preferences, and productivity environment to determine if a relocation package or remote work stipend better supports your lifestyle and work efficiency. Analyze the financial implications, including upfront moving expenses versus ongoing remote work costs like internet and office equipment, to choose the most beneficial employment term. Consider long-term career goals and work-life balance to negotiate terms that align with your overall job satisfaction and performance.

Best Practices for Successful Negotiation

Emphasize clarity and specificity when negotiating a relocation package or remote work stipend by outlining detailed expenses such as moving costs, temporary housing, or home office setup allowances. Prioritize alignment with company policies and industry standards to ensure requests are reasonable and substantiated with market data. Utilize a collaborative approach that highlights mutual benefits, fostering goodwill and increasing the likelihood of a favorable outcome for both parties.

Common Pitfalls to Avoid in Both Negotiations

Common pitfalls in relocation package and remote work stipend negotiations include underestimating the total cost of living or remote work expenses, leading to inadequate requests. Failing to clearly define the scope of reimbursements or lump sums can cause misunderstandings and reduced benefits. Overlooking tax implications and company policies during these negotiations may result in unexpected financial burdens or denied claims.

Making the Final Decision: Relocate or Work Remotely?

Evaluating relocation package negotiation versus remote work stipend negotiation requires weighing direct costs and long-term benefits linked to each option. A comprehensive analysis should include housing allowances, travel reimbursements, and potential tax implications for relocation alongside ongoing home office setup costs, internet expenses, and flexibility advantages in remote work. Prioritizing factors such as family needs, career growth opportunities, and lifestyle preferences supports making an informed final decision between relocating or working remotely.

Related Important Terms

Geo-differentiated Compensation Adjustment

Geo-differentiated compensation adjustment plays a critical role in relocation package negotiation by aligning salary and benefits with the local cost of living and housing market fluctuations. Remote work stipend negotiation often requires a tailored approach to cover home office expenses and regional utility disparities, ensuring equitable support without inflating base compensation.

Virtual Mobility Allowance

Negotiating a relocation package typically involves securing comprehensive support for physical moving expenses, housing, and local adjustments, while remote work stipend negotiations center on a Virtual Mobility Allowance, which covers costs related to home office setup, technology upgrades, and internet connectivity for effective remote productivity. Employers increasingly prioritize Virtual Mobility Allowance to enhance virtual work flexibility and employee satisfaction without incurring the higher costs associated with traditional relocation assistance.

Distributed Workforce Stipend

Negotiating a relocation package typically covers moving expenses and temporary housing costs, while a distributed workforce stipend negotiation focuses on ongoing remote work expenses such as home office setup, internet, and utility costs. Employers offering distributed workforce stipends often provide a fixed monthly amount, optimizing employee productivity and satisfaction without the one-time financial burden of relocation.

Digital Nomad Reimbursement

Negotiating a relocation package often involves securing comprehensive expenses for moving, housing, and settling in a new city, while remote work stipend negotiation targets ongoing support for a digital nomad lifestyle, including internet costs, co-working space fees, and travel allowances. Prioritizing a digital nomad reimbursement in remote work discussions can lead to flexible, location-independent employment that enhances productivity and work-life balance without the constraints of physical relocation.

Location-flexibility Premium

Negotiating a relocation package often involves securing a lump sum or reimbursed expenses to facilitate a physical move, highlighting a one-time location-flexibility premium tailored to geographic transition costs. Conversely, a remote work stipend negotiation emphasizes ongoing monthly or annual payments to support home-office setups and technology needs, reflecting continuous location-flexibility benefits without necessitating relocation.

Remote Infrastructure Subsidy

Negotiating a remote infrastructure subsidy often provides employees with essential funds to enhance home office setups, covering expenses such as high-speed internet, ergonomic furniture, and technology upgrades. This targeted financial support contrasts with relocation package negotiations, which primarily address moving costs and initial living expenses but may not cover ongoing remote work necessities.

Relocation Transition Pay

Relocation transition pay typically offers a more comprehensive financial support package compared to remote work stipends, covering expenses such as moving costs, temporary housing, and travel during relocation. Negotiating relocation transition pay enhances overall compensation by addressing the tangible costs and logistical challenges of physically moving, whereas remote work stipends primarily offset ongoing home office expenses.

Dual-location Support Package

Negotiating a dual-location support package often offers greater flexibility and comprehensive benefits compared to a standard relocation package or remote work stipend, addressing costs for both home and office spaces, travel expenses, and technology setup. Employers are increasingly valuing dual-location support to enhance employee productivity and satisfaction across hybrid work environments.

Home Office Expense Provision

Relocation package negotiation often includes substantial home office expense provision such as ergonomic furniture, technology setup, and utility reimbursements to offset moving costs, while remote work stipend negotiation typically focuses on ongoing monthly allowances covering internet, electricity, and essential office supplies. Understanding these distinctions helps employees secure tailored support aligned with their unique work environment, maximizing comfort and productivity.

Destination Onboarding Incentive

Negotiating a relocation package often includes a substantial Destination Onboarding Incentive designed to cover moving expenses, temporary housing, and local orientation, providing a comprehensive support system for transitioning employees. In contrast, remote work stipend negotiations prioritize flexible monthly allowances for home office setup and utilities, emphasizing ongoing remote productivity rather than upfront relocation costs.

Relocation Package Negotiation vs Remote Work Stipend Negotiation for employment terms. Infographic

hrdif.com

hrdif.com