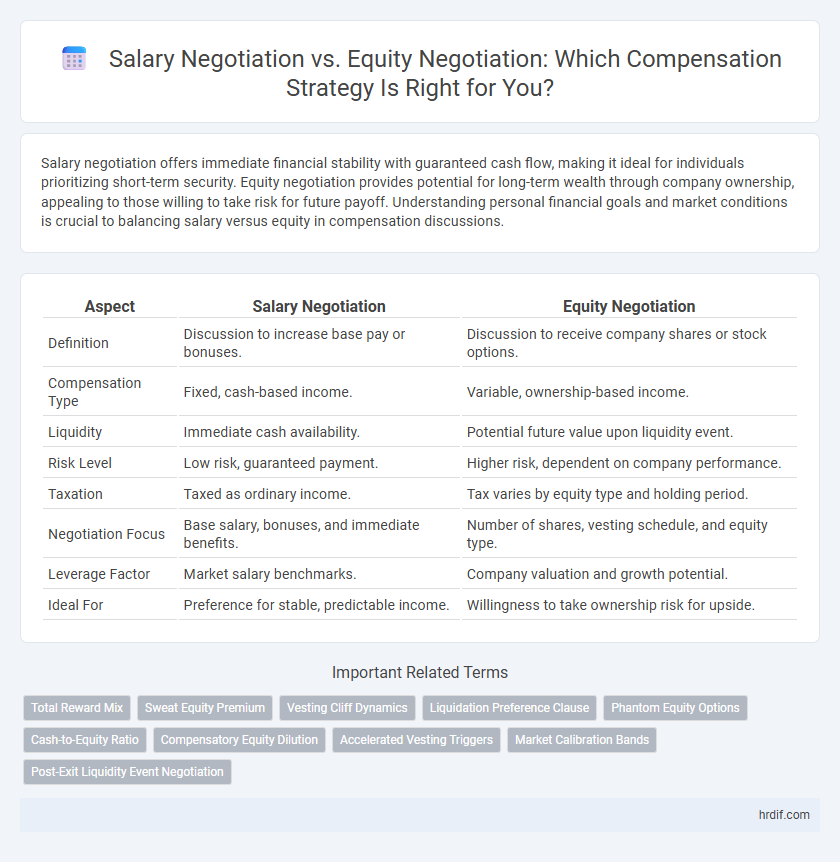

Salary negotiation offers immediate financial stability with guaranteed cash flow, making it ideal for individuals prioritizing short-term security. Equity negotiation provides potential for long-term wealth through company ownership, appealing to those willing to take risk for future payoff. Understanding personal financial goals and market conditions is crucial to balancing salary versus equity in compensation discussions.

Table of Comparison

| Aspect | Salary Negotiation | Equity Negotiation |

|---|---|---|

| Definition | Discussion to increase base pay or bonuses. | Discussion to receive company shares or stock options. |

| Compensation Type | Fixed, cash-based income. | Variable, ownership-based income. |

| Liquidity | Immediate cash availability. | Potential future value upon liquidity event. |

| Risk Level | Low risk, guaranteed payment. | Higher risk, dependent on company performance. |

| Taxation | Taxed as ordinary income. | Tax varies by equity type and holding period. |

| Negotiation Focus | Base salary, bonuses, and immediate benefits. | Number of shares, vesting schedule, and equity type. |

| Leverage Factor | Market salary benchmarks. | Company valuation and growth potential. |

| Ideal For | Preference for stable, predictable income. | Willingness to take ownership risk for upside. |

Understanding Salary Negotiation: Basics and Strategies

Salary negotiation centers on securing a competitive base pay by researching industry standards, understanding personal value, and confidently communicating expectations. Key strategies include leveraging market salary data, articulating unique skills or achievements, and preparing counteroffers to enhance negotiation outcomes. Mastering these elements ensures candidates maximize immediate financial compensation and establish a strong foundation for future raises or bonuses.

Equity Negotiation: What It Means for Employees

Equity negotiation in compensation allows employees to obtain ownership stakes in the company, aligning their financial interests with the company's growth and long-term success. This form of negotiation typically involves stock options, restricted stock units (RSUs), or other equity awards that can appreciate in value over time, offering potential for substantial future wealth beyond base salary. Understanding vesting schedules, tax implications, and company valuation is crucial for employees to maximize the benefits of equity in their overall compensation package.

Key Differences Between Salary and Equity Compensation

Salary negotiation involves discussing fixed, guaranteed cash payments that provide immediate, predictable income, while equity negotiation focuses on stock options or shares offering potential long-term financial gains tied to company performance. Salary offers liquidity and stability, whereas equity compensation carries investment risk and the possibility of significant appreciation if the company grows. Understanding the tax implications, vesting schedules, and market conditions is essential when balancing salary versus equity to optimize total compensation.

Pros and Cons of Negotiating Salary vs Equity

Negotiating salary offers immediate financial security with predictable income and benefits but limits potential long-term gains. Equity negotiation provides the opportunity for substantial wealth if the company grows, yet carries high risk and uncertain liquidity. Balancing guaranteed salary against speculative equity requires evaluating personal financial needs, risk tolerance, and company growth potential.

When to Prioritize Salary in Your Negotiation

Prioritize salary negotiation when immediate financial stability and cash flow are critical, such as covering living expenses or paying off debt. A higher base salary ensures consistent and predictable income, reducing financial stress during uncertain economic periods or in volatile industries. Focus on salary if liquidity and short-term financial security outweigh potential long-term gains from equity.

