Negotiating base pay typically provides immediate financial security and predictable income, making it a critical factor for candidates prioritizing short-term stability. Equity compensation negotiation can offer significant long-term wealth potential but carries inherent risks tied to company performance and vesting schedules. Balancing these elements requires assessing personal financial needs against confidence in the company's growth trajectory to determine the most advantageous overall package.

Table of Comparison

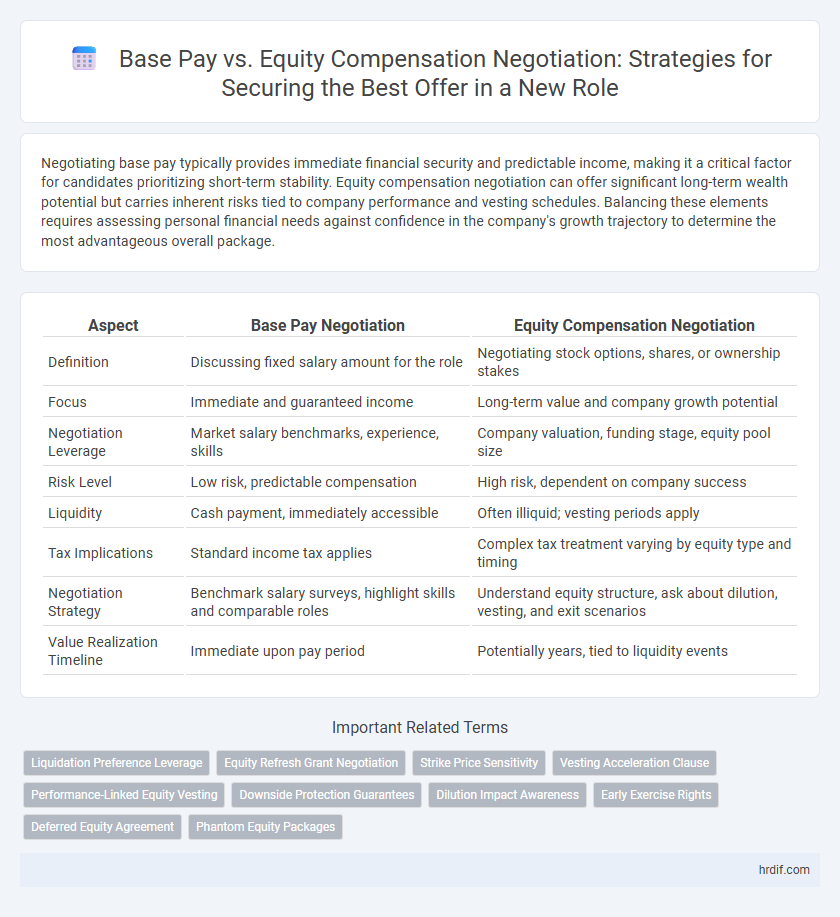

| Aspect | Base Pay Negotiation | Equity Compensation Negotiation |

|---|---|---|

| Definition | Discussing fixed salary amount for the role | Negotiating stock options, shares, or ownership stakes |

| Focus | Immediate and guaranteed income | Long-term value and company growth potential |

| Negotiation Leverage | Market salary benchmarks, experience, skills | Company valuation, funding stage, equity pool size |

| Risk Level | Low risk, predictable compensation | High risk, dependent on company success |

| Liquidity | Cash payment, immediately accessible | Often illiquid; vesting periods apply |

| Tax Implications | Standard income tax applies | Complex tax treatment varying by equity type and timing |

| Negotiation Strategy | Benchmark salary surveys, highlight skills and comparable roles | Understand equity structure, ask about dilution, vesting, and exit scenarios |

| Value Realization Timeline | Immediate upon pay period | Potentially years, tied to liquidity events |

Understanding Base Pay and Equity Compensation

Base pay negotiation involves securing a fixed salary component that reflects market rates, individual skills, and job responsibilities, providing immediate and predictable income. Equity compensation negotiation focuses on shares, stock options, or restricted stock units that offer long-term financial growth tied to company performance and vesting schedules. Understanding both elements ensures a balanced total compensation package aligning short-term needs with potential future value.

Key Differences Between Salary and Equity Negotiations

Salary negotiations typically focus on fixed amounts and immediate financial benefits, offering clarity and predictability in compensation. Equity compensation negotiations involve variable future value tied to company performance, requiring consideration of vesting schedules, stock options, and potential dilution. Understanding these differences helps candidates balance short-term income needs with long-term wealth-building opportunities when negotiating a new role.

Assessing Market Value for Base Pay Offers

Assessing market value for base pay offers involves analyzing industry salary benchmarks, regional pay scales, and comparable roles to ensure competitiveness. Data from trusted sources like salary surveys, compensation reports, and professional networks provide critical insights into fair base compensation. Accurate evaluation strengthens negotiation leverage by aligning expectations with current market standards.

Evaluating Equity Compensation Packages

Evaluating equity compensation packages requires understanding stock options, restricted stock units (RSUs), and their vesting schedules to accurately assess long-term value. Prioritize metrics such as company valuation, potential growth, and exit opportunities to gauge the true financial impact beyond base salary. Consider tax implications and liquidity events to align equity benefits with personal financial goals during negotiation.

Strategies for Negotiating Base Salary

Effective strategies for negotiating base salary in a new role include researching industry salary benchmarks and leveraging quantifiable achievements to justify higher pay. Emphasizing the immediate value you bring to the company and setting clear priorities on compensation components can strengthen your negotiation position. Understanding the employer's budget constraints while confidently articulating your salary expectations creates a balanced and persuasive dialogue.

Tactics for Negotiating Equity Awards

Effective tactics for negotiating equity awards include understanding the company's valuation and vesting schedule, which helps in assessing the true value of the offer. Prioritize clarity on liquidity events and potential dilution to gauge long-term financial benefits. Leveraging competitive market data and aligning equity terms with personal career goals strengthens negotiating positions.

Balancing Immediate Income vs. Future Potential

Balancing base pay negotiation with equity compensation negotiation involves weighing immediate income against future potential financial gains. Candidates should assess their current financial needs alongside the company's growth prospects and valuation trajectory to determine the appropriate mix. Prioritizing a competitive base salary ensures stability, while equity offers upside tied to long-term success and potential wealth accumulation.

Common Pitfalls in Compensation Negotiations

Common pitfalls in base pay negotiation include undervaluing market salary data and failing to consider total compensation impact. Equity compensation negotiations often suffer from misunderstandings about vesting schedules, valuation methods, and potential dilution. Overlooking these factors can lead to suboptimal agreements that do not reflect the candidate's true worth or long-term financial interests.

Navigating Total Compensation Discussions

Navigating total compensation discussions requires a strategic balance between base pay negotiation and equity compensation negotiation, as both elements significantly impact long-term financial outcomes and job satisfaction. Base pay provides immediate financial security and sets the foundation for future raises and bonuses, while equity compensation, such as stock options or RSUs, offers potential for wealth accumulation tied to company performance. Understanding the valuation, vesting schedules, and tax implications of equity is crucial for maximizing total compensation in a new role.

Making an Informed Decision: Base Pay or Equity?

Evaluating base pay versus equity compensation requires analyzing immediate financial stability against potential long-term gains, considering factors like company valuation, growth prospects, and personal risk tolerance. Base pay offers predictable income crucial for meeting short-term expenses, while equity compensation can deliver significant future wealth if the company performs well. Understanding tax implications, vesting schedules, and market conditions is essential to making an informed decision tailored to individual career goals and financial needs.

Related Important Terms

Liquidation Preference Leverage

Base pay negotiation centers on guaranteed, immediate financial rewards, while equity compensation negotiation often hinges on liquidation preference leverage, which determines the payout priority during exit events, significantly impacting long-term value. Understanding liquidation preferences provides candidates leverage to negotiate favorable equity terms that protect their investment against downside risk and potential dilution.

Equity Refresh Grant Negotiation

Equity refresh grant negotiation offers long-term ownership potential and aligns employee incentives with company growth, often proving more valuable than immediate base pay increases. Securing larger or more frequent equity refresh grants can enhance total compensation and provide significant wealth-building opportunities over time.

Strike Price Sensitivity

Strike price sensitivity plays a critical role in equity compensation negotiation, as a lower strike price increases the potential upside of stock options, directly impacting the perceived value compared to base pay. Negotiators must weigh the immediate certainty of base pay against the future financial gains influenced by strike price volatility and market conditions to optimize total compensation.

Vesting Acceleration Clause

Negotiating base pay provides immediate financial security, while equity compensation with a vesting acceleration clause offers potential long-term gains by accelerating stock ownership upon specific events such as termination or acquisition. Prioritizing a vesting acceleration clause in equity negotiations safeguards employee interests by ensuring faster access to shares during company transitions or job changes.

Performance-Linked Equity Vesting

Performance-linked equity vesting aligns employee incentives with company success, making equity compensation negotiations critical for long-term wealth creation compared to base pay adjustments. Negotiating performance metrics, vesting schedules, and potential dilution factors ensures that equity grants reflect true value and risk, optimizing overall compensation in a new role.

Downside Protection Guarantees

Base pay negotiation provides immediate financial certainty and downside protection by ensuring a fixed income regardless of company performance, while equity compensation negotiation focuses on potential upside but requires careful terms to guarantee value in case of company underperformance or exit scenarios. Effective downside protection guarantees in equity agreements, such as liquidation preferences or vesting acceleration, are critical to mitigate risk and secure meaningful compensation in volatile startups.

Dilution Impact Awareness

Negotiating equity compensation requires a clear understanding of dilution impact, as the value of stock options can decrease when more shares are issued or the company undergoes additional funding rounds. Base pay negotiation offers immediate, guaranteed income, whereas equity demands awareness of ownership percentage changes and potential future value fluctuations due to dilution.

Early Exercise Rights

Negotiating base pay often provides immediate financial security, whereas equity compensation negotiation, particularly with early exercise rights, offers long-term wealth potential by allowing employees to purchase stock options before they fully vest, reducing tax implications and maximizing investment gains. Prioritizing early exercise rights in equity negotiations can significantly enhance financial outcomes by enabling stock option liquidity and accelerated capital gains treatment.

Deferred Equity Agreement

Negotiating base pay often provides immediate financial security, while equity compensation, particularly through a Deferred Equity Agreement, offers long-term value linked to company performance and growth potential. Emphasizing a Deferred Equity Agreement in negotiations aligns employee incentives with corporate success, balancing risk with future financial reward.

Phantom Equity Packages

Negotiating base pay provides immediate financial stability, while Phantom Equity Packages offer long-term value tied to company performance without diluting ownership. Phantom equity negotiation focuses on vesting schedules, payout triggers, and valuation methods to maximize potential future rewards in a new role.

Base pay negotiation vs equity compensation negotiation for new role. Infographic

hrdif.com

hrdif.com