When Equity is More Valuable Than Salary

Equity becomes more valuable than salary in compensation when the company's growth potential is high, offering long-term wealth through stock appreciation and dividends. Early-stage startups often provide lower salaries but significant equity stakes, which can yield substantial financial rewards if the company succeeds or goes public. Employees willing to take financial risks in exchange for future gains prioritize equity negotiation over immediate salary increases.

Assessing Company Stage in Negotiation Decisions

Assessing the company stage is crucial in salary versus equity negotiation, as early-stage startups often offer lower salaries but higher equity stakes, reflecting growth potential and risk. Established companies typically provide competitive salaries with limited equity, emphasizing immediate financial stability over long-term gains. Understanding the company's maturity helps candidates balance risk tolerance and compensation preferences for optimal negotiation outcomes.

Risk Tolerance: Evaluating Your Comfort with Equity

Evaluating your risk tolerance is essential when deciding between salary negotiation and equity negotiation, as salary offers fixed income while equity involves potential fluctuations tied to company performance. Individuals with high risk tolerance may prefer equity for its growth potential and long-term wealth creation, whereas those seeking financial stability often favor a higher guaranteed salary. Understanding your personal financial goals and comfort with market volatility guides informed decisions in balancing immediate compensation against future equity gains.

Negotiation Tactics for Salary and Equity Offers

Effective negotiation tactics for salary and equity offers include thorough market research to establish a competitive baseline and clear prioritization of immediate cash versus long-term value. Leveraging data on industry salary benchmarks and equity valuation models strengthens your position and demonstrates informed decision-making. Communicating flexible trade-offs and using a collaborative approach can help optimize the overall compensation package to meet both personal financial goals and company constraints.

Making the Right Choice: Salary, Equity, or Both?

Choosing between salary and equity in compensation hinges on your financial goals and risk tolerance; salary offers immediate, stable income while equity provides potential long-term gains tied to company performance. Evaluating the company's growth prospects and your personal liquidity needs helps determine if prioritizing equity aligns with your wealth-building strategy. Balancing both salary and equity can optimize financial security and upside, ensuring a comprehensive compensation package.

Related Important Terms

Total Reward Mix

Salary negotiation directly impacts fixed income, providing immediate financial security, while equity negotiation influences long-term wealth through stock options or shares, shaping the total reward mix in compensation packages. Balancing salary and equity components ensures a comprehensive total reward mix that aligns with both short-term financial needs and long-term growth opportunities.

Sweat Equity Premium

Salary negotiation typically centers on immediate cash compensation, while equity negotiation emphasizes long-term ownership value, often resulting in a Sweat Equity Premium that rewards founders or early employees for their non-monetary contributions. This premium reflects the increased potential upside and aligns individual incentives with company growth, making equity a strategic tool for talent retention and motivation beyond base salary.

Vesting Cliff Dynamics

Salary negotiation offers immediate, fixed compensation, while equity negotiation involves vesting cliffs that delay full ownership, typically locking employees into a waiting period before they access stock options. Understanding vesting cliff dynamics is crucial for evaluating total compensation value and long-term financial incentives during equity discussions.

Liquidation Preference Clause

Salary negotiation focuses on immediate, fixed income, while equity negotiation involves ownership stakes that can appreciate but are subject to terms like the liquidation preference clause, which prioritizes investor returns before employees receive their share in a liquidation event. Understanding the liquidation preference clause is crucial for employees to accurately assess the true value and risks of equity compensation compared to guaranteed salary.

Phantom Equity Options

Phantom equity options provide a strategic alternative to salary negotiation by offering employees the potential financial rewards tied to company performance without diluting ownership. Unlike direct salary increases, phantom equity aligns long-term incentives with shareholder value, fostering commitment while preserving cash flow.

Cash-to-Equity Ratio

Balancing salary negotiation with equity negotiation requires analyzing the cash-to-equity ratio to optimize overall compensation value and risk tolerance. High cash-to-equity ratios offer immediate financial security, while lower ratios emphasize long-term equity growth potential in startup or high-growth environments.

Compensatory Equity Dilution

Salary negotiation secures fixed, immediate income, whereas equity negotiation involves ownership stakes that dilute over time as more shares are issued, impacting the actual value of compensation. Understanding compensatory equity dilution is crucial since increased dilution reduces the percentage of ownership and potential future financial gains compared to a guaranteed salary amount.

Accelerated Vesting Triggers

Accelerated vesting triggers in salary negotiations typically involve immediate cash bonuses or salary increases upon achieving certain milestones, whereas in equity negotiations, these triggers enable faster ownership of stock options or shares, enhancing long-term wealth potential. Understanding the specific terms of accelerated vesting clauses, such as change of control or termination without cause, is crucial for maximizing compensation value in equity agreements.

Market Calibration Bands

Market calibration bands establish competitive salary ranges based on industry standards and company benchmarks, guiding salary negotiations with quantifiable data to ensure fairness and alignment. Equity negotiation, however, often relies on valuation metrics and company growth projections within those bands to balance risk and long-term compensation potential.

Post-Exit Liquidity Event Negotiation

Salary negotiation provides immediate, guaranteed cash flow, while equity negotiation focuses on long-term wealth accumulation contingent on a successful post-exit liquidity event such as an IPO or acquisition. Key factors in equity negotiation include vesting schedules, percentage ownership, and liquidation preferences that directly impact the value realized when the company undergoes a liquidity event.

Salary Negotiation vs Equity Negotiation for compensation. Infographic

hrdif.com

hrdif.